A powerful stock picking methodology: Peerless Score of Financial Strength explained

If you have been investing in equity markets for a long time, both directly in equity shares of companies and through mutual funds, take a look at your portfolio of stocks and mutual fund schemes and ask yourself the question, which portfolio has given better returns in the long term, your portfolio of stocks or mutual funds? Based on my experience, for most retail investors, their portfolio of mutual funds would have given higher returns in the long term than your portfolio of stocks. If that is the case with you as well, ask yourself why did your portfolio of stocks not do as well as your mutual fund investments? There are a number of factors that would explain why, but the most important reason is that, while you use your own judgement to buy stocks that will generate good profits for you, in a mutual fund you rely on the experience and expertise of a fund manager. A few weeks back, I had the opportunity to chat with Amit Nigam, Head of Equities, Peerless Mutual Fund, to get some insight on his stock picking methodology. In this blog, we will discuss how Peerless Mutual Fund’s proprietary stock picking model, Peerless Score of Financial Strength Works. Hopefully, readers will get an understanding how professional fund managers construct their long term stock portfolio.

There are a large number of books on stock picking of which I have read quite a few. I have also spoken with a number of investment experts and over the years I have realized that stock picking is both art and science. The art part is always difficult, but even if we get the science part right, we can get good returns in the long term. However, even the science part is quite complicated, if you read different books on equity investing. Which is more important? price earnings multiple, earnings per share growth, revenue growth, cash flows, debt equity ratio or some other financial ratios? What appealed to me about the Peerless Score of Financial Strength stock picking model, is the intrinsic simplicity of its approach and at the same time the robustness of its philosophy. Before we dive into the stock picking model in Peerless Score of Financial Strength, let us understand the basic philosophy first.

One thing I have noticed about retail equity investors is their extraordinary interest in price levels. We hear things like Infosys is not a good buy at 1120 but a good buy at 1080. While the valuation (P/E) of Infosys at 1080 is more attractive than the valuation at 1120, it is only marginal. Amit Nigam, Head of Equities at Peerless Mutual Fund, believes that growth is more important than valuations. Amit gave the example of HDFC Bank and Asian Paints. Even back in 2000, these companies were not trading at cheap valuations. However, in the last 15 years, HDFC Bank and Asian Paints have given 50 to 60 times returns. Here is where we go into fundamentals. The starting point of stock picking, as per Amit, is you, the investor and not the company. We should remember that, as retail investors, we are minority shareholders. Therefore, we should invest in companies, where our interests as minority shareholders, are taken care of. What are the characteristics of these companies? The business should be self sustaining. Let us understand, what this means. If a company has to raise money from the market, either debt or equity, from time to time to run the business, the interest of minority shareholders is diluted. Using the Peerless Score of Financial Strength, Amit invests in companies which are self sustainable. How do they identify such companies? They use a metric known as Return on Capital Employed (ROCE). Return on Capital Employed is simply the Earnings before Tax and Depreciation (EBIT) of the company divided by the total capital employed by the company, both equity and debt. If the return on capital employed by the company is greater than the cost of funds of that company, then the business is strong and self sustainable.

Let us understand how they use this metric. The cost of debt in India is currently 14 – 15%. The cost of Equity is 15 – 16%. If debt equity ratio of a company is 50:50, the weighted average cost of funds is around 15%. Therefore, if a company’s ROCE is more than 15% then there is no need for the company to raise capital to run its business and in fact, create value for shareholders. In fact, Peerless has a hurdle rate of 20% for selecting companies based on ROCE. For companies that have a ROCE of more than 20%, the Peerless Score of Financial Strength assigns a score of 1. For companies that have a ROCE of less than 20% in a year, the Peerless Score of Financial Strength assigns a score of 0.

Apart from ROCE, the Peerless Score of Financial Strength looks at another important metric. It is Free Cash Flows. Free Cash Flow is the cash generated by the company after paying for all the expenses required to run or even grow the company, including changes in working capital, capital expenditures and taxes. Free cash flow allows a company to enhance value of its shareholders. For companies, For companies, which had a free cash flow of more than zero in a year, the Peerless Score of Financial Strength assigns a score of 1. For companies that have a free cash flow of less than zero in a year, the Peerless Score of Financial Strength assigns a score of 0.

Peerless Score of Financial Strength

Peerless Score of Financial Strength (PSFS) scores companies 0 or 1 based on the criteria discussed above for each year, for the last 15 years. Amit explained that, they chose a horizon to 15 years to cover different market cycles, both bull markets and bear markets. The long time horizon has enabled them to look beyond market cycles, when investing in companies. The maximum PSFS score a company can get is 30, 1 each for ROCE and Free Cash Flows for each year over 15 years. They then select the companies in the top 40th percentile.

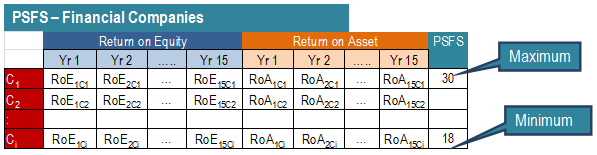

For financial institutions, Amit explained that, instead of ROCE and Free Cash Flows, Peerless uses two metrics Return on Equity (ROE) and Return on Assets (ROA). For financial institutions that have a ROE of more than 15%, the Peerless Score of Financial Strength assigns a score of 1. For companies that have a ROE of less than 15% in a year, the Peerless Score of Financial Strength assigns a score of 0. Similarly, for financial institutions that have an ROA of more than 1%, the Peerless Score of Financial Strength assigns a score of 1. For companies that have a ROE of less than 1% in a year, the Peerless Score of Financial Strength assigns a score of 0. The financial institutions are scored 0 or 1 each year, for the last 15 years, as described earlier. The maximum PSFS score a company can get is 30, 1 each for ROE and ROA for each year over 15 years. They then select the companies in the top 40th percentile.

Selecting companies for the PSFS scoring

Amit Nigam explained to me that, in Peerless they have a market capitalization cut off of र 1,000 crores, for scoring companies through the Peerless Score of Financial Strength model. Even within the set of companies, with a market cap of more than र 1,000 crores, they screen companies based on management quality. They want to ensure, in Amit’s words, “invest in companies that have a great business, are run by capable management and who also respect minority shareholders”. I asked Amit, if his methodology had a bias towards excluding certain sector for his stock portfolio. Amit said that, while some sectors may have intrinsically low ROCE, he said that, one can always find good companies in any sector that do well on the metrics discussed earlier. As such, the methodology has no significant sector bias and the Peerless Mutual Fund schemes employing this methodology are truly diversified equity schemes. There is also no bias, against any particular market segment, large cap or midcap. Companies selected using PSFS belong to both large cap and midcap segments.

Advantages of PSFS

The major advantages of Peerless Score of Financial Strength model are as follows:-

- This methodology is a true bottoms-up stock picking methodology. It enables the fund manager able to look beyond market indices

- It enables the fund manager to the absence of near term performance triggers. This methodology is especially useful in volatile market conditions.

- It enables the fund manager to look beyond market cycles. High quality stocks bought at the right price offer far more safety than taking a call on economic performance and market performance.

Conclusion

Peerless Score of Financial Strength is a stock selection methodology which though, easy to understand in terms of concept, is philosophically robust to identify both value and growth opportunities. Amit Nigam, Head of Equities, Peerless Mutual Fund, mentioned to me that, Peerless uses this methodology for portfolio construction of Peerless Equity Fund and also other equity oriented schemes, including recent NFOs. This methodology can potentially enable investors to earn returns over long investment horizon and at the same time avoid permanent loss of capital in the long term.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team

-

Reciprocal Tariffs: Casting a wider net

Apr 7, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Energy Opportunities Fund

Apr 3, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty 500 Momentum 50 ETF FOF

Apr 3, 2025 by Advisorkhoj Team