HDFC Small Cap Fund: Investing For Long-Term Wealth Creation

About HDFC Small Cap

HDFC Small Cap Fund has an illustrious history. The fund was launched in April 2008 as a Multi-cap fund, Morgan Stanley A.C.E. Fund under Morgan Stanley India AMC. In 2013, when HDFC AMC acquired Morgan Stanley India AMC, the fund's name change was changed to HDFC Mid and Small Cap fund. Then in 2016, the fund's name was again changed, and today, we find it with the same name, HDFC Small Cap Fund.

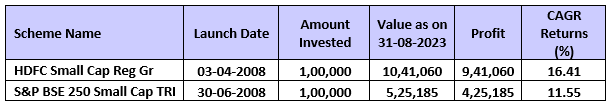

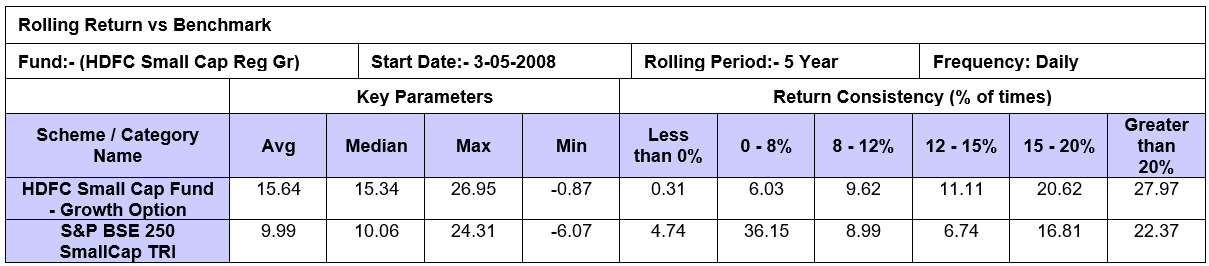

The fund’s AUM is at Rs 22,560.06 crores as of August 31, 2023 (source HDFC website). The fund’s benchmark index is S&P BSE 250 Small Cap TRI. The fund has outperformed its benchmark index by a large margin (see the table below).

Source: Advisorkhoj.com

What Are Small Cap Funds?

According to the SEBI, small-cap stocks are beyond 250 largest stocks in terms of average market capitalisation. The SEBI Scheme Categorization states that all small-cap funds must invest at least 65% of their portfolio in small market-cap stocks. The remaining 35% is at fund manager’s discretion.

How Can Small Cap investing create Alpha?

As the size of the business increases, more analysts tend to start tracking the company. Institutional holding often increases as companies get larger. This may result in superior price discovery and the probability of the stock price continuing to trade a deep discount to fair price is lower. Also, better disclosure levels can lead to greater familiarity and higher multiples than its peers. As a result of all these, mispriced or under-value smaller stocks may get re-priced.

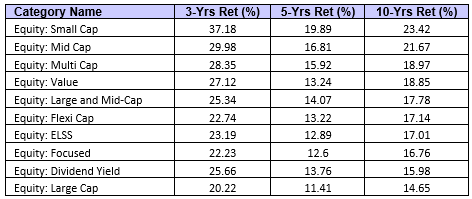

Source: Advisorkhoj.com; as of 6-Sep-2023. The returns are averages of the aggregate of the regular-growth plan of the funds comprising of the category.

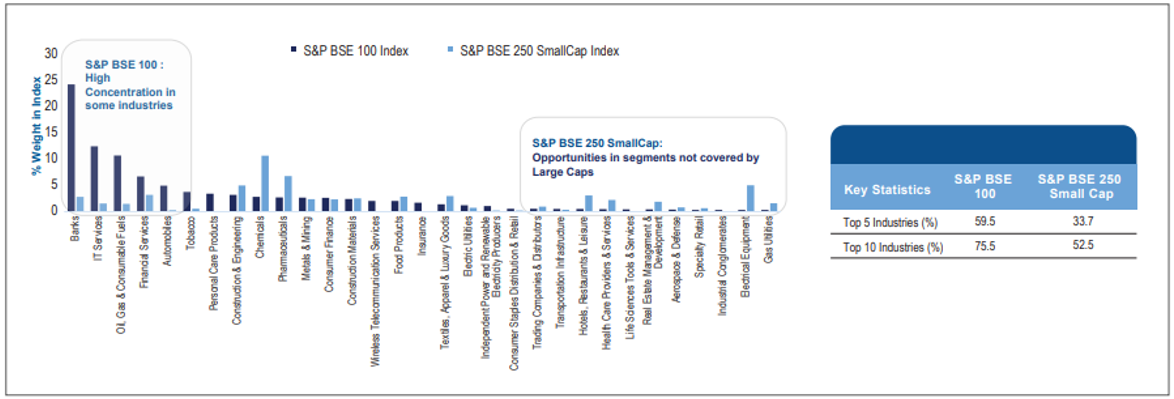

Small Caps provide investment opportunities in segments of the economy that are not covered by Large Caps.

Source: HDFC Small-cap Presentation.

Consistency in HDFC Small Cap Fund Performance

While the scheme presentation states that the fund can be considered by anyone who would remain invested for at least 3 years. We believe than investors with a minimum investment horizon of 5 years should consider investing in this category of funds.

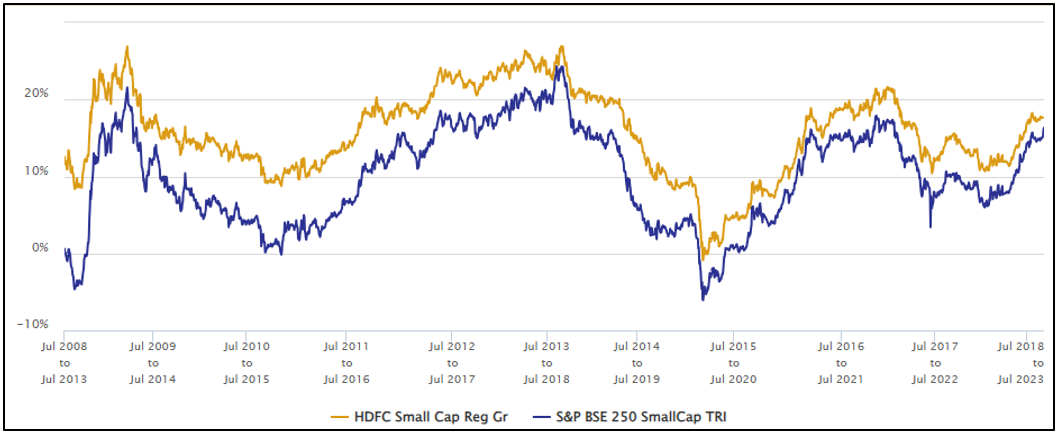

On a five-year rolling basis since inception, the fund has consistently outperformed its benchmark.

(Click on MF Research>>Rolling Returns vs Benchmark)

Source: Advisorkhoj.com.

If you deep dive into the same data (looking at the table below), it highlights if an investor remained invested for more than 5 years. Then 75% of the time fund has given above 12% returns, including 24% of the time when the fund has given above 20%.

Source: advisorkhoj.com.

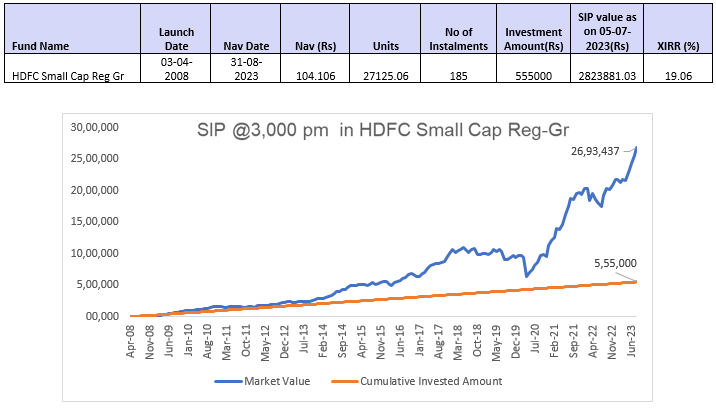

Wealth Creation by HDFC Small Cap

The fund’s SIP performance is also good. If an investor had started SIP at the inception of the fund and continued it, then their SIP would have given returns of 18%. This would have been generated over 184 instalments. A total Sum of Rs 5,52,000 was invested (@3000 per month), and its value as on 5-July-2023 would have been Rs 25,93,681.

Source: advisorkhoj.com.

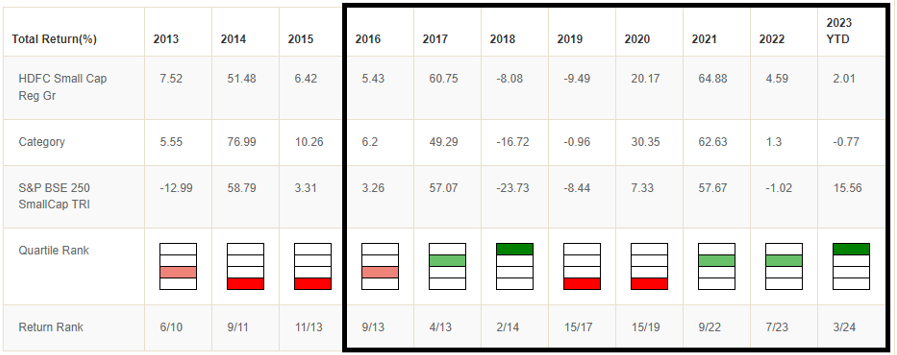

Quartile Performance

Another way of assessing the performing of a mutual fund scheme is to look at the year on year performance on a quartile basis. HDFC Small Cap Fund was in the top 2 quartiles in 5 out of the 7 years since the scheme was acquired by HDFC MF (2016). This shows a high level of consistency in the performance. Also, during this period, the fund manager continuity has been maintained, thus giving a higher conviction in the scheme.

Source: Advisorkhoj.com.

Investment Strategy

- Focus on quality companies, with sound financial strength and reasonable return on equity

- Invest at sensible valuations in companies trading at reasonable multiples (P/E, P/B, EV/EBITDA etc.)

- Aim to minimize mistakes by investing in companies with sustainable and understandable business models, with good management quality

- Portfolio overweight/underweight vs benchmark controlled to manage portfolio risk by the Fund Manager

- Portfolio to be invested between 90-100%, as far as possible

Who should invest in HDFC Small Cap Fund?

- Investors looking for capital appreciation over long investment tenures

- Investors with high-risk appetite

- Investors with minimum 5-year investment tenure

Investors should consult with their financial advisors if HDFC Small Cap Fund is suitable for their investment needs

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team