HDFC Top 200 Fund: Form is temporary but class is permanent

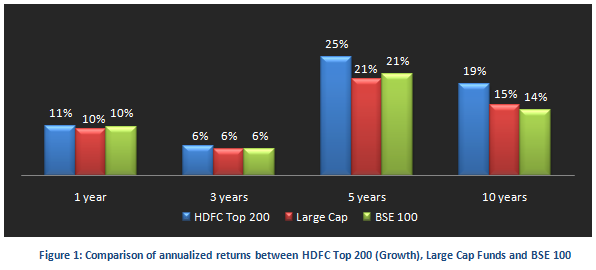

There is an old saying in cricket, "form is temporary but class is permanent". This applies to HDFC Top 200 fund, a long term top performer in the large cap funds category. This fund from HDFC AMC, the largest asset management company in India, invests in companies with large market capitalization, primarily from the BSE 200 basket. The fund’s large-cap, quality-oriented portfolio mix ensured strong performance across different market cycles in the last 18 years. The fund may be lagging behind the top performing peers in the very short term, but over the long term HDFC Top 200 fund has clearly outperformed many of its peers. See the chart below, for the comparison of annualized returns over one, three, five and ten year periods, between HDFC Top 200, the large cap funds category and the benchmark index BSE 100 (NAVs as on Mar 9)

HDFC Top 200 Fund – Fund Overview

This fund is suitable for investors looking for high capital appreciation over a long time horizon, for long term financial objectives, such as retirement planning, children’s education etc. Since this is a large cap fund downside potential in market downturns is limited to an extent. Launched in 1996, this HDFC Top 200 is one of the oldest and most popular schemes in its category. It has a huge AUM base of over Rs 10,000 crores. The expense ratio of the fund is 2%. HDFC AMC is the largest asset management company in India, is widely recognized as amongst the best performers across most mutual fund categories. The fund is managed by industry veteran, Prashant Jain (since 2003), and Rakesh Vyas. Prashant is known as one of the best fund managers in the industry with keen eye for buying high quality stocks at attractive valuations and holding them for long term capital appreciation. Prashant has a long term outlook and sticks to his conviction, even at the cost of short term underperformance. The current NAV (as on Feb 21 2014) is 243.2 for the growth plan and 39.4 for the dividend plan.

Portfolio Construction

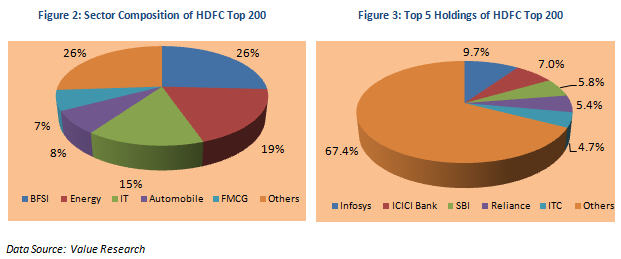

The portfolio stocks belong largely to the BSE 200 basket. However, the portfolio weights from a stock and sector perspective differs from the index weights, to generate superior returns over time. The portfolio has a long term high growth focus. From a sector perspective, the fund managers are overweight on the BFSI sector, with substantial exposure also to energy, IT, automobile and FMCG. The portfolio bias to cyclical sectors explains the short term relative underperformance. However, as the investment cycle revives, the portfolio is expected to generate handsome returns. the In terms of company concentration, the portfolio is fairly well diversified with its top 5 holdings, Infosys, ICICI Bank, SBI, Reliance Industries and ITC accounting for about 33% of the total portfolio value.

Risk & Return

From a risk perspective, the volatility of the fund is on the higher side. The annualized standard deviations of monthly returns of HDFC Top 200 fund for three to ten year periods are in the range of 20% and 25% respectively, which is on the higher side relative to the large cap funds category in the 3 to 5 year period. While the high volatility is a watch out for the fund from a risk perspective, the risk adjusted return is very attractive. On a risk adjusted basis, as measured by Sharpe Ratio, the fund has outperformed the diversified category. Sharpe ratio is defined as the ratio of excess return (i.e. difference of return of the fund and risk free return from Government securities) and annualized standard deviation of returns. Higher the Sharpe ratio better is the risk adjusted performance of the fund. See charts below for comparison of volatilities and Sharpe ratios between HDFC Top 200 fund and large cap funds

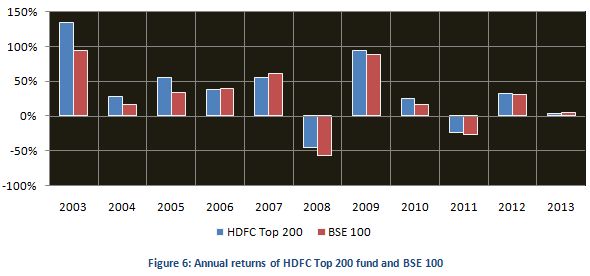

In terms of consistency, the HDFC Top 200 has outperformed the benchmark every year for the last 10 years, across different market cycles (both in bull and bear markets). See chart below, for annual returns of HDFC Top 200 fund and BSE 100 index over the last 10 year period (2003 to 2013)

Dividend Payout Track Record

HDFC Top 200 fund has an excellent dividend payout track record. Since 2000 the fund has paid dividends every year, except 2005.

SIP and Lump Sum Returns

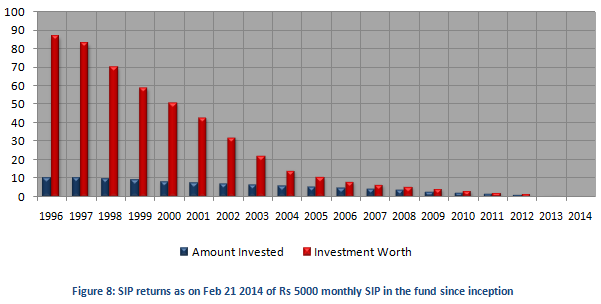

The chart below shows returns as on Feb 14 2014 (NAVof 243.2) of Rs 5000 monthly SIP in the HDFC Top 200 fund Growth Plan, for respective years starting since inception in 1996. The SIP date has been assumed to first working day of the month. The amounts are shown in Rs lakhs.

The chart above shows that a monthly SIP of Rs 5000 in the fund since inception would have grown to Rs 87 lakhs, while the investor would have invested a little over Rs 10 lakhs. If the investor had started the SIP ten years, his or her investment would be worth over Rs 14 lakhs, while the investor would have invested only Rs 6 lakhs. This shows the power of compounded returns from the HDFC Top 200 fund. If the investor had invested a lump sum amount of Rs 1 lakh in the NFO, his or her investment would have grown over twenty four times to Rs 24.3 lakhs

The HDFC Top 200 Fund has delivered nearly 18 years of strong performance and is considered a top pick in many investor portfolios. With equity markets showing definite signs of bullishness, the long term appreciation potential of the fund looks very positive. However, investors need to have a long time horizon while investing in this fund. Given the investment approach, the fund may underperform in the short term. Investors with aggressive risk profiles, who are looking for long term capital appreciation or regular dividends, can consider investing in the scheme through the systematic investment plan (SIP) or lump sum route with a long time horizon. Investors should consult with their financial advisors, if this scheme is suitable for their financial planning objectives

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Motilal Oswal Mutual Fund launches Motilal Oswal Diversified Equity Flexicap Passive Fund of Funds

Jan 2, 2026 by Advisorkhoj Team

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025 by HDFC Mutual Fund

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team