Canara Robeco Emerging Equities Fund: Wealth Creation Story

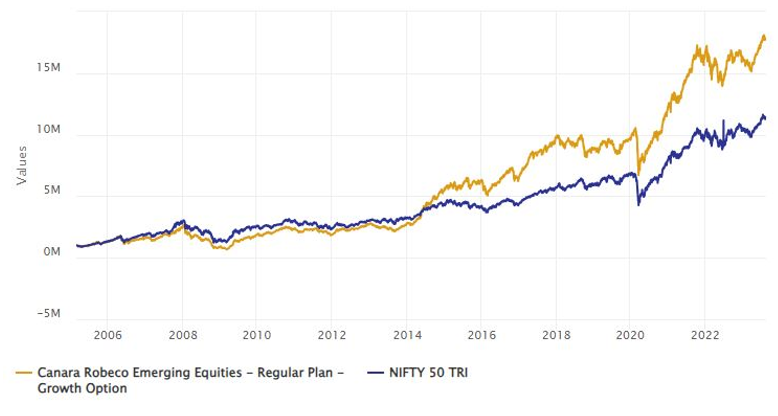

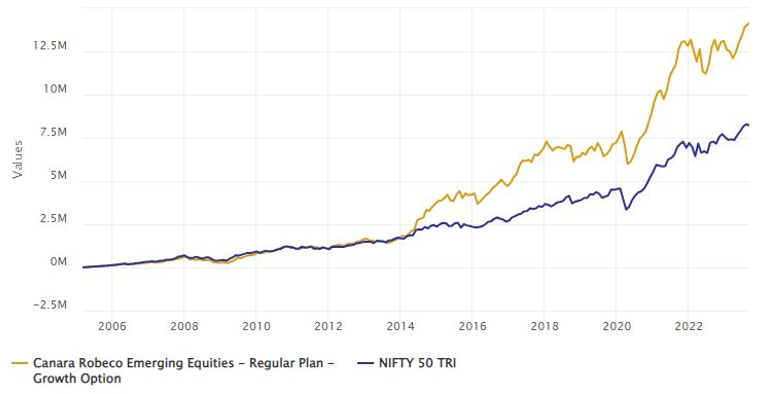

If you invested Rs 10 lakhs in Canara Robeco Emerging Equities Fund at its New Funds Offer (NFO) in March 2005, your investment would have multiplied 18 times to nearly Rs 1.8 crores (as of 21st August 2023). The CAGR of Canara Robeco Emerging Equities Fund since inception is 16.9%. The chart below shows the fund's performance versus the market index Nifty 50 TRI since the fund's inception. You can see that the fund is able to deliver large alphas and create wealth for investors.

Source: Advisorkhoj Research, as on 21st August 2023

About Canara Robeco Mutual Fund

Canara Robeco Asset Management Company (AMC) has a very strong pedigree backed by Canara Bank and Orix Corporation. Canara Robeco is one of the oldest, started in 1993, and most popular names in the mutual fund industry, with more than Rs 70,000 crores of assets under management. A few mutual fund schemes have a vintage of more than 20 years or 30 years, along with a good track record. One such scheme is the Canara Robeco Emerging Equities Fund.

History of Canara Robeco Emerging Equities Fund

The scheme was launched in 2005. For several years, this scheme was primarily midcap-oriented scheme, though it also had substantial allocations to large caps. It was one of the best-performing diversified equity funds for many years; it was a top quartile fund in 2014, 2015 and 2017 (see the chart below).

Source: Advisorkhoj Quartile Ranking, as on 21st August 2023

In 2017, SEBI issued a circular on categorization of mutual fund schemes, in which SEBI defined different market capitalization segments e.g. large cap, midcaps and small caps. Through that circular SEBI also stipulated market cap mandates for different fund categories. Post SEBI’s circular, Canara Robeco Emerging Equities Fund was categorised as a large and midcap fund. In 2020, Canara Robeco Emerging Equities Fund was again a top quartile performer (see the chart above). As on 31st July 2023, Canara Robeco Emerging Equities Fund has Rs 17,931 crores of assets under management (AUM). The expense ratio of the regular plan of the scheme is 1.65% and of direct plan is 0.57%.

What are Large and Midcap Funds?

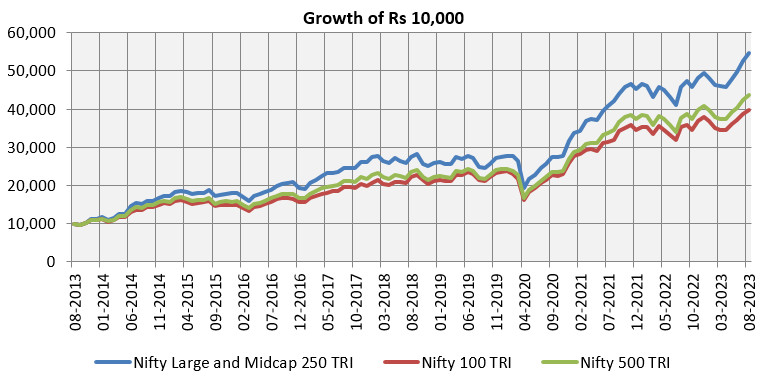

According to SEBI’s directive, large and midcap schemes must mandatorily invest at least 35% of its assets in large-cap stocks and at least 35% of their assets in midcap stocks. SEBI classifies the top 100 stocks by market capitalisation as large-cap stocks and the next 150 stocks by market capitalisation as midcap stocks. Over the last 10 years ending 21st August 2023, large and midcap index has outperformed the large cap index and even the broader market index (please see the chart below).

Source: NSE, Advisorkhoj Research, as on 21st August 2023

SEBI’s mandate for large and midcap schemes is quite flexible allowing considerable freedom for fund managers to change the market cap mix according to their outlook. Depending on market conditions and their outlook, fund managers have the flexibility of changing their large and midcap allocations from 35% to 65%. Fund managers can also make substantial allocations to small caps (up to 30%).

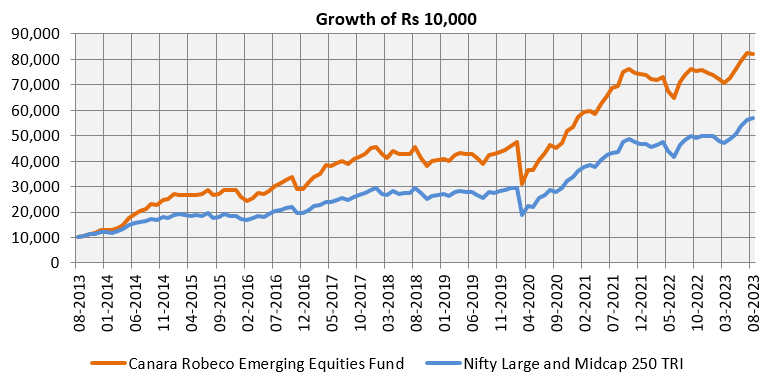

Canara Robeco Emerging Equities Fund outperformed the benchmark over the last 10 years

You can see that Canara Robeco Emerging Equities Fund was able to outperform its benchmark index ‘Nifty Large and Midcap 250 TRI’ over the last 10 years and create substantial alpha for investors.

Source: NSE, Advisorkhoj Research, as on 21st August 2023

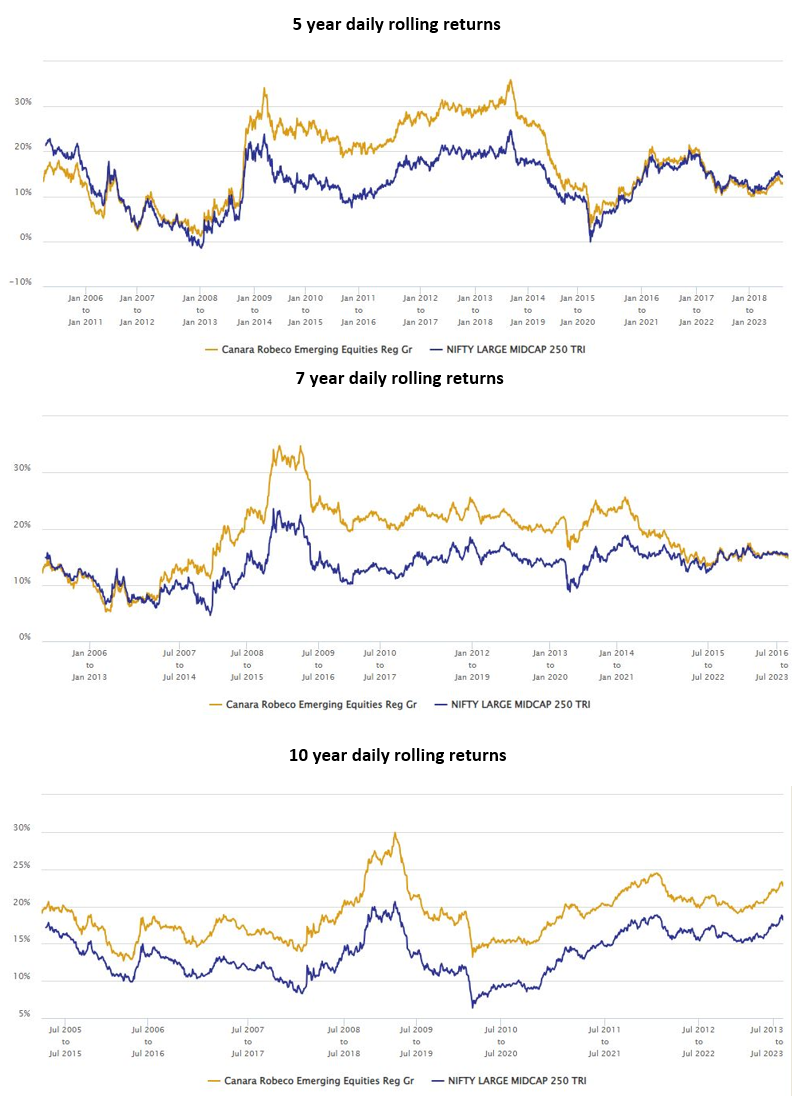

Performance over long investment tenures across market conditions

The charts below show the daily rolling returns of Canara Robeco Emerging Equities Fund versus the benchmark index over different investment tenures since the inception of the scheme. You can see that over longer investment tenures, the scheme has been able to beat the benchmark with greater consistency across different market conditions.

Source: Advisorkhoj Rolling Returns, as on 21st August 2023

Bottom up stock selection strategy

The investment style of the fund manager is a blend of growth and value. The scheme invests in companies with the following attributes:

- High Growth Potential

- Market leadership

- Intrinsic Value

- Healthy Financial

- Management Track Record

- Corporate Governance

Broad investment themes

- Technological edge

- High barriers to entry

- Brand play

- Beneficiaries of shift from unorganized to organized sectors (effect of GST)

- Government Capex

- Distribution and logistics

Wealth creation by Canara Robeco Emerging Equities Fund

The chart below shows the wealth created by Rs 10,000 monthly SIP in Canara Robeco Emerging Equities Fund since the inception of the scheme. With a cumulative investment of around Rs 22 lakhs over the last 18 years, one would have accumulated a corpus of more than Rs 1.4 crores. The SIP XIRR since inception is 17.6%.

Source: Advisorkhoj Research, as on 21st August 2023

Why invest in Canara Robeco Emerging Equities Fund?

The fund has a quality orientation. As a result, the fund saw smaller drawdown in the COVID-19 crash. Strong performance in one year can impact next year’s performance because you will be starting next year off a higher base versus another fund which starts off a lower base. This may have contributed to underperformance in 2021. Although, the fund was a top quartile performer in 2020 (source: Advisorkhoj Quartile Rankings). The underperformance versus peers can partially be attributed to higher allocations to large caps relative to some of its peers. Short-term underperformance can also be a consequence of various factors like fund manager strategy; some high conviction bets, especially value stocks may not necessarily play out in the short term, but it may give excellent returns and alpha in the long term. There are several reasons why we like the scheme. The same is mentioned as follows:

- Bottom-up stock picking endeavours to select the best among the emerging companies which forms part of the portfolio.

- Fund manager’s endeavour to identify companies which have the potential to become leaders of tomorrow in their respective sectors.

- The fund invests with a long term view, staying away from herd behaviour, chasing short term profits, running after certain market spurs. Such herd behaviour/short term approach tends to be very risky and may not pay off in the long term.

- The scheme has a long term track record of strong performance and alpha creation.

Who should invest in Canara Robeco Emerging Equities Fund?

- Investors looking for capital appreciation over long investment tenures.

- Investors with minimum 5 years of investment tenure.

- Investors with a very high-risk appetite.

- One can invest in this fund either in lump sum or SIP depending on the investor’s financial situation or investment needs.

- Investors should consult with financial advisors or mutual fund distributors if Canara Robeco Emerging Equities Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team