Franklin India Prima Fund is a Consistent mid cap picker for last 20 years

In our previous fund review, we had analyzed Franklin India Bluechip fund. In this article we will review another fund from the Franklin Templeton stable, Franklin India Prima fund. Unlike the Franklin India Bluechip fund which invests only in companies with large market capitalization, the Franklin India Prima fund aims to generate superior returns by investing in a diversified portfolio of small and mid-cap companies with high growth potential.

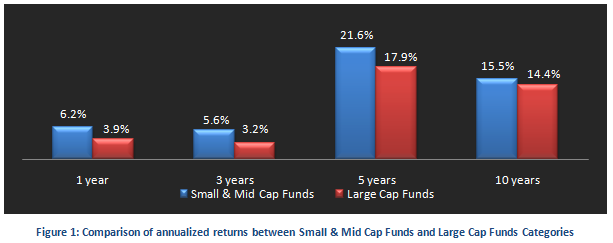

Inherently small and mid-cap funds are more risky than large cap funds. However, they have the potential to generate superior returns. See the chart below, for the comparison of annualized returns over one, three, five and ten year periods, between small and mid-cap Funds and the large cap funds categories (NAVs as on Feb 23)

The outperformance of the small & mid-cap fund versus large cap category is despite the fact, that the mid cap stocks have lagged behind the market. While the Nifty has gained 5.2% in the last one year, the mid-cap index (CNX Midcap) fell by 3.3%. As many mid-cap stocks are trading at very attractive valuations, their future outlook, as the market recovers, is very positive

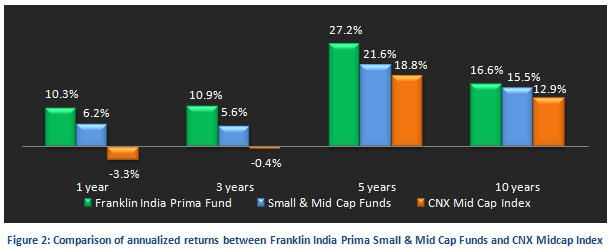

Within the small and mid-cap funds category, Franklin India Prima fund has been a strong and consistent performer. It has consistently outperformed many of its peers in the small and mid-cap mutual fund category, as well as the CNX Midcap index. See the chart below, for the comparison of annualized returns over one, three, five and ten year periods, between Franklin India Prima Fund, small & mid-cap funds Category and the CNX Mid Cap Index (NAVs as on Feb 23)

Franklin India Prima Fund – Fund Overview

This fund is suitable for investors with high risk appetites, looking for high capital appreciation over a long term. As such the fund is suitable for investors planning for long term financial objectives. However, investors should be prepared for high volatilities in the short term. Launched in 1993, this is one of the oldest mutual fund schemes. The scheme is open both for growth and dividend plans. The Franklin India Prima Fund has an AUM base of Rs 940 crores with an expense ratio of 2.33%. As an asset management company Franklin Templeton is recognized as amongst the best performers across several mutual fund categories. While the Franklin India Prima Fund has lagged behind some of the top performers in the small and mid cap funds category in terms of long term track record, after certain changes in the fund management in the recent past (2011), the performance relative to its peers has certainly been stronger. The current fund managers of this scheme are Janakiraman Rengaraju and Neeraj Gaurh. KN Sivasubramanian, the veteran fund manager of Franklin Templeton recently retired and much credit goes to him for the sterling performance of this fund as well as Franklin India Bluechip Fund. However, Jankiraman also has strong research experience in the small and midcap space, and focuses on selecting good quality stocks with high growth potential, at attractive valuations for his portfolio. The current NAV (as on Feb 23 2014) is 348.7 for the growth plan and 35.5 for the dividend plan.

Portfolio Construction

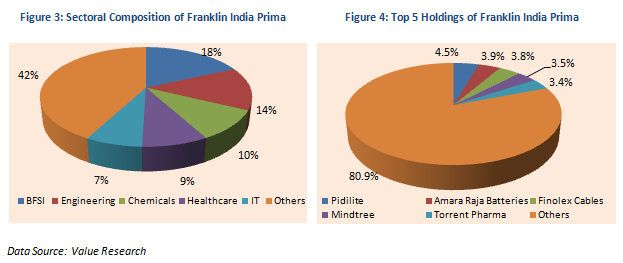

The fund selects good quality small and mid-cap stocks with low balance sheet risks and strong earnings potential for the portfolio. The fund managers focus on stocks that have long term high growth potential. From a sector perspective, the portfolio is fairly well diversified with BFSI, Engineering, Chemicals, Healthcare and IT comprising about 58% of the portfolio. In terms of company concentration, the portfolio is very well diversified with its top 5 holdings, Pidilite, Amara Raja Batteries, Finolex Cables, Mindtree and Torrent Pharma accounting for only 19% of the total portfolio value. The fund also holds around 7% of its portfolio in cash equivalents as a cushion to downside risks in volatile market conditions.

Risk & Return

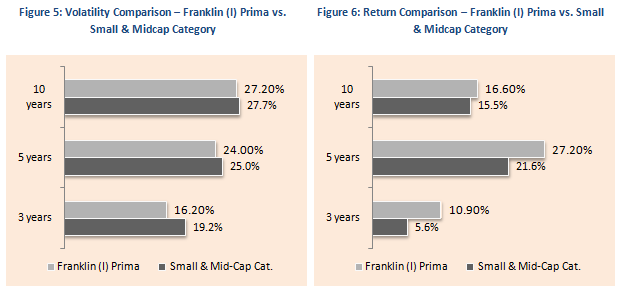

In terms of risk or volatility measures, the annualized standard deviations of monthly returns for three to ten year periods of the fund are in the range of 16 to 27%, which is consistently lower than the volatility of small and mid-cap funds as a category. In fact, the volatility gap between the fund and its category has widened over the last three years, reflecting the risk and quality orientation of the new fund management. While the volatility of the fund is lower than the category average, the annualized returns over the same periods are better than the category, indicative of strong risk adjusted returns performance from this fund. See the charts below for comparison of risk versus return performance of the fund versus the small and mid-cap funds category.

An investment of Rs 1 lakh in the growth plan of Franklin India Prima Fund on its inception Dec 1993, would have by now grown more than thirty four times to nearly Rs 34.5 lakhs.

Dividend Payout Track Record

Franklin India Prima Fund Dividend Plan has an excellent dividend payout track record. The fund has been paying dividends every year for the last 15 years.

SIP Returns

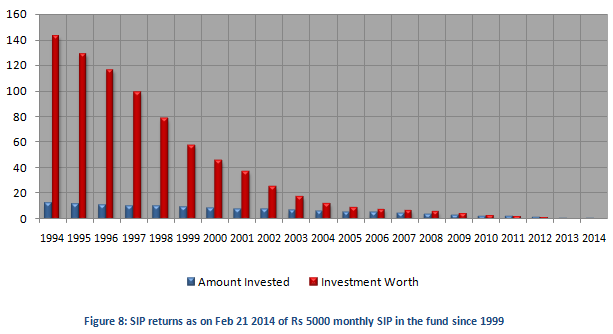

The chart below shows returns as on Feb 23 2014 (NAVof 348.7) of Rs 5000 monthly SIP in the Franklin India Prima Fund Growth Plan, for respective years since inception (in Dec 1993). The SIP date has been assumed to first working day of the month. The amounts are shown in Rs lakhs.

The chart above shows that a monthly SIP of Rs 5000 started on the first working day of the month since inception in Dec 1993 in the fund would have grown to over Rs 1.45 crores, while the investor would have invested in total only Rs 12.15 lakhs (Annualised yield works out to 21.89% as on 23rd Feb 14). Similarly, if the investor started his SIP from Jan 1 1999, his or her corpus would have grown close to Rs 58 lakhs in fifteen years, with an investment of only Rs 9.10 lakhs (Annualised yield works out to 21.89% as on 23rd Feb 14). The above chart demonstrates the power of compounded returns from Franklin India Prima fund.

The Franklin India Prima Fund has delivered over 20 years of strong and consistent performance. With the recent changes in fund management, the fund seems poised to deliver even stronger performance in the future. Investors can consider the scheme through the systematic investment plan (SIP) or lump sum route with a long time horizon. For this, they should judge their risk taking appetite; identify their financial goals by consulting with their financial advisors if Franklin India Prima fund is suitable for their investment portfolio.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Kotak Mahindra Mutual Fund launches Kotak Energy Opportunities Fund

Apr 3, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty 500 Momentum 50 ETF FOF

Apr 3, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty 500 Momentum 50 ETF

Apr 3, 2025 by Advisorkhoj Team

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV and New Age Automotive ETF FOF

Mar 28, 2025 by Advisorkhoj Team

-

UTI Mutual Fund launches UTI Income Plus Arbitrage Active Fund of Fund

Mar 21, 2025 by Advisorkhoj Team