360 ONE Focused Equity: One of the best performing focused funds

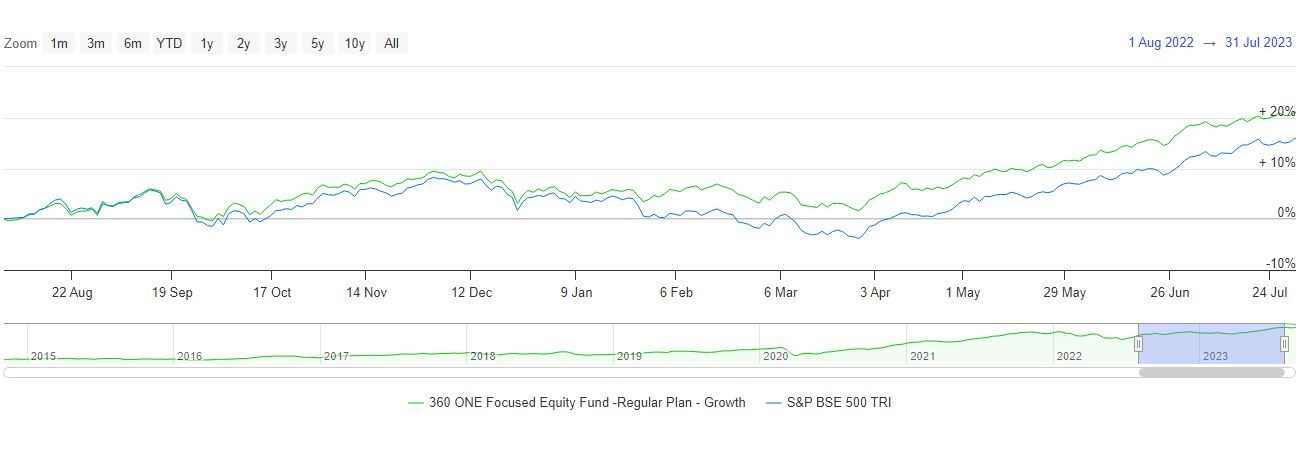

360 ONE Focused Equity Fund, erstwhile IIFL Focused Equity Fund, is one of the best performing focused funds. In the last 1 year, 360 One Focused Equity Fund ranks among the top 3 funds (Mutual Fund Trailing Returns - Equity Focused). The chart below shows the NAV growth of 360 ONE Focused Equity Fund in the last one year.

Source: mutualfundtools.com

What are Focused Equity Funds?

As per SEBI guidelines, focused equity funds is a category of mutual fund schemes where each scheme is focused on a few stocks – the maximum number of stocks a focused equity fund can invest in is 30. A portfolio with higher allocations to top-performing stocks in different industry sectors has the potential to outperform a portfolio with a larger number of stocks but lower allocations to top performers. Focused equity funds invest in a relatively concentrated portfolio of high-conviction stocks.

About 360 One Focused Equity Fund

The scheme was formerly known as IIFL Focused Equity Fund. In April 2023, IIFL Mutual Fund issued a notice to investors rebranding itself as 360 ONE Mutual Fund. Consequent to the rebranding, the names of erstwhile IIFL Mutual Fund schemes were changed. IIFL Focused Equity Fund was renamed 360 ONE Focused Equity Fund. Investors should understand that the name change is only a rebrand; the fundamental attributes of the scheme remains unchanged. 360 ONE Focused Equity Fund was launched in August 2014 and has Rs 4,337 crores of assets under management (AUM) as on 31st July 2023. The Total Expense Ratio (TER) of the scheme is 1.89%. The scheme’s benchmark is S&P BSE 500 TRI. Mayur Patel is the fund manager and has been managing the scheme since November 2019.

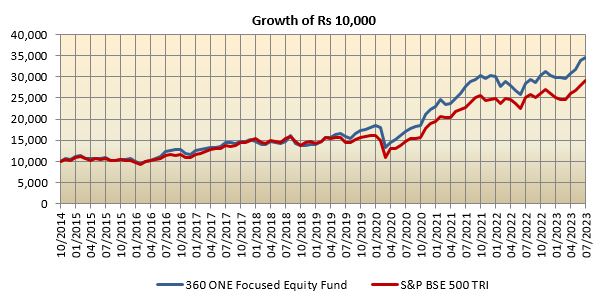

Performance of 360 One Focused Equity Fund since inception

The chart below shows the growth of Rs 10,000 investment in 360 One Focused Equity Fund versus its benchmark S&P BSE 500 TRI since the inception of the scheme (as on 31st July 2023). You can see that your investment would have multiplied nearly 3.5 times in the last 9 years or so. The CAGR return of 360 One Focused Equity Fund since inception is 15.4% (as on 31st July 2023). The performance track record of 360 One Focused Equity Fund since inception shows that this fund is a proven wealth creator.

Source: Advisorkhoj Research, as on 31st July 2023

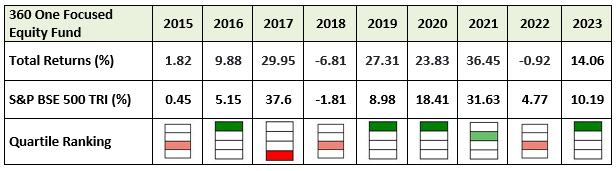

A consistent performer

Point to point or trailing returns can often be misleading about a scheme’s true strengths particularly if the current market conditions favour the investment strategy of the fund manager. In our view, investors should look at performance consistency across different market conditions. We have looked at the annual returns of 360 One Focused Equity Fund since inception versus its peers and the scheme benchmark (see the chart below). You can see that the fund was able to beat the benchmark (S&P BSE 500 TRI) in most years. Compared to performance of peer funds, 360 One Focused Equity Fund ranked in the top 2 performance quartiles in 5 out 9 years, featuring in the top quartile 4 times.

Source: Advisorkhoj Research, as on 31st July 2023

Rolling returns of 360 One Focused Equity Fund

Let us now see how the fund performed over longer investment tenures across different market conditions since the inception of the scheme. The chart below shows the 3 year rolling returns of 360 One Focused Equity Fund versus the benchmark index, S&P BSE 500 TRI. You can see that barring the initial years, the fund was able to outperform the benchmark over 3 year investment tenure most of the time across different market conditions. The average 3 year rolling returns of 360 One Focused Equity Fund since inception was 16.1%.

Rolling returns since inception for 3 year investment tenures (rolled daily)

Source: Advisorkhoj Rolling Returns, as on 22nd August 2023

Let us now see, how the scheme performed over 5 year investment tenure. We are taking 5 year investment tenure because a focused equity funds invest in high conviction stocks and sometimes these high conviction bets may take longer to fully play out and deliver desired outcomes for investors. You can see that 360 One Focused Equity Fund was always able to beat the benchmark over 5 year investment tenures. As such, in our view, you should have minimum 5 year investment tenure for this fund.

Rolling returns since inception for 5 year investment tenures (rolled daily)

Source: Advisorkhoj Rolling Returns, as on 22nd August 2023

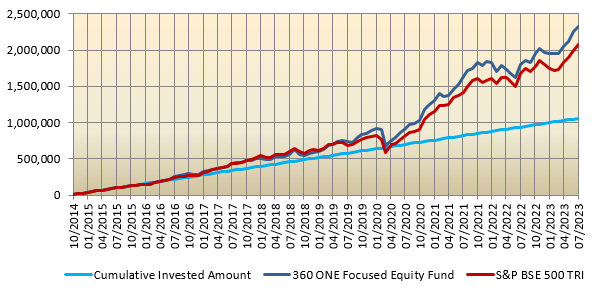

Wealth creation through SIP

The chart below shows the wealth accumulated through Rs 10,000 monthly SIP in 360 One Focused Equity Fund since the inception of the scheme. You can see that with a cumulative investment of Rs 10.6 lakhs you could have accumulated wealth of around Rs 23 lakhs over the last 9 years or so. The annualized SIP returns (XIRR) over the last 5 years was 17.44%.

SIP returns since inception

Source: Advisorkhoj SIP Returns, as on 31st July 2023

Investment Strategy

- The fund identifies the sectors that are likely to do well in the medium term, based on the business cycle of the economy and takes focused exposure to stocks in identified sectors.

- The sectors are actively monitored and changes made to invest in sectors that will benefit from the current stage of the business cycle.

- The fund manager analyses the business cycle, which reflects the fluctuations of activity in an economy, can be a critical determinant of equity sector performance over the longer term

- Historically changes in key economic indicators have provided a fairly reliable guide to recognizing the different phases of an economic cycle— Early, Mid and Late.

- The business cycle approach to sector investing uses probabilistic analysis to identify the shifting phases of the economy, which provides a framework

- Generating outperformance among equity sectors with a business cycle approach may be enhanced by adding complementary analysis on industries and inflation, as well as fundamental security research, among other factors

- The scheme is market cap and sector agnostic. Currently 61% of the scheme portfolio is in large cap, 21% in midcap and 15% in small cap.

Who should invest in 360 One Focused Equity Fund?

- Investors looking for capital appreciation and wealth creation.

- Investors should have at least 5 year investment horizon in this scheme.

- Investors with high to very high risk appetites.

- You can invest in this scheme either in lump sum or through

- Investors should consult with their financial advisors if 360 One Focused Equity Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Bandhan Mutual Fund launches Bandhan Silver ETF FOF

Jan 12, 2026 by Advisorkhoj Team

-

Bandhan Mutual Fund launches Bandhan Gold ETF FOF

Jan 12, 2026 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF FOF

Jan 9, 2026 by Advisorkhoj Team

-

Mahindra Manulife Mutual Fund launches Mahindra Manulife Innovation Opportunities Fund

Jan 9, 2026 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches Jio BlackRock Short Duration Fund

Jan 8, 2026 by Advisorkhoj Team