Flexible investing makes Reliance equity Opportunities a strong performer

In a previous article, we discussed that consistent performance should be one of the most important mutual fund selection criteria. Consistent performers aim to outperform the market and generate good returns across all time scales from short to long term. Consequently these funds are suitable for a wide variety of financial planning objectives. These funds not only help the investors create wealth in the long term, but also provides the flexibility of earning good returns in the short to medium term, in case the investors have cash flow needs in that timeframe. As such, in terms of mutual funds performance ranking, CRISIL has a separate classification for consistent performers. Reliance Equity Opportunities Fund is one of the top consistent performers across all equity fund categories. This diversified equity fund, ranked 1 by CRISIL has a flexible investment approach, with both large cap and mid cap companies in its portfolio. The fund also a bias for emerging growth sector and value based themes. This has helped Reliance Equity opportunities fund generate good returns even in difficult market conditions.

While, inherently mid-cap funds are more risky than large cap funds, they have the potential to generate superior returns, since midcap companies generally have higher growth potential compared to large cap companies, both in terms of earnings and valuations. See the chart below, for the comparison of annualized returns over one, three, five and ten year periods, between small and mid-cap Funds and the large cap funds categories (NAVs as on Mar 2)

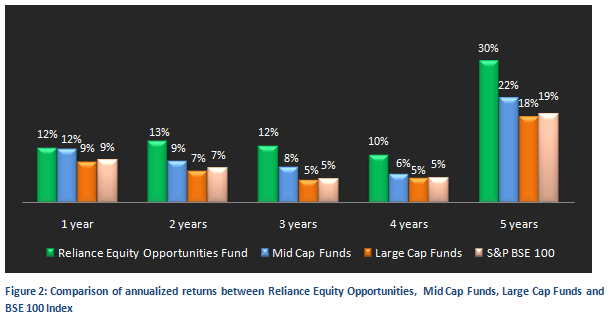

Among diversified equity funds, Reliance Equity opportunities fund has not only been a strong performer, but one of the most consistent ones across several time periods. It has consistently outperformed many of its peers in the mid-cap and large cap fund category, as well as its benchmark index the S&P BSE – 100. See the chart below, for the comparison of annualized returns over one, three, five and ten year periods, between Reliance Equity Opportunities fund, mid-cap funds Category and the CNX Mid Cap Index (NAVs as on Mar 2). Not only has the fund delivered excellent 5 year trailing annualized return of over 30%, but across all time periods (over a year) its trailing annualized returns have never fallen below 10%. On a post tax basis, the trailing returns across different time scales have been better than fixed income or debt investments, despite difficult equity markets during some periods. That is why the fund is an excellent investment option both for medium and long time horizons.

Reliance Equity Opportunities Fund – Fund Overview

This fund is suitable for investors looking for high capital appreciation over a long term, with limited downside potential in bear market conditions. During market downturns in 2008 and 2011, while annual returns from the Reliance Equity Opportunities Fund were negative, the fall was less than the category average. On the other hand in 2009, 2010, 2012 and 2013 when the Sensex gained the fund gave better annual returns compared to the category average. As such the fund is suitable for investors planning for retirement, children’s education or other long term financial objectives. The fund was launched in March 2005 and has been very popular with investors. It has a huge AUM base of over Rs 4800 crores, and has therefore managed to keep its expense ratio very low at only 1.84%. The fund managers of this scheme are Shailesh Raj Bhan and Jahnvee Shah. Shailesh has been managing the fund since March 2005. Shailesh has been with Reliance AMC since 2003 and has established himself as an experienced portfolio manager running both diversified equity and sector funds. He focuses on inherently strong, cash rich companies with high growth potential. He also identifies high growth emerging themes, backed by robust research. The fund managers’ research oriented investment approach has led to excellent risk adjusted returns in different market conditions over the years. The scheme is open both for growth and dividend plans. The current NAV (as on Mar 2 2014) is 46.1 for the growth plan and 25.1 for the dividend plan.

Portfolio Construction

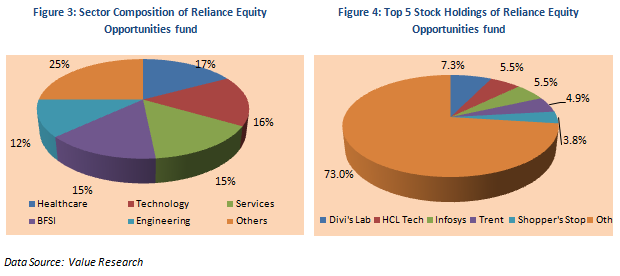

The portfolio mix is about 50:50 between large cap and mid cap companies. The portfolio has a bias in emerging themes mostly in healthcare and technologies, where companies have strong underlying fundamentals. From a sector perspective, the fund has a bias to healthcare, IT, services, BFSI and engineering. The portfolio is very well diversified, in terms of company concentration, with its top 5 holdings, Divi’s Lab, HCL Tech, Infosys, Trent and Shopper’s accounting for only 27% of the total portfolio value.

Risk & Return

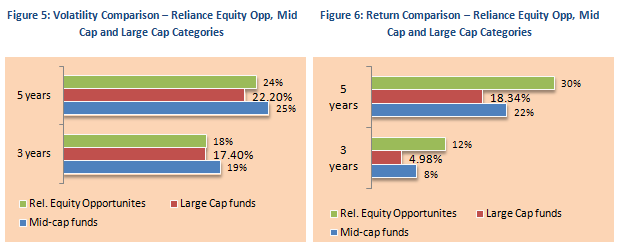

It is in terms of risk adjusted returns that the fund performs. The annualized standard deviations of monthly returns for three to five year periods of the fund are in the range of 17 to 24%. This is lower than the volatility of mid cap funds and only slightly higher than large cap funds. See the charts below for comparison of risk versus return performance of the fund versus mid-cap and large cap funds categories over three and five year periods.

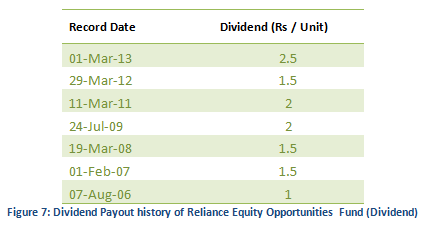

Dividend Payout Track Record

Reliance Equity Opportunities dividend plan has an excellent dividend payout track record. The fund has paid out dividends every year since its inception except 2010.

SIP and Lump Sum Returns

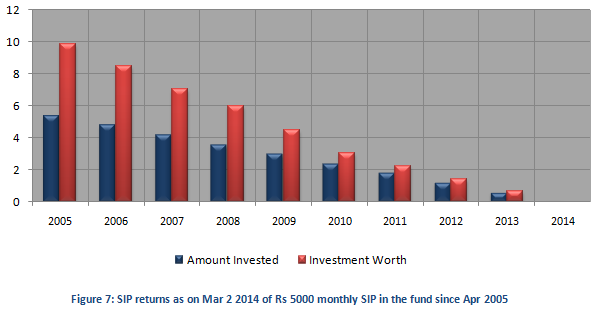

The chart below shows returns as on Mar 2 2014 (NAV of 46.1) of Rs 5000 monthly SIP in the Reliance Equity Opportunities Fund Growth Plan, for respective years since inception (in March 2005). The SIP date has been assumed to first working day of the month. The amounts are shown in Rs lakhs.

The chart above shows that a monthly SIP of Rs 5000 started on October 2005 in the fund would have grown to over Rs 9.9 lakhs, while the investor would have invested in total only Rs 5.4 of that amount.

If the investor had invested a lump sum amount of Rs 1 lakh in the NFO in Sep 2005, his or her investment would have grown to nearly five times to Rs 4.6 lakhs.

The Reliance Equity Opportunities Fund has a strong record of delivering excellent performance across different market cycles. The fund navigated through the market downturns and volatile conditions much better than its peers. As discussed earlier, consistency of performance is an important criterion in selecting a mutual fund. The Reliance Equity Opportunities fund has been a top pick for many investment portfolios. Investors can consider investing in the fund through the systematic investment plan (SIP) route or lump sum route for their long term financial planning objectives. The fund also has a good dividend payout track record and as such is suitable for investors who prefer dividend distribution plan. Investors should consult with their financial advisors if this fund is suitable for their investment portfolio, in line with their risk profiles.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Kotak Mahindra Mutual Fund launches Kotak Energy Opportunities Fund

Apr 3, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty 500 Momentum 50 ETF FOF

Apr 3, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty 500 Momentum 50 ETF

Apr 3, 2025 by Advisorkhoj Team

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV and New Age Automotive ETF FOF

Mar 28, 2025 by Advisorkhoj Team

-

UTI Mutual Fund launches UTI Income Plus Arbitrage Active Fund of Fund

Mar 21, 2025 by Advisorkhoj Team