How Axis Midcap Fund is a proven wealth creator

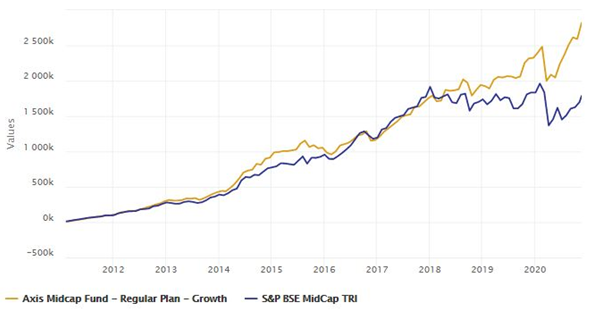

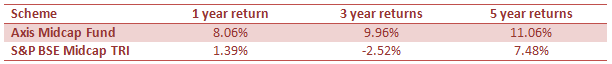

Axis Midcap Fund is one best performing midcap equity funds in the last 3 to 5 years period. The fund was ranked 1 in terms of trailing returns over the last 3 and 5 years (ending 17th November 2020) respectively. The scheme was launched in February 2011 and has given 16.9% compounded annual returns (CAGR) since inception (as on Nov 17, 2020).

If you had invested Rs 100,000 in the scheme at its inception (Feb 2011), your investment would have multiplied to Rs 462,000 by 17th November 2020 (Source: Advisorkhoj Research). The stock market has had to face at least 4 major corrections since the launch of the scheme.

The long term wealth creation track record of Axis Midcap Fund despite these corrections is testimony of India Growth Story and the alpha creation skills of the fund manager.

Source: Advisorkhoj Research (Period: 05.02.2011 – 17.11.2020). Disclaimer: Past Performance may or may not be sustained in the future

SIP Returns

The chart below shows the returns of Rs 10,000 monthly SIP in the scheme since inception. With a cumulative investment amount of Rs 11.8 lakhs through monthly SIPs you could have accumulated a corpus of Rs 28.2 lakhs by 25th September 2020. The annualized SIP returns (XIRR) since inception of the scheme is 17.22%. In the last 3 and 5 years, SIPs in Axis Midcap Fund delivered 16.6% and 15.5% XIRR returns respectively despite difficult market conditions for the midcap segment of the market.

Source: Advisorkhoj Research (Period: 05.02.2011 – 17.11.2020). Disclaimer: Past Performance may or may not be sustained in the future

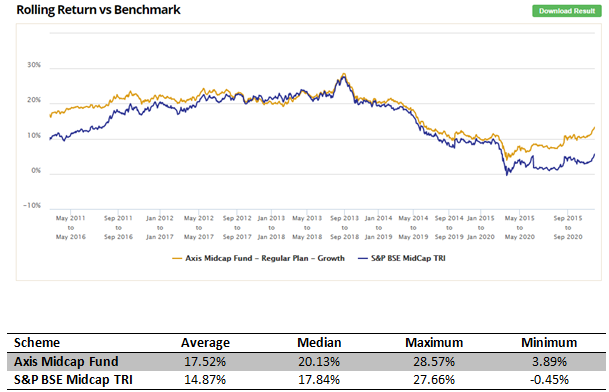

Rolling Returns

The chart below shows the 5 year rolling returns of Axis Midcap Fund versus its benchmark index, S&P BSE Midcap TRI, since the scheme’s inception. We are showing 5 year rolling returns because in our view, investors should have minimum 5 year investment horizon while investing in equity funds. Even though quality midcaps have the potential to outperform large caps in the long term, they are more volatile than large caps in the short term. Therefore, investors should always have long investment horizons for midcap funds.

You can see in the chart below that over the 5 year investment tenures since inception, Axis Midcap Fund was able to deliver more than 10% CAGR returns most of the times.

Source: Advisorkhoj Research (Period: 05.02.2011 – 17.11.2020). Disclaimer: Past Performance may or may not be sustained in the future

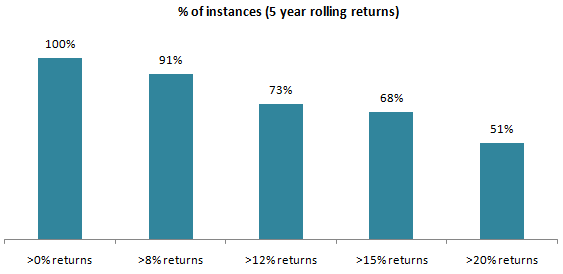

The chart below shows the percentage of instances of 5 year rolling returns of Axis Midcap Fund over certain return levels. Over 5 year investment tenures in the past, Axis Midcap Fund has never given negative returns. It has delivered 8%+ annualized returns over 5 year tenures in 91% of instances in the past. So over sufficiently long investment tenures the risk / return trade-off in the scheme is good. Extrapolating historical rolling returns, the wealth creation potential of the fund is very attractive since it has delivered more than 12% annualized returns over 5 year tenures in 74% of the instances and more than 20% annualized returns in 53% of instances since inception. Disclaimer: Past Performance may or may not be sustained in the future

Source: Advisorkhoj Research (Period: 05.02.2011 – 17.11.2020). Disclaimer: Past Performance may or may not be sustained in the future

Investment strategy

SEBI’s mandate requires midcap funds to invest at least 65% of their assets in 101st to 250th stocks (midcap) by market capitalization. Midcap stocks have the potential to deliver superior returns in the long term due to potential of faster earnings growth. However, such companies are emerging companies and hence it is crucial to be vigilant about their business and growth prospects and hence carry risks. From year 2009 – 2019, the bottom 25% companies of Nifty Midcap 100 index in performance terms gave -64.2% returns destroying investor wealth (source: Axis MF).

The fund manager of this scheme, Shreyash Devalkar, looks for innovative and entrepreneurial companies with experienced management. These companies can be market leaders in emerging industries or higher growth companies in established businesses. The fund manager looks for companies with economic moats.

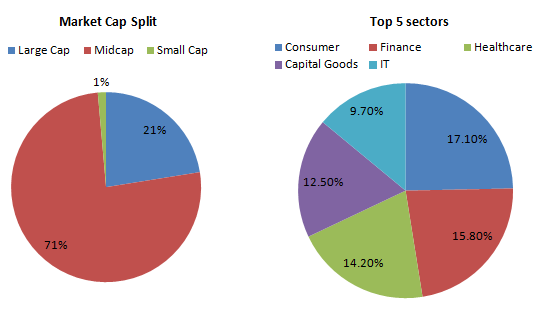

Along with quality midcap stocks, Axis Midcap Fund invests 20 – 25% of its assets in large cap stocks. Currently, 78.18% (as 31st October 2020) of the scheme’s assets are deployed in midcap stocks, 1.66% in small cap stocks and little over 20% in large cap stocks. The balance scheme assets are currently deployed in cash or cash equivalents. The fund manager’s approach is to deploy funds in a staggered manner looking for quality and growth stocks in a prudent manner.The fund manager employs a bottom up stock picking approach. Consumer, Finance, Healthcare, Capital Goods and IT are the top 5 sectors in the scheme portfolio.

Source: Axis MF (As on 31st October 2020)

For the last year or so, the fund manager has maintained a concentrated alpha focused approach. This has enabled Axis MF to deliver strong alphas. Given the economic uncertainty caused by COVID-19 pandemic, few companies are expected to beat earnings growth expectations. As such, in our view, a relatively concentrated approach with focus on quality and growth, along with prudent cash calls, may continue to outperform the broader market and deliver alphas to investors.

Source: Axis MF (As on 31st October 2020)

Conclusion

Axis Midcap Fund is approaching 10 years from inception by next February. As discussed in this review, the scheme has a strong performance track record. The expense ratio of the scheme regular plan is 2.01%. The scheme has an AUM of Rs 6,949 Crores having more than doubled in size in just the last 12 months. This scheme is suitable for your long term financial goals like children’s education, retirement planning and wealth creation. Though we usually recommend SIPs as the preferred way of investing in midcap funds, you can also take advantage of corrections to invest in lump sum on dips. Alternatively, a simpler approach can be to invest in this fund through a 3 – 6 month STP. You should have moderately high risk appetite for this scheme. You should consult with your financial advisor if Axis Midcap Fund is suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team