Canara Robeco Balance Fund: An ideal fund for moderate risk taker

Balanced Funds have been around in Indian Mutual Industry for nearly 25 years now. Balanced funds are essentially hybrid funds with both debt and equity in its portfolio to balance the risk. The Balanced fund portfolios typically hold up to 65-70% of its portfolio assets in equities and the rest in fixed income instruments. Balanced Funds are an ideal investment option for moderate risk profile investors and also for those who are new to mutual funds.

As balanced Funds are less volatile compared to equity funds, it has become very popular with mutual fund investors. The surge of balanced fund AUM from Rs 39,355 Crores in December 2015 to Rs 63,320 Crores in December 2016 is a testimony to this fact.

If we look at the historical returns, Balanced Funds have given excellent returns and helped investors meet different long term financial goals. Historical returns also show that returns of Balanced Funds have been better than Large Cap Equity Funds over longer tenures. This is one of the reasons why smart investors now prefer Balanced Funds. The other reasons are –

- It takes care of investor’s asset allocations automatically by maintaining the balance between equity and debt

- Balanced funds are taxed as Equity Funds and therefore long term capital gains are tax free

- Dividends received from Balanced Funds are also tax free.

Source: ValueExpress (Data as on 23/01/2017)

You can see in the above chart how the returns of Balanced Fund category beaten the returns of Large Cap Equity Funds category over 3, 5 and 10 year period with a good margin. In fact, the last one year return differential is also little above 1% only.

Canara Robeco Balance Fund is one of the oldest Balanced Fund schemes with a good long term track record of stable performance. Canara Robeco Balance Fund is in the Top 10 Balanced funds in terms of performance over the last 3 years (Please see Top Performing Balanced Funds.

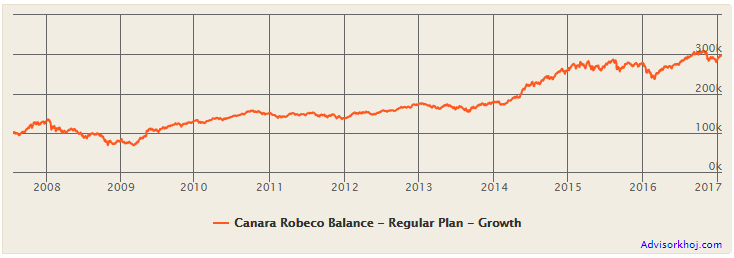

The chart below shows the growth of Rs 1 Lakh lump sum investment in Canara Robeco Balance Fund - Regular Growth over 9 and half years (since Growth option launch date 20/07/2007) would have grown to Rs 2.96 Lakhs (based on NAV of January 20, 2017) – a return of almost 3 times!

Source: Advisorkhoj Research

Fund Overview of Canara Robeco Balance Fund Regular Growth

Launched as a close ended Fund in February 1993, the fund was made open ended from March 2000. The growth option was introduced on 20/07/2007. The fund has over Rs 768 Crores of assets under management (AUM) with an expense ratio of 2.60%. The fund managers of this scheme are Ravi Gopalkrishnan, Avnish Jain and Shridatta Bhandwaldar. Ravi is also the Head – Equities. The chart below shows the annual returns of Canara Robeco Balance Fund - Regular Growth and the Balanced Fund Category over the last 9 years.

Source: ValueExpress

As you can see in the chart above, the annual returns of Canara Robeco Balance Fund has beaten the Hybrid Fund category returns in most of the years.

CRISIL has assigned this fund Rank 3. Valueresearch and Morningstar both have given it a 3 Star rating.

Portfolio Construction

In terms of portfolio construction equity comprises 57% of the portfolio whereas the debt holding is around 35%. The cash holding of the portfolio is high with around 8%. The top 10 equity holdings of the fund show that it has a large cap bias with a high growth focus. It is very well diversified across sectors like - Financial services, Automobile, Engineering, Technology and Construction. The top 5 equity holdings are, ICICI Bank, HDFC Bank, Sun Pharma, UPL and Maruti Suzuki India.

Source: Advisorkhoj Research

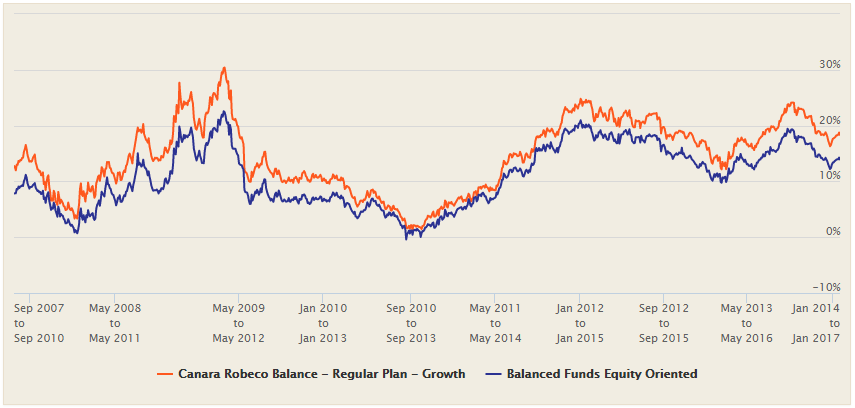

Rolling Return of Canara Robeco Balance Fund Regular Growth

The chart below shows the 3 year rolling returns of Canara Robeco Balance Fund - Regular Growth over the last 9 and half years (since launch of Growth option date 20/07/2007). We have chosen a three year rolling returns period, because investors must have atleast 3 year investment horizon for investing in Balanced Funds.

Source: Advisorkhoj Rolling Return Research Tool

You can see in the chart above that, the 3 year annualized rolling returns of Canara Robeco Balance Fund - Regular Growth, over last 9 and half years (since launch of Growth option date 20/07/2007), never dipped below zero. Therefore, investors with a three year investment horizon never made a loss by investing any time in Canara Robeco Balance Fund - Regular Growth over this period.

At Advisorkhoj, we have reiterated time and again through our articles that rolling return is the best measure of a fund’s performance consistency and is a useful measure from future performance perspective. The rolling return of the fund, relative to the category, is a conclusive evidence of the strength of the fund within the balanced fund category.

SIP Returns of Canara Robeco Balance Fund Regular Growth

In the last 9 and half years, a lump sum investment in Canara Robeco Balance Fund - Regular Growth would have grown to almost 3 times in value!

The chart below shows the returns of Rs 5,000 monthly SIP in Canara Robeco Balance Fund - Regular Growth over the last 9 and half years.

Source: Advisorkhoj SIP return Research Tool

You can see in the chart above that, a Rs 5,000 monthly SIP in Canara Robeco Balance Fund - Regular Growth, since launch date of Growth option 20/07/2007, would have grown to over Rs 11.39 Lakhs (by January 20, 2017); the investor would have made a profit of nearly Rs 5.64 Lakhs on an investment of Rs 5.75 Lakhs. The SIP XIRR, over this period, is nearly 14%, beating the SIP returns of many pure equity funds during this period.

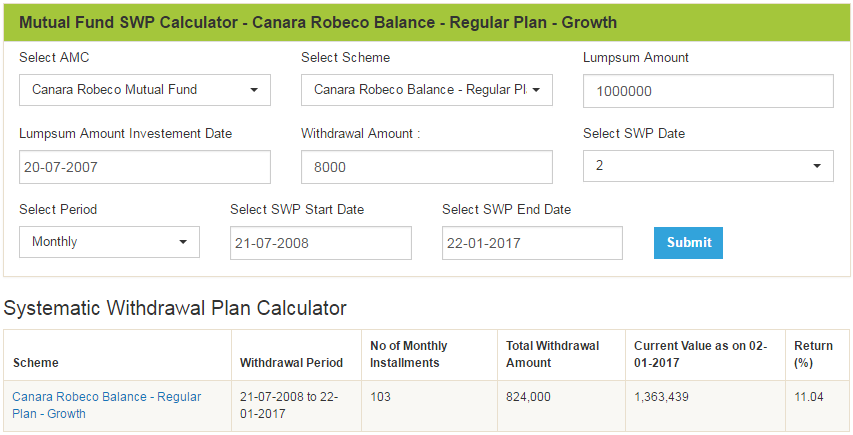

How SWP worked in Canara Robeco Balance Fund Regular Growth

If you had invested Rs 10 Lakhs in Canara Robeco Balance Fund – Regular Growth, on 20/07/2017 (the day Growth option was launched) and withdrawn Rs 8,000 per month after one year (July, 2008), then the current value of your investment would have been more than Rs 13.50 Lakhs even after withdrawing Rs 8.24 Lakhs over a period of 8 and half years through 103 equal instalments of Rs 8,000 each! The SWP returns of the fund is annualised (IRR) over 11%.

We assumed that the monthly SWP withdrawal of Rs 8,000 was started after one year (starting date July 21, 2008) from the date of investment (July 20, 2007) and thereafter on the 21st of every month so that each and every SWP amount in the hands of the investor is tax free!

Please look at the image below to understand how we have selected the different options in our research tool to get this result. You can also explore this SWP Research tool to check SWP return of any fund of your choice.

Source: AdvisorKhoj SWP Research Tool

Through a Systematic Withdrawal Plan (SWP) investors can regularly withdraw a fixed amount from a fund. The amount to be withdrawn and the frequency of withdrawal are decided by the investor. One can withdraw a fixed amount monthly, quarterly, half yearly or annually. SWP from a Balanced Fund is an ideal investment option for investors seeking regular income from their investment especially during retirement years.

Dividend track record of Canara Robeco Balance Fund – Regular Plan – Monthly Dividend

Canara Robeco Balance Fund started with Quarterly dividend option. But from June 23, 2015, the Quarterly dividend payout option was changed to Monthly dividend payout. Since then the scheme has been paying uninterrupted monthly dividends as shown in the chart below.

The highlighted portion in blue colour in the chart below shows the monthly dividend payout track record of Canara Robeco Balance Fund - Regular Plan - Monthly Dividend since June 2015.

Source: Advisorkhoj Historical Dividend Tool

Conclusion

Balanced Funds are excellent investing option for the long term. These Funds are a unique choice even in a falling market as the debt portion keeps earning fixed returns. Also, investors can take advantage of rising markets due to the exposure in equities. With automatic rebalancing of your portfolio between debt and equities and tax efficient returns – long term capital gains tax as well as tax free dividends – Balanced Funds makes the best investing choice of investors with moderate risk taking ability. The monthly dividend paying option of the fund makes it further attractive for investors looking for regular return from their investments.

You must consult your financial advisor and check if balanced funds are ideal for your risk profile before investing in Canara Robeco Balance Fund either through lump sum or systematic investing route.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team