Canara Robeco Infrastructure Fund: One the best performing infra funds

Macroeconomic context

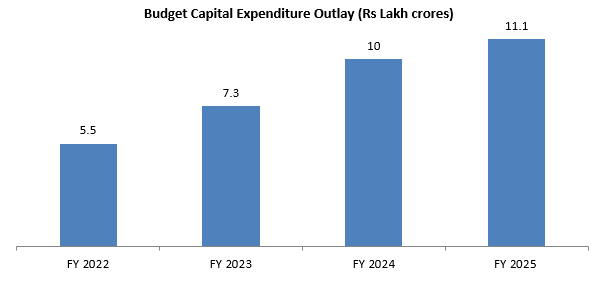

IMF has forecasted India to become the third largest economy of the world by 2028-29.India's nominal GDP is expected to grow from $3.6 trillion in 2023 to $5.8 trillion in 2028 (source: IMF). Growth of the manufacturing sectors and infrastructure development is expected to play a central role in India’s aspiration of becoming a developed economy by 2047. With evolving geostrategic dynamics and global supply chain strategies e.g. China + 1, global manufacturers may look at India as potential manufacturing hub. Improving infrastructure network is crucial step in creating a high growth manufacturing ecosystem. The Government recognizes the infrastructural gaps / needs and has developed various policies in this regard. In the last 3 years, the Government has spent Rs 23 lakh crores on infrastructure development in areas of roads, highways, ports, power transmission, etc. The capex outlay for FY 2025 is Rs 11.11 lakh crores, which is Rs 1.1 lakh crore higher than the previous fiscal year.

Source: Union Budget Documents, Ministry of Finance

Private Sector Capex spending is required to drive infrastructure growth

Economic Survey FY 2024-25 has highlighted significant scope for boosting India’s private investment, especially in the context of investment requirements facing the Indian economy in the areas of infrastructure, green transition, etc. With improving balance sheets (lower debt to equity ratios) and change in RBI’s monetary policy stance from “withdrawal of accommodation” to “neutral”, the time is ripe for private sector capex spending. With impetus of Government spending and potential private sector, infrastructure sector companies are likely to play a key role in the India Growth Story.

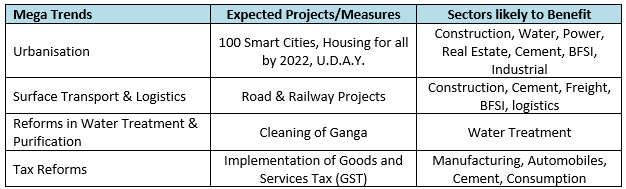

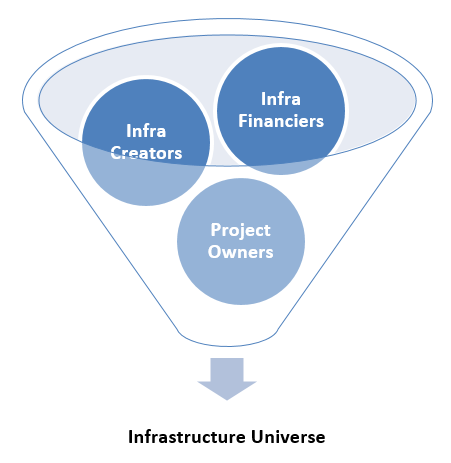

Likely Beneficiaries from infrastructure related megatrends

Source: Canara Robeco MF

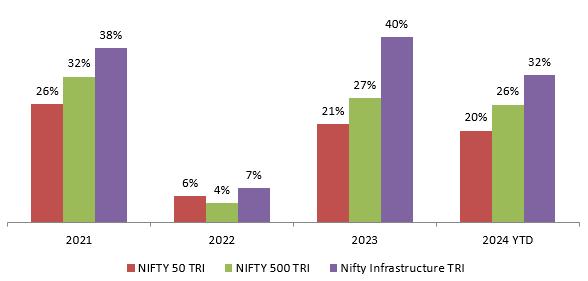

Infrastructure Sector has outperformed the broad market

The infrastructure sector has outperformed the broad market since the economic recovery post COVID-19 pandemic in 2020-21 (see the chart below). Government spending on the infrastructure sector from 2021 Union Budget onwards has benefitted the stocks in this sector and this has in turn helped them in outperforming the market.

Source: National Stock Exchange, Advisorkhoj Research, as on 30th September 2024

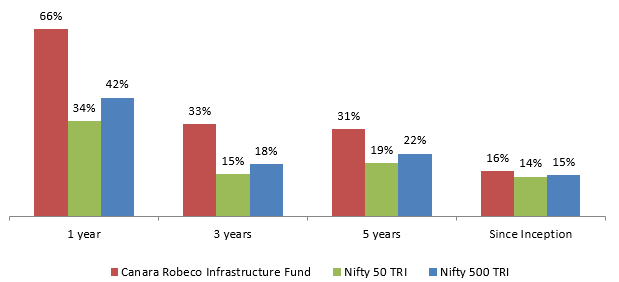

About Canara Robeco Infrastructure Fund

Canara Robeco Infrastructure Fund is among the Top 3 performing infrastructure funds. The fund was launched in December 2005. The fund has given 16.2% return since inception (as on 30th September 2024). The chart below shows the 1, 3, 5 years and since inception CAGR returns of the fund versus the broad market Index (represented Nifty 50 and Nifty 500 TRI). You can see that the fund has generated alpha for investors relative to the broad market index. Vishal Mishra and Shridatta Bhandwaldar are the fund managers of this scheme.

Source: Advisorkhoj Research, as on 30th September 2024

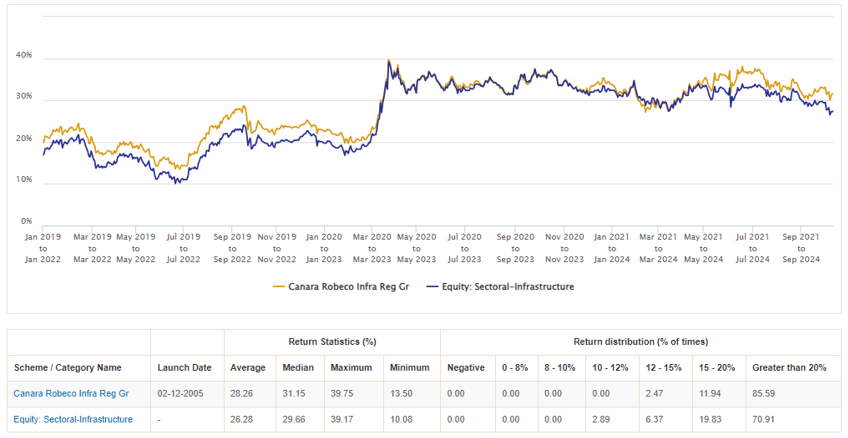

Consistent track record of alpha creation over long investment tenures

The chart below shows the 3 year rolling returns of Canara Robeco Infrastructure Fund (rolled daily) versus category average rolling returns over the last 5 years. You can see that the fund was able to beat category average across different market conditions / investment cycles. The fund has given 15%+ CAGR returns in more than 97% of the instances (observations) over the last 5 years.

Source: Advisorkhoj Research, as on 30th September 2024

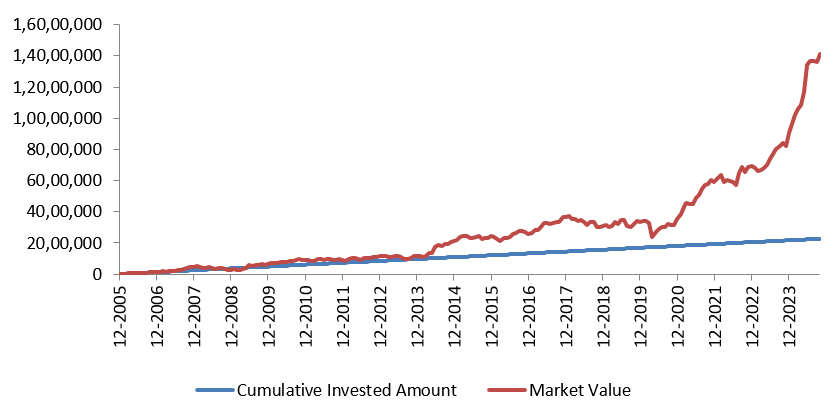

Wealth creation through SIP

Many investors plan on timing the market with sectoral or thematic funds. However, we think that infrastructure is a long term play since it is integral to the India Growth Story and our journey to becoming a developed country. The chart below shows the growth of Rs 10,000 monthly SIP Canara Robeco Infrastructure Fund since the inception of the fund. With a cumulative investment of Rs 22.6 lakhs, you could have accumulated a corpus of more than Rs 1.41 crores (as on 30th September 2024) over the last 18-19 years.

Source: Advisorkhoj Research, as on 30th September 2024

Investment Strategy

- Invests in Companies which directly or indirectly participate in India’s Infra Story

- Follows a theme based Investment Approach which lends superior flexibility in fund management over a Sector based Investment Approach

- Identified Megatrends - Surface Transport & Logistics and Urbanisation which are likely to be growth drivers

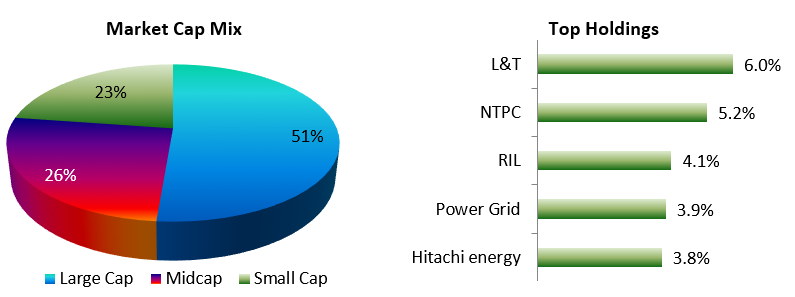

- Concentrated Portfolio with a Large cap bias

Investment Universe

Portfolio Construction

The Fund invests in Growth Oriented Companies and companies which are ‘Market leaders’ or businesses with ‘Unique Business Proposition’. It excludes companies like heavy asset owners, companies with high leverage and those with over ambitious management.

Source: Advisorkhoj Research, as on 30th November 2023

Why invest in Canara Robeco Infrastructure Fund?

- Opportunity to participate in ‘India Growth Story’

- Canara Robeco Infrastructure Fund is a dedicated Infrastructure fund, that invests in ‘Market leaders’ or businesses with ‘unique business proposition’

- The fund is positioned to tap businesses which are expected to gain multifold with the implementation of the government’s reforms

- Canara Robeco Infrastructure Fund is less riskier than sector funds as Infrastructure covers various industries – it is relatively more diversified than other single industry specific funds

Who should invest in Canara Robeco Infrastructure Fund?

- Investors willing to have Tactical Allocation to overall equity portfolio

- Investors looking for capital appreciation over long investment tenures from infrastructure theme

- Investors with a very high risk appetite

- Investors with minimum 5 year of investment tenure

- You can invest in this fund through SIP

Investors should consult with their financial advisors or mutual fund distributors if Canara Robeco Infrastructure Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team