Taking Life Insurance term plan can be a smart choice

Term insurance policies are becoming increasingly popular in India, and for a very good reason. Yet a large number of people still go for traditional plans like endowment plans or money back plans. The appeal of the traditional plans lies in the maturity amounts, if the policy holder outlives the term of the insurance policy. In a traditional plan the policy holder gets a guaranteed amount (also known as sum assured) and a bonus amount. In the event of an untimely death, at any point of time during the term of the policy, the family of the policy holder gets the sum assured. The sum assured is almost equal to the total premium amounts paid over the entire term of the policy. On the other hand in a term insurance plan, while the family of the policy holder gets the sum assured in the event of an untimely death, if the policy holder outlives the term of the insurance policy, then the policy holder does not get a maturity amount (i.e. zero maturity amount)

So the insurance premiums in traditional plans, not only enables the policy holders to get a life insurance cover in the event of an untimely death, but also is an investment for the policy holder on maturity. So it makes perfect sense for investors, or does it? The answer lies in the cover (or sum assured) to premium ratio. But before we examine that, there are several things we should note about insurance.

- The most important objective of life insurance is to provide life cover to the policy holder’s family in the event of an untimely death, not to generate the best investment return

- There are plenty of better investment options that give much better return on investments than life insurance policies

- While insurance premiums qualify for tax savings under Section 80C, there are other investment options, like mutual funds, PPF etc, that also qualify for tax savings under Section 80C

- The more insurance companies add features an insurance policy, higher is the cost and the premium for the policy holder. Plain vanilla insurance policies have the lowest cost and premium

Premiums: Term Plans versus Traditional Plans

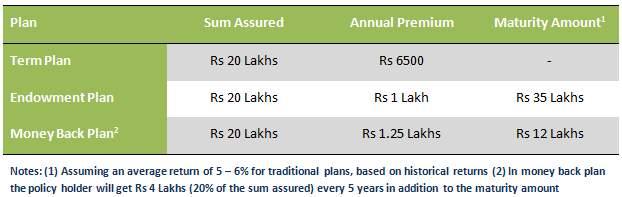

The premiums of traditional plans like endowment plans or money back plans are several times higher than term plans, because the traditional plans provide additional features like giving the policy holders sum assured and bonus on maturity of the policies. While actual premiums vary from plan to plan and the age of the policy holder, the table below shows approximate premiums for a certain sum assured for term insurance, endowment and money back plans offered by Life Insurance Corporation of India. The age of policy holder is assumed to be30 years and the term of the life insurance policy is assumed to be 20 years.

The table above clearly shows the huge difference in premiums between the three plans, for the same sum assured. While apparently it seems that based on returns, Endowment plan is the best and Term plan is the worst, the key here is the premium for different plans. The Term Plan charges the premium only for protection purpose and not for investment purpose, while Endowment Plan and Money Back Plan charges premium for both protection and investment purpose. From a return point of view, however there are much better options than insurance plans. Let us examine, with the help of a small case study.

Case Study

Let us assume there are three policy holders, Suresh, Rajesh and Ramesh. All three of them are 30 years old and have the same income and risk profile. All of them want a life cover of Rs 20 lakhs. All three want to maximize tax savings under Section 80C of Income Tax Act. However, each of them takes a different approach:-

- Suresh opts for an endowment plan from an insurance company with a sum assured of Rs 20 lakhs. For this policy, he pays a premium of Rs 1 lakh every year and maximises tax savings

- Rajesh opts for a term plan with a sum assured of Rs 20 lakhs. For his term policy, he pays a premium of Rs 6500. To maximize his tax savings, Rajesh invests Rs 93,500 in Public Provident Fund on an annual basis

- Ramesh opts for a term plan with a sum assured of Rs 20 lakhs. For his term policy, he pays a premium of Rs 6,500. To maximize his tax savings, Ramesh invests Rs 93,500 in Equity Linked Savings Scheme through a monthly systematic investment plan

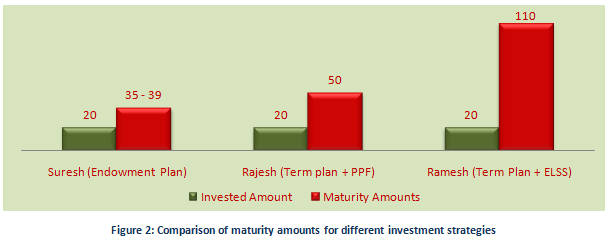

In the event of an untimely death, each of their families will get Rs 20 Lakhs as life cover. However, if they survive the term of the insurance (20 years), the returns look very different. See the chart below for amounts invested by Suresh, Rajesh and Ramesh, and the maturity amounts in Rupees Lakhs.

- Suresh will get a post tax maturity amount of Rs 35 - 39 Lakhs, assuming a 5 – 6% investment return (based on historical returns)

- Rajesh will get a post tax maturity amount of Rs 50 Lakhs, assuming a 8.7% compounded annual interest rate on PPF (based on PPF interest rate in 2013 – 2014)

- Ramesh will get a post tax maturity amount of Rs 1.25 crores, assuming a 15% annualized return from ELSS (based on 15 years performance from top performing ELSS)

The reason why Rajesh and Ramesh’s maturity corpus is bigger than Suresh’s is due to the fact that only a small fraction (only about 6%) of their investment goes to buying life cover, the balance in invested in instruments like PPF and ELSS, that give much higher returns than endowment plans.

If Suresh opted for a money back plan, his maturity amount would depend on how he re-invested Rs 4 Lakhs that he received from the insurance company. He may have used the money for his expenses, like a lot of investors, in which case his total maturity amount would be even lower. Even if he re-invested the money back in PPF or ELSS, his returns would be lower than Rajesh or Ramesh, due to compounding effect.

Conclusion

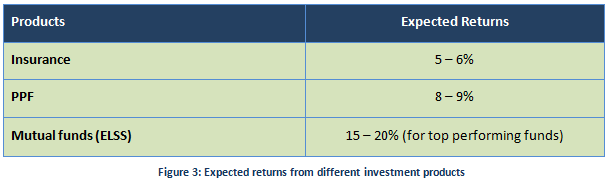

A term plan is the purest form of insurance and is a straightforward protection policy. Endowments and money back policies will offer a return of between 5 to 6% per annum. Considering the term of these policies (20 or 25 years), this return is very low relative to other investment options available, like PPF or ELSS. Also due to the higher premiums of the traditional plans, policy holders in these plans tend to be under-insured. Investors should consider buying a term plan purely for insurance purpose and invest in long term investment products for their financial planning objectives.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team