How Principal Balanced Advantage Fund is a good investment in high markets

What are Balanced Advantage Funds?

Balanced Advantage Funds dynamically rebalance their asset allocation between equity and debt based on a dynamic asset allocation model. If equity valuations are low, then dynamic asset allocation model will increase asset allocation to equity and reduce allocation to debt. If equity valuations are high, then the model will reduce allocation to equity and increase allocation to debt. These funds work on age old investment tenet of buying low and selling high. Balanced Advantage Funds are also known as dynamic asset allocation funds. They aim to reduce downside risk and generate relatively stable returns.

Principal Balanced Advantage Fund

Principal Balanced Advantage Fund works on the dynamic asset allocation strategy based on market valuations. The dynamic asset allocation model of the fund defines valuation (Price Earnings Multiple) bands and corresponding asset allocation ranges for each band. PE bands work better than absolute PE levels because it gives the fund managers some flexibility of managing asset allocation changes within the band. Having valuation bands also reduces impact cost of sudden asset allocation changes and volatility of returns.

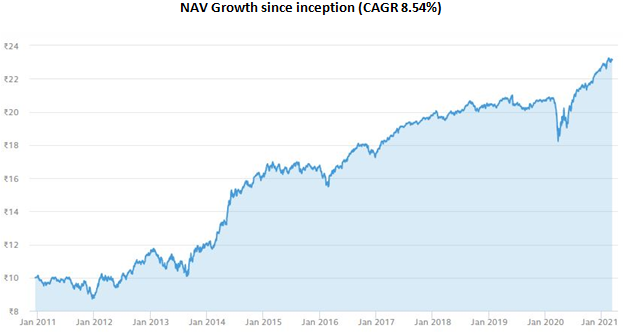

The fund was launched in December 2010. Mr. Ravi Gopalakrishnan and Ms. Beckxy Kuriakose are the fund managers of this hybrid scheme. The chart below shows the NAV growth of the scheme since inception.

Source: Principal Mutual Fund, Advisorkhoj Research. As on 9th March 2021

Rolling Returns

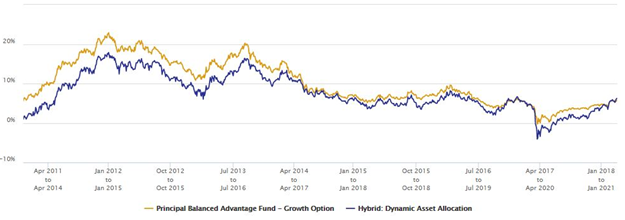

The chart below shows the three year rolling returns of Principal Balanced Advantage Fund versus rolling returns of balanced advantage funds category since the scheme’s inception. You can see that Principal Balanced Fund gave more consistent returns than the balanced advantage funds category average returns.

Source: Advisorkhoj Research

Investors should notice how downside risks are limited over 3 year investment tenor in Principal Balanced Advantage Fund. The minimum 3 year rolling returns is 5.2%. The average 3 year rolling return is 12.5%, while the median 3 year rolling return is 13%. The maximum 3 year rolling return is 23%. This shows that, the fund had enabled investors, over a sufficiently long investment tenor, to capture the upside potential, while limiting downside risks.

How Principal Balanced Advantage Fund provides stability

Many investors and financial advisors use returns to compare different mutual fund schemes. However, one should not use returns only to evaluate a balanced advantage. One of the most important investment objectives of balanced advantage funds is to limit downside risks and provide stability to your portfolio.

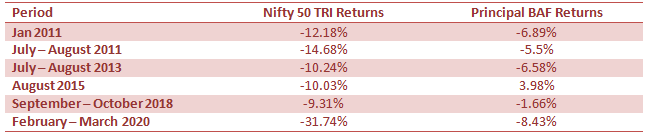

The table below shows the worst monthly periods of Nifty 50 and corresponding returns of Principal Balanced Advantage Fund. Notice how downside risk in volatile markets was protected by the fund.

Source: Advisorkhoj Research (as on 9th March 2021)

Longer tenures are more suitable for this fund

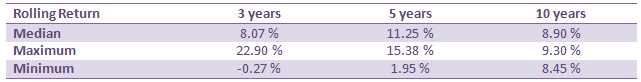

The table below shows the median, maximum and minimum rolling returns of Principal Balanced Advantage Fund for 3, 5 and 10 year investment tenures since the inception of the scheme. You can see over 5 to 10 year investment tenures, the scheme never gave negative returns. Further the median returns are higher over 5 to 10 years investment tenures. Therefore in our view, you can get better risk adjusted returns over 5 years plus investment tenures.

Source: Advisorkhoj Research (as on 9th March 2021)

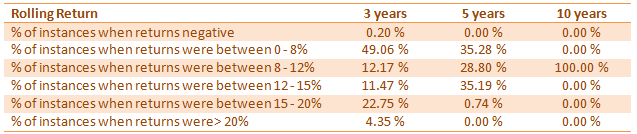

The table below shows the % of instances when the returns of Principal Balanced Advantage Fund were within certain annualized returns ranges for different investment tenures (3, 5 and 10 years).

This table further reinforces our earlier finding that 5 years plus investment tenures. You can see in the table below that, the possibility (% of instances) of getting 8% or higher annualized returns is much higher (65% to 100%) over 5 to 10 year investment tenures.

Source: Advisorkhoj Research (as on 9th March 2021)

Tax Advantage

One of the biggest benefits of Balanced Advantage Funds is that they enjoy equity taxation – short term capital gains (investment held for less than 12 months) are taxed at 15%, while long term capital gains (investment held for more than 12 months) up to Rs 1 lakh are tax free – long term capital gains in excess of Rs 1 lakh are taxed at 10%. There is no Dividend Distribution Tax on mutual fund dividends, but dividends paid bymutual fund schemes are taxed as per the income tax rate of the investor.

Conclusion

With stock markets at record high many investors are worried about investing at very high valuations. There are also near term risk factors with pace of recovery, commodity prices, global interest rates, particularly interest rates in the US etc. With bond yields hardening longer duration debt funds are not expected to sustain their performance in the near term. Balanced advantage funds are good investment options for investors who do not have appetite for high volatility. In this post, we discussed how Principal Balanced Advantage Fund limits downside risks and provides stability following its dynamic asset allocation strategy. We also discussed that, investors should have long investment horizon to get the superiorrisk adjusted returns from this fund. Investors should consult with their financial advisors if Principal Balanced Advantage Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team