Aditya Birla Sun Life Frontline Equity Fund: Nearly 40X returns in 20 years

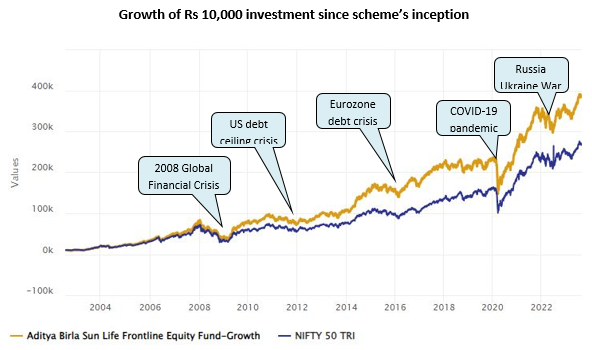

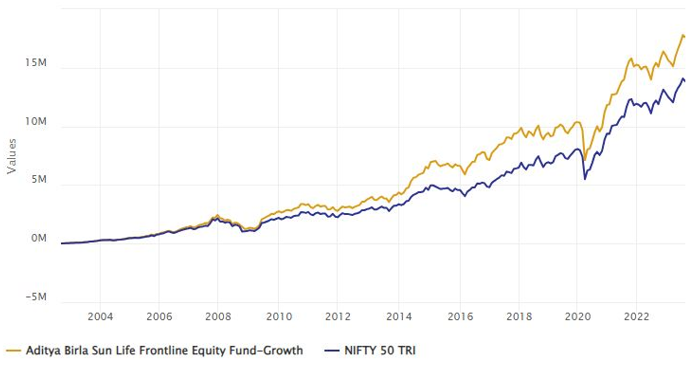

Aditya Birla Sun Life Frontline Equity Fund has completed more than 21 years since its launch. Over this period the equity market went through several cycles of bull and bear markets, but this large cap fund created substantial wealth for investors (see the chart below). If you had invested Rs 10,000 in Aditya Birla Sun Life Frontline Equity Fund at the times of its inception your investment would have multiplied nearly 40 times to Rs 3.8 lakhs (as on 27th August 2023). The fund’s CAGR return since inception is nearly 19%.

Source: Advisorkhoj Research. Period: 5th August 2002 to 25th August 2023.

What is a large cap fund?

As per SEBI, listed companies from 1st to 100th in terms of full market capitalization are called Large Cap companies (Large Cap stocks). Large cap companies have many proven years of history, mature and stable business models. They are market share leaders in their respective industry sectors and are usually better positioned to survive economic downturns. Large caps usually have large percentage of institutional (FIIs and DIIs) ownership compared to their midcaps and small caps. They are well researched and provide better visibility of earnings compared to midcaps and small caps. They are traded in large volumes in the stock market and are therefore, highly liquid. Large cap stocks are also usually less volatile than midcap and small cap stocks. Large cap funds are equity mutual fund schemes which have to invest at least 80% of their assets in large cap stocks.

About Aditya Birla Sun Life Frontline Equity Fund

Aditya Birla Sun Life Frontline Equity Fund was launched in 2002 and has around Rs 23,758 crores of assets under management (AUM). It is a very popular large cap fund with retail investors. The total expense ratio (TER) for the regular plan of the scheme is 1.68% only. The scheme benchmark is Nifty 100 TRI. Unlike several large cap funds which classified themselves as large cap after SEBI’s rationalization and categorization of mutual fund schemes in 2018, Aditya Birla Sunlife Frontline Equity Fund was always a true to label large cap fund. Mahesh Patil (Chief Investment Officer of Aditya Birla Sun Life Mutual Fund) and Dhaval Joshi are the fund managers of this scheme. The fund managers have combined experience of 40 years. Mahesh Patil has been managing the scheme for the last 17.7 years.

Outperformance over different time-scales

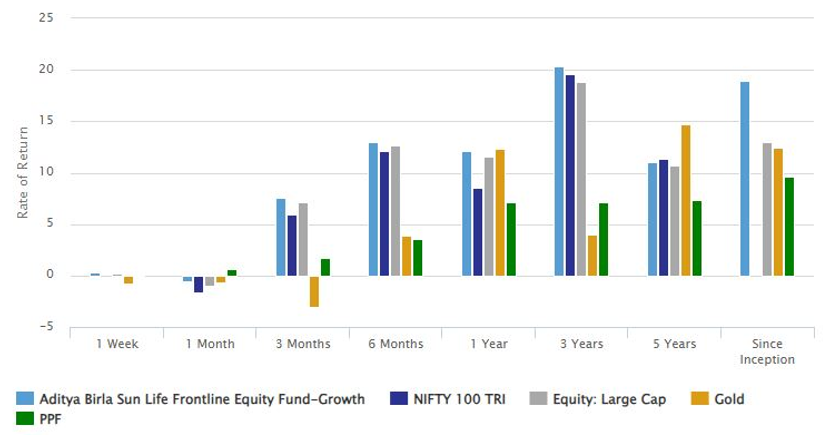

The chart below shows the performance of Aditya Birla Sun Life Frontline Equity Fund versus its benchmark index Nifty 100 TRI and the large cap funds category average. You can see that the fund was able to outperform the benchmark index, over short term and long term investment tenures.

Source: Advisorkhoj Research

Investment strategy of Aditya Birla Sun Life Frontline Equity Fund – 3 pillars

The 3 pillars of the investment strategy

- Discipline: The scheme targets to maintain sector exposure within ± 30% relative to benchmark or absolute ± 5%, whichever is higher, of the sectoral weight in the benchmark index. This, along with well defined market cap exposure and stock concentration limits provide better diversification and discipline to investment strategy.

- Fundamental research driven investment process: Scheme seeks to generate excess returns over benchmark by following a combination of top-down and bottom-up approach to investing.

- Performance over benchmark – Alpha: The fund targets to beat the benchmark across the market cycles.

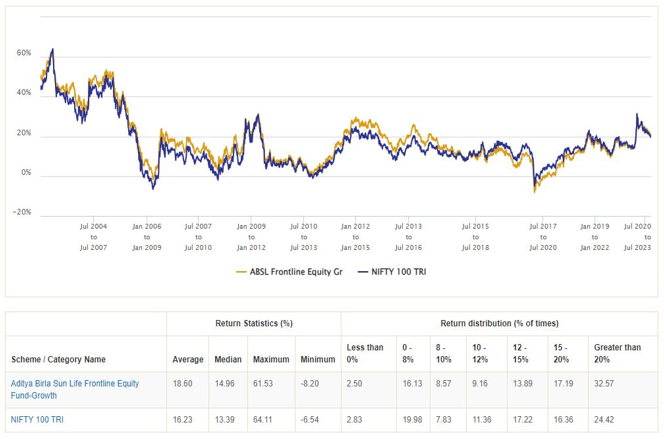

Track record of alpha creation

The chart below shows the 3 year rolling returns of Aditya Birla Sun Life Frontline Equity Fund versus its benchmark index Nifty 100 TRI since the scheme’s inception. We are showing 3 year rolling returns because equity investors need to have minimum 3 year investment horizon. You can see that Aditya Birla Sun Life Frontline Equity Fund was able to beat the benchmark most of the times across different market conditions over 3 years investment tenures. The scheme underperformed in 2018 and 2019, but performance picked again from 2020 onwards.

Consistency is one of the most important attributes of a mutual fund scheme’s performance. You can see that average and median rolling returns of Aditya Birla Sun Life Frontline Equity Fund were higher than the benchmark index. Aditya Birla Sun Life Frontline Equity Fund has 15%+ CAGR returns more consistently compared to the benchmark index. You can see that the Aditya Birla Sun Life Frontline Equity Fund has a consistent long term track record of alpha creation.

Source: Advisorkhoj Research

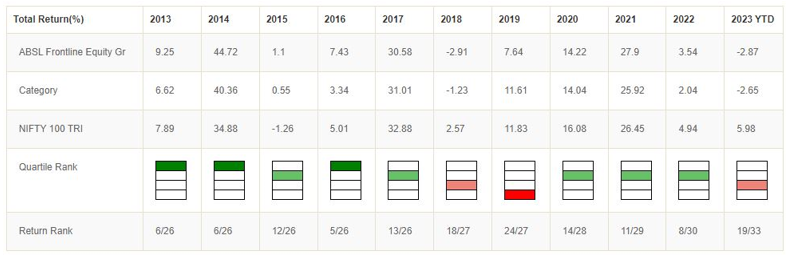

Consistency in outperformance versus peers

The table below shows the annual returns of Aditya Birla Sun Life Frontline Equity Fund versus category / benchmark and its annual quartile ranking. The preponderance of greens in the quartile ranking chart shows that the fund has spent most of its time in the top 2 performance quartiles in the last 10 years across different market conditions. As mentioned before the fund underperformed in 2018 and 2019 but the strong comeback from 2020 onwards gives us confidence in the fund managers’ investment strategy and conviction.

Source: Advisorkhoj Research

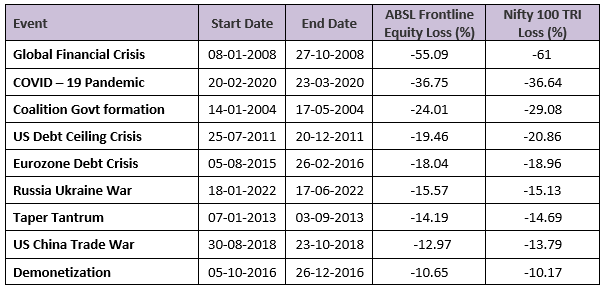

Lower downside risk

The table below lists the some of the biggest market drawdowns in the last 20 years or so. You can see that fund managers were successful in lowering downside relatively to the benchmark index; Aditya Birla Sun Life Frontline Equity Fund usually suffered smaller drawdowns compared to NSE 100 TRI.

Source: Advisorkhoj Research

Wealth Creation through SIP

The chart below shows the growth of Rs 10,000 monthly SIP investment in Aditya Birla Sun Life Frontline Equity Fund since the inception of the scheme. With a cumulative investment of around Rs 25 lakhs, you could have accumulated a corpus Rs 1.7 lakhs. The SIP XIRR of the fund since inception is 16% The SIP performance again demonstrates the long term wealth creation track record of Aditya Birla Sun Life Frontline Equity Fund.

Source: Advisorkhoj Research

Why invest in Aditya Birla Sun Life Frontline Equity Fund?

- Long Track Record: A scheme with a long track record of over 20 years.

- Handpicked Investments: Investment in promising companies across industries.

- Diversification: Avoids excessive concentration and practices diversification across sectors and stocks.

- IDCW: Endeavours to declare regular dividends under IDCW option, subject to availability of distributable surplus.

- Flexibility: Large cap-tilt isn't a constraint to performance as Fund Manager has the leeway of handpicking winners outside the Niy 100 also.

- True to Label Fund: The fund has maintained large cap bias over the years by keeping average large cap allocation to approximately 80% or higher since inception.

Who should invest in Aditya Birla Sun Life Frontline Equity Fund?

- Investors looking for capital appreciation over long investment tenures.

- Investors with minimum 5 years investment tenures.

- Investors with moderately high to high-risk appetites.

- Since the scheme invests in blue chip stocks and aims for lower volatility relative to the market, it may be suitable for first time or new investors.

Investors should consult with financial advisors or mutual fund distributors if Aditya Birla Sun Life Frontline Equity Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Infrastructure Fund

Apr 23, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Gilt Fund

Apr 23, 2025 by Advisorkhoj Team