Giving your Mutual Fund SIP a market timing kicker

Most investors who have invested in mutual funds through Systematic Investment Plan (SIP) over a long period of time vouch for the wonderful benefits of systematic investing. Even a small monthly auto debit from your bank account, which very often you do not even notice in your bank statement, over a period of time, creates substantially large corpus, often many times larger than the cumulative investment amount. Our readers know the two big benefits of SIP, namely disciplined investing and rupee cost averaging. We have discussed the importance of disciplined investing a number of times in our blog; suffices to say that, discipline is of critical importance in meeting your long term financial objectives. We have also discussed the benefits of rupee cost averaging a number of times in our blog. Equity markets are volatile and SIP helps investors take advantage of the volatility by averaging out the purchase price of units, which over a period of time, helps investors get superior returns.

Volatility is essentially price fluctuation depending on demand and supply in capital markets. One problem, however, with the concept volatility is that, it ignores the direction of price fluctuation. Both rising asset prices and falling asset prices cause volatility. However, from the investor’s perspective, one is desirable, while the other, is not. When you invest a fixed amount every month in purchasing units of mutual fund schemes, you are buying units both when prices are rising and when prices are falling. The direction of price movement notwithstanding, SIP is beneficial to the investor because, even if you are buying units at a higher price in rising markets, over a sufficiently long period of time, you will also be able to invest in the market downsides. However, if investors had an option of investing only in market downsides, surely they can get superior returns vis a vis the regular SIP. In our post, Is Mutual Fund Systematic Investment Plans really the Best Mode of Investing, we had discussed that, a valuation based approach to SIP can generate superior returns than the plain vanilla monthly SIP.

In a valuation based approach, we invest in equity funds when the valuation (P/E ratio of market benchmark) is low and invest in low risk debt fund when the valuation is high; we also switch from debt to equity funds when valuation is low. While this strategy is a little more complex than your regular SIP, it is fairly obvious that this strategy will beat the plain vanilla SIP, because you are buying when prices are cheap; in other words, you are timing the market. But implementing this strategy will require you to devote some time and effort on a regular basis tracking the market and executing your transactions.

Edelweiss Mutual Fund has come up with a very innovative solution, Prepaid SIP, where you can invest in market downsides or time the market, without you having to track the market. In other words, with Edelweiss Prepaid SIP, you can automate market timing. The Prepaid SIP is like a Systematic Transfer Plan (STP) with an inbuilt simple market timing feature. Without making any complex structure of market valuations, it simply works on market falls, in the Prepaid SIP product, investors can invest in select source funds namely, Edelweiss Liquid Fund and Edelweiss Arbitrage Scheme, Edelweiss Absolute Return Fund, and switch pre-determined amount to the target equity funds namely, E.D.G.E Top 100, Edelweiss Emerging Leader Fund, Edelweiss ELSS, Edelweiss Prudent Advantage Fund and Edelweiss Absolute Return Fund, based on specific investment triggers:-

- 0.5% day on day drop in Nifty 50 or Nifty Free Float Midcap 100

- 1% day on day drop in Nifty 50 or Nifty Free Float Midcap 100

- 2% day on day drop in Nifty 50 or Nifty Free Float Midcap 100

Any amount can be invested in the source scheme on each trigger maximum amount of Rs 1,99,000 instalment /switch can move to target schemes. Investor continues to earn returns of source scheme till such time a switch is triggered by fall in Nifty 50 or Nifty Free Float Midcap 100. The investor can select multiple trigger with differentiated switch value i.e. investor can choose on 0.5% fall, switch value of Rs 5000 where as on 1% he can choose Rs 15,000 switch and depending on fall %age higher trigger value will be switched. By investing in down market, the investor can capture a bigger upside potential of the target schemes. The investor has the option to transfer a prescribed amount from the source fund to target fund, each time the switch is triggered., each time Nifty 50 or Nifty Free Float Midcap 100 drops 0.5% / 1% / 2%, the investor can take advantage of prescribed amount on each opportunities on dip. The investor should select the switch amount based on the downside trigger selected by him or her. For example, if the investor selects a 0.5% drop in Nifty or CNX Midcap as a switch trigger, he or she should transfer prescribed amount of say 10000/-from source to target fund, because the investor will have more investment opportunities based on the trigger selected. On the other hand, if the investor selects a 2% drop in Nifty or CNX Midcap as a switch trigger, he or she should transfer Rs 20000/- from source to target fund, because the investor will have the opportunity to invest more in bigger corrections.

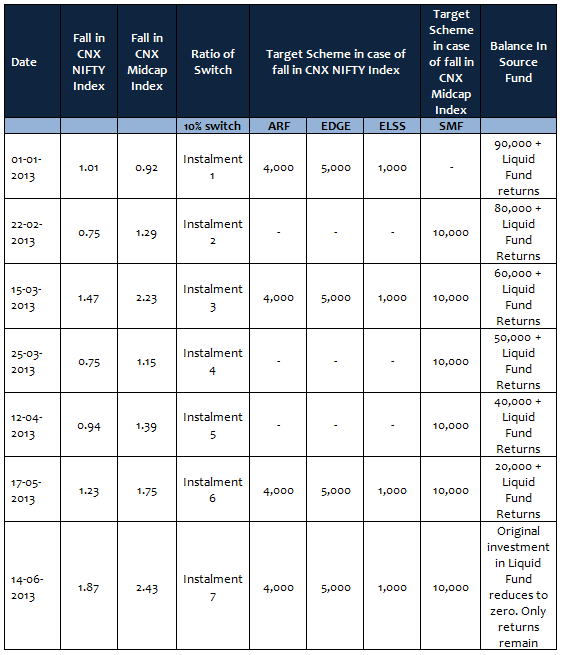

Prepaid SIP gives investors to switch from one or more source funds to one or more target funds. Investors can determine the proportion in which funds are switched from the source fund to different target funds. Let us understand how Prepaid SIP works by walking through an example. Suppose an investor invested र 100,000 in Edelweiss Liquid Fund and transferred 10% to target equity schemes if Nifty or CNX Midcap Index fell by more 1% from previous close. If Nifty fell by 1% or more, the investor opted for Rs 10000/- transfer from Liquid Fund to Edelweiss Absolute Return (ARF), E.D.G.E Top 100 (EDGE) and Edelweiss ELSS (ELSS) in the ratio of 40:50:10. If CNX Midcap fell by 1% or more, the investor opted for Rs 10000/-10% transfer from Liquid Fund to Edelweiss Select Midcap Fund (SMF). The table below shows how the Prepaid SIP worked, when the switches were triggered.

Source: Edelweiss Mutual Fund

You can see in the table above, how the funds are transferred to designated schemes in specified proportions whenever Nifty or CNX Midcap indices falls more than 1%. Investors may have often heard market experts advising them to buy on dips. Though buying on dips is simple to understand, it is often difficult to execute. The Prepaid SIP is the perfect example of buying on dips.

Conclusion

Back-testing of Edelweiss Prepaid SIP returns compared to regular SIP / STP returns have shown that Prepaid SIP is able to generate significantly superior returns compared regular STPs. As discussed earlier, this should not come as a surprise, because you are essentially buying on dips through Prepaid SIP. While you get the advantage of buying on dips, with the Edelweiss Prepaid SIP, you do not have to track the market and execute transactions on an ongoing basis.

By filling out a Prepaid SIP one-time mandate at the time of filling out the application form, you can, at your end, basically automate the process. You can also integrate Prepaid SIP in your regular financial planning, by topping up the target funds on a regular basis. Edelweiss Prepaid SIP offers investors the flexibility of investing as per their needs and preferences, by offering different trigger points, switch percentages, choice of source schemes and choice of target schemes. Investors should consult with their financial advisors, if Edelweiss Prepaid SIP is suitable for their investment requirements.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team