Consistent performance makes Sundaram Select Midcap Fund a big wealth creator

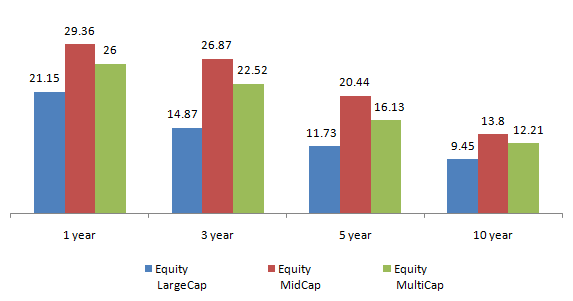

The last one year has been very good for mid and small cap funds. Mid and small cap funds have generated significantly superior returns relative to large cap and diversified equity funds categories over the last 1, 3, 5 and even 10 year periods, as can be seen in the chart below (NAVs as on March 04, 2017).

As we know investments in equity mutual funds are suitable only to those investors with high, moderately high or very high risk taking appetite. Within the equity funds category, mid & small cap funds and sectoral funds are best suited to investors with highest risk taking appetite. However, if one can take a very high risk, then mid & small cap funds can be the most rewarding as well, as we can see in the above chart. In all the periods, the equity midcap category has always significantly surpassed the returns of large cap and diversified equity fund categories.

Source: ValueExpress

If you see in the chart above, the return % difference between large cap versus midcap fund has been as high as 8%, 11%, 9% and 4% in the 1, 3, 5 and 10 year periods. Again, if you compare the midcap funds versus diversified equity funds the annualised return difference percentage is in the range of 3-4% which is also quite significant. As thesecategory return gaps are significantly high, this has the potential of changing the fortunes of the investors with a very long horizon. Therefore, if you can take a bit of very high risk on a certain percentage of your mutual fund portfolio, then midcap funds could be your best long term bet.

Within the midcap funds category, one fund that has always caught the attention of investors and financial advisors is Sundaram Select Midcap Fund. With almost 15 years of continued strong performance (annual CAGR of 29.46% since inception), this fund has proved that a good midcap fund like this, can really be a wealth creator for investors provided they have a long term investment horizon. Imagine, the fund has multiplied investor’s money 43 times in little less than 15 years!

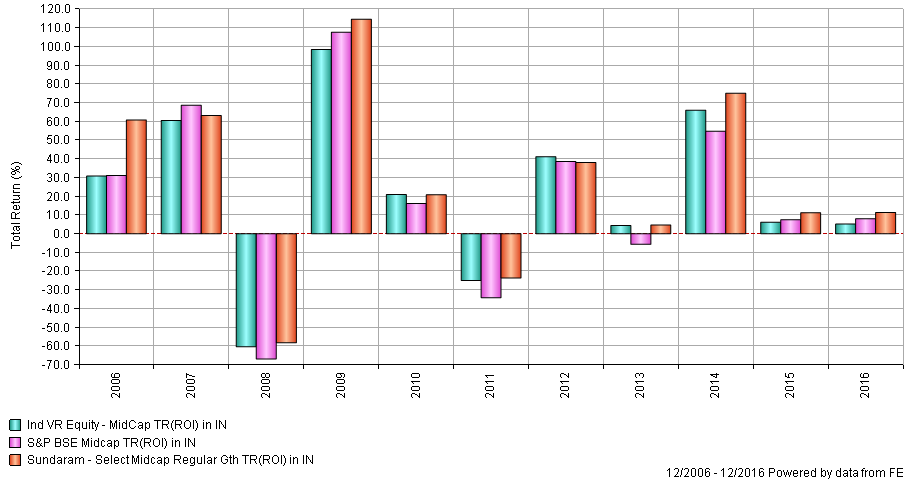

Sundaram Select Midcap Fund has been able to deliver this phenomenal performance through active re-balancing of sectors and stocks so as to give excellent long term returns to its investors. The fund has a strong track record of outperformance. As you can see in the chart below, in the last 11 years, 2008 and 2011 were years when the markets were in negative return territory. Barring these two years and the year 2007, Sundaram Select Midcap Fund has always been able to outperform its benchmark S&P BSE Midcap and also the Valueresearch Equity Midcap index with a good margin.

Source: ValueExpress

Sundaram Select Midcap Fund – Fund overview

Sundaram Select Midcap fund is suitable for investors with high risk appetite and looking for high capital appreciation in order to achieve their long term financial goals. Launched in July 2002, the Sundaram Select Midcap fund has an AUM base of over Rs 4,501Crores with an expense ratio of 2.29%. Incorporated in 1996, Sundaram AMC is a fully owned subsidiary of Sundaram Finance, one of the oldest NBFC’s in India. As an AMC, Sundaram specializes in small and midcap funds and has wide array of open ended and closed ended funds in this category. From 2007 to 2012, Sundaram Select Midcap was under the stewardship of SatishRamanathan, one of the most renowned fund managers in the midcap sector. S.Krishnakumar has been managing the fund since Satish exited from Sundaram in the middle of 2012. Krishnakumar has been with Sundaram since 2003 andis the Chief Investment Officer (CIO) of Equities at Sundaram Asset Management Company and has an excellent track record of fund management.

The Fund has got a Rank-2 from CRISIL and Valueresearch has given its 3 Star rating. The fund rating from Morningstar is 4 Star (Silver)

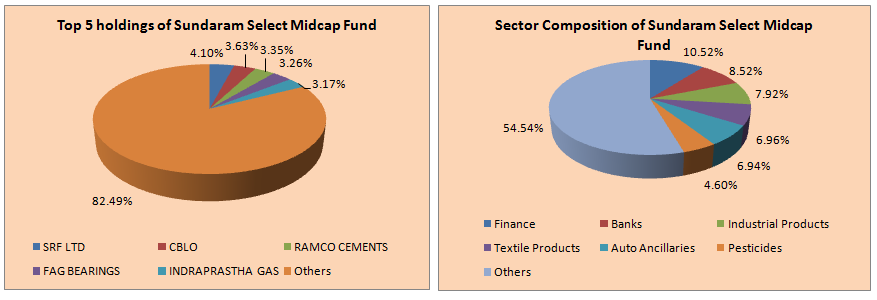

Portfolio construction

The fund selects good quality mid-cap stocks with stable cash flow and strong earnings potential. From a sector perspective, the portfolio has a bias towards cyclical sectors like Banking & Financial Services, Engineering, Textiles, Automobiles and Chemicals. The fund is well poised to do even better when the capex cycle revives in the Indian economy. In terms of company concentration, the portfolio is very well diversified with its top 5 holdings, SRF, The Ramco Cements, Fag Bearings India,Indraprastha Gas and UPL accounting for only 17% of the total portfolio value. Even the top 10 stock holdings account for only 31% of the total portfolio value.

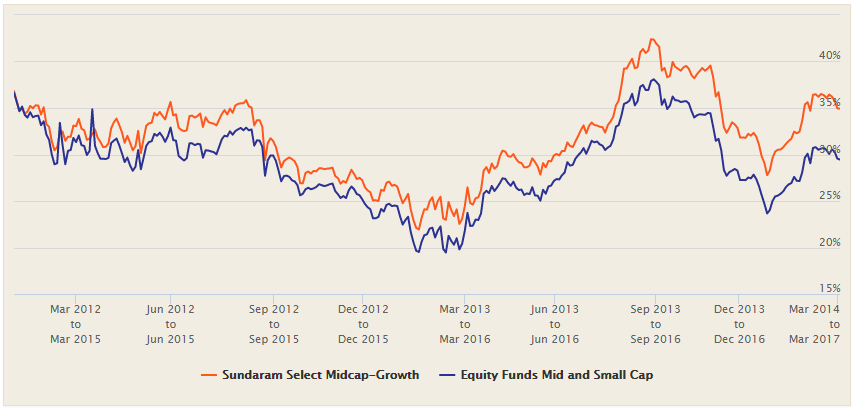

Rolling returns of Sundaram Select Midcap Fund versus Equity Fund Mid & Small Cap Category

The chart below shows the 3 year rolling returns of Sundaram Select Midcap Fund versus the Equity Funds Mid and Small Cap Category. We have taken 3 years rolling return as we suggest that investors with minimum of 3-5 years investment horizon should invest in equities.

Source: Advisorkhoj Rolling return Chart

The rolling returns chart of Sundaram Select Midcap Fund and the Equity Funds Mid and Small Cap Category over the last 5 years is a testimony of the performance consistency of this fund relative to its category. We can see that, the fund has beaten the category returns almost 100% of the times in the last 5 years. Moreover, we can also observe that, the rolling returns outperformance margin of the fund versus the category is quite stable most of the time. This is an evidence of structured fund management approach and prudent risk management practices.

SIP returns

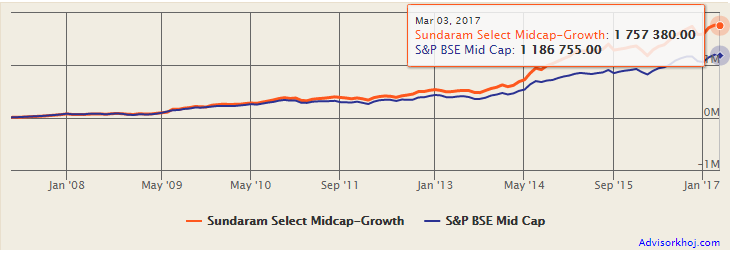

The chart below shows returns as on March04, 2017 of Rs 5,000 monthly SIP in the Sundaram Select Midcap Fund Growth Plan, in the last 10 years (April 2007 to March 2017). The SIP date has been assumed to be first working day of each month.

Source: Advisorkhoj

The chart above shows that a monthly SIP of Rs 5,000 in Sundaram Select Midcap fund Growth in the last 10 years would have grown to nearly Rs 17.57 Lakhs, with a total cumulative investment of only Rs 6.00Lakhs only. The SIP return of the fund in the last 10 years has beenan amazing 20.65%(XIRR) !

Wealth creation by Sundaram Select Midcap Fund versus other asset classes

The chart below shows that had you invested Rs 1 Lakh in the NFO of Sundaram Select Midcap Fund – Growth option,your investment would have grown to Rs 43.37 Lakhs – a 43 times return in 15 years – the fund has delivered 29.46% return since inception (NAV as on March 04,2017).

Sundaram Select Midcap has also proved how equities as an asset class can deliver the most superior returns over long period. As the chart below showsthat had you invested the same amount (i.e. Rs 1 Lakh) in S&P BSE Midcap Index or CNX NIFTY or in a fixed deposit, Gold or silver, your investment would have grown only to Rs 14.91 Lakhs, Rs 9.03 Lakhs, Rs 2.53 Lakhs, Rs 5.42 or Rs 4.59 Lakhs respectively compared to Rs 43.37 Lakhs generated by Sundaram Select Midcap Fund.

Source: Advisorkhoj Lump sum return Calculator

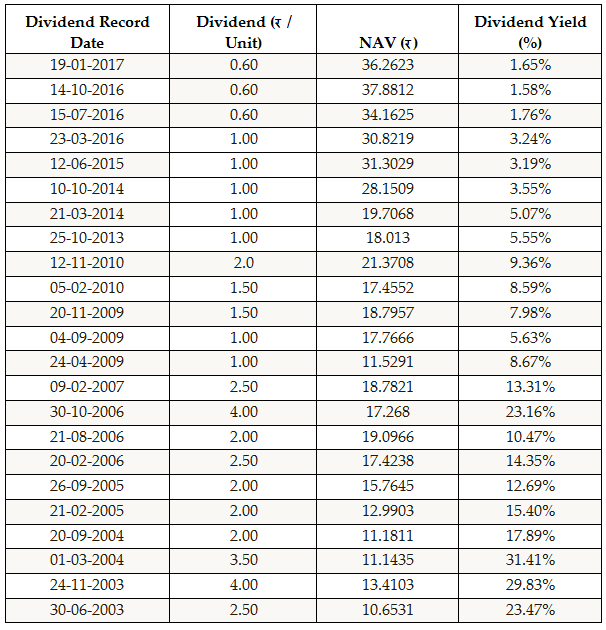

Dividend paymenttrack record

Sundaram Select Midcap Dividend Plan has a very good dividend payment track record. Since inception in 2002, the fund has paid dividends every year, except for 3 years (2008, 2011 and 2012)

Conclusion

The Sundaram Select Midcap Fund has delivered around 15 years of strong and consistent performance. The investment approach of Sundaram Select Midcap Fund has the potential to continue to generate long term capital appreciation as the capex cycle and Indian economy revives. Investors can consider investing in the scheme through the systematic investment plan (SIP) or lump sum route with a long time horizon, provided they can take high risk. Investors looking for regular returns in terms of tax free dividends can opt for the dividend plan as its dividend paying track record has been very good. Others may invest in the growth option of the fund. Investors with high risk profile and willing to achieve their long term financial goals by investing in equities can consider investing in the fund in consultation with their financial advisors.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team