How Principal Emerging Bluechip Fund still a good fund despite short term underperformance

We have reviewed Principal Emerging Bluechip Fund a couple of times in the last one year. You can refer to our posts, Principal Emerging Bluechip Fund: One of the best large and midcap funds (published on 29th August 2018) and Principal Emerging Bluechip Fund: Money multiplied 10 times in 10 years (published on 12th November 2018). If you go through our November post on this scheme, you will see that the scheme was underperforming both against its benchmark index (Nifty Large and Midcap 250 Index) and its category (large & midcap equity funds). However, both our fund reviews were quite favorable because we always look at the long term track record of a scheme and its fund manager when analyzing a scheme’s performance.

We have been receiving comments from a number of our readers (both investors and financial advisors) regarding the performance of some mutual fund schemes post SEBI’s reclassification of mutual funds. In this blog post, we will discuss the factors attributable to Principal Emerging Bluechip fund’s last one year performance.

We would like to reiterate that investors should always judge a scheme’s performance by its long term track record, unless there has been a change in the fund manager of the scheme in the recent past. Please note that in this post, we will not do a full-fledged fund review of this scheme, since we did one just 5 months back (you can refer to our post, Principal Emerging Bluechip Fund: Money multiplied 10 times in 10 years for the same).

Performance of Principal Emerging Bluechip Fund

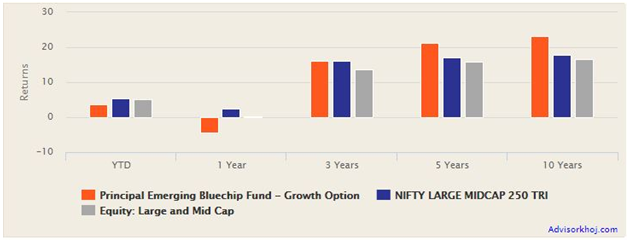

The chart below shows the trailing returns of Principal Emerging Bluechip Fund over various periods ending 17th April 2019, versus its benchmark index and category (returns over periods longer than 1 year have been annualized). You can see that the scheme has underperformed versus the benchmark and also the category in the last one year – the underperformance relative to category is less than relative to benchmark. Another important point to note in the chart below is that the category itself underperformed versus Nifty Large and Midcap 250 (TRI) Index. We will now try to analyze why the scheme underperformed versus the benchmark in the last 1 year.

Source: Advisorkhoj Research

History of Principal Emerging Bluechip Fund

Principal Emerging Bluechip Fund was launched in November 2008 and has its returns since inception have been outstanding (please see our post, Principal Emerging Bluechip Fund: Money multiplied 10 times in 10 years). Dhimant Shah has been managing this scheme since 2011 (nearly for 8 years now). Historically, this scheme was positioned as a midcap fund; in January 2018, allocation to midcap and small cap was around 85% (out of which allocation to midcap was more than 70%). In January 2018, on a trailing 5 year basis, Principal Emerging Bluechip Fund outperformed its then benchmark Nifty Free Float 100 Index by a wide margin, creating substantial alphas for investors.

Change in scheme attribute

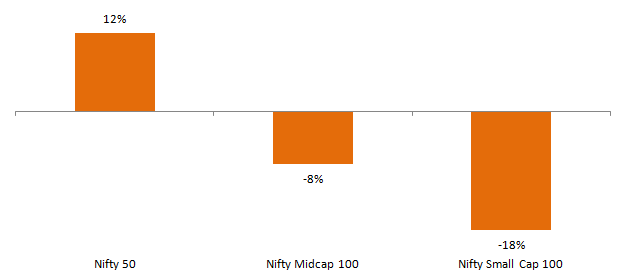

In April 2018, the scheme benchmark was changed to Nifty Large and Midcap 250 (TRI) Index. The change in scheme benchmark signaled a considerable change in the market cap composition of the scheme portfolio as well as the scheme categorization, as per SEBI’s circular to the AMCs. The new scheme category was to be Large and Midcap Fund. As per SEBI’s mandate, Large and Midcap Funds need to have 35% allocation each to large cap and midcap stocks. By April 2018, the fund manager had increased the large cap allocation to 35% (from just 9% in January), the minimum required for the scheme to be classified as a Large and Midcap Fund. If we look at this change from the perspective of existing investors, then it was very beneficial for the investors. Large cap outperformed small and midcaps by a huge margin in the last one year – the chart below shows the last 1 year returns (as on 17th April, 2019) of Nifty - 50, Nifty Midcap 100 and Nifty Small Cap 100 indices.

Source: Moneycontrol.com

You can see that significant investor downside (large cap outperformed midcap by 20% and small cap by an even bigger margin) in the scheme was protected by increasing large cap allocationby 26%.

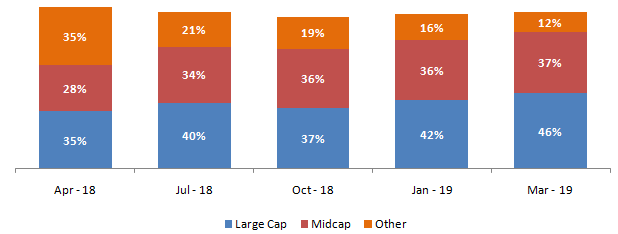

Shifting allocation Mix of the scheme over the last 1 year

The chart below shows the changing allocations to different market cap segments in Principal Emerging Bluechip Fund. You can see that in last fiscal year, the large cap allocation in the scheme was increased from 35% to 46%, while midcap allocation was maintained around 36 – 37%. We think market cap mix is now close to the target ranges for the scheme.

Source: Principal MF fund factsheets

Why did the scheme underperform the benchmark?

The scheme benchmark is the Nifty Large and Midcap 250 Index. As per SEBI’s definitions, the 100 largest stocks by market capitalization are classified as large cap stocks, while the next 150 stocks are classified as midcap. As per National Stock Exchange, “the aggregate weights of large cap stocks and mid cap stocks are 50% each and are reset on a quarterly basis”. If a scheme’s allocation to large cap is less than 50%, then in a year like FY 2018 – 19, when large cap outperformed midcaps by a huge margin, a large and midcap scheme is likely to underperform the benchmark. We mentioned earlier that large and midcap funds category on the whole, underperformed Nifty Large and Midcap 250 Index in the last 1 year. Scheme with higher allocations to midcap and small cap, however, will outperform the benchmark in years when midcaps outperform large caps.

Principal Emerging Bluechip Fund started FY 2018-19 with 35% allocation to large cap and ended the year with large cap allocation in the 45 – 50% range. Where did the incremental allocation to large cap come from? If you see at the stacked bar chart above, it came from the orange bars, which primarily reflect the small cap segment. This was the worst performing market segment in FY 2018-19. The adjustment (shifting allocation from small cap to large cap) took some time and average allocation to small cap stocks for most of the year was higher. For this reason the scheme underperformed the benchmark index by nearly 7%.

Adjustment takes time because the fund manager has to take into consideration several factors like market conditions, liquidity, impact costs and interest of long term investors, when changing a midcap fund to a large and midcap fund. FY 2018-19 was a bear market for small cap stocks, with prices falling by 30 – 40%. If the fund manager sold large volumes of small cap stocks to buy large cap, stock prices would have fallen further and investors would have incurred losses. Therefore, the adjustment to the intended position was gradual in nature, keeping long term investor interest in mind.

Why is Principal Emerging Bluechip Fund still a good investment?

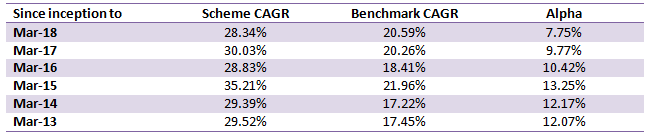

We have discussed this in detail in our post, Principal Emerging Bluechip Fund: Money multiplied 10 times in 10 years, but for the benefit of readers who have not read the post, the long term track record of the fund manager Dhimant Shah gives us confidence in this scheme. The table below shows since inception returns of the scheme versus the relevant benchmark for the past several years (prior to the change in scheme attribute).

Source: Principal MF fund factsheets

SEBI’s mandate for large and midcap schemes leaves considerable room for flexibility which good fund managers can exploit. Dhimant Shah has a strong track record of alpha creation for investors, as you can see in the table above. We think that the period of adjustment for Principal Emerging Bluechip Fund is over and the market mix of the scheme is now where the fund manager intends it to be.

Last one year has been difficult for midcaps and small caps, but historical data shows that midcap and small caps have bounced back strongly from their lows. We think that Principal Emerging Bluechip continues to have strong potential to generate excellent long term returns for investors. Investors should consult with their financial advisors if Principal Emerging Bluechip Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches JioBlackRock Arbitrage Fund

Dec 9, 2025 by Advisorkhoj Team

-

Tata Mutual Fund launches Tata BSE Multicap Consumption 50:30:20 Index Fund

Dec 9, 2025 by Advisorkhoj Team

-

Edelweiss Mutual Fund launches Edelweiss Silver ETF Fund of Fund

Dec 8, 2025 by Advisorkhoj Team

-

Abakkus Mutual Fund launches Abakkus Liquid Fund

Dec 8, 2025 by Advisorkhoj Team