Axis Flexi Cap Fund: A good flexicap fund for long term wealth creation

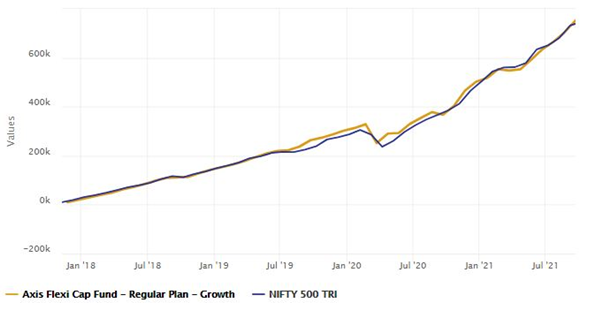

Axis Flexi Cap Fund (formerly Axis Multi-cap Fund) completed 3 years in November 2020. 3 year performance period is usually a good horizon to evaluate the performance of a fund. The chart below shows the growth of Rs 10,000 in the scheme since its inception. You can see that the scheme was able to outperform its benchmark index, Nifty 500 TRI. The CAGR returns of the fund since inception was 19.4% (as 23rd September 2021).

Source: Advisorkhoj Research, as on 21st September 2021. Disclaimer: Past performance may or may not be sustained in the future

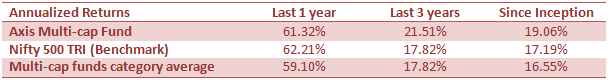

The table below shows the performance of Axis Flexi Cap Fund versus its benchmark (Nifty 500 TRI), flexicap funds category and Nifty 50 TRI over various trailing periods. You can see that the scheme was able to outperform both its benchmark and category average over sufficiently long investment tenures.

Source: Advisorkhoj Research, as on 21st September 2021. Disclaimer: Past performance may or may not be sustained in the future

Rolling Returns

The chart below shows the 1 year rolling returns of the scheme since the scheme inception. We saw different market conditions in the last 4 years or so. The mid 2018 to mid 2020 saw bear market conditions in mid and small cap market segments, with severe correction in small caps. We saw a pre-election rally in the run up to 2019 Lok Sabha elections and continuation of the rally after the polls confirmed a clear NDA majority in Parliament. The financial markets were rocked by the outbreak of COVID-19 pandemic in February and March of 2020, with the Nifty crashing 23% in March 2020. After that we saw a recovery, which became stronger in the coming months as the economy was gradually re-opened after a stringent lockdown. By the final quarter of calendar year 2020, Nifty was trading at its all time high and the momentum in the stock market has been sustained. Midcap and small cap rally was stronger than large cap, but faced a big correction in August 2021. You can see how Axis Flexi Cap Fund performed in different market conditions.

Source: Advisorkhoj Rolling Returns Calculator, as on 21st September 2021. Disclaimer: Past performance may or may not be sustained in the future

The chart above shows that Axis Flexi Cap Fund was able to consistently outperform the benchmark in different market conditions and generate alphas for investors. You can see that the scheme underperformed the benchmark during small / midcap rally in 2020; the scheme maintained a large cap bias. However, the scheme caught up with the benchmark over the last few weeks. More importantly, you can see in the chart above that the fund manager was able to limit downside volatility of scheme relative to the index.

Percentage of negative 1 year return instances of the scheme since inception was 12% versus 28% for the benchmark since the inception of the scheme. Percentage of 12%+ 1 year return instances of the scheme since inception was 48% versus 32% for the benchmark since the inception of the scheme. This is the hallmark of a good fund manager – a good fund manager should be able to outperform the market across different conditions (both bull and bear markets) over long investment tenures.

SIP Returns

The chart below shows the returns of Rs 10,000 monthly SIP in that Flexicap Fundsince inception. You can see in the chart above that you could have accumulated a corpus of Rs761,615 with a cumulative investment of just Rs 460,000. The annualized SIP returns (XIRR) since inception is 27.09%.

Source: Advisorkhoj Research, as on 21st September 2021. Disclaimer: Past performance may or may not be sustained in the future

About Axis Flexi Cap Fund

The scheme was launched in November 2017 and has Rs 9,783 Crores of assets under management (AUM) as on 31st August 2021. The expense ratio of the scheme is 1.82%, as on 31st August 2021. As per SEBI’s mandate, flexicap funds can invest across market cap segments without any segment wise restrictions. Axis Flexi Cap Fund seeks to invest across the market cap spectrum in high conviction ideas with improved riskadjusted return characteristics. The fund manager looks for stocks that are expected to grow faster than the broader market benchmark.

The fund as such is sector agnostic and focuses on a bottom up approach to invest in stocks that are at an inflection point such as market share gain, industry consolidation, sunrise industries, improved management focus and capital allocation or regulatory & policy changes. Currently (as on 31st December 2020), the top 5 sectors of the scheme are Banking and Financial Services, Information Technology, Consumer goods, Cement & building materials and Healthcare.

Stock Selection Strategy

- High conviction ideas with improved risk - adjusted return characteristics

- Look for stocks that are expected to report the faster growth relative to the benchmark

- Aims to look for stocks that are at inflection point

- Invests across market cap spectrum. Current market cap allocation is 84% large cap, 9% midcap and 6% small cap.

Why invest in Axis Flexi Cap Fund?

- This scheme aims to provide long term returns while minimizing risks associated with market volatility.

- Endeavours to invest in quality companies with high growth prospects with an aim to deliver superior risk adjusted returns for investors.

- Investing in a flexi cap fund is less risky as compared to a pure mid cap or a small cap fund as the fund manager has the leeway to capture best available opportunities in the market at that time.

- The scheme is suitable for long-term goals such as children's education & their future, retirement or any other long term growth that need wealth creation plan.

- You can invest in this scheme either in lump sum with long investment horizon or from your regular savings through Systematic Investment Plans (SIP).

- The scheme has a strong track record since inception.

Who should invest in Axis Flexi Cap Fund?

- Investors looking for long term capital appreciation or wealth creation

- Investors with high to very high risk appetites

- Investors with minimum 5 years investment tenures.

Investors should consult with their financial advisors if Axis Flexi Cap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team