Canara Robeco Consumer Trends Fund: One of the best performing consumption fund in last 10 years

Canara Robeco Consumer Trends Fund is one of the best performing consumption funds over the last 10 years. If you invested Rs 1 lakh in this fund 10 years back, your investment would have multiplied nearly 5.5X to Rs 5.37 lakhs. India is a consumption driven economy – historical data shows that consumption accounts for 70% of India’s GDP. Domestic consumption will continue to drive economic growth in India. Accordingly, consumption will be an important investment theme in the future. In this article, we will review Canara Robeco Consumption Trends Fund.

Why is consumption an attractive investment theme in the long term?

- Demographic dividends will drive consumption growth in India. 65% of the population is in the working age group (source: Economic Survey 2018).

- Rising prosperity will also be a major driver of consumption growth rate. India’s per capita GDP at constant prices (2015 USD) grew from sub $1,000 levels in the mid 90s to nearly a $2,500 in 2023 (source: World Bank).

- Growing urbanization of India will also be a major driver of consumption growth. 30 years back 26% of India’s population lived in urban areas. This percentage has now grown to 36% (source: World Bank, 2023).

- Other drivers of consumption growth include shift from unorganized to organized sectors, nuclearization of families, digital penetration and online shopping.

- International Monetary Fund (IMF) forecasted India’s per capita income will rise to $4,000+ in the next 5 years (source: IMF). As per capita rises, consumption patterns and consumer preferences change.

Canara Robeco Consumer TrendsFund has outperformed the broad market

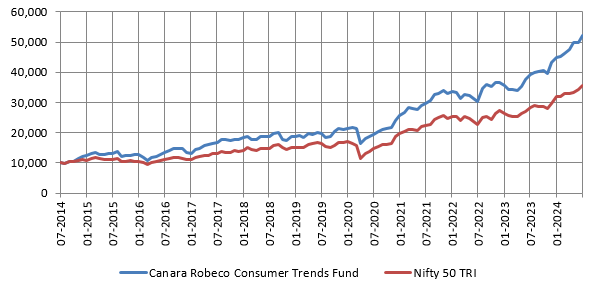

The chart below shows the growth of Rs 10,000 investment in Canara Robeco Consumer Trends Fund versus Nifty 50 TRI over the last 10 years (as on 30th June 2024).

Source: Advisorkhoj Research, National Stock Exchange, as on 30th June 2024.

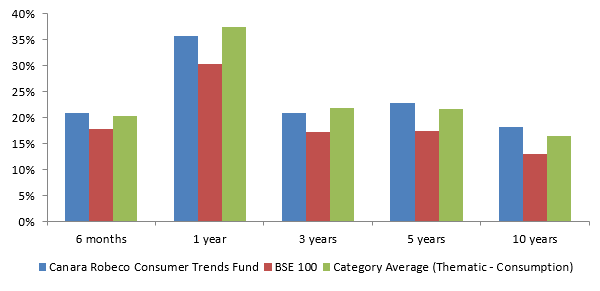

Canara Robeco Consumer Trendshas outperformed benchmark and category over long tenures

You can see that the fund has outperformed the benchmark and category over long tenures. The fund underperformed in the last 1 to 3 years, but has started outperforming again in 2024.

Source: Advisorkhoj Research, National Stock Exchange, as on 18th July 2024.

Consistently in upper quartiles performer

You can see that the fund consistently featured in top 2 quartiles in the last 10 years or so - 8 times in last 11 years. Even though it underperformed in 2022 and 2023, the fund has bounced back into the top quartile in 2024.

Source: Advisorkhoj Quartile Rankings, National Stock Exchange, as on 18th July 2024.

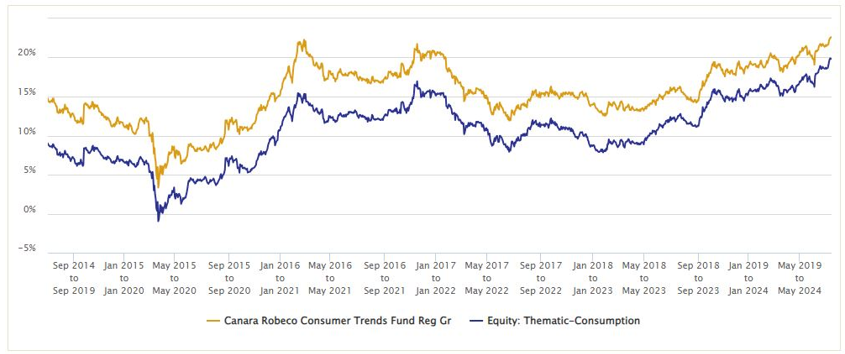

Superior rolling returnscompared to peers

The chart below shows the 5 year rolling returns of Canara Robeco Consumer Trends Fund versus the Thematic Consumption Funds category average over the last 10 years. You can see that during this period Canara Robeco Consumer Trends Fund consistently outperformed the category average for 5 year investment tenures across all market conditions e.g. rising market, falling market, range bound market etc. The fund gave 15%+ CAGR returns over 5 year investment tenures in more than 50% of the instances (observations) and gave 12%+ CAGR returns over 5 year investment tenures in more than 80% of the instances (observations).

Source: Advisorkhoj Rolling Returns, National Stock Exchange, as on 18th July 2024.

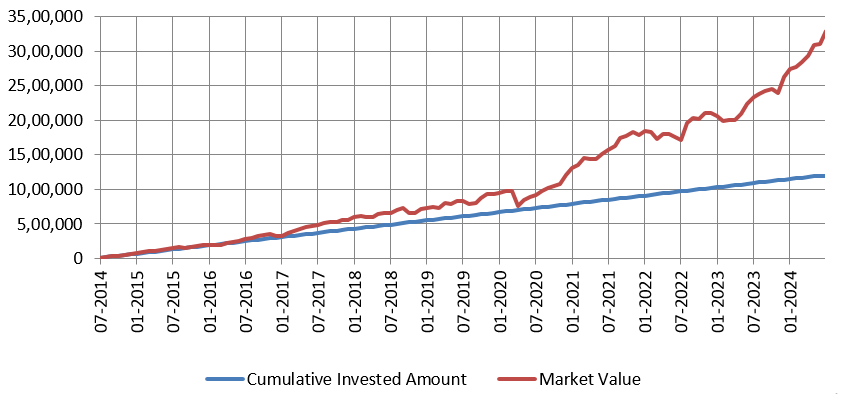

Wealth creation through SIP

There is a perception among investors that thematic funds need market timing and therefore suitable mainly for lump sum investments. However, a broad theme like consumption, which is diversified across several sectors, can be suitable for long term investment through SIP. The chart below shows the growth of Rs 10,000 monthly SIP in Canara Robeco Consumer Trends Fund over the last 10 years. With a cumulative investment of Rs 12 lakhs, you could have accumulated a corpus of nearly Rs 33 lakhs in the last 10 years.

Source: Advisorkhoj Research, as on 30th June 2024.

Canara Robeco Consumption Fund – Investment Strategy

- The fund identifies themes like changing consumption pattern emerging out of rising middle class and increase in per capita income potential

- Fund follows a ‘Growth’ style of investing

- Market cap agnostic with focus on management quality

- Focus is on selective categories such as 1) discretionary consumption - supported by aspirational spending and rising disposable income and 2) the retail financers (banks and NBFCs) benefiting from the low credit penetration in the retail segment

- The fund participates in categories supported by regulatory or demand-backed tailwinds

- For stock selection, the fund manager spots the changing dynamics in an industry, identify winners early and then stay invested with superior executors to earn compounding returns

- Canara Robeco, as an AMC, focuses on the fundamentals of the business, the quality of management, sensitivity to economic factors and the financial strength of the company

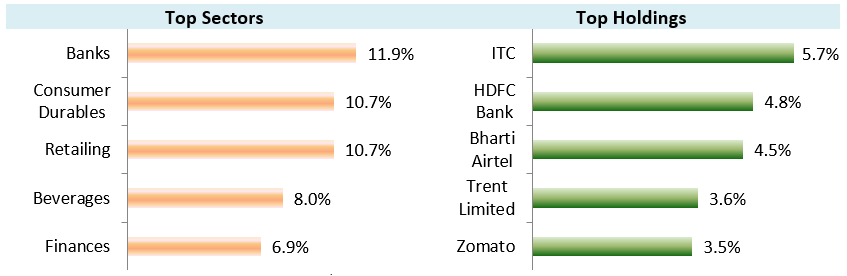

Current Portfolio Positioning

Consumption as an investment theme is diversified across many sectors. You are likely to get diversified sector exposure by investing in Canara Robeco Consumer Trends Fund.

Source: Canara Robeco Fund Factsheets, as on 30th June 2024.

Who can invest in Canara Robeco Consumer Trends Fund?

- Suitable for investors looking for tactical satellite allocations to their overall equity portfolio

- Investors who want decent returns on investment over sufficiently long investment tenure

- Investors with investment horizons of at least 5 years or longer

- Investors with very high risk appetite

- You can invest in lump sum or SIP depending on your financial situation and investment needs

- Investors should consult with their financial advisors or mutual fund distributors if Canara Robeco Consumer Trends Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Sundaram Mutual Fund launches Sundaram Income Plus Arbitrage Active FoF

Jan 5, 2026 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Dividend Yield Fund

Jan 5, 2026 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Diversified Equity Flexicap Passive Fund of Funds

Jan 2, 2026 by Advisorkhoj Team

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025 by HDFC Mutual Fund

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team