Reliance Small Cap Fund: Fantastic 5 years SIP Returns from this marquee fund

A र 5,000 monthly SIP in Reliance Small Cap Fund over the last 5 years would have grown to a value of more than र 6 lacs (as on 21.04.2016) while the investor would have invested only र 3 lacs on a cumulative basis. The annualized SIP returns of this marquee small and midcap fund over the last 5 years was nearly a whopping 30%. While the returns of this fund have been nothing short of spectacular, investors should remember that the last 5 years was not at all smooth sailing for the equity market. We had two bear market periods over the last 5 years, one in 2011 and again in 2015 – 2016. In fact, in 2015, while the Sensex fell 15%, Reliance Small Cap Fund gave more than 15% returns. Some readers may argue that, the fall in the market in 2015 affected large cap stocks much more than small and midcap stocks. It is true that small and midcap segments outperformed the large cap segments in 2015. However, Reliance Small Cap Fund outperformed even the BSE Small Cap Index by a big margin. While BSE Small Cap Index grew by around 6% in 2015, Reliance Small Cap fund, as discussed earlier, gave over 15% returns, an outperformance of more than 150% in percentage terms. The strong performance of Reliance Small Cap fund in 2015 was on the back of a spectacular 2014 performance, when the fund almost doubled the money of investors (nearly 100% returns in 2014). This fund is a fabulous example of alpha creation.

Fund Overview

Reliance Small Cap Fund was launched in September 2010. The fund has given more than 18% annualized returns since inception. The fund has over र 1,870 crores of assets under management (AUM). Some investors express concerns about the AUM size of small and midcap funds. A large AUM size can become a disadvantage for small and midcap funds, given the breadth of the stock market in India. With an AUM size of र 1,870 crores, Reliance Small Cap fund is very comfortably placed versus some midcap funds which have AUM sizes approaching र 10,000 crores or even exceeding it. The expense ratio of Reliance Small Cap Fund is 2.12%. The fund manager of this mutual fund scheme is Sunil Singhania, who is also the Chief Investment Officer – Equity Investments of Reliance Mutual Funds. People who are familiar with the mutual fund industry know that the reputation of Mr Singhania as a fund manager ranks among the highest in the history of mutual funds in India. The success story of Reliance Growth Fund (please see our post Reliance Growth Fund is one of the biggest wealth creators ever among mutual funds), which Mr Singhania has been managing for 13 years now, is very well known in the annals of mutual funds in India. Mr Singhania, as the fund manager of Reliance Small Cap Fund, surely inspires a lot of confidence in the investors of this fund. CRISIL ranks Reliance Small Cap Fund as one of the best performers in the small and midcap category (Rank 1). Morningstar has a 4 – star rating for this fund.

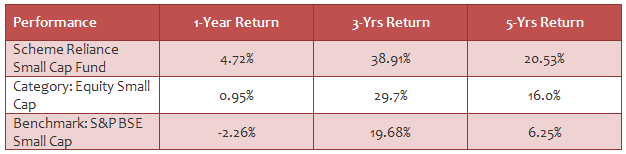

The table below shows the annualized trailing returns of Reliance Small Cap over various time-scales. You can see that, the fund has outperformed its peers and the benchmark BSE Small Cap index across all time-scales.

Source: Advisorkhoj Research

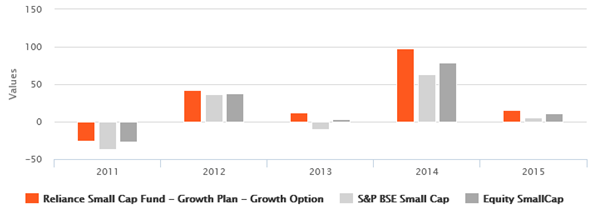

The chart below shows the annual returns of Reliance Small Cap Fund over the last 5 years. Again, we can see that, Reliance Small Cap Fund has outperformed the category (small cap funds) and the benchmark index, both in bull and bear markets.

Source: Advisorkhoj Research

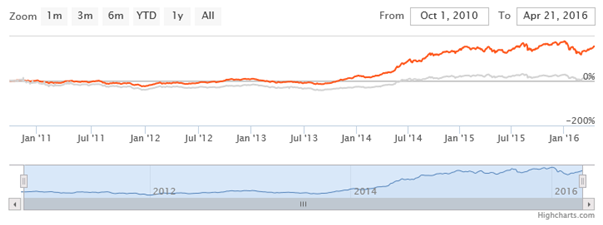

The chart below shows the NAV movement of Reliance Small Cap Fund since inception.

Source: Advisorkhoj Research

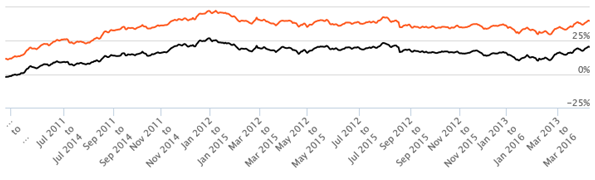

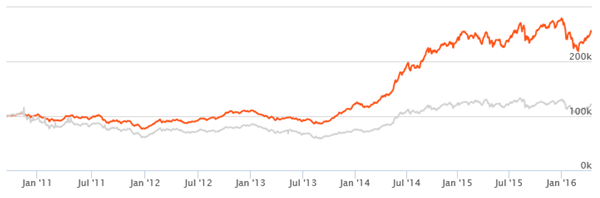

Rolling Returns

Readers who are familiar with our blog know that, we believe rolling returns is the best measure of a fund’s performance. For readers who are not familiar with the concept of rolling returns, they are the annualized returns of the scheme taken for a specified period (rolling returns period) on every day and taken till the last day of the duration. In this chart we are showing the annualized returns of Reliance Small Cap Fund (orange line) over the rolling returns period on every day over the last 5 years and comparing it with the benchmark, BSE Small Cap Index (black line). We have chosen a rolling return period of 3 years, because it is advisable for equity fund investors to remain invested for at least 3 years to get the best returns from the investment.

Source: Advisorkhoj Research

There are three remarkable things about the rolling returns chart of Reliance Small Cap Fund. Firstly, over the last 5 years, the fund has beaten the benchmark index 100% times. This shows consistency of performance across different market conditions. Secondly, notice that the gap between the rolling returns of Reliance Small Cap Fund and the benchmark index, BSE Small Cap Index, is very stable. This implies that the fund manager follows a structured and consistent fund management approach, which is very important for long term investors. Finally, notice that the three year annualized rolling returns have, almost always been, above 25%. That is indeed a remarkable performance. While it does not assure that the fund will continue to give 25% annualized returns in the future, the rolling returns of this fund is a testimony of the fund manager’s ability to consistently generate big alphas, or in simpler terms, big outperformance.

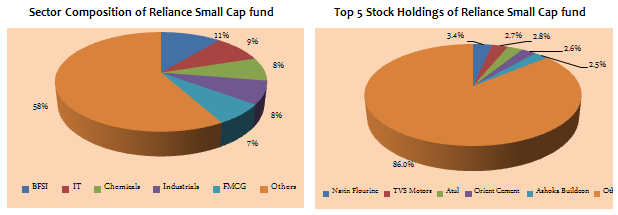

Portfolio Construction

Reliance Small Cap fund focuses on small cap companies in the BSE Small Cap index. Small and micro cap companies comprise nearly 80% of the portfolio in value terms. The fund manager identifies good growth businesses with reasonable size, quality management and rational valuation. The investment approach adopts prudent risk management measures like margin of safety and diversification across sectors & stocks with a view to generate superior risk adjusted performance over a period of time. The investment style is a mix of growth and value. From a sector perspective, Banking and Finance, Technology, Chemicals, Industrial Product and FMCG are the top 5 sectors. From a company concentration perspective, the fund is very well diversified, with the top 5 holdings, Navin Flourine, TVS Motors, Atul Industries, Orient Cement and Ashoka Buildcon accounting for just 14% of the portfolio value.

Source: Reliance Mutual Fund

Risk and Return

From a risk perspective, the volatility of the fund is slightly on the higher side. The annualized standard deviation of monthly returns of Reliance Small Cap Fund is 23.74%, which is on the higher side even relative to the riskier small and mid cap category. While the high volatility is definitely a watch out for the fund from a risk perspective, the risk adjusted return of the fund is very attractive. On a risk adjusted basis, as measured by Sharpe Ratio, the fund has outperformed the small and midcap category. The Sharpe ratio of the fund is 1.44, while that of the category is 1.25.

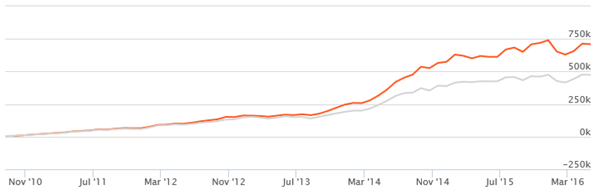

The chart below shows the growth of र 1 lac lump sum investment in the fund (growth option) at the time of the NFO.

Source: Advisorkhoj Research

The value of र 1 lac lump sum investment in the fund at the time of the NFO would nearly be र 2.6 lacs as on April 21, 2016.

The chart below shows the returns of र 5,000 monthly SIP in the fund (growth option) since inception.

Source: Advisorkhoj Research

The SIP returns are indeed fantastic. The value of your र 5,000 monthly SIP in the growth option of Reliance Small Cap Fund from inception will now be र 7.1 lacs; while your cumulative investment would be only र 3.4 lacs. The annualized SIP returns since inception is around 27%. We think that, SIP is the best mode of investment in small and midcap equity mutual funds over a long investment horizon, since small and midcap funds are more volatile and therefore, the investor can take advantage of the volatility through rupee cost averaging of the units.

Conclusion

Reliance Small Cap Fund has completed 5 years of terrific performance. The strong track record of the fund and the fund manager suggests that the future prospects of this fund are also very bright. Investors should note that small and midcap funds are intrinsically more volatile than large cap funds. Therefore, they should have a long investment horizon, when investing in Reliance Small Cap Fund. Investors should consult with their financial advisors if Reliance Small Cap Fund is suitable for their investment needs.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team