DSP BlackRock Micro Cap Fund: 3 times returns in 5 years

DSP BlackRock Micro Cap Fund has been the best performing mid and small cap fund for several years now. A र 1 lakh investment in the fund made 5 years back would have grown to र 3.1 lakhs. It is no surprise that, this fund featured at the very top our list of Top 7 Best Mid and Small Cap Equity Mutual Funds to Invest in 2016. The exceptional performance of this fund has made it extremely popular with investors and the AUM of this fund has crossed र 3,100 Crores. A very large AUM size can often become a handicap for small and midcap fund managers, by making it difficult for them to stick to their investment mandate. DSP BlackRock is controlling the AUM of Micro Cap Fund by imposing a limit on the amount of one time purchases (Maximum र 2 Lakhs per day per PAN number). Systematic Investment plan is a great way to invest in this fund. If you started a monthly SIP of र 5,000 in DSP BlackRock Micro Cap Fund, 5 years back, you would made a profit of nearly र 4 lakhs on a cumulative investment of just a little over र 3 Lakhs (as on July 14, 2016); an annualized SIP return of nearly 35%. CRISIL had ranked this fund as 1 (very strong performer) in the midcap category in their latest quarterly ranking.

Fund Overview

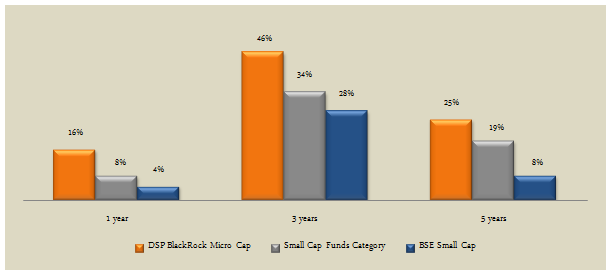

The scheme was launched in June 2007 and has given nearly 19% annualized returns since inception. The expense ratio of the fund is 2.49%. Vinit Sambre and Jay Kothari are the fund managers of this scheme. The portfolio turnover of this fund is just 6%, which shows that the fund managers make high conviction bets and stick to it. The investment strategy of the fund managers has enabled DSP BlackRock Micro Cap Fund to outperform the small and midcap funds category by the wide margin over the last several years. The chart below shows the trailing annualized returns of DSP BlackRock Micro Cap Fund, small cap funds category and the benchmark BSE – Small Cap Index over the last 1, 3 and 5 years.

Source: Advisorkhoj Research

The chart below shows the annual returns of DSP BlackRock Micro Cap Fund versus the category and index over the last 5 years.

Source: Advisorkhoj Research

You can see that, DSP BlackRock Micro Cap Fund outperformed the category and benchmark every year, both in rising market and in falling market. The market capture ratios of this fund are exceptionally good. Market capture ratios tell us how a fund manager performs against the benchmark in up (rising) and falling markets. If you look at market capture ratios of this fund (please see our tool Market Capture Ratio) over the last 5 years, you will see that the Up Market Capture Ratio of this fund is 120%. This means that fund managers of DSP BlackRock Micro Cap Fund, outperformed the BSE – Small Cap index by 20% when the market was rising. The Down Market Capture ratio of the fund (-13%) is even more amazing. This means that, when the BSE – Small Cap Index fell by 10%, DSP BlackRock Micro Cap Fund NAV actually rose by 1.3%. Statistical research shows that, funds which have low down market capture ratios, deliver outstanding results in the long term.

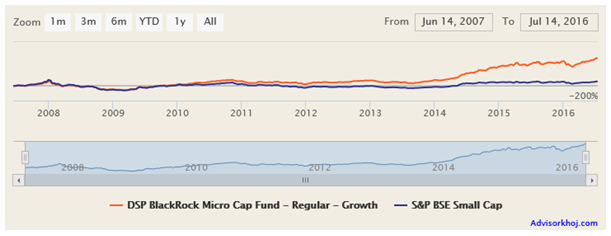

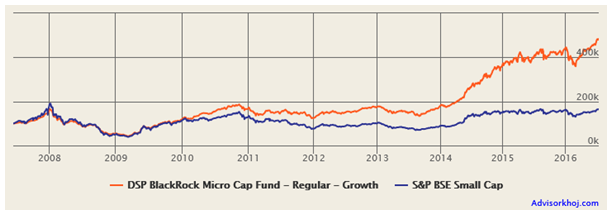

The chart below shows, the NAV movement of DSP BlackRock Micro Cap Fund since inception.

Source: Advisorkhoj Research

Rolling Returns

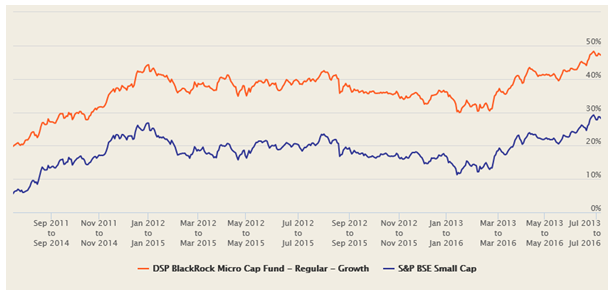

The chart below shows the 3 year rolling returns of DSP BlackRock Micro Cap Fund over the last 5 years. We have chosen a three year rolling returns period, because investors must have a long investment horizon for investing in equity funds. For midcap funds in fact, investors should have a longer investment horizon than large cap or diversified equity funds.

Source: Advisorkhoj Rolling Returns Calculator

You can see that, the fund has not only beaten the benchmark consistently, but the three year rolling returns have consistently been exceedingly good, at over 20%. In fact, the fund gave more than 30% 3 year rolling returns more than 80% of the times.

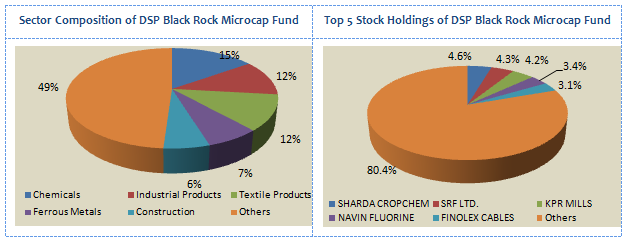

Portfolio Construction

From a portfolio perspective, the fund is biased towards small cap segment. Small Cap companies account for 60% of the portfolio value, while midcap companies account for 40%. From an investment style standpoint, the fund managers invest in growth stocks. As discussed earlier, the fund managers employ buy and hold approach. In terms of sector allocations, the portfolio is weighted towards chemicals, industrial goods and textiles, with substantial allocations to metals, construction, financial services and automobile ancillaries. In terms of company concentration, the portfolio is well diversified with its top 5 holdings, Sharda Cropchem, SRF, KPR Mills, Navin Flourine and Finolex accounting for less than 20% of the total portfolio value.

Source: Advisorkhoj Research

Risk and Return

While the volatility of the fund is above average, the Sharpe Ratio is excellent (for more scheme performance and other details, please see our fund research page). This has been an investor favorite for the last few years.

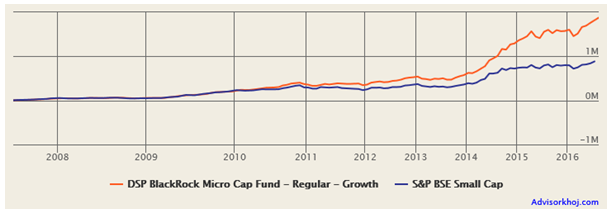

The chart below shows the growth of र 1 lakh lump sum investment in DSP BlackRock Micro Cap Fund (Growth Option) since inception.

Source: Advisorkhoj Research

An investment of र 1 Lakh investment in the NFO would have grown to र 4.84 Lakhs by July 14, 2016.

The chart below shows the returns of र 5,000 monthly SIP in DSP BlackRock Micro Cap Fund (Growth Option) since inception.

Source: Advisorkhoj Research

You can see in the chart above that, a र 5,000 monthly SIP in DSP BlackRock Micro Cap Fund (Growth Option) since inception, would have grown to र 18.9 lakhs (by July 14, 2016); the investor would have made a profit of र 13.3 lakhs on an investment of just र 5.5 lakhs. The SIP XIRR since inception is a whopping 26%, despite the stock market going through three major bear market periods since the inception of the fund.

Conclusion

DSP BlackRock Micro Cap Fund has delivered over 9 years of strong performance. The exceptional alphas created by the fund managers can give investors the confidence that, this fund will continue to do well in the future as well. Investors should have a long investment horizon, when investing in DSP BlackRock Micro Cap Fund. We have seen that, SIP is the best mode of investing in this fund. However, investors can also use lump sum investment in market corrections to tactically increase their asset allocation in equities. Investors should consult with their financial advisors if DSP BlackRock Micro Cap Fund is suitable for their investment portfolios.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team