How have your mutual funds done after each election

In our previous article, Elections results and equity market, we had discussed how equity markets performed after each election and during the terms of the respective governments. We had seen that the impact of election results on equity markets lasts only for a few days. Once the initial euphoria or disappointment with election results dissipates, the performance of equity markets is determined by fundamentals like macro-economic factors, fiscal policies, corporate earnings and the global factors. In this article, we will discuss how some top mutual funds performed during the term of government after each election. For our analysis we have chosen three popular diversified equity funds that delivered strong performance for 5 year government terms after the elections of 1999, 2004 and 2009. For the period 1999 -2004, when the NDA Government was in office, we have selected Franklin Prima Plus fund, from the Franklin Templeton stable. For the period 2004 – 2009, when the UPA – 1 Government was in the office, we have selected ICICI Prudential Dynamic Plan, from the ICICI Prudential stable. For the period 2009 – 2013, when the UPA – 2 Government was in office, we have chosen HDFC Equity Fund, from the HDFC Mutual Fund stable.

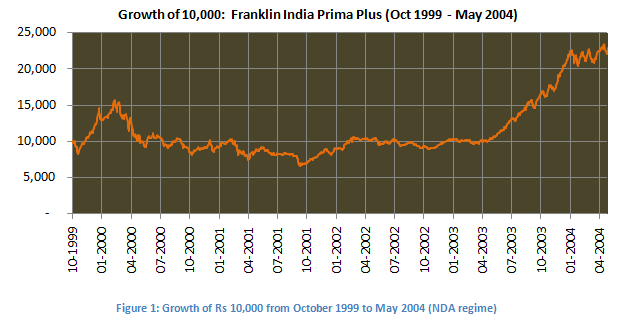

1999 – 2004 (NDA Government)

The market welcomed the NDA victory in the 1999 general elections with a 7% rally on the Sensex. However in the first 2 years of the NDA rule, the Sensex fell by 50% due to combination of global and local factors. Though the Sensex rallied in the latter part of the NDA rule, the absolute return during the term of the NDA Government was a little over 14%. On an annualized return basis, the Sensex gave a compounded annual return of just around 3% during this period. Let us now see, how the Franklin Prima Plus fund performed during this period. The chart below shows the growth of the standard Rs 10,000 investment, in the growth option of the fund during this period.

A lump sum investment of Rs 10,000 in the Franklin India Prima Plus fund, growth option, made just after the October 1999 general election would have grown to Rs 22,781 by the end of the term of the NDA Government. Over the four and half year period (remember the NDA government called for early election in 2004), the fund gave an absolute return on 128%. On an annualized basis, the fund gave compounded annual return of 20% during this period, compared to 3% given by the Sensex.

Like the Sensex, the NAV of the fund fell by 50% from April 2000 to October 2001. However, the fund recovered faster and outperformed the Sensex by a wide margin. This clearly shows that good mutual funds can beat the market over a period of time. One should try to invest in good funds which generate outperformance, also known as alpha, to maximise capital appreciation.

2004 – 2009 (UPA-1 Government)

The market, which was expecting an NDA victory in the 2004 elections, was disappointed with the election results. The Sensex gave up 15% in two or three trading sessions. But despite the initial disappointment, the Sensex saw the biggest bull market rally till the end of 2007, helped by strong GDP growth and Foreign Institutional Investor flows into Indian equity market. In 2008 the Indian equity market was severely impacted by the global financial crisis and the recession that followed. The Sensex crashed 60% from 21,000 to nearly 8,500 by November 2008, but recovered sharply in 2009 and was well over 12000, by the time the country went to polls in May 2009. The absolute return on the Sensex during this period was nearly 150%, despite the severe recession. On an annualized basis, the compounded return was over 20%. Let us now see, how the ICICI Prudential Dynamic Plan performed during this period. The chart below shows the growth of the standard Rs 10,000 investment, in the growth option of the fund during this period.

A lump sum investment of Rs 10,000 in the ICICI Prudential Dynamic Plan, growth option, made just after the May 2004 general election would have grown to Rs 33,882 by the end of the term of the UPA - 1 Government. Over the five year period, the fund gave an absolute return on 239%. On an annualized basis, the fund gave compounded annual return of 28% during this period, compared to 20% given by the Sensex. The ICICI Prudential Dynamic Plan outperformed the Sensex both in the bull market and the bear market cycles. While the Sensex rose 370% during the bull market rally, the NAV of the ICICI Prudential Dynamic Plan grew by 440%. When the Sensex crashed 60% in the bear market, the NAV of the ICICI Prudential Dynamic Plan fell by only 45%. The ICICI Prudential Dynamic Plan is a great example of how the fund manager generated alpha, during the 2004 to 2009 period.

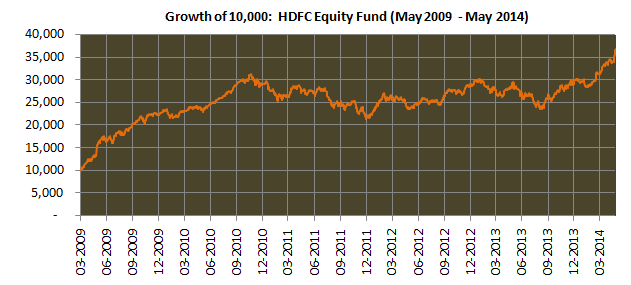

2009 – 2014 (UPA-2 Government)

The market welcomed the UPA victory in the 1999 general elections with a 20% rally on the Sensex. The Sensex was largely choppy during the UPA – 2 regime, rising to 20,000 in 2010 and then falling to 15,000 in 2011 and then resuming its upward trend to 20,000 and above. For the overall economy, this was not a good period, as GDP growth slowed down, inflation rose stubbornly and the government was hit by a series of high profile corruption scandals. During the term of the UPA – 2 Government, the Sensex gave an absolute return of 67% over five years. On an annualized basis, the Sensex gave compounded annual returns of 11%. Let us now see, how the HDFC Equity fund performed during this period. The chart below shows the growth of the standard Rs 10,000 investment, in the growth option of the fund during this period.

A lump sum investment of Rs 10,000 in the HDFC Equity Fund, growth option, made just after the May 2004 general election would have grown to Rs 36,782 by the end of the term of the UPA - 2 Government. Over the five year period, the fund gave an absolute return on 268%. On an annualized basis, the fund gave compounded annual return of 30% during this period, compared to 20% given by the Sensex. The HDFC Equity Fund is another great example of how good fund managers generate alpha (or market outperformance) for the investors

Conclusion

New governments are faced with challenges and opportunities of accelerating economic growth and capital formation in the country. The performance of the market depends both on local and global factors. However, good mutual funds beat the market to maximise capital appreciation for the investors. We have seen in this article, how good funds gave compounded annual returns in excess of 20%, over various five year periods, even though the Sensex gave annualized returns ranging from 3 to 20%. As the new government takes office in a few days, through disciplined investing in quality funds, investors can create wealth in the long term.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025 by HDFC Mutual Fund

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team