Axis Banking and PSU Debt Fund

Banking and PSU Funds are debt mutual fund schemes which invest in debt and money market instruments issued by banks, public sector undertaking (PSU) and public financial institutions (PFI). As per SEBI’s mutual fund classification guidelines, Banking and PSU Funds must invest at least 80% of their assets in instruments issued by such institutions. Unlike several debt fund categories, SEBI does not have duration limits for Banking and PSU funds. The fund managers have the flexibility to invest in durations which give attractive yields from a risk return trade-off perspective.

Credit risk

Debt and money market instruments issued by Banks, PSUs and PFI are usually of high credit quality. PSUs and some of the PFIs are Government owned entities. Debt and money market securities enjoy quasi sovereign status. As such their credit risk is very low. Banks and PFIs (both public sector and private sector) enjoy high credit rating because they are regulated entities and are usually adequately capitalized. Most banks and PFIs enjoy high credit ratings. Investors should also know that many banks are owned by the Government of India (PSU banks).

About Axis Banking and PSU Fund

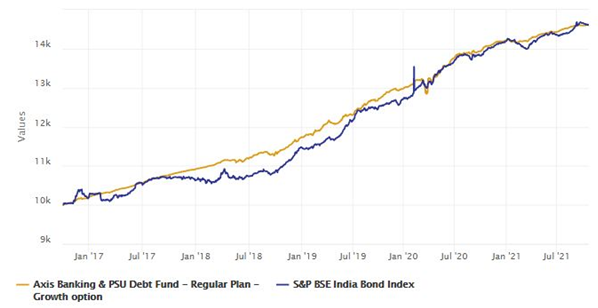

Axis Banking and PSU Debt Fund was launched in June 2012 and has Rs 16,745 crores of assets under management (AUM) as 30th September 2021. The expense ratio of the fund regular plan is 0.62%. Aditya Pagaria is the fund manager of the scheme. The Scheme seeks to generate optimal returns with low credit risk. The chart below shows the growth of Rs 10,000 lump sum investment in the scheme regular plan over the last 5 years. The CAGR return of the scheme over the last 5 years was 7.8%.

Source: Advisorkhoj Research

Rolling Returns

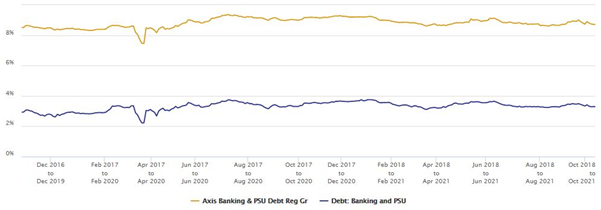

The chart below shows the 3 year rolling returns of the scheme versus the banking and PSU funds category over the last 5 years (Regular plan). You can see that 3 year rolling returns of the scheme are very stable in the 7 – 8% range over the last 5 years across different interest rate regimes. The returns stability of the scheme makes it a good choice for moderately conservative investors over 3 years or longer investment tenure.

Source: Advisorkhoj Research

Credit Quality

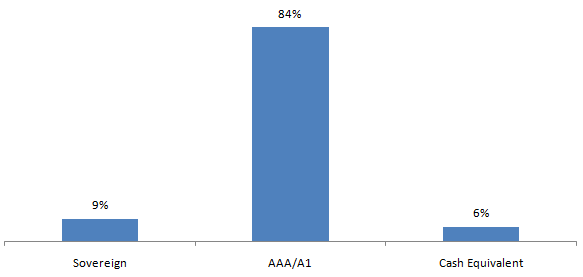

The chart below shows the credit quality profile of the scheme. You can see that 94% of the scheme assets enjoy sovereign or the highest credit rating (AAA or A1). The rest of the scheme assets are in cash equivalents. The credit quality of the scheme is very high.

Source: Advisorkhoj Research

YTM and Maturity

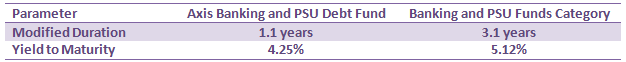

The chart below shows the yield to maturity and average maturity of Axis Banking and PSU Fund versus the banking and PSU funds category. The average maturity of the scheme is lower than the category average. The fund manager has adopted a conservative strategy as far interest rate risks are concerned. Shorter the duration or maturity profile of a debt fund, lower is the interest rate risk. We think that this is a prudent strategy due to challenges of high inflation and looming taper of US Federal Reserve’s stimulus.

Source: Advisorkhoj Research

Why invest in Axis Banking and PSU Debt Fund?

- With interest rates of traditional fixed income investments declining, Banking and PSU debt funds provide alternative investment options to fixed income investors.

- Axis Banking and PSU Debt Fund has very high credit quality e.g. Sovereign, AAA, A1+ etc.

- The scheme has moderately limited interest rate sensitivity and can provide stability to your fixed income portfolio.

- Benefit of long term capital gains taxation (indexation benefits) for investment tenures of 3 years or longer.

Who should invest?

- Investors who are primarily looking for income and capital appreciation in favourable interest rate environment.

- Investors with moderately low to moderate risk appetites.

- Investors are prepared to remain invested for at least 2 to 3 years. Investors can get long term capital gains taxation benefits for investment tenures of 3 years or longer.

Investors should consult with their financial advisors if Axis Banking and PSU Debt Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team