Bharat 22 ETF: Diversification can give better risk adjusted returns

Bharat 22 is an Exchange Traded Fund (ETF) offering by the Government of India to sell its stake in 22 companies to the public; this is part of Rs 72,500 Crore disinvestment target of the Government for FY 2017 – 2018. Bharat 22 is the second in the series of ETFs for divestment of Government stake.

In 2014 the Government launched the CPSE ETF (managed by Reliance Mutual Fund) to divest its stake in 10 central Public Sector Undertaking (PSU) companies. A further funds offer for CPSE ETF was made in January of this calendar year and the third tranche of CPSE ETF was offered to investors in March. The AUM of the CPSE ETF is around Rs 5,000 Crores. The Bharat 22 ETF is likely to be launched in the next few days and it will be managed by ICICI Prudential Asset Management Company.

How is the Bharat 22 ETF different from the previous ETF offered by the Government?

Some of our readers may be aware of the CPSE ETF (because Advisorkhoj covered the launch of its tranches earlier this year) and may ask how the Bharat 22 ETF is different from the previous offering? It is different from the CPSE ETF in a number of ways.

- Whereas the CPSE ETF has investments in 10 stocks, the Bharat 22 ETF will have investments in 22 stocks.

- Whereas the CPSE ETF has exposure only in PSU companies, the Bharat 22 ETF will have not only have exposure in PSU companies (where Government ownership is more than 51%) but also in public sector banks (where Government ownership is more than 50%). Further the Bharat 22 ETF will also invest in select companies where the Government holds stake under the Specified Undertaking of the Unit Trust of India (SUUTI) including the likes of Axis Bank, Larsen and Toubro and ITC

- Whereas the CPSE ETF is purely a thematic fund, with a heavy bias towards energy / oil and gas stocks (more than 70% exposure to oil & gas and energy stocks) like ONGC, Oil India, Indian Oil, Coal India, GAIL, the Bharat 22 ETF will be a more diversified fund, with exposures to a number of sectors like Industrial (e.g. L&T), banking (e.g. SBI, Axis Bank etc), utilities (e.g. NTPC, Power Grid etc), energy (e.g. ONGC, Indian Oil, BPCL etc), FMCG (e.g. ITC) and materials (e.g. National Aluminium).

- Whereas the CPSE ETF was almost entirely large cap oriented, the Bharat 22 ETF, while being primarily large cap oriented, will have around 10% portfolio exposure to mid and small cap stocks.

This shows that, Bharat 22 ETF is a much more diversified offering compared to the previous ETF.

Benefits of Diversification

We have discussed the benefits of diversification a number of times in Advisorkhoj, but let us recap some key benefits for the sake of all readers. Stocks are subject to company risks, sector risks and market risks. Market risk is not diversifiable, but company and sector risks can be diversified by investing in a larger portfolio of companies (for company risk) and investing in different sectors. Different sectors impact differently in various stages of business cycles. Some sectors are highly sensitive to business cycles (periods of low and high demand in the economy); these sectors are known as cyclical sectors (Banking, Capital goods etc are examples of cyclical sectors). Some sectors are not sensitive to business cycles (demand is more or less uniform despite peaks and troughs of business cycles); these sectors are known as defensive sectors (FMCG, Pharmaceuticals etc are examples of defensive sectors). Some sectors are sensitive to commodity rates / prices; these sectors are known as sensitive sector (Oil and gas is an example of a sensitive sector). Sensitive sectors are less affected by business cycles than cyclical sectors, but are more affected by it than defensive sectors.

Some stocks perform well in bull markets, while others outperform in bear markets; if you have a diversified portfolio of stocks it can perform well in different market conditions and economic scenarios. S Naren, ED & CIO ICICI Prudential AMC say that, “for adequate diversification, an index requires a set of defensive, cyclical and structural stocks. All three conditions are met by S&P BSE Bharat 22 index”.

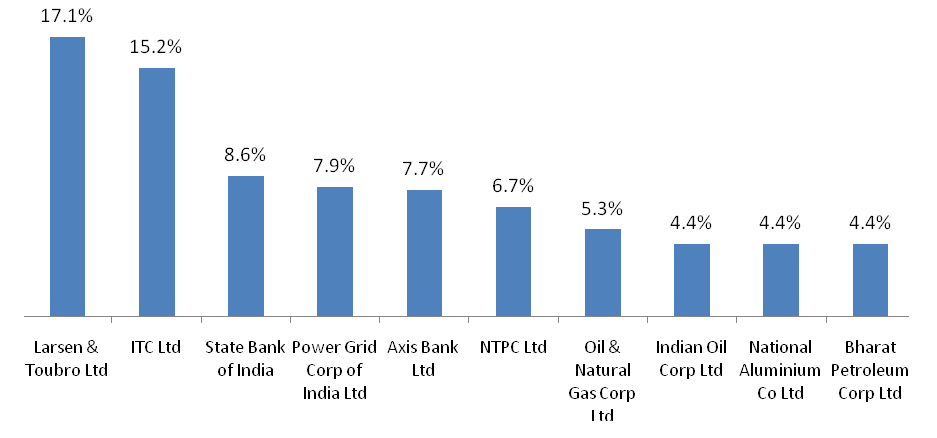

Stocks and sector composition of the Bharat 22 Index

Asia Index Pvt. Ltd. (S&P BSE Indices) was mandated to design and launch the S&P BSE Bharat 22 Index in August 2017. The index will measure the performance of the 22 companies selected to be dis-invested via the Bharat 22 ETF by the Central Government of India. The index follows a free float adjusted market cap weighing methodology. For portfolio diversification, weighting of individual index constituent is capped at 15% while weighting of each BSE sector is capped at 20%. These weight constraints will be applied during the annual index rebalancing in March each year. The chart below shows the Top 10 stocks in the Bharat 22 Index, which comprise more than 80% of the index in value terms.

Source: ICICI Prudential (data as of July 31, 2017)

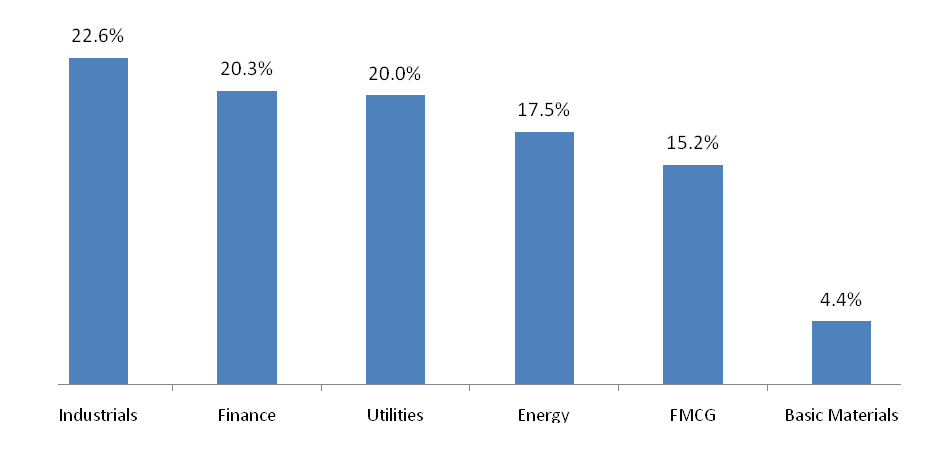

The chart below shows the sector composition of Bharat 22 ETF.

Source: ICICI Prudential (data as of July 31, 2017)

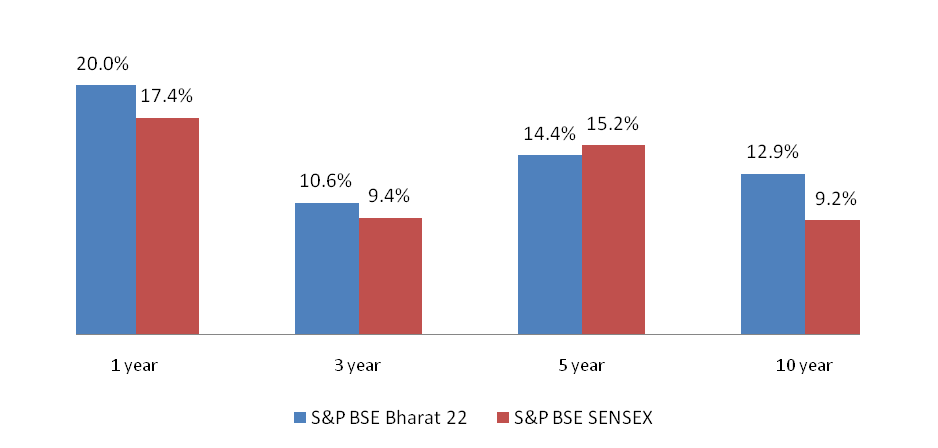

Historical performance of Bharat 22 Index versus the Sensex

Though Bharat 22 is a newly constructed Index, since the stock composition and index weights are known, we can back test the historical performance of the index versus the leading benchmark index of Indian stock market, the BSE Sensex. The chart below shows the trailing returns of Bharat 22 Index versus the Sensex (for different trailing periods ending July 31, 2017).

Source: Asia Index Private Limited and ICICI Prudential (data as of July 31, 2017)

The dividend yield of the Bharat 22 index is also superior compared to the Sensex.

Source: Asia Index Private Limited and ICICI Prudential (data as of July 31, 2017)

Stocks with higher dividend yields have greater value potential than stocks with lower dividend yields and as such can give superior returns over a long investment horizon.

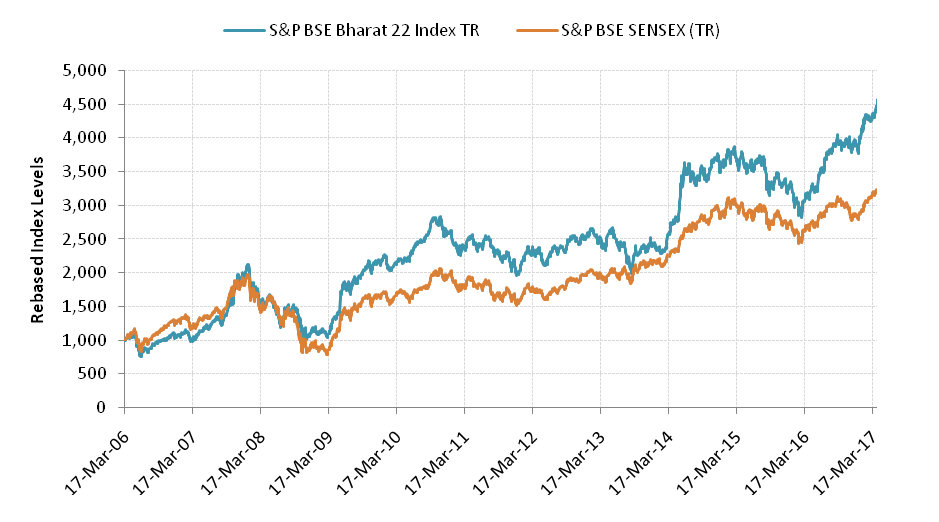

The chart below shows the growth Rs 1,000 in Bharat 22 Index versus the Sensex over the last 10 years (investment date Mar 17, 2006).

Source: Asia Index Private Limited and ICICI Prudential (data as of July 31, 2017)

You can see that, the Bharat 22 index has outperformed the Sensex by a big margin over the last 10 years period.

What are ETFs and how to invest in it?

ETFs are index funds which are traded in the stock exchanges. As Index funds is a passive fund whose primary objective is to track an index (the Bharat 22 Index in this case) and not outperform it. The expense ratios of index funds are considerably lower than actively managed diversified equity funds. Over a long period of time, lower expense ratios can have a significant impact on returns for investors. To invest in ETFs, investors need to have trading and demat accounts with brokers in stock exchanges. ETFs are open ended funds, which imply that you can sell / redeem them at any point of time; there are no exit loads. ETFs combine aspects of both mutual fund investing and stock trading.

Conclusion

Bharat 22 ETF is a diversified ETF which will track the Bharat 22 index, which can provide good returns to investors with a long investment horizon. The constituents of the Bharat 22 index capture the various key reforms and initiatives of the Modi Government like Financial Inclusion, Digital and Cashless Economy, Goods and Services Tax (GST), Infrastructure Reforms, Make in India and Direct Benefit Transfer of subsidy. According to Chintan Haria - Fund Manager & Head Product Development and Strategy, ICICI Prudential AMC, “The above reforms can enhance the earnings growth potential of the constituent companies, thus can benefit the investors”.

Like the CPSE ETF, the Government may add sweeteners like discount to market price for this ETF, when it opens for subscription in a few days. With or without the sweetener, the Bharat 22 ETF can be a good investment for the long term. We will cover further developments regarding Bharat 22 ETF on Advisorkhoj website in the coming days. Please stay tuned for more.....

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Motilal Oswal Mutual Fund launches Motilal Oswal Diversified Equity Flexicap Passive Fund of Funds

Jan 2, 2026 by Advisorkhoj Team

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025 by HDFC Mutual Fund

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team