Bank of India Business Cycle Fund: Investing in growth themes of the future

Bank of India Mutual Fund has launched a new fund offer (NFO), Bank of India Business Cycle Fund. The fund focuses on riding business cycles by identifying and investing in growth themes through dynamic allocation across sectors and stocks at different stages of business cycle, resulting from the impact of medium and long term trends or macro factors. Mr Alok Singh, Chief Investment Officer of Bank of India Mutual Fund, is the fund manager of this scheme. The NFO opened for subscription on 9th August 2024 and will close on 23rd August 2024.

What is business cycle?

All markets go through cycles of economic growth and slowdown – these are known as business cycles. A business cycle usually has 4 phases:-

- Expansion – Rising GDP, increasing employment, consumer confidence and spending

- Peak – Economic growth slows down, inflation may rise, interest rates are high and market valuations may be stretched

- Contraction – Declining GDP, rising unemployment, reduced consumer and business spending

- Trough – Economic activity bottoms, green shoots of recovery begin to appear

How macro factors affect business cycles?

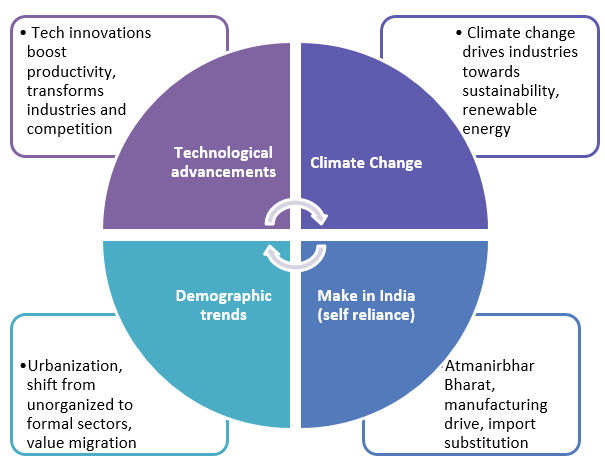

Macro factors play a crucial role in influencing and creating medium to long term trends / themes, thereby impacting businesses and industry sectors. Business cycle across sectors / industries gets impacted to varying extent and degree due to mega-trends/themes created due to unfolding of macro factors.

Prominent macro factors at play in India

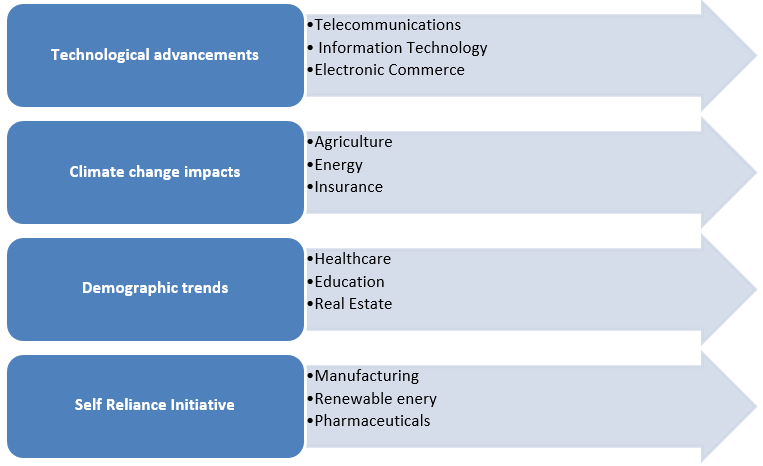

Examples of Industry sectors and business impacted positively macro-factors

- Digital payment platforms like Paytm, PhonePe etc have transformed the payment landscape.

- SBI Yono app has transformed customer service experience providing omni channel banking experience to customers

- Food and grocery delivery apps like Zomato, Blinkit etc provides high level of user convenience

- The pharmaceuticals sector is a great example of success of the Make in India initiative. Pharma industry is expected to reach $65 Billion by 2024 and $130 by 2030

- Electronics manufacturing is another shining example of Make in India initiative. There has been over 2X increase in the domestic production of electronics in India

- The Production Linked Incentive (PLI) Scheme of the Government has led to a production or sales worth Rs 8.7 lakh crore and generated employment for over 7 lakhs

- Growth in installed capacity of renewable energy is an example how climate change and sustainability is transforming the energy landscape. As on May 2023, renewable energy (e.g. hydro, solar, wind, biomass etc) with 179 GW of installed comprised 43% of the energy mix of India. The capacity target for renewable energy for 2030 is 500 GW.

- The seismic shift of urbanization in India is poised to redefine the dynamics of our nation’s real estate landscape

- Growth of the premium segment in beauty and personal care products is an example of value migration. The share of premium products in beauty and personal care sales has grew from 39% in 2016 to 45% in 2021 and is expected to grow to 55% by 2026.

Bank of India Business Cycle Fund – Investment strategy

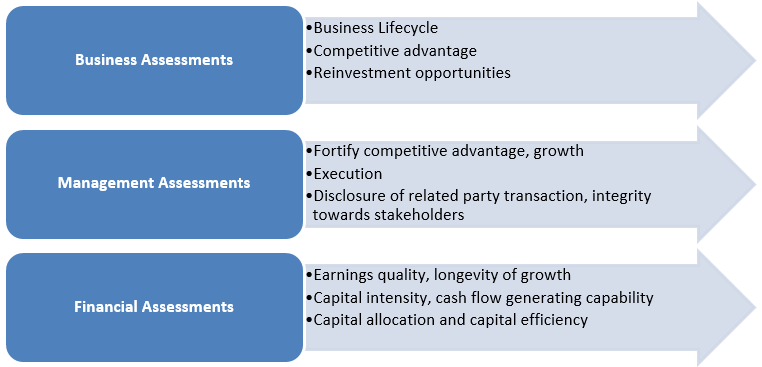

- Aims to capture impact of macro factors & mega-trends on business themes that are likely to be impacted positively across medium to long term

- Portfolio construct would be mainly Top-down with endeavour to provide focused exposure across 3 to 5 relevant growth themes, with a dynamic approach to navigating impact on business cycles

- Theme based investing helps build wider exposure across the whole spectrum of sectors, market cap segments and stocks impacted by the advent of a new mega-trend and are likely to see an expansionary phase; the fund allocation construct would be sector and market capitalization agnostic

- Identified themes get reviewed and revalidated at every stage of the business cycle and portfolio allocations may be altered accordingly

Stock Selection Approach

Why invest in Bank of India Business Cycle Fund?

- Macro / trends based investing

- Top down approach to portfolio construction

- Sector and market cap agnostic

- Intended investment in themes and businesses that are at the cusp of or undergoing expansionary phase in Business Cycle

- Fresh portfolio with no legacy stocks

- Strong long term track record of the fund manager

Who should invest in Bank of India Business Cycle Fund?

- Suitable for investors looking to invest in a thematic fund long term capital appreciation

- Investors looking for an equity oriented portfolio that aims to invest dynamically across businesses and sectors that are expected to be impacted positively by medium to long term growth themes

- Investors with investment horizons of at least 5 years

- Investors with very high risk appetites

- The minimum investment amount is Rs 5,000 or in multiples of Re 1/- thereafter

- Investors should consult with their financial advisors or mutual fund distributors whether Bank of India Business Cycle Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Mirae Asset Investment Managers (India) Pvt. Ltd. IFSC branch launches Mirae Asset Global Allocation Fund IFSC at Gift City

Apr 21, 2025 by Mirae Asset Mutual Fund

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund