How Principal Small Cap Fund is a good choice for long term investors

Small cap funds, as a category is the best performer among diversified equity funds over the last 6 months or so. We had mentioned a number of times in our blog that small caps saw deep correction in 2018 & 2019 and were well positioned to stage a smart recovery. When the stock market crashed in March 2020 due to outbreak of COVID-19 pandemic and the impending lock-down, small caps which were already available at attractive valuations, saw further cuts. As a result, it was expected that this segment would outperform when the market recovered. In the last 6 months small cap funds on an average gave 39% returns. Principal Small Cap Fund outperformed the small cap category giving more than 40% return in the last 6 months and 20.6% return in the last 1 year, making it one of the best performing small cap funds.

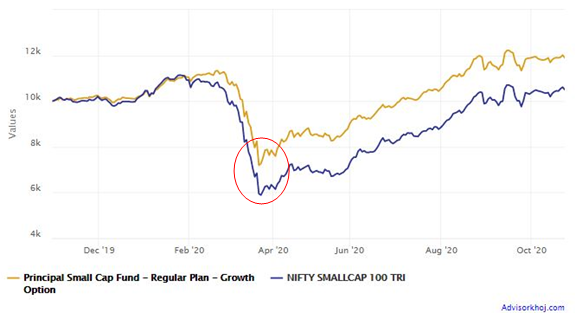

Beating the benchmark

Principal Small Cap Fund has outperformed its benchmark index, Nifty Small Cap 100 TRI by a wide margin in the last 1 year. The chart below shows the growth of Rs 10,000 in the scheme versus the benchmark index over the last one year. One of the important highlights of the scheme’s performance in the last one year is the drawdown relative to the benchmark (see the portion of the chart circled in red). Market experts say that when market recovers after a deep correction, stocks see similar recoveries. Fund managers who are able to limit downside risk / drawdowns through superior stock selection have a much better chance of creating alphas for investors. The performance of Principal Small Cap Fund in the last one year is a testimony to superior stock selection skills of the fund manager.

Source: Advisorkhoj Research (as on 26.10.2020)

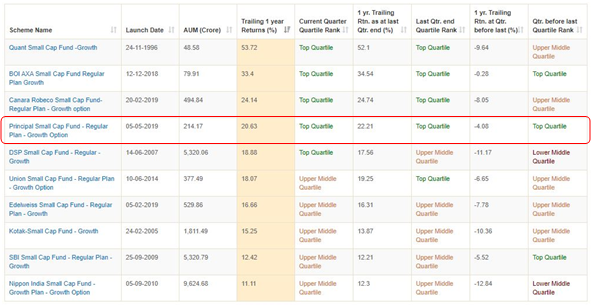

Outperforming its peers

Principal Small Cap Fund delivered 20.6% returns in the last 1 year versus category average of 12.7% - this is significant outperformance. Principal Small Cap Fund has been a top quartile performer in its category over the last 1 year. What is even more impressive is the performance consistency in terms of being in the top quartile in small cap category for consecutively 3 quarters. The table below shows the trailing return performance of top 10 funds in the small cap category in the current and last 2 quarters.

Source: Advisorkhoj Research (as on 26.10.2020)

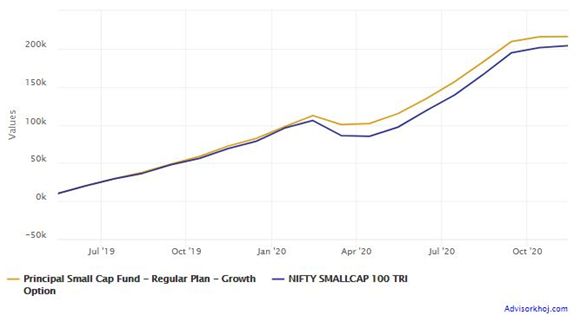

SIP Returns

The chart below shows the returns of Rs 10,000 monthly SIP in Principal Small Cap Fund since the scheme’s inception in May 2019. With a cumulative investment of Rs 170,000 you would have accumulated a corpus of nearly Rs 216,000 till date (as on 27.10.2020). The annualized SIP return (XIRR) of the scheme since inception is nearly 27%. The SIP return of this scheme is even more impressive than the lump sum returns. The SIP XIRR of Principal Small Cap Fund especially in highly volatile market re-affirms a point that we often repeat in our blog – SIP is the ideal way of investing in small cap funds.

Source: Advisorkhoj Research (as on 26.10.2020)

Portfolio Construction

As per SEBI’s mandate small cap funds must invest at least 65% of their assets in small cap stocks. Principal Small Cap Fund has 65% of its portfolio in small caps, 12% in midcaps and 11% in large caps with the balance in cash / cash equivalents.

The fund managers of Principal Small Cap Fund follow bottoms up stock selection based on Growth at Reasonable Price (GARP) principles and tactical value stock picks. The Top 5 sectors of this fund are, chemicals, software, consumer durables, finance and industrial products (as at 30th September 2020). The top 5 stocks in the scheme portfolio (as 30th September 2020) are Persistent Systems, Alkyl Amines Chemicals, Navin Fluorine International, Neogen Chemicals and Galaxy Surfactants.

Why invest in small cap funds?

- Small caps are breeding grounds of multi-baggers

- Potential PE re-rating

- Exposure to sectors where there is virtually no large cap presence.

- Promoter’s commitment and entrepreneurial spirit

- Small caps have the potential of outperforming large and midcaps over long investment horizons

Why invest in small caps now?

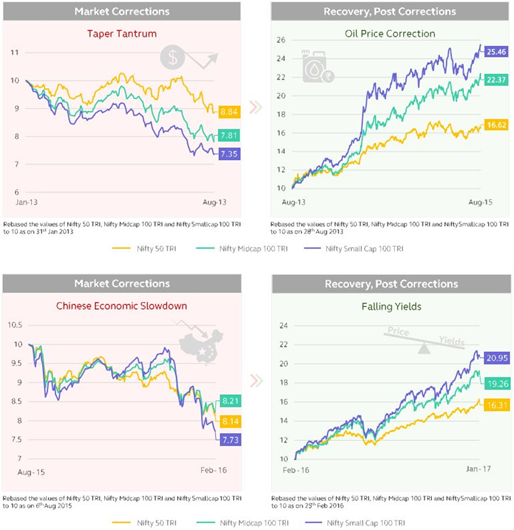

As per historical data, small caps have bounced back strongest compared to large and midcaps from bear market bottoms (see the charts below).

Source: Principal MF

Though small caps have bounced back from March 2020 lows, Nifty Small Cap 100 index is still 37% below its all time high (January 2018). We believe that there is considerable headroom for recovery at these levels and investors can potentially get good returns over long investment horizons.

Why Principal Small Cap Fund?

- The fund managers (Ravi Gopalakrishnan and Sidharth Mohta) are experienced (combined experience of 41 years) and have strong performance track records.

- Though Principal Small Cap Fund is relatively new (launched in 2019) the fund house has successfully invested in the small cap segment in other schemes in their product portfolio.

- Strong portfolio management process for small cap including meeting with every company before investing, low concentration risk, focus on liquidity, rigorous portfolio review (including 3 – 4 annual interactions with portfolio companies) and sell discipline.

- Six pillars of investment process:-

- Business dynamics

- Operating Matrix

- Profitability

- Quality of growth

- Capital allocation

- Valuation

Conclusion

Principal Small Cap Fund is relatively new but has delivered strong performance in difficult market conditions. The performance track record of the fund managers and the fund house inspires confidence. You need to have moderately high risk appetite and long investment horizon for this fund. SIP is the ideal way for investing in this fund. However, if you have lump sum funds available then you can invest in the fund at these levels or invest through 3 – 6 month STP if you are worried about volatility. Investors should consult with their financial advisors if Principal Small Cap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches JioBlackRock Arbitrage Fund

Dec 9, 2025 by Advisorkhoj Team

-

Tata Mutual Fund launches Tata BSE Multicap Consumption 50:30:20 Index Fund

Dec 9, 2025 by Advisorkhoj Team

-

Edelweiss Mutual Fund launches Edelweiss Silver ETF Fund of Fund

Dec 8, 2025 by Advisorkhoj Team