Canara Robeco Bluechip Equity Fund: A proven wealth creator

If you started a monthly SIP of Rs 10,000 in Canara Robeco Bluechip Equity Fund at the time of its inception(August 2010), you could have accumulated a corpus of nearly Rs 56 lakhs (as on 31st July 2024) with a cumulative investment of just Rs 16.8 lakhs. This large cap fund has recently completed 14 years since launch. In this article, we will review Canara Robeco Bluechip Equity Fund.

Current market context

The stock market is trading at an all-time high. India’s positive macro outlook (strong GDP growth forecast, narrowing fiscal deficit and INR’s stability), stable Government at centre and bullish sentiments are supporting the rally in the Indian Equity markets. Global markets, especially the US markets, have also supported the momentum in the Indian Equity markets. The rally has been broad based with small and midcap stocks outperforming the large cap stocks. However, the rally has raised valuations in certain pockets of the market. The valuation premium of mid caps (PE ratio 43.76 as on 23rd August 2024) and small caps (31.29 as on 23rd August 2024) compared to large caps (PE ratio of 23.96 as on 23rd August 2024) is nearly at an all-time high. Investors should put greater stress on asset allocation at market peaks, especially if valuations seem stretched. Asset allocation can add stability to your investment portfolios by balancing returns and risks.

Why large cap?

- Large cap companies are significant in size in terms of sales and net profits. They are amongst the biggest companies in India and are household names.

- Large cap companies are market share leaders in their respective industry sectors and are usually better positioned to survive economic downturns.

- The core sectors of the Indian economy like coal, oil and gas, petroleum products, steel, cement, power, etc are dominated by large cap companies. Many of these sectors are highly capital- intensive having significant entry barriers.

- Large cap companies usually have a larger percentage of institutional (FIIs and DIIs) ownership compared to midcap and small cap companies. Large caps are well researched and provide better visibility of earnings compared to midcaps and small caps.

- Since large caps have a larger percentage of institutional ownership, they are traded in higher volumes in the stock market and are more liquid than midcaps and small caps, which have a much smaller percentage of free-floating shares.

About Canara Robeco Blue Chip Equity Fund

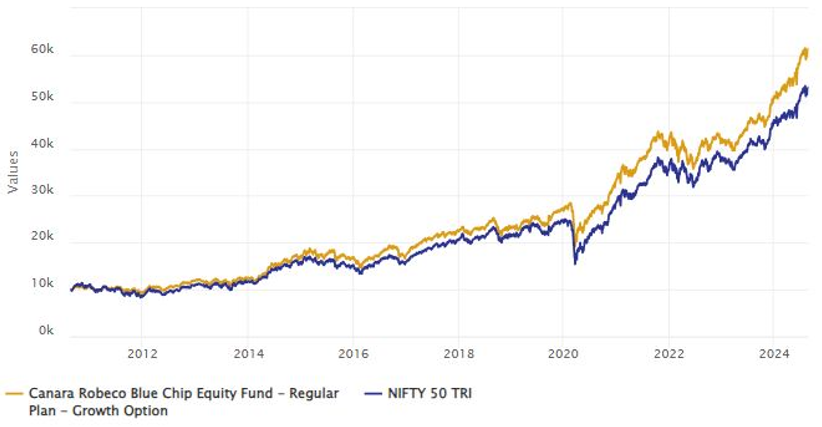

The fund was launched in August 2010. As the name suggests, Canara Robeco Blue Chip Equity Fund is a large cap fund. SEBI mandates large cap funds to invest at least 80% of their assets in Top 100 companies by market capitalization. Canara Robeco Blue Chip Equity Fund has an AUM of more than Rs 14,500 crores. The fund has outperformed Nifty 50 TRI since its launch to date (as of 23rd August 2024).

Source: Advisorkhoj Research, as on 23rd August 2024

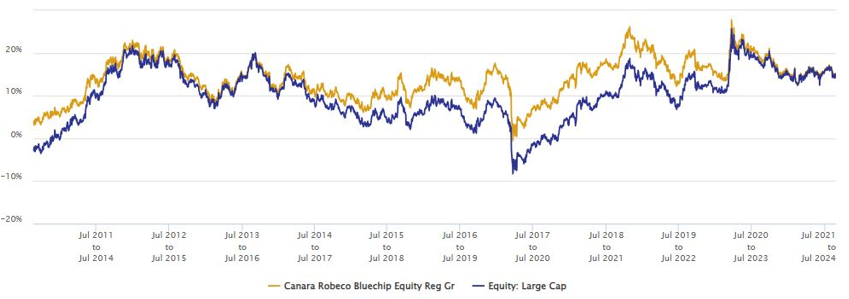

Outperformed peers across different market cycles

The chart below shows the 3 year rolling returns of Canara Robeco Blue Chip Equity Fund compared to the large cap category average rolling returns since the inception of the fund. You can see that the fund was able to consistently outperform the category average over 3-year investment tenures across different market conditions, except in the last couple of years.

Source: Advisorkhoj Rolling Returns, as on 23rd August 2024

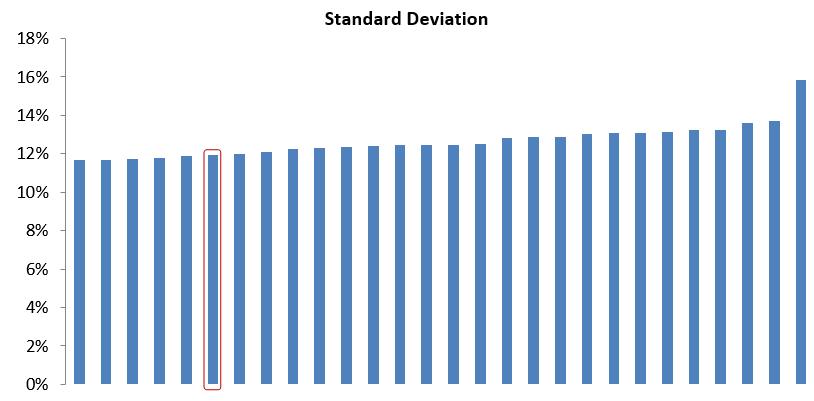

Lower volatility compared to peers

The chart below shows the annualized standard deviations of monthly returns of large cap funds. Standard deviation is a measure of volatility or risk. Please note that we have not considered funds which have not completed 3 years. You can see that Canara Robeco Blue Chip Equity Fund has lower standard deviation than most of its peers.

Source: Advisorkhoj Research, as on 31st July 2024

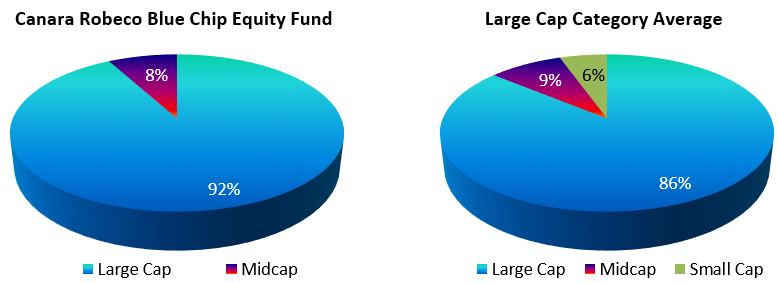

True to label Large Cap Fund

Canara Robeco Blue Chip Equity Fund has higher large cap market allocations and lesser mid cap allocations compared to large cap category average. Canara Robeco Blue Chip Equity Fund has no small cap allocations, whereas the peers on average have 6% in small caps. One should understand that while small caps can boost returns in bull markets, it can cause higher volatility during market corrections.

Source: Advisorkhoj Research, as on 31st July 2024

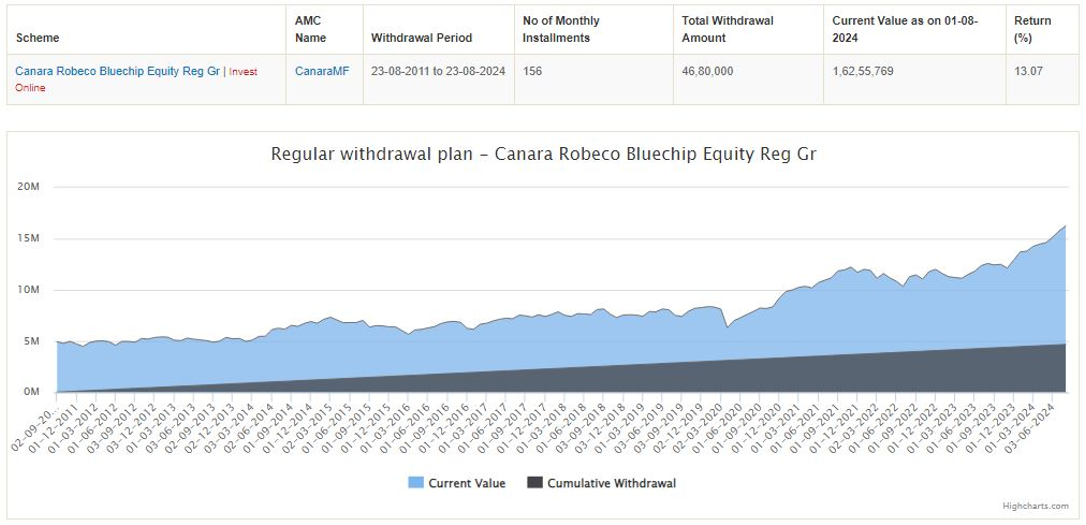

SWP from Canara Robeco Blue Chip Equity Fund

Since large cap funds are less volatile than midcaps, small caps and other diversified equity funds with substantial allocations to small and midcaps, it can be suitable for Systematic Withdrawal Plans. Through SWP, one can receive fixed cash-flows at regular intervals irrespective of market movements. Let us assume that you have invested Rs 50 lakhs in Canara Robeco Blue Chip Equity Fund at the time of its inception. You started a monthly SWP of Rs 30,000 one year later (to avoid exit load and short term capital gains taxation). Let us see the results of this SWP:

Source: Advisorkhoj Research, as on 1st August 2024

You can see that despite withdrawing nearly Rs 47 lakhs (almost as much as you had invested in lump sum) over the last 13 years, your investment would have grown to Rs 1.63 crores over this 14-year period. The SWP results are a glowing testimony of the performance of Canara Robeco Blue Chip Equity Fund and the power of mutual funds in creating a stream of consistent cash-flows and capital appreciation.

Who should invest in Canara Robeco Blue Chip Equity Fund?

- Investors who are looking for capital appreciation with a long-term investment horizon.

- Those who are looking to build their core portfolio with large-cap stocks.

- Those who have an investment horizon of 5 or more years.

- You can invest in this fund either in lump sum or SIP depending on your financial situation or investment needs.

- Investors should consult their financial advisors or mutual fund distributors if Canara Robeco Blue Chip Equity Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team