Canara Robeco Equity Hybrid Fund: A Good Investment Option in Uncertain Market Conditions

The equity market has enjoyed a strong rally this year with the Nifty 50 index crossing the historic 20,000 levels in September 2023. From the middle of September, we saw profit booking and Nifty correcting nearly 700 points (as on October 20, 2023) from its all-time high. The global risk factors weighing on the equity markets are:

- Inflation and US Federal Reserve’s monetary policy stance is causing uncertainty about the future interest rates.

- Uncertainty about interest rates has caused US Treasury Bond yields to surge to 16-year highs. Market commentators have said that this is the worst bond bear market in the history of US.

- High US Treasury bond yields are causing risk aversion among global investors, and this has an impact on Emerging Markets in terms of FII flows.

- Crude oil prices have gone to US$ 91 per barrel due to OPEC (Organization of the Petroleum Exporting Countries) production cuts. Rising crude prices pose significant global inflation risks.

- The recent terrorist attack carried out by Hamas in Israel and Israel’s response constitutes a geo-political risk. If the Israel – Hamas conflict spreads to other parts of the Middle East, then crude prices may shoot up further.

Investors should focus on asset allocation in uncertain times. Asset allocation refers to spreading your investments over different asset classes e.g., equity, debt, etc. Asset allocation can maintain a balance between risk and returns and provide stability to your portfolio in volatile markets. Hybrid mutual funds provide asset allocation solutions for investors of different risk appetites and investment needs. In this article, we will review Canara Robeco Equity Hybrid Fund.

About Aggressive Hybrid Funds

Aggressive hybrid funds invest in both equity and debt asset classes. As per SEBI’s mandate, aggressive hybrid funds must invest minimum 65% and maximum 80% of their assets in equity and equity related securities. Minimum 20% and maximum 35% of the assets should be invested in debt and money market securities. The fund managers have the flexibility to manage asset allocation within these ranges. Short term capital gains (investment holding period of less than 12 months) are taxed at 15%. Long term capital gains (investment holding period of more than 12 months) exceeding Rs 1 lakh are taxed at 10%.

Canara Robeco Equity Hybrid Fund

Canara Robeco Equity Hybrid Fund is one of the oldest hybrid mutual fund schemes in India. The scheme is over 30 years old and was launched in 1993 and has over Rs 9,033 crores of assets under management (AUM) as of September 30, 2023. The expense ratio of the scheme is 1.75%. The scheme has given 12.4% CAGR returns since inception (as on 19th October 2023). Shridatta Bhandwaldar, Avnish Jain and Ennette Fernandes are the fund managers of this scheme.

Performance of Canara Robeco Equity Hybrid Fund

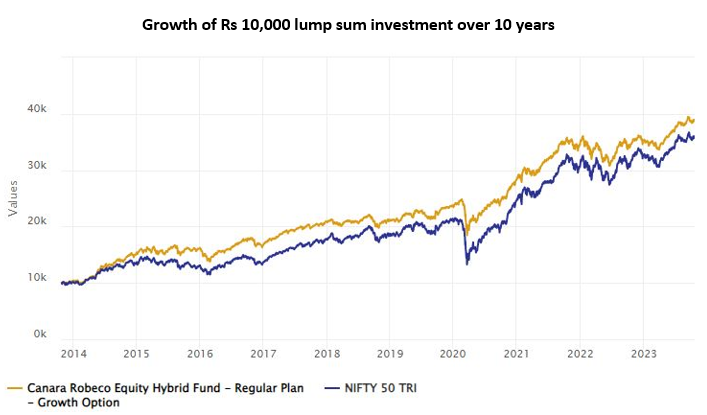

The chart below shows the growth of Rs 10,000 investment in Canara Robeco Equity Hybrid Fund versus Nifty 50 TRI over the last 10 years (ending 19th October 2023). As can be seen, the scheme had outperformed Nifty 50. The long term performance of Canara Robeco Equity Hybrid Fund shows that asset allocation and regular rebalancing can produce superior risk adjusted returns even over long investment tenures. The 10 year CAGR of the scheme is around 14.5% (as on 19th October 2023).

Source: Advisorkhoj Research, as on 19th October 2023. Disclaimer: Past performance may or may not be sustained in the future

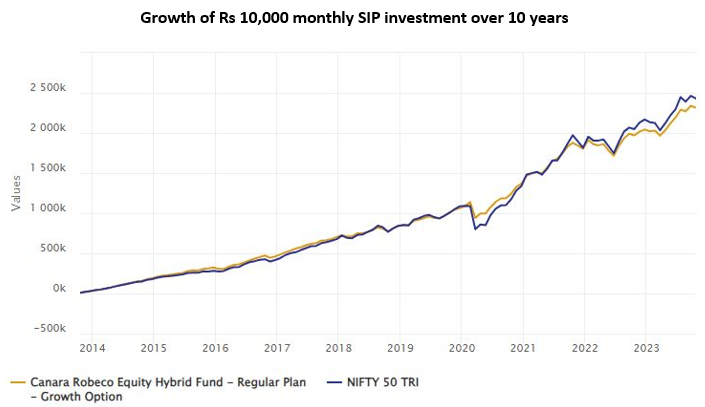

The chart below shows the growth of Rs 10,000 monthly Systematic Investment Plan (SIP) in Canara Robeco Equity Hybrid Fund versus Nifty 50 TRI over the last 10 years (ending 19th October 2023). As can be seen, the scheme nearly matched Nifty 50 in terms of SIP returns even though the volatility was much lower. There is a misconception among some investors that SIPs are only suitable for equity funds. It can be seen that Canara Robeco Equity Hybrid Fund gave good long term SIP returns. The 10-year SIP returns (XIRR) of the scheme was 12.6%.

Source: Advisorkhoj Research, as on 19th October 2023. Disclaimer: Past performance may or may not be sustained in the future

Limited Downside Risks

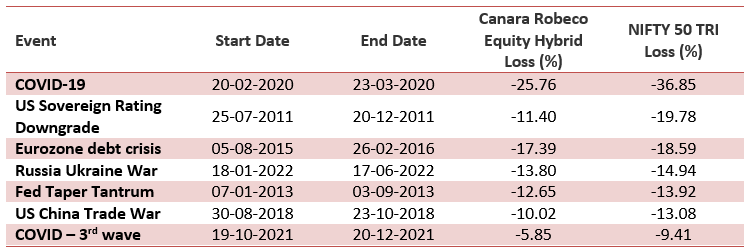

The table below shows the impact of the 5 largest drawdowns in the equity market over the last 15 years on Canara Robeco Equity Hybrid Fund and Nifty 50 TRI. You can see that drawdown in the hybrid scheme was much smaller than that of Nifty. The asset allocation of the scheme was able to limit the downside risk for investors in volatile market.

Source: Advisorkhoj Research, as on 19th October 2023. Disclaimer: Past performance may or may not be sustained in the future

Performance versus peers

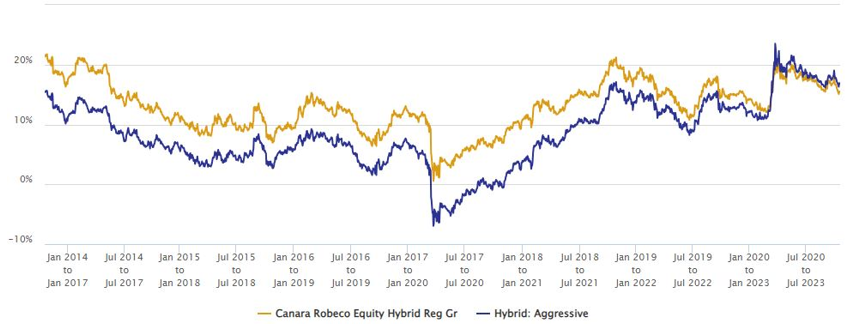

The chart below shows the three year rolling returns of Canara Robeco Equity Hybrid Fund versus the average 3 year rolling returns of the Aggressive Hybrid Funds category over the last 10 years. We have chosen a 3 year rolling return period because investors should have minimum 3 year investment horizon for Aggressive Hybrid Funds. You can see that the scheme consistently outperformed the category average across different market conditions. The fund may be underperformed in recent times, but the long term track record of the fund gives us confidence that the fund will be able to rebound in performance relative to peers in the medium to long term.

Source: Advisorkhoj Rolling Returns, as on 19th October 2023. Disclaimer: Past performance may or may not be sustained in the future

Investment Strategy

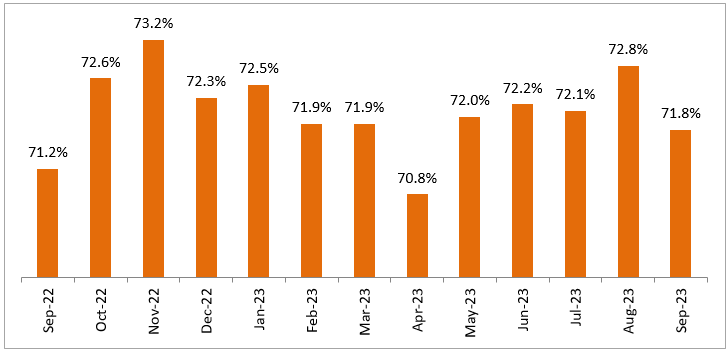

- The allocation to Equity is maintained in the range of 65% to 75%. With a cautiously optimistic outlook on equities, current asset allocation towards equity has been around 70%.

- When equity market rallies, the allocation towards equity increases. Rebalancing brings allocation within range and also helps book profits at higher levels.

- Similarly, when equity markets correct, allocation towards equity reduces and rebalancing helps buy more equity at lower levels.

The chart below shows equity allocation of Canara Robeco Equity Hybrid Fund over the past 12 months.

Source: Canara Robeco MF, as on 29th September 2023

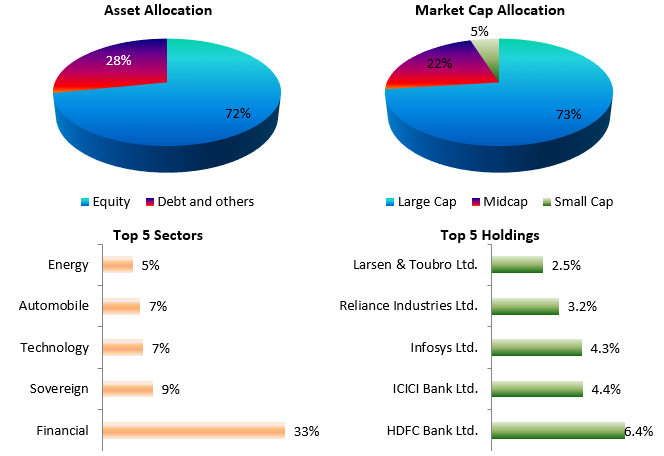

Current Asset Allocation

Equity allocation of the scheme was 72% (as on 29th September 2023), while the debt and cash was 28% (as on 29th September 2023). The equity portion of the scheme portfolio has a predominantly large cap bias; nearly 75% of the equity portfolio is in large caps while the balance is primarily in midcaps. The duration strategy of the debt portion is in the short to medium duration range.

Why invest in Canara Robeco Equity Hybrid Fund?

- Equity as an asset class has the highest potential of wealth creation in the long term compared to other asset classes. The scheme invests 65 – 80% of its assets in equity.

- The debt portion of the scheme reduces downside risks and provides stability in volatile market conditions.

- Canara Robeco Equity Hybrid Fund invests judiciously between Equity and Debt.

- Cost & operational efficiency for investors as compared to investors managing asset allocations at their end.

- If there is pullback in the equity markets due to the risk factors mentioned earlier, the scheme is expected to limit volatility and at the same time, expected to generate capital appreciation for investors in the long term.

- Canara Robeco Equity Hybrid Fund has a strong long term performance track record.

Who should invest in Canara Robeco Equity Hybrid Fund?

- Investors who want capital appreciation in the long term.

- Investors seeking investments to save for specific goals like children education, foreign vacation

- Investors who do not want high volatility.

- Investors aiming to earn better inflation-adjusted returns compared to traditional investments.

- Investors looking for exposure to equity market with a relatively low risk as compared to other High risk Equity Funds.

- The scheme is suitable for new investors who do not have the experience of volatile markets.

- Investors should have moderately high to high risk appetite.

- Investors should have minimum 3-to-5-year investment horizons for this scheme.

- The scheme is suitable both for lump sum and SIP investments. If investors have lump sum funds but are worried about volatility, then, they can invest through 3 – 6 months Systematic Transfer Plan from Canara Robeco Liquid Fund or Canara Robeco Ultra Short Duration Fund.

- Investors should consult with their financial advisors, if Canara Robeco Equity Hybrid Fund is suitable for their long-term investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team