Birla Sun Life Pure Value Fund: Strong long term SIP returns through Value Investing

We have discussed growth and value investing a number of times in our blog. For benefit of our readers who are not familiar with growth or value investing in mutual funds, let us briefly recap these two concepts.

Growth Investment Style:

In the growth investment style, the fund managers invest in companies that will experience faster growth in revenues, earnings per share (EPS) and share price. Growth stocks, even if they are perceived to be expensive, usually outperform the market in the near term.Value Investment Style:

Value funds, on the other hand, invest in companies which are trading at a considerable discount to its intrinsic or fair valuation. The can be a number of reasons for these companies to be undervalued in the market and the valuations may remain depressed for a period of time, but in the long run these stocks can give outstanding returns.

The debate on growth versus value investing will continue, but in my opinion it really depends on the investment objectives and horizon of the investor. Over the last 3 years (April 2013 – April 2016), growth stocks in India, as represented by the MSCI Growth Index outperformed value stocks, as represented by MSCI Value Index. However, in the past one year (April 2015 – April 2016), in difficult market conditions, MSCI Value Index outperformed the MSCI Growth Index. Over a ten year period from April 2006 to April 2016, MSCI Value Index outperformed MSCI Growth Index.

Birla Sun Life Pure Value Fund, a midcap equity fund has delivered outstanding long term returns to investors by employing the value investing approach. If you had invested र 100,000 in the NFO of the scheme in March 2008, the value of your investment on May 1, 2016 would have been nearly र 400,000. The SIP returns of the fund have been simply outstanding. If you had started a monthly SIP of र 3,000 in the fund in April 1, 2008 the value of your investment today (May 1, 2016) would be more than र 7.2 lacs, while your cumulative investment over this period would have been less than र 3 lacs. A compounded annual SIP return of more than 21% is superlative, especially in light of the fact that, over the past 8 years, the Sensex has given only 6% annualized returns.

Fund Overview

Birla Sun Life Pure Value Fund was launched in March 2007. It has an AUM base of about र 430 crores. The relatively small AUM base, in fact, is an advantage for this fund because it primarily invests in stocks in the midcap segment. The expense ratio of the fund is a bit on the higher side at 2.9%. Mahesh Patil and Milind Bafna are the fund managers of this scheme. The fund has given more than 18% compounded annual returns since inception.

The chart below shows the trailing annualized returns of Birla Sun Life Pure Value Fund, midcap funds category and the benchmark BSE-200 index over different time-scales.

Source: Advisorkhoj Research

You can see in the chart above that, Birla Sun Life Pure Value Fund was not only able to beat the benchmark index it also outperformed most of its peers in the midcap equity fund category. The chart below shows the annual returns of Birla Sun Life Pure Value Fund, midcap funds category and the benchmark BSE-200 index over the last 5 years.

Source: Advisorkhoj Research

Again you can see that Birla Sun Life Pure Value Fund outperformed in most years. The chart below shows the NAV movement of Birla Sun Life Pure Value Fund.

Source: Advisorkhoj Research

We have mentioned repeatedly in our blog that rolling returns in the best measure of a fund’s performance, because it measures a fund’s performance at any point of time and is not biased by market conditions. The chart below shows the 3 year rolling returns of Birla Sun Life Pure Value Fund versus the benchmark index over the past 5 years. We have chosen a rolling return period of 3 years, because we believe that investors in equity funds should have a minimum investment horizon of three years. In fact, investors in value funds should have an even longer investment horizon to get the best returns, since it sometimes takes time for a value of a stock to get realized.

Source: Advisorkhoj Research

You can see that, the fund has consistently beaten the rolling returns of its benchmark. You can also see that, the outperformance in rolling returns of the fund versus the benchmark is fairly stable over time, which shows that the fund managers employ prudent risk management approach. Another remarkable observation that one can make from the rolling returns chart of Birla Sun Life Pure Value Fund has almost always been above 25%, irrespective of market conditions.

Portfolio Construction

The fund managers of Birla Sun Life Pure Value Fund seek to generate consistent long-term capital appreciation by investing in stocks that are trading for less than their fair value, i.e. stocks that the market is undervaluing. As per Morningstar, the forward P/E ratio of Birla Sun Life Pure Value Fund portfolio is 10.6, whereas that of BSE 200 is over 21 (as per BSE data). From a market cap perspective, about 65% of the portfolio is in mid and small cap companies, while 35% of the portfolio is in large cap companies. The fund managers have a bias towards cyclical sectors like Oil and Gas and Banking and Finance. However, the portfolio has substantial allocations to defensive sectors like Pharmaceuticals, Technology and FMCG. From a company concentration standpoint the fund is fairly well diversified with the top 5 stock holdings, GAIL, HPCL, Gulf Oil Lubricants, Kaveri Seeds and Chennai Petroleum accounting for 24% of the portfolio value. Even the top 10 stock holdings in the portfolio account for less than 50%.

Source: Advisorkhoj Research

Risk and Return

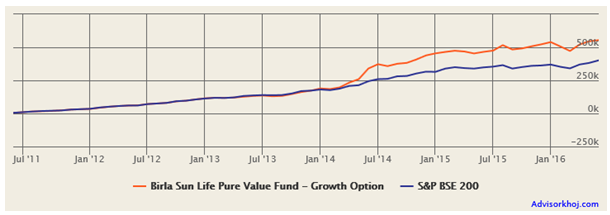

While the standard deviation of Birla Sun Life Pure Value Fund is higher than the average standard deviation of midcap funds as a category, the fund manager has delivered outstanding alpha. As a result the risk adjusting returns of the fund is excellent. The chart below shows the growth of र 100,000 lump sum investment in the fund over the last five years.

Source: Advisorkhoj Research

You can see that, a lump sum investment of र 100,000 made 5 years back in Birla Sun Life Pure Value Fund would have grown to over र 236,000 by June 1, 2016 beating the benchmark by a wide margin.

The chart below shows the returns of र 5,000 monthly SIP in Birla Sun Life Pure Value Fund over the past 5 years.

Source: Advisorkhoj Research

You can see that a SIP of र 5,000 per month over the last 5 years in Birla Sun Life Pure Value Fund would have grown to over र 5.5 lacs, while the investor on a cumulative basis would have invested a little over र 3 lacs. The annualized SIP return works out to be more than 24%.

Conclusion

Birla Sun Life Pure Value Fund has delivered outstanding performance over the last 5 years. Investors should have a long investment horizon when investing in this fund. While both lump sum and SIP mode of investing can give excellent long term returns, in volatile market conditions SIP is more effective. Investors should consult with their financial advisors, if Birla Sun Life Pure Value Fund is suitable for their investment portfolios.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Kotak Mahindra Mutual Fund launches Kotak Energy Opportunities Fund

Apr 3, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty 500 Momentum 50 ETF FOF

Apr 3, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty 500 Momentum 50 ETF

Apr 3, 2025 by Advisorkhoj Team

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV and New Age Automotive ETF FOF

Mar 28, 2025 by Advisorkhoj Team

-

UTI Mutual Fund launches UTI Income Plus Arbitrage Active Fund of Fund

Mar 21, 2025 by Advisorkhoj Team