Bank of India Consumption Fund: Invest in India's consumption story

Bank of India Mutual Fund has launched a new fund offer (NFO), Bank of India Consumption Fund. This is a thematic fund which will invest in stocks related to the “India consumption theme”. Consumption is one of the most important mega-trend in the India Growth Story as India is largely a domestic consumption driven economy. Retail investors usually associate the consumption theme with FMCG and consumer durables. However, consumption is a much broader theme covering industry sectors like FMCG, Consumer Durables, Consumer Services, Realty, Auto, Telecom, Healthcare, Power etc. The NFO opened for subscription on 29th November 2024 and will close on 13th December 2024.

Drivers of consumption growth in India

- Demographic dividend will provide a long runway for growth. India’s GDP in 2023 was comparable with China’s GDP in 2007. The per capita income in 2023 is slightly lower than China’s per capita income, but the median age in India (28 years) is significantly lower than China. This youthful demographic gives India a strong advantage for sustained economic growth fuelled by a dynamic workforce and growing consumer demand.

Source: Bank of India MF

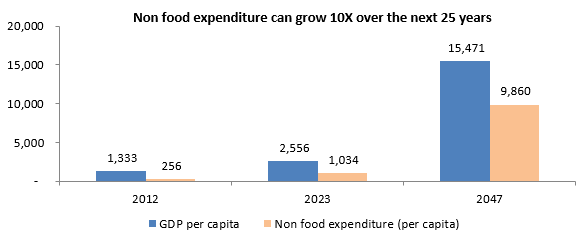

- There is a certain inflexion level in per capita income, below which most of the income is spent on food, above the inflexion level, the non food expenditure increases. This inflexion point is around $2,000 per capita income. When the United States crossed this threshold, vehicles per 1,000 people increased 1.5X in the next decade. When the China and Indonesia crossed this threshold, vehicles per 1,000 people increased 2X in the next decade. Non food expenditure per capita in India can multiply 10X by 2047.

Source: Bank of India MF

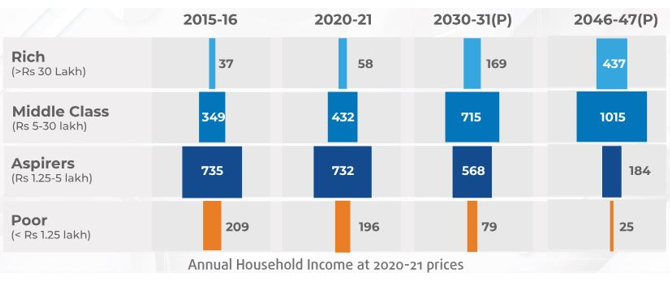

- Growing middle class and affluent population will fuel consumption growth in India. Growing urbanization and prosperity are mutually reinforcing, fuelling each other’s growth.

Source: Bank of India MF

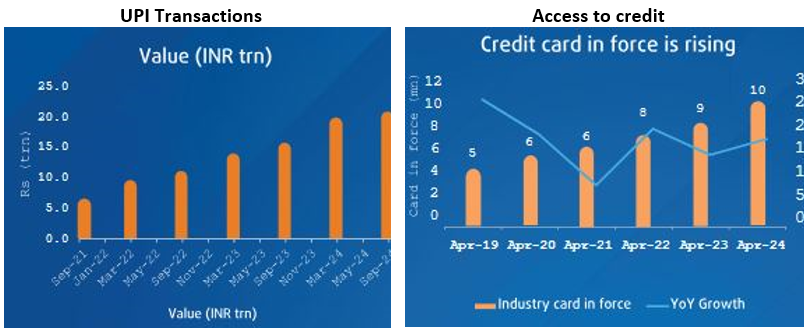

- Easy credit and convenient payment options can boost consumer spending. UPI transactions offer faster and convenient payment options. Credit cards and personal loans can widen customer base to engage in larger purchases.

Source: NPCI, RBI

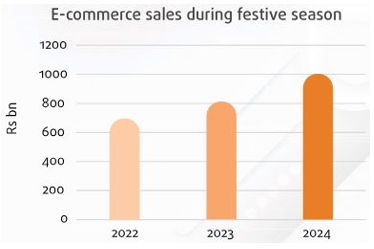

- India’s mobile and social media revolution expanded connectivity and engagement for 1.2 Billion users. Mobile penetration in India is 80% with 1.1 Billion in use. 62% of internet users are active on at least one social media platform with 462 million active social media users. Top 5 E-commerce deliver 3 million orders daily.

Source: BOI MF

Why thematic fund for consumption?

Consumption is under-represented in the broad market indices like Nifty 50 or Nifty 500. Consumption as an investment theme has only 32% weightage in Nifty 50 and 41% weightage in Nifty 500. A thematic fund will provide comprehensive exposure to consumption.

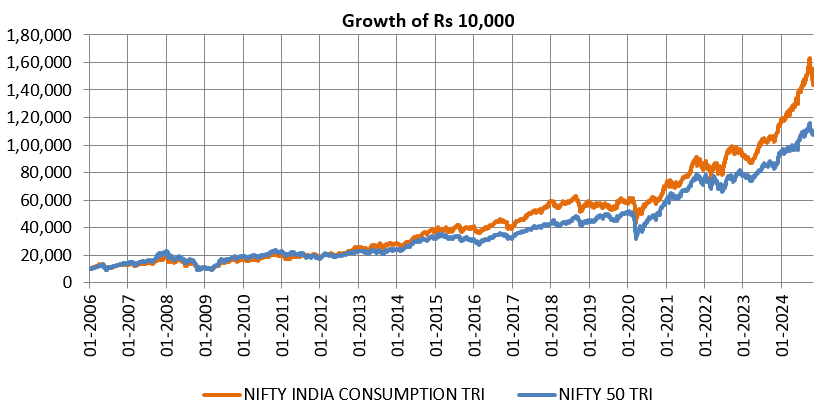

Consumption as an investment theme has outperformed the broad market

Source: National Stock Exchange, Advisorkhoj Research, Period: 02.01.2006 (inception of Nifty India Consumption Index) to 31.10.2024.

Why invest in consumption theme now?

- Ability to participate in structural India Growth Story – Rising disposable income, value migration, premiumisation

- Capitalize on world’s largest middle-class advancement journey

- Engage in growth and new emerging growth opportunities

- Pricing power and cash-flow visibility

- Relatively less prone to market cycles vis a vis broader market indices

Bank of India Consumption Fund – Salient features

- Balancing growth and stability

- Dynamic top down and bottom-up approach

- Market cap agnostic

Bank of India Consumption Fund - Investment strategy

Bank of India Consumption Fund – Stock Selection

Why invest in Bank of India Consumption Fund?

- Capitalize on evolving consumption trends driven by higher disposable incomes and lifestyle changes

- Blend of consumer staples, discretionary, e-commerce, consumption ecosystem and allied activities

- Agile portfolio management, balancing growth and stability across market conditions

- Participate in value shifts mature business and growth trends in emerging companies

- Market cap agnostic

Who should invest in Bank of India Consumption Fund?

- Suitable for investors looking to invest in a thematic fund long term capital appreciation

- Investors looking for an equity oriented portfolio that aims to invest in structural growth opportunities driven by changing demographic and economic upliftment

- Investors with investment horizons of at least 3 years

- Investors with high risk appetites

- Investors should consult with their financial advisors or mutual fund distributors whether Bank of India Consumption Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team