What is Life Insurance

Life insurance

A term which made sense to me when I saw its importance exemplified in front of my eyes. Up until that experience, I felt it was something that the friendly uncle, who turned out to be our family agent,visiting our house touted about. For me, life insurance meant a payment cheque and some important-looking documentation. But then life happened and I learned how a life insurance policy could save the day. My neighbor, Mr. Mehra, a 40 year old working man, had a good life. Two kids, a loving wife, own house and a car, life was going great for him until a tragedy struck. Mr. Mehra met with an accident and lost his life. In those difficult times, his wife was emotionally and financially bereaved and didn’t know how to cope up with the situation. At that time, the friendly agent uncle came bearing some papers for the family which, surprisingly, put a smile on Mrs. Mehra’s face. I didn’t understand what the papers held at that time but now I know. It was the life insurance claim containing a fat paycheck which solved the financial dilemma of the family and was the reason of the smile.

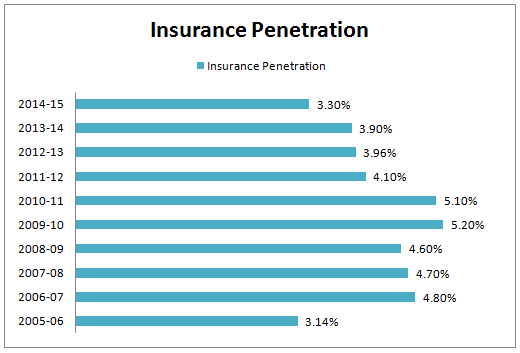

I am sure most of us can relate to the story as tragedy might strike any family and cause a financial dilemma. A life insurance policy is the only solution out of such a dilemma. Though the concept of life insurance is about a century old, its importance is not felt universally. Many of us still shy away from a life insurance plan and the reasons are many. For some it is the inevitable premium outgo while for others it is an unnecessary expense. Some feel it is technically complicated while others do not realize the plan’s importance. Whatever the reason, life insurance suffers a setback as evident in the low penetration rate.

Source – Swiss Re’s Sigma Study

Though the penetration rate is dismal, the hope is not completely lost. In the past decade, people are waking up to the importance of a life insurance policy. If you are also afflicted with any of the above-stated reasons, fret not. Let us un-complicate the concept of life insurance and point out its significance.

What is life Insurance

Life insurance is a contract between the insurance company and the proposer in which the company promises to pay the proposer a pre-defined benefit if the event against which the policy is taken happens. The proposer promises to pay premiums which form the consideration of the contract.

In simple terms, if you buy a life insurance policy, you are buying a promise from the insurance company that if the events against which the policy is taken happen, the company would be liable to pay you or your family a claim. In return for this promise, you are required to pay premiums to the company for a specified tenure.

Why life insurance

Now this is the most pertinent question. Though I can explain the concept of life insurance to you, it wouldn’t matter until you understand why you need a life insurance policy. The need of a life insurance policy stems from the benefits which a life insurance plan provides and hence, here are some benefits of having a life insurance cover on your life:

Financial security

– a life insurance policy promises to pay a lump sum benefit in case the individual buying the plan falls prey to pre-mature death. This promise is very important in case of individuals who are bread-winners for their families. In the unforeseen absence of the bread-winner, the family suffers from emotional and financial loss. Though emotional loss is irreplaceable, the financial loss can be taken care of by an insurance plan. Thus, a life insurance policy provides the sense of financial security to the individual buying the plan.Funds in case of emergency

– the above point is from the viewpoint of the individual buying the insurance plan but what about the impact life insurance has on the beneficiaries who receive the benefit? By providing the claim amount, the life insurance policy provides the much needed funds to the bereaved family in case of their emergency, viz. – death of the bread-winner.Meeting financial goals

– the life insurance industry has seen a massive revolution since their inception and today there is a whole gamut of Life Insurance plans designed to cater to the myriad life goals. So, whether you are planning for building a child education fund or a retirement corpus, whether you want to protect your finances against untimely demise or want to create wealth, there is a life insurance policy tailor-made to suit your requirements. Such plans help in earmarking the funds for all your life goals and have the potential to provide you with a diversified and complete financial portfolio.

The beauty of the life Insurance plan is that the above goals can be fulfilled even if the sole bread winner is demised.

Inculcates the habit of savings

– when I said that life insurance helps in earmarking funds for your specific life goals, I didn’t mention how. A life insurance policy comes for a specified tenure ranging from 5 years to 30 years or even life time. You are required to pay premiums for the entre tenure or a limited tenure of the plan. Such premium payments inculcate your saving habit as you are bound to pay the premiums on your policies by the due date. As such, though forced, you create savings which come in handy in rainy days. In case of big premiums you can even pay on a monthly basis.Saves taxes

– life insurance plans have both theoretical and financial benefits. Apart from providing funds in emergent situations a life insurance plan also saves taxes. Premium contributions to life insurance plans, uptoर150,000 per year, are eligible for tax rebate under section 80C of the Income Tax Act. The maturity proceeds are also tax under Section 10 (10D) and also the claim amount which is received under the policy in case of sudden death of the policy holder. So, if you are looking for investments which are tax-free and yet protects your family, life insurance is the most preferred choice of many.

How much life Insurance coverage is required?

Though Life Insurance provides invaluable protection for your loves ones in case of an unfortunate event, but how much life cover you want is a tricky question with an equally tricky answer. The amount of insurance one requires is completely relative in nature. It is case-specific and varies from individual to individual. Just like every one of us has varying needs and requirements, the quantum of life insurance required also varies from individual to individual.

Experts have developed various techniques which enable individuals to find out the coverage required. Some stress the relevance of the Human Life Value technique to identify the life insurance requirement while others devise a simple income-based approach to this question. A very rudimentary method is 10 to 12 times your annual earnings.

However some financial planners suggest that the life coverage should be equal to an amount which, if invested in a safe instrument, would fetch a regular income for the dependants of the insured so that they are able to maintain the same lifestyle which they were used to when the life assured was alive. That essentially means that in case there are any liabilities, like home loan, personal loan etc. such amounts should be added to the amount of insurance required.

Therefore, whatever the technique, one thing is universal. A fact-finding exercise is required which highlights the existing financial position of the proposer, identifies his life goal requirements, analyses the asset and liabilities and then arrives at the required amount of life coverage.

Types of life insurance policies available in the market

As stated before, life insurance industry has seen tremendous changes in terms of the plan varieties offered and today, various different types of plans are available in the market. Some of the basic life insurance plans are:

- Tern Insurance

- Whole life insurance plans

- Endowment Assurance Plans

- Money-Back Plans

- Child Plans

- Pension Plans

- Unit Linked Insurance Plan

Out of all the stated plans of insurance, a term plan is the most basic and the purest form of life Insurance. It is the cheapest plan which epitomizes the importance of the concept of life insurance. The plan covers the mortality risk and pays a lump sum benefit in the event of death of the life insured if it happens during the tenure of the plan. The plan, thus, covers only the mortality risk and comes cheap. The USP of the plan lies in the cheap rates of premiums against the high coverage options available and the plan essentially fulfils the income protection requirement of any individual, and that too at dirt-cheap prices.

How to buy a life insurance plan

Up until a few years ago, people had to resort to conventional modes of buying the plans through appointed agents, brokers, corporate agents or banks. Today, with the rapid progression of the electronic media, buying life insurance has been simplified. Though life insurance plans are also available through the aforesaid conventional channels, the online medium of buying is also available. Insurers have developed many plans which are available online and can be bought through simple clicks of computer buttons directly from the Insurance Company’s website or through IRDA (Insurance Regulatory and Development Authority) licensed online portals

Which is the better option of buying – online or offline

Both online and offline modes of buying have their relative pros and cons. While online mode promises cheaper premium rates, it is better for individuals who have knowledge about insurance technicalities and know their requirements. For laymen lacking the technical knowhow, offline mode holds better relevance as they can secure the assistance of a qualified agent or broker to answer their queries. Thus, the modes are relative and you need to make a choice based on your requirements

Conclusion

Life insurance is not only an important requirement but the most essential requirement of your financial life and thus should form a quintessential part of your portfolio. In this blog we have discussed why investment in Life Insurance should be the core of your portfolio. We have also discussed the amount of life coverage required and how to arrive at the right amount and the various types of life Insurance policies available in the market.

If you want to enjoy the various benefits which life insurance has to offer and protect your family from the uncertainties of life so that they can maintain the same standard of living in your absence, don’t keep yourself alienated from a life insurance policy and get your coverage today, if you have not taken it already. Believe me, you and your family would thank me later.

Insurance is the subject matter of the solicitation.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Kotak Mahindra Mutual Fund launches Kotak Energy Opportunities Fund

Apr 3, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty 500 Momentum 50 ETF FOF

Apr 3, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty 500 Momentum 50 ETF

Apr 3, 2025 by Advisorkhoj Team

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV and New Age Automotive ETF FOF

Mar 28, 2025 by Advisorkhoj Team

-

UTI Mutual Fund launches UTI Income Plus Arbitrage Active Fund of Fund

Mar 21, 2025 by Advisorkhoj Team