From one market peak to another: How your Mutual Fund SIPs are doing

Many of our advisor friends requested us to do this article just because the markets have been scaling new highs almost daily during the last 7 – 10 days. The Sensex closed at 23871.23 after hitting the all time high of 24068.94 (Sensex) yesterday. When I asked them why they wanted us to do this article, the simple reply was that they wanted to show these to those investors who opted out of Mutual Fund SIPs during every high or every low of the market. The closure of Mutual Fund SIPs was highest when the market touched new lows during the last 6 years. Clearly, my advisor friends wanted to prove the point “Time spent in the market is more important than timing the market”. Investors typically try timing the market when the markets do not behave the way we all desire (i.e. always up!).

When the market keeps going up the fear in the minds of the investors is that they are accumulating units at higher NAVs and when it goes down they feel that it can go down further so better stop the SIP and restart when the market settles or reaches the bottom. No one can ‘time’ the market and if anyone can then it will be a bigger business than Apple, Google or Amazon. But, you can of course spend time in the market and create wealth. The classic example is Berkshire Hathaway Inc which believes that the holding period of equity investment could even be forever (“Our favourite holding period is forever” – Warren Buffett) and thus it became the ‘Most expensive stock in the world’

Investors forget that Mutual fund SIPs are the best and proven way to create long term wealth for reaching your financial planning goals like retirement, children’s education, a family vacation, buying a house or a big car and so on. The benefits of SIPs as you all know are – rupee cost averaging, investment of small amounts in disciplined manner, power of compounding and diversification of risk as you are investing into a basket of stocks. For more details about SIPs and check how much wealth it can create, you can visit our Tools and Calculator section.

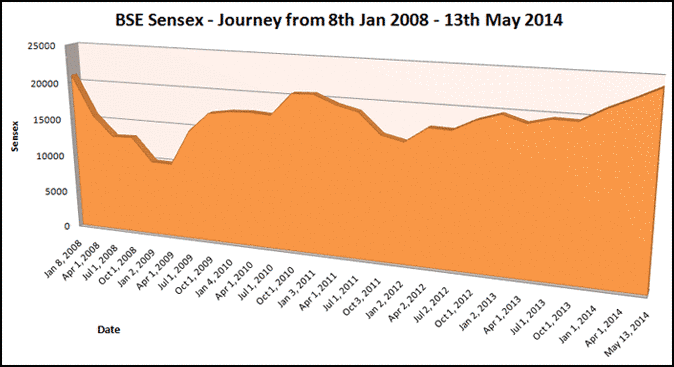

Based on the feedback we have evaluated the returns of some of the popular Mutual Fund SIP Schemes (remember, this not an exhaustive list and the names have been chosen based on popularity and recall of scheme names by some of our advisor friends and our research team) from last Sensex peak of 21206.77 on January 10, 2008 to latest Sensex peak of 24068.94 on May 13, 2014 (closing at 23871.23). But, let us first see how the journey of BSE Sensex was during this famous period (highs and lows of each year). You may also download BSE historical data from Jan 8, 2008 – May 13, 2014 -

(Absolute returns on the basis of entry at the lowest point to exit at the highest point in respective years

including the years when entry was made at the highest point and exit at the lowest point)

As you can see the period was extremely volatile as the returns varied from as low as – 63.70% (negative return) in 2008, - 26.75% (negative return again) in 2011 to as high as 117% in 2009 (positive return). Also, these were the periods when huge number of SIP folios was either closed or further instalments were stopped due to panic. Therefore, the investors could not average out the prices, which is the core of SIP investments. The point, I am driving here is two –

- ‘Not to panic’ as you are accumulating units at low NAV when markets are not in your favour but remember these NAVs gets appreciated significantly when the markets go up. That is how average accumulation price works in favour of the investors if he keeps on investing irrespective of market movements.

- It is impossible to enter at the lowest point and get out at the highest point!

Let us now see the journey through of BSE Sensex the following graph –

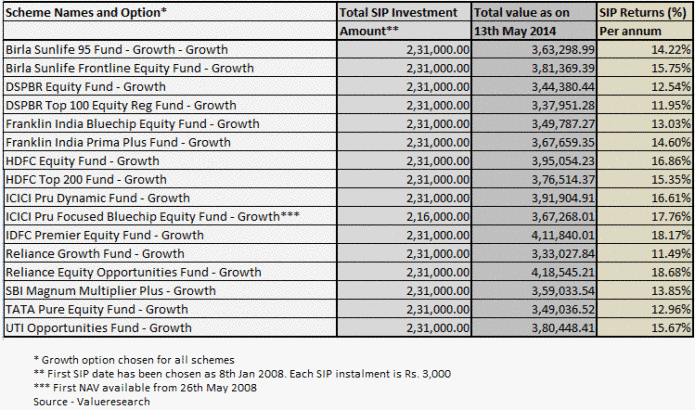

We will now evaluate the returns of some popular SIPs which were started at the peak of 2008 but were not closed during these volatile periods and are still continuing. Also, let us see how the returns are looking in these schemes when the BSE Sensex hit the new high yesterday –

SIP RETURNS AS ON MAY 13, 2014 FOR SOME POPULAR MF SCHEMES STARTED ON 8TH JAN 2008

As you can see the investors have made positive returns in each of the schemes as they were able to average out the NAV during the volatile period. The annualised returns vary from 11.49% - 18.68% which clearly beats the inflation and real return is much higher than bank fixed deposit and/or recurring deposit schemes. Please note that the above example is not indicative of future return or an advice to invest in these funds. This is just to prove the point that it is impossible to time the market and thus the benefits of investing through Mutual Fund SIPs works in your favour always, if you investing for the long term.

Conclusion – The above proves that if you are investing for the long term wealth creation then you need not waste your time watching the markets or even try timing it. Investing in a good diversified equity fund through SIP is the proven and time tested formula across different market cycles. The levels of market should not be the criterion for starting or closing a SIP. Investors need to stay on the course during the volatility as it could turn favourable for him/her. The investors who stayed invested in SIPs and continued them or even those who forgot to close during this most volatile period in the history of stock markets in India, have successfully beaten the inflation and made more returns than Bank FD or recurring deposit schemes.

However, based on your risk taking appetite and the time by which you want to achieve a particular goal you should select an appropriate fund and the best way would be to consult a financial advisor who may help you suggest one or more.

Disclaimer – the above schemes are popular funds with large SIP folios but not an exhaustive list for investors for selecting a right fund for their SIPs. There could be funds which are giving better returns and not covered in this list. For selecting an appropriate fund consult your financial advisor. You may also refer our section on articles about SIPs for your knowledge

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team