How SIPs in best Mid and Small Cap Equity Mutual Funds created wealth

Mutual Fund Systematic Investment Plans or SIPs were introduced in India way back in 1993 by Franklin Templeton Mutual Fund. Since then investing through SIPs have come a long way and it is now the preferred way of investing in mutual funds.

The current Mutual Fund SIP accounts in India stood at 1.66 Crores! The amount collected through Mutual Fund SIPs in September 2017 was a record Rs 5,516 Crores! The record collection of September 2017 shows a whopping growth of 49% over the collection made in September 2016.

Mutual Fund industry in India collected Rs 43,921 Crores through Mutual Fund SIPs in the last FY 2016-17. During the current FY the total collection through Mutual Fund SIPs already crossed Rs 29,266 Crores in the first 6 months of the current FY (Source: AMFI).

The above figures clearly demonstrate the confidence investors have in investing through Mutual Fund SIPs. If we crunch long term industry data of equity mutual fund SIP returns, there is no doubt best equity Mutual Funds SIPs have created immense wealth for investors who remained invested for the long term.

What was the return of best equity Mutual Funds SIPs

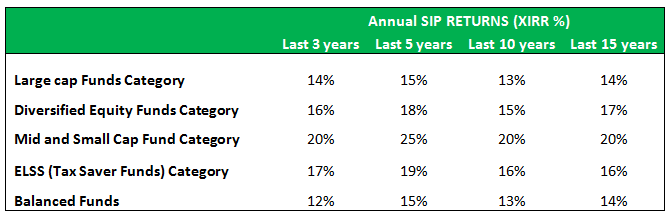

Following is a chart which shows the SIP returns of various equity mutual fund categories in the last 3, 5,10 and 15 years if one had invested in any of these categories of equity mutual funds –

Source: Advisorkhoj Top Performing SIP Funds

As you can see across all the categories and the 4 periods chosen – 3, 5, 10 and 15 years – the SIP returns in the respective categories were always in double digit. The above category returns are nothing but the average return of the funds in the said category. But, the actual SIP return of best performing equity schemes of different categories was higher than their category returns (2% to 5% higher than the category returns).

Benefits of investing in Mutual Fund SIPs

Now that we know that the SIPs are a great way of investing, let us see what are the benefits of investing through SIPs in mutual Funds. As we have a lot of resources on Advisorkhoj website, I will not elaborate on this today and rather request our readers to read these very interesting articles on the said topic as well as on various other SIP related topics –

Is mutual Fund SIPs really the best mode of investment

How to avoid system investment planning mistakes

7 things to know before starting to invest through SIPs

Should you continue with SIPs even in higher market

How and which funds were chosen to showcase the SIP returns

In this article, we will look at how SIPs in best mid and small cap funds created wealth for the investors in the last 10 years. In case you want to know why you should invest in mid and small cap funds, we suggest you read this article – Why mid and small cap funds can be your best investment choice

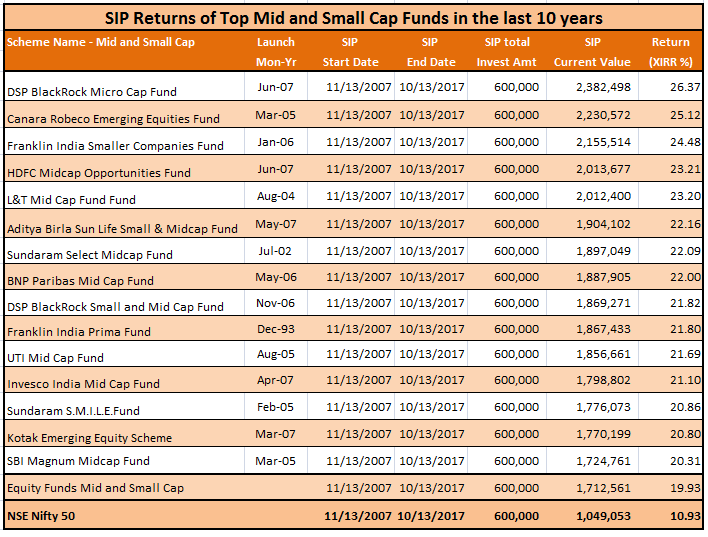

For this article, our criterion was to select mid and small funds which gave over 20% annual returns in the last 10 years. We found that 15 mid and small Cap Funds gave annual returns of over 20% in the last 10 years. We also fund that return range of these funds were between 20 – 26% in the last 10 years.

However, if you want, you can see here the entire list of mid and small cap funds SIP returns in the last 10 years.

We chose these funds purely based on their SIP returns in the last 10 years. Most of the fund names are very popular and still continuing their stellar performance but there are some which are now not performing that well (according to our research) but still part of this selection. However, we will discuss later if investment in the selected funds can still be suggested now.

Source: Advisorkhoj Top Performing SIP Funds returns

Each of the funds in our selection was regular plan with growth option. Since SIP investments are made over a period of time, the method of calculating SIP returns is different from that of lump Sum investments. SIP returns are calculated by a methodology called XIRR, which is a variant of Internal Rate of Return (IRR). XIRR is similar to IRR, except that XIRR can calculate returns on investments that are not necessarily strictly periodic.

For our examples, we have assumed a monthly SIP of Rs 5000 only, made on 13th day of every month in the funds that we have selected above. The SIP start date was 10 years back on the 13th day of November 2007 and end date is 13th day of October 2017. Over this period, the investor would have invested Rs 6.00 lakhs through 120 monthly instalment of Rs 5,000 SIP.

As you can see above, the investors would have accumulated Rs 17.12 Lakhs to Rs 23.82 Lakhs based on the scheme he had chosen, against an investment of Rs 6.00 Lakhs only, in the last 10 years. These top 15 SIP funds have beaten the average category return of 19.93% of mid and small cap fund and NSE NIFTY 50 return which is 10.93% with a huge margin.

The same amount, i.e. Rs 5,000, if invested in monthly SIPs in NSE NIFTY 50, it would have given you a corpus of only Rs 10.75 Lakhs against Rs 23.82 Lakhs generated by the top fund in the above list!

What is the reason of selecting these funds?

Having selected the above funds based on their 10 year SIP returns, however, we are neither recommending these funds to start new SIPs nor trying to prove a point that these are still the best funds in the mid and small cap category.

The reason of highlighting these SIP returns is just to illustrate how long term investments in best equity Mutual Funds SIPs can be the easiest way for creating long term wealth to meet your various financial goals. The other reason is that those of you who have not yet started a mutual fund SIP then this is high time you should start one!

SIPs in Mid and Small Cap Funds can give the best returns

In the first chart we had seen the SIP returns of various categories of equity mutual funds over 3, 5, 10 and 15 years period. If you compare the returns of mid and small cap fund category with that of any other category, you will find that the returns of mid and small cap category is much superior in all the periods compare to other equity fund categories.

However, mid and small cap funds as you may know, is suitable only for investors with high risk appetite. Investors with low or moderate risk appetite should avoid investing in mid and small cap funds.

Even though investors with high risk appetite can invest in mid and small cap funds, they must know how to select the best mid cap funds. They should also know the difference between investing in mid cap fund versus large cap equity funds. Being a high risk taker one may also explore what should be the percentage of mid cap funds in their mutual fund portfolio.

Which are the top mid and small cap funds now?

To see top funds in any category we have a research tool – Top Consistent Mutual Fund Performers. You can visit this tool and see the top 10 funds in any category. Here is the list of current Top 10 Funds from Mid and Small Cap Category –

Reliance Small Cap Fund

SBI Small and Midcap Fund

Mirae Asset Emerging Bluechip Fund

L&T Midcap Fund

Canara Robeco Emerging Equities Fund

Franklin India Smaller Companies Fund

DSP BlackRock Micro Cap Fund

Kotak Emerging equity Fund

Principal Emerging Bluechip Fund

Aditya Birla Sun Life Pure Value Fund

Out of the above selection, two funds – SBI Small and Midcap Fund and DSP BlackRock Micro Cap Fund is not accepting any fresh investments as of now. Also, Reliance Small Cap accepts lump sum of Rs 2 Lakhs only and Mirae Asset Emerging Bluechip Fund accepts only SIPs worth maximum Rs 25,000. Mirae Asset Emerging Bluechip Fund does not accept any lump sum investments.

If you compare the current top performing list of 10 mid and small cap funds and the list of top 15 SIP funds in the last 10 years (refer the Mid and Small Cap SIP return chart) based on their SIP returns, following are the common funds (funds which have completed 10 years of existence) –

L&T Midcap Fund

Canara Robeco Emerging Equities Fund

Franklin India Smaller Companies Fund

DSP BlackRock Micro Cap Fund

Kotak Emerging equity Fund

In this list of above 5 funds, Mirae Asset Emerging Bluechip Fund, SBI Small and Midcap Fund, Principal Emerging Bluechip Fund and Aditya Birla Sun Life Pure value Fund are not present as these funds, though top performing, have not yet completed 10 years of age.

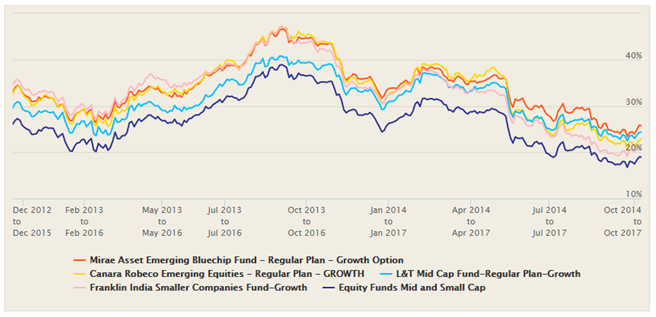

Therefore, if one has to select the top mid and small cap funds to invest now, you may refer to the following rolling return chart (we have selected top 5 funds for you).

Source: Rolling return versus category – Mid and Small Cap Funds

As you can see in the above rolling return chart, all the 5 funds in our selection continue to beat their benchmark returns (the deep blue line) in the last 5 years. We have taken 3 years period for the rolling return as we feel that one should have a minimum 3 years investment horizon if investing in equity mutual funds. Therefore, we can conclude that if you want to start SIP in mid and small cap funds now, you may choose these funds. In case you already have SIP in these funds, you should continue with your investments for the long run while reviewing the individual performances at least every 1 or 2 years.

Therefore, the final suggested list for starting a SIP or lump sum in top 5 mid and small cap fund is given below as per Advisorkhoj research –

Reliance Small Cap Fund

Mirae Asset Emerging Bluechip Fund

L&T Midcap Fund

Canara Robeco Emerging Equities Fund

Franklin India Smaller Companies Fund

Conclusion

In this article, we have seen how best equity Mutual Funds SIPs of mid and small funds have created wealth for the investors who started SIPs 10 years back and stay invested in it. SIPs inculcate a habit of savings and benefit from the power of compounding, and therefore the earlier we start SIPs and longer we stay invested, the greater is the potential for wealth creation. However, it is important to select right funds for your SIPs.

We have also seen that SIPs in best mid and small cap equity Mutual Funds can generate the best return but it is not suitable for investors who cannot take high risk. SIP is a powerful wealth creation tool and investors must select funds based on their risk appetite and investment horizon. 5 years should be the minimum investment horizon if you are investing in equity funds either through SIPs or lump sum.

Before selecting best equity Mutual Funds SIPs for meeting your long term investment needs, you must consult your financial adviser who can help you select the right funds that is suitable according to your risk profile.

You may also refer to read how SIPs in diversified equity mutual funds created long term wealth for investors.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team