HDFC ELSS Tax Saver: One of the best performing ELSS Funds

We are approaching the end of 2023 and there is just 3 months left to complete your tax planning for FY 2023-24. If you have not done your tax planning yet, then you should start at the earliest. Tax payers can claim deductions of up to Rs 1.5 lakhs every year from their gross taxable income by investing in various schemes allowed in Section 80C of Income Tax Act 1961. Investors in the highest tax bracket save up to Rs 46,800 in taxes by claiming deductions u/s 80C.

Types of 80C investments

80C investments can be either non-market linked or market linked. Non market linked 80C investments like Public Provident Funds (PPF), National Savings Certificates (NSC), tax saver term deposits etc are risk free investments. Market linked investments like Equity Linked Savings Schemes (ELSS) and Unit Linked Insurance Plans (ULIPs) are subject to market risks.

What is ELSS?

Equity Linked Savings Schemes are diversified equity funds with a lock-in period of 3 years. These funds diversify across different industry sectors and market capitalization segments. You can start investing in ELSS with Rs 100 only. There is no upper limit of investments in ELSS; however, you can claim tax deduction of up to Rs 1.5 lakhs u/s 80C. You can invest in ELSS either in lump sum or through SIP.

Why invest in ELSS?

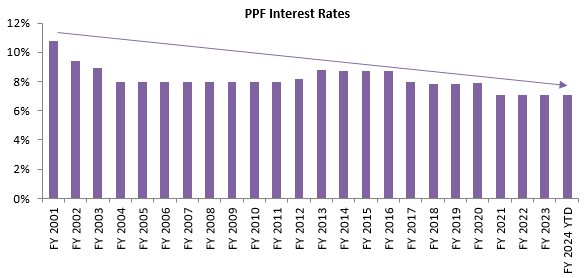

- Government small savings like PPF have been popular 80C investment options for many investors, but small savings scheme interest rates have been declining over the long term.

Source: Advisorkhoj Research, India Post

- Historical data shows that equity, as an asset class, has the potential of giving superior returns in the long term. In the last 20 years (ending 30th November 2023) Nifty 50 TRI has given 14.75% CAGR returns.

- Since ELSS funds can invest across market capitalizations segments, there is opportunity for fund managers to create alphas by investing in a bigger universe of stocks.

- The three year lock-in period of ELSS enables fund managers to invest in high conviction stocks for a long period of time because of relatively less redemption pressure.

- ELSS is the most liquid investment option u/s 80C. ELSS has lock-in period of three years, whereas minimum lock-in period of other 80C investment options is 5 years.

- ELSS is one of the most tax efficient investment options u/s 80C. We will discuss taxation of ELSS later in this article.

About HDFC ELSS Tax Saver Fund

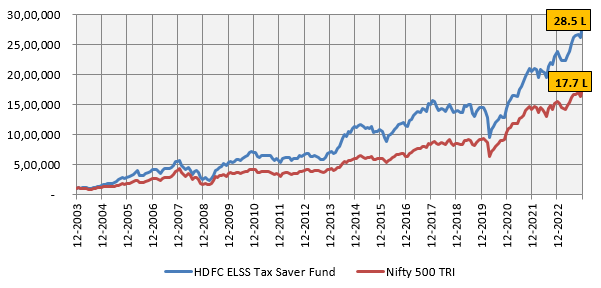

HDFC ELSS Tax Saver Fund is an equity linked savings scheme. The scheme was launched in 1996 and has Rs 12,197 crores of assets under management (as on 30th November 2023). The expense ratio (TER) of the fund is 1.75%. The scheme benchmark is Nifty 500 TRI and it is market cap agnostic. The chart below shows the growth of Rs 1 lakh investment in HDFC Tax Saver Fund over the last 20 years. In the last 20 years, HDFC Tax Saver Fund gave 18.2% CAGR returns (as on 30th November 2023), burnishing its credentials as a proven wealth creator, tax saving fund. You can also see that the fund created alphas for investors by beating the benchmark index (Nifty 500 TRI gave 15.5% CAGR over the same period).

Source: Advisorkhoj Research, as on 30th November 2023. Disclaimer: Past performance may or may not be sustained in the future

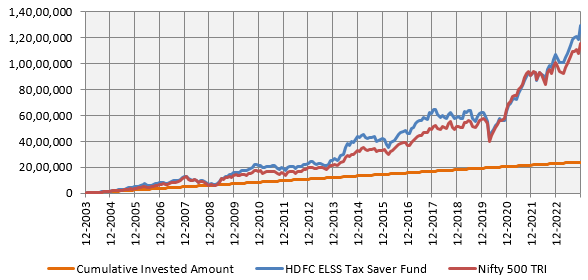

SIP – Effective and disciplined way of tax planning

Investing in ELSS through SIP not only keeps you disciplined in your tax planning, it can also help you accumulate wealth in the long term. The chart below shows the growth of Rs 10,000 monthly SIP in HDFC ELSS Tax Saver Fund over the past 20 years. You can see that with a cumulative investment of Rs 24 lakhs, you could have accumulated nearly Rs 1.3 crores (as on 30th November 2023). You should not think about tax planning, purely from the standpoint if tax savings. In addition to tax savings, ELSS has considerable potential of wealth creation for disciplined investors.

Source: Advisorkhoj Research, as on 30th November 2023. Disclaimer: Past performance may or may not be sustained in the future

Outperformance versus peers

The chart below shows the annual (calendar year) performance of HDFC ELSS Tax Saver Fund relative to the benchmark and ELSS category since 2013. You can see that the fund was in the top 2 quartiles, 7 times in the last 10 years. This shows strong performance consistency. The fund has been in the top 2 quartiles for the last 3 years consecutively.

Source: Advisorkhoj Research, as on 30th November 2023. Disclaimer: Past performance may or may not be sustained in the future

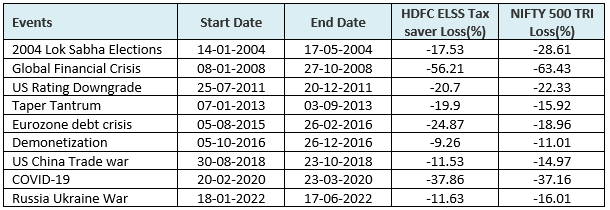

Performance in market drawdowns

We have shown the drawdowns of HDFC ELSS Tax Saver Fund versus the Nifty 500 TRI in the biggest corrections over the last 20 years. You can see that in most big corrections, HDFC ELSS Tax Saver Fund was able to limit the downside risks for the investors.

Source: Advisorkhoj Research, as on 30th November 2023. Disclaimer: Past performance may or may not be sustained in the future

Investment Strategy

- Fundamentally strong companies with growth drivers in the medium to long term.

- Competitively placed in an industry with good prospects.

- Will consider stage and trajectory of industry cycle and take a risk-adjusted view so as to position ahead of the market.

- Strong Management with an ability to capitalize on opportunities while managing risks.

- Track record of corporate governance, ESG sensitivity and transparency.

- Emphasis on valuation to provide reasonable margin of safety.

- Holistic approach to valuations without relying solely on traditional parameters like P/E or P/B.

- Considering the long term nature of investments in the Scheme, stock selection will be strategic and long term in nature, instead of tactical.

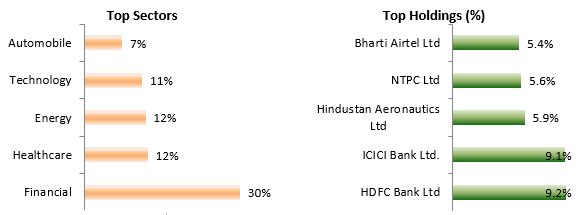

Portfolio positioning

Source: Advisorkhoj Research, as on 30th November 2023. Disclaimer: Past performance may or may not be sustained in the future

Who should invest in HDFC ELSS Tax Saver Fund?

- Investors looking for tax savings under section 80C and capital appreciation over long investment horizons.

- Investors with high-risk appetite.

- Investors with minimum 3 years investment tenures.

- You can invest either in lump sum or SIP depending on your financial needs.

Investors should consult their financial advisor or mutual fund distributors if ,b>HDFC ELSS Tax Saver Fund is suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team