Axis Growth Opportunities Fund: One of the best performing Large and Midcap funds now

Axis growth opportunities fund has been one of the best-performing large- and mid-cap funds in the last 1 year. The scheme was launched nearly 5 years back, and its performance since inception is stellar. If you invested Rs 1 lakh in the scheme at its inception / NFO in October 2018, your investment would have multiplied more than 2X (CAGR of 18.8%). A unique feature of Axis Growth Opportunities Fund is that the scheme allocates a portion of its portfolio to international stocks (up to 30%). With equity markets making a broad-based recovery after the first couple of months of volatility this year, Axis Growth Opportunities Fund can be a good investment option for long-term investors who want downside risk limitations in highly volatile markets.

What are Large and midcap funds?

As per SEBI requirements, large and midcap funds must have a minimum 35% allocation to large cap (top 100 stocks by market capitalisation) and 35% allocation to midcap stocks (101st to 250th stocks by market capitalisation). While the minimum large-cap allocation potentially ensures stability in volatile market conditions, the mandate for these funds provides enough flexibility for fund managers to position their portfolios for long-term capital appreciation by identifying attractive investment opportunities across different market cap segments and industry sectors. Large- and mid-cap funds are good investment choices for investors with high to very high-risk appetites for long-term financial goals.

Axis Growth Opportunities Fund Overview

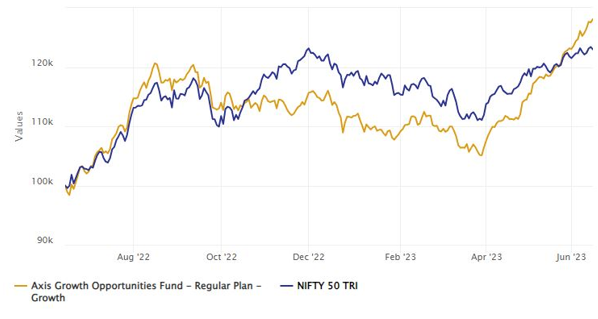

Axis Growth Opportunities Fund was launched in October 2018 and has Rs 8,977 crores of assets under management (as of stMay 2023). The expense ratio of the scheme is 1.75%. Veteran fund managers Mr Jinesh Gopani and Mr Vinayak Jayanath helm the scheme. The chart below shows the growth of Rs 1 lakh investment in the scheme over the last 1 year versus its benchmark index Nifty Large and Midcap 250 TRI.

Source: Advisorkhoj Research

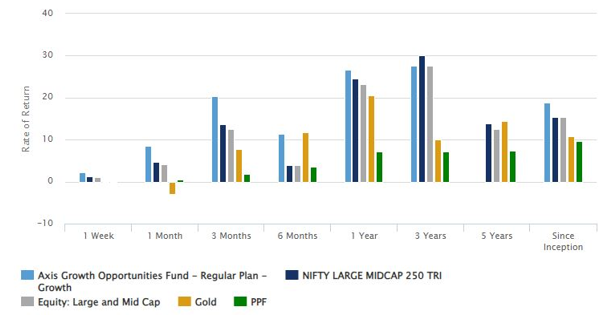

Performance versus category and different asset classes

The chart below shows the performance of Axis Growth Opportunities Fund versus its fund category and various asset classes over different time scales. The scheme has outperformed the benchmark and category average across all time scales. It has also outperformed the other asset classes over more extended investment periods.

Source: Advisorkhoj Research

Rolling Returns

The chart below shows the 3-year rolling returns of Axis Growth Opportunities Fund versus the large and midcap category average since the scheme’s inception. You can see that the scheme consistently beat the category average over 3-year investment tenures. The average 3-year rolling returns (CAGR) of Axis Growth Opportunities Fund is 22.35%. The scheme gave 15%+ CAGR returns over 3-year investment tenures nearly 100% of the time (see the rolling returns chart below).

Source: Advisorkhoj Rolling Returns Calculator

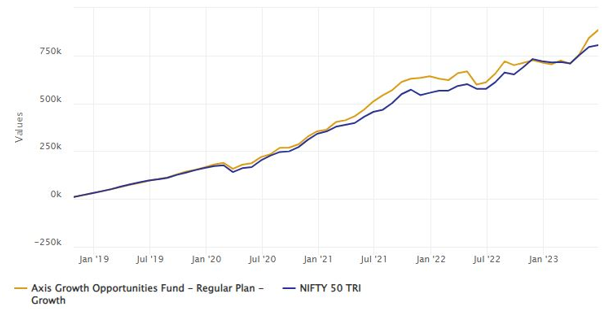

Wealth Creation - SIP Returns

The chart below shows the Rs 10,000 monthly SIP returns in Axis Growth Opportunities Fund since the scheme’s inception. You can see that with a cumulative investment of Rs 5.6 lakhs through SIP, you could have accumulated a corpus of over Rs 8.8 lakhs in the last 5 years. The XIRR of monthly SIP in Axis Growth Opportunities Fund since inception is nearly 20%. The SIP performance of Axis Growth Opportunities Fund is a testimony of the wealth creation potential of the scheme over long investment horizons.

Source: Advisorkhoj Research

Why invest in international stocks?

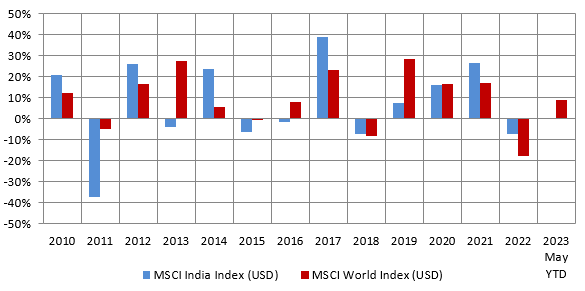

There is a low or even negative correlation between the returns of the different countries. The chart below shows the annual returns of MSCI World and MSCI India (in dollar terms) Indices over the last 13 years (ending 31st May 2023). You can see that MSCI India outperformed MSCI World in specific years and underperformed in specific years. In the years India underperformed, having international stocks in your portfolio would have reduced overall portfolio volatility and provided stability.

Source: MSCI Indices, Advisorkhoj Research, as on 31st May 2023.

Axis Growth Opportunities Fund stock selection strategy

- Innovative & entrepreneurial Indian companies with experienced management

- Market leaders in emerging industries or higher growth companies in established businesses

- Focusing on quality companies that can generate sustainable long-term returns

- High conviction bottom-up based portfolio construction

- The Overseas allocation is based on advice from Schroders Investment Management and follows a high-conviction alpha strategy.

Who should invest in Axis Growth Opportunities Fund?

- Investors are looking for capital appreciation and wealth creation.

- Investors should have at least a 5-year investment horizon in this scheme.

- Investors with high to very high-risk appetites.

- You can invest in this scheme through SIP for your long-term financial goals.

- You can also tactically invest in a lump sum in deep corrections, provided you have an investment horizon of at least 5 years or longer.

- Investors should consult their financial advisors if Axis Growth Opportunities Fund suits their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team