Reliance Small Cap Fund gave more than 2 times returns in the last 3 years

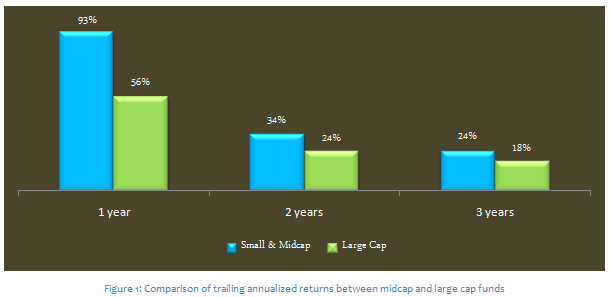

Small and midcap stocks have the potential to give higher returns than large cap stocks in a bull market. These stocks usually get beaten down more in market corrections, but good quality mid cap stocks rebound strongly when strength returns to equity markets. Over the past few months midcap stocks are rallying smartly, outperforming large cap stocks. In fact, over the last 3 years small and midcap funds as a category has clearly outperformed large cap funds by a big margin. Please see the chart below for the comparison of trailing annualized returns between midcap funds and large cap funds over the last 1, 2 and 3 year periods.

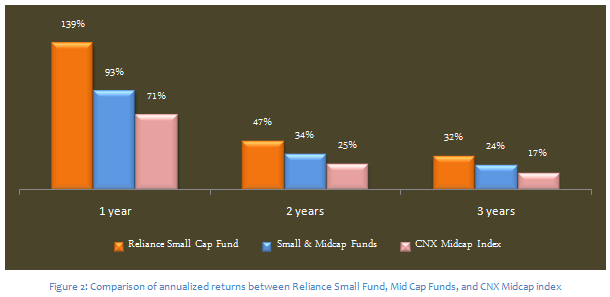

Within the small and midcap funds category, the Reliance Small Cap fund has given an exceptional performance, and is clearly the one of the best midcap funds over the last few years. Not only has it given the highest return in the last one year among all small and midcap funds, it has outperformed the category also in terms of two and three year trailing returns and generated superior alphas compared to most of the other small and midcap funds. Please see the chart below for the trailing annualized returns of Reliance small cap fund for 1, 2 and 3 years, in comparison with Midcap funds and the benchmark CNX Midcap index.

Fund Overview

This fund is suitable for investors with high risk tolerance, looking for high capital appreciation over the long term. However, investors in this fund should be comfortable with high volatilities of NAVs and returns. As such the fund is suitable for investors who have a sufficiently long time horizon. The fund was launched in September 2010. It has an AUM base of about Rs 566 crores. The expense ratio of this fund is 2.52%. The fund manager of this scheme is Sunil Singhania. The scheme is open both for growth and dividend plans. The current NAV (as on Aug 28 2014) is 20.43 for the growth plan and 18.68 for the dividend plan. The fund has been ranked 1 by CRISIL in its most recent mutual fund ranking. Morningstar has a 4 star rating for this fund.

Portfolio Construction

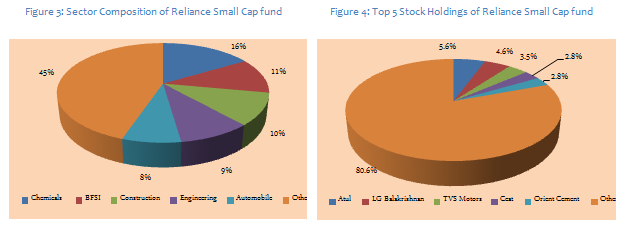

The portfolio has a bias for small and midcap stocks with high growth potential. In terms of sector allocations, the portfolio is heavily weighted towards cyclical sectors like Chemicals, BFSI, Cement & Construction, Engineering and Automobiles. In terms of company concentration, the portfolio is very well diversified with its top 5 holdings, accounting for only 19% of the total portfolio value. Even the top 10 stock holdings account for less than 32% of the portfolio value. The fund manager allocates 18% of his portfolio in cash and cash equivalents, to meet liquidity needs and leverage investment opportunities.

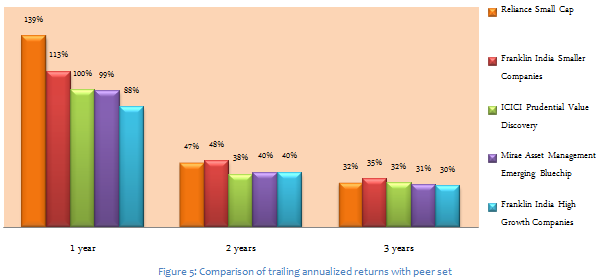

Comparison with Peer Set

A comparison of annualized returns of Reliance Small Cap fund versus its peer set over various time periods shows why this fund is considered a top pick in its category. See chart below for comparison of annualized returns over one, three and five year periods. NAVs as on August 28 2014.

Risk & Return

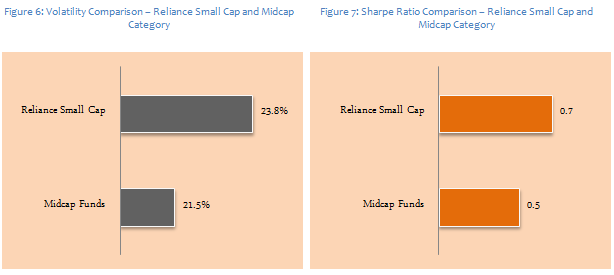

From a risk perspective, the volatility of the fund is slightly on the higher side. The annualized standard deviation of monthly returns of Reliance Small Cap Fund is 23.76%, which is on the higher side even relative to the riskier small and mid cap category. While the high volatility is definitely a watch out for the fund from a risk perspective, the risk adjusted return of the fund is very attractive. On a risk adjusted basis, as measured by Sharpe Ratio, the fund has outperformed the diversified category. Sharpe ratio is defined as the ratio of excess return (i.e. difference of return of the fund and risk free return from Government securities) and annualized standard deviation of returns. Higher the Sharpe ratio better is the risk adjusted performance of the fund. See charts below for comparison of volatilities and Sharpe ratios between Reliance Small Cap fund and small and midcap funds category.

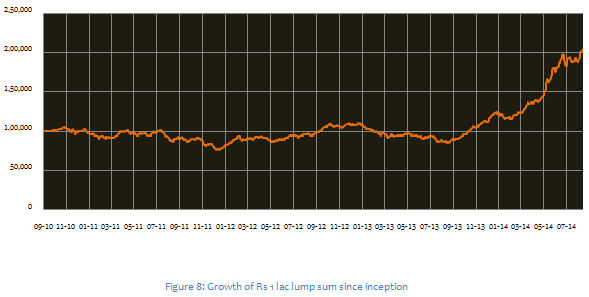

Rs 1 lac lump sum investment in the Reliance Small Cap fund NFO (growth option) in September 2010 would have doubled by August 28 2014. The chart below shows the growth of Rs 1 lac investment in the Reliance Small Cap fund (growth option).

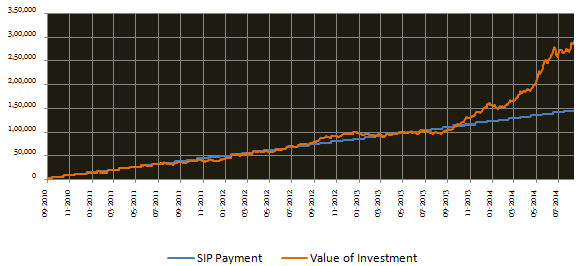

A SIP investment in the Reliance Small Cap fund would have performed even better. The chart below shows the returns since inception of Rs 3000 invested monthly through SIP route in the Reliance Small Cap fund (growth option). The SIP date has been assumed to be first working day of the month. The chart below shows the SIP returns of the fund. NAVs as on August 28 2014.

A Rs 3000 monthly SIP in the Reliance Small Cap fund (growth option) since inception would have grown to almost Rs 3 lacs as on August 28 2014, while the investor would have invested a little over Rs 1.4 lacs. This implies that the fund gave a SIP return of over 37% since inception. Very few mutual fund investments give that kind of returns over a 3 – 4 year period.

Conclusion

The Reliance Small Cap fund has delivered strong performance since its inception. With the improving sentiments in the Indian equity markets the fund seems poised to deliver even stronger performance in the future. Investors with high risk tolerance can consider investing in the fund through the systematic investment plan (SIP) route for their long term financial planning objectives. Even though small and midcap funds like Reliance Small Cap fund can give higher returns than large cap or diversified equity funds, investors should also remember that the risk associated with small and midcap funds are higher. Investors should consult with their financial advisors if this fund is suitable for their investment portfolio, in line with their risk profiles.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team