Good track record makes Sundaram Select Mid Cap Fund a worthy choice

In our past few fund reviews, we have analysed some top performing mid-cap funds. As part of our mid-cap series, in this article we will review a top performer in terms of long term track record. Sundaram Select Midcap fund, from the Sundaram AMC stable, is one of the Top 3 mid-cap funds on the basis on ten years trailing annualized returns. This is purely a mid-cap fund and has achieved capital appreciations through active re-balancing of sectors and stocks, to deliver excellent long term returns on investment.

Inherently small and mid-cap funds are more risky than large cap funds. However, they have the potential to generate superior returns. See the chart below, for the comparison of annualized returns over one, three, five and ten year periods, between small and mid-cap funds and the large cap funds categories (NAVs as on Mar 5)

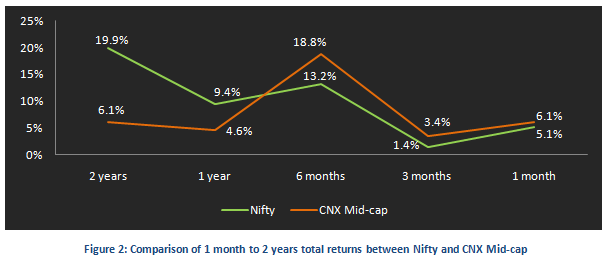

The outperformance of the small & mid-cap fund versus large cap category is despite the fact, that the mid cap stocks have lagged behind the market. While the Nifty has gained 9.4% in the last one year, the mid-cap index (CNX Midcap) gained by only 4.6%. However, in the past few weeks and months mid-cap stocks has been in favour and have been outperforming the Nifty. See the chart below, for comparison of returns across various time periods between Nifty and CNX Mid Cap.

The Sensex today has closed at an all time high and Nifty is very close to its all time high. Though the markets may move either ways within a range till the Lok Sabha elections, it is expected to break-out on the higher side if we get a stable government, which recent opinion polls seem to indicate. When the market rallies further, mid cap stocks which are trading at attractive valuations may outperform large cap stocks.

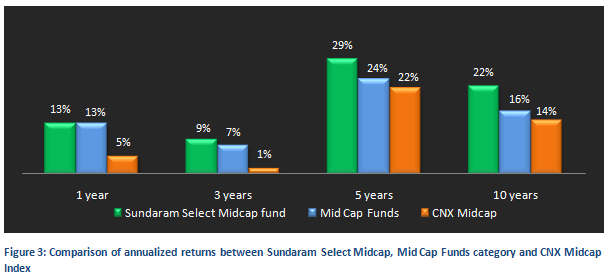

Within the mid-cap funds category, Sundaram Select Midcap fund has strong track record of out performance. The fund may be lagging behind its peers in the short term, but over the long term Sundaram Select Midcap has clearly outperformed most of its peers, as well as the benchmark CNX Midcap index. In terms of 10 year annualized returns this fund is ranked second in the entire mid-cap category, only behind SBI Magnum Global fund. See the chart below, for the comparison of annualized returns over one, three, five and ten year periods, between Sundaram Select Midcap fund, mid-cap funds category and the CNX Mid Cap Index (NAVs as on Mar 5)

Sundaram Select Midcap Fund – Fund Overview

This fund is suitable for investors with high risk appetites, looking for high capital appreciation over a long term. As such the fund is suitable for investors planning for long term financial objectives. However, investors should be prepared for high volatilities in the short term. Launched in 2002, the Sundaram Select Midcap fund has an AUM base of nearly Rs 1640 crores with an expense ratio of 2.09%. The asset management company Sundaram AMC, incorporated in 1996, is a fully owned subsidiary of Sundaram Finance, one of the oldest NBFC’s in India. From 2007 to 2012 the fund was under the stewardship of Satish Ramanathan, one of the most renowned fund managers in the midcap sector. S.Krishnakumar has been managing fund since Satish exited from Sundaram in the middle of 2012. Krishnakumar has been with Sundaram since 2003, and has a good track record of fund management. The fund positions itself as the first mutual fund in India, dedicated only to mid-cap stocks. The fund manager focuses on selecting good quality stocks with high growth potential at attractive valuations. The fund also aims to capture short term opportunities, by leveraging momentum plays. The fund is open both for growth and dividend plans. The current NAV (as on Mar 5 2014) is 177.4 for the growth plan and 18.9 for the dividend plan.

Portfolio Construction

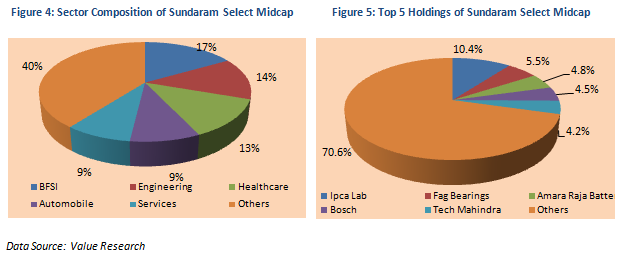

The fund selects good quality mid-cap stocks with stable cash flow and strong earnings potential for the portfolio. From a sector perspective, the portfolio has a BFSI bias, but also has substantial exposure to Engineering, Healthcare, Automobile and Services. Since the exposure to the defensive sectors is relatively less, the last one year returns have been muted. However, once the investment cycle revives, the portfolio has strong appreciation potential. In terms of company concentration, the portfolio is very well diversified with its top 5 holdings, Ipca Laboratories, Fag Bearings, Amara Raja Batteries, Bosch and Tech Mahindra accounting for only 29% of the total portfolio value. Even the top 10 stock holdings account for less than 45% of the total portfolio value.

Risk & Return

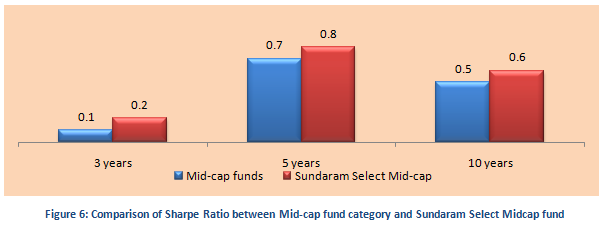

In terms of risk measures, the volatility of returns is on the higher side, even slightly higher than the category as an average. Annualized standard deviations of monthly returns for three to ten year periods of the fund are in the range of 18 to 30%. The 5 year and 10 year standard deviations are higher than the category average. However, the last 3 years standard deviation is in line with the category. On a risk adjusted basis, as measured by Sharpe Ratio, Sundaram Select Midcap fund has however outperformed the category. Sharpe ratio is defined as the ratio of excess return (i.e. difference of return of the fund and risk free return from Government securities) and annualized standard deviation of returns. Higher the Sharpe ratio better is the risk adjusted performance of the fund. See the chart below, for the comparison of Sharpe ratio of the fund versus the mid-cap category.

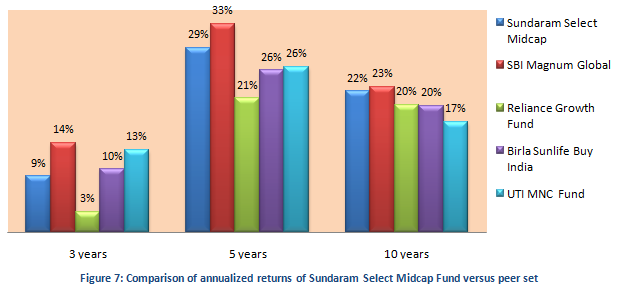

Comparison with Peer Set

A comparison of annualized returns of Sundaram Select Midcap fund versus its peers (top performing midcap funds in terms of 10 years annualized returns) over various time periods shows that this fund has outperformed most of its peers, with the exception of SBI Magnum Global, over the five to ten year period. See chart below for comparison of annualized returns over three, five and ten year periods. NAVs as on Mar 5 2014.

Dividend Payout Track Record

Sundaram Select Midcap Dividend Plan has a good dividend payout track record. Since inception in 2002, the fund has paid dividends every year, except for 3 years (2008, 2011 and 2012)

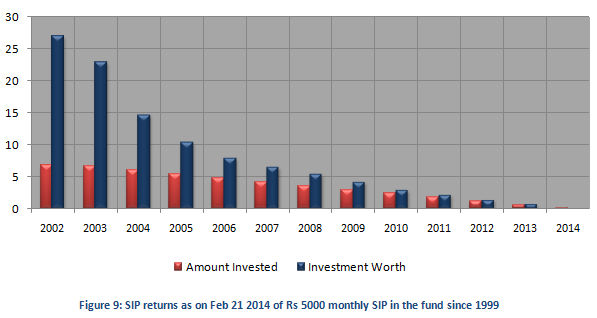

SIP Returns

The chart below shows returns as on Mar 5 2014 (NAVof 177.4) of Rs 5000 monthly SIP in the Sundaram Select Midcap Fund Growth Plan, for respective years since inception (in July 2002). The SIP date has been assumed to first working day of the month. The amounts are shown in Rs lakhs.

The chart above shows that a monthly SIP of Rs 5000 started on the first working day of the month since inception in July 2002 in the fund would have grown to over Rs 27 crores, while the investor would have invested in total only about a quarter of that amount (Rs 6.9 lakhs). If the investor had invested a lump sum amount of Rs 1 lakh in the NFO in July 2002, his or her investment would have grown to nearly eighteen times to Rs 17.7 lakhs.

The Sundaram Select Midcap Fund has delivered over 10 years of strong and consistent performance. Though the recent performance of the scheme has not been as strong as its long term performance, the investment approach has the potential to generate long term capital appreciation. Investors can consider buying the scheme through the systematic investment plan (SIP) or lump sum route with a long time horizon. Investors can opt either for the growth plan or the dividend plan depending upon their individual financial plan. They should consult with their financial advisors if Sundaram Select Midcap fund is suitable for their investment portfolio.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches JioBlackRock Arbitrage Fund

Dec 9, 2025 by Advisorkhoj Team

-

Tata Mutual Fund launches Tata BSE Multicap Consumption 50:30:20 Index Fund

Dec 9, 2025 by Advisorkhoj Team

-

Edelweiss Mutual Fund launches Edelweiss Silver ETF Fund of Fund

Dec 8, 2025 by Advisorkhoj Team

-

Abakkus Mutual Fund launches Abakkus Liquid Fund

Dec 8, 2025 by Advisorkhoj Team