Axis Quant Fund: A good quant in current market scenario

What are quant funds?

Quant funds are thematic equity mutual fund schemes which use quantitative investment strategies. Stock selection of quant funds are based on mathematical models. The fund managers of quant schemes are responsible for developing and reviewing the mathematical models on a periodic basis, and make updates to quantitative models from time to time. Quantitative investment strategies have no human biases and therefore, follows a more systematic and consistent approach, which can generate better investment outcomes for investors.

Axis Quant Fund

Axis Quant Fund was launched in June 2021. The scheme has Rs 1,242 crores of assets under management (AUM). The expense ratio of the scheme regular plan is 2.13%. The investment strategy uses Growth at a Reasonable Price (GARP) style with focus on quality stocks. The scheme invests across market capitalization segments and industry sectors.

Parameters of Axis Quant Fund quantitative model

Axis Quant fund aims to leverage Axis AMC’s fundamental research base and strategically use quantitative data to offer a fundamentally driven alpha strategy with an endeavour to generate consistent alpha for long term investors. The offering blends traditional research based approach with rules based criteria to identify stocks and sectors within a well-established quality framework. The key parameters of Axis Quant Fund investment strategy is as follows.

- Quality: The tendency of lower risk and higher quality assets to generate higher risk adjusted returns.

- Growth: A parameter that captures the excess return on stocks due to improving growth prospects.

- Valuation: An important parameter that acts as a safety net by identifying the difference between market price and the fair value.

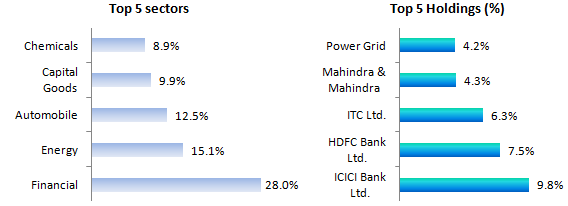

Current Portfolio Construct

Source: Advisorkhoj Research

Axis Quant Fund in current market context

- The portfolio of Axis Quant Fund is a well-diversified offering at several levels. From a style perspective, the aim is to invest in a combination of styles i.e. portfolio of quality stocks but with good growth at a reasonable price (Q-GARP) while at a sector level it has a good mix of cyclical and defensive exposure. On the size front as well it exploits investment opportunities across large, mid and small cap space.

- The market has been quite challenging on the style front as only high volatility & high beta stocks have convincingly beaten the markets while most front line styles like Growth, quality, momentum and value have struggled for consistency.

- The earnings season this quarter for the fund and the market has been reasonably good. However, high relative valuation at a market level, hawkish global central bank policy, continued high inflation and currency pressures need to be tracked closely.

Why invest in Axis Quant Fund?

- Unique fundamentally driven quantitative approach.

- The fund can leverage Axis MF’s strong fundamental research capabilities.

- Unbiased approach to portfolio management.

- Aims to capture the best of Valuation, Growth & Quality parameters.

- Adequate diversification across industry sectors and market capitalization segments.

- Axis MF has a strong long term performance track record across multiple product categories.

- The current global scenario of equities is challenging with high interest rates, stubborn high inflation and US dollar pressures on the Indian Rupee.

- Amidst the challenging global scenario, Indian equities have been outperformers, despite relatively high valuations.

- In the current market context, a systematic and consistent fundamentals driven quantitative investment approach has the potential of generating alphas over long term investment horizons.

Who should invest in Axis Quant Fund?

- Investors seeking capital appreciation or wealth creation over long investment horizons.

- You should have high risk appetite for this fund.

- You should have minimum 5 year investment tenure for this fund.

- You can invest in this fund either in lump sum or Systematic Investment Plan (SIP) based on your investment needs and financial situation.

- If you have lump sum funds available but are worried about short term volatility, then you can invest in Axis Quant Fund through 3 – 6 month Systematic Transfer Plan(STP) from Axis Liquid Fund. You can take advantage of short term volatility through Rupee Cost Averaging using the STP route

Investors should consult with their mutual fund distributors or financial advisors if Axis Quant Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Motilal Oswal Mutual Fund launches Motilal Oswal Diversified Equity Flexicap Passive Fund of Funds

Jan 2, 2026 by Advisorkhoj Team

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025 by HDFC Mutual Fund

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team