How to choose a Life Insurance provider

In our previous article on life insurance, we had discussed how to determine how much life insurance cover you need. Once you have determined how much cover you need the next question is which life insurance policy you should buy. There are 24 life insurance companies in India, 23 in the private sector and one in the public sector (Life Insurance Corporation of India). Each of the companies offers a variety of plans, so there are a large number of options to choose from. But before you evaluate the plans and the various features therein, it is important that you select the right life insurance provider. We Indians are price conscious and instinctively like to buy policies that are cheaper (lower premium to cover ratios). However, it is very important to note that, a cheaper policy is no good, if the life insurance company for some reason or another cannot fulfil the claim in the event of an untimely death. Even if the life insurer fulfils the claim, if it takes a very long time to fulfil the claim it is certainly not a desirable situation for your family to be in. There are three metrics that one needs to analyze, when evaluating life insurance providers. The IRDA annual report has exhaustive data on all the three metrics.

Claims Settlement Ratio

This is the single most important metric to consider when choosing a life insurance provider. The metric tells us how many insurance claims were made to the insurer in a financial year and how many were fulfilled or paid, and gives you a broad sense of the probability that your insurance claim will be paid. This metric is critical in determining the reliability of the life insurance company, irrespective of the premium to cover ratio and brand image of the company. The IRDA annual report provides this information for all life insurers in the country. The table below shows the claims settlement ratios for the some of the biggest life insurers in FY 2012 – 2013 (you can find the same information for all insurers in the death claims table in the IRDA annual report, available for download on the IRDA website)

It is evident from the table above that LIC has the best claims settlement ratio (lowest claims rejected percentage), followed by ICICI Prudential. What is a good claims settlement ratio? There is no straightforward answer. However, it suffices to say that a rejects (or repudiations) percentage of more than 10% warrants further analysis. There may be genuine reasons for rejects to be high. Therefore, one needs to look at this data over a 4 to 5 year period. If rejects or repudiations are generally low over a 4 to 5 year, with occasional spikes, one may treat the spike as an outlier. However, if the rejects or repudiations are consistently high, then it is a cause of concern.

Solvency Ratio

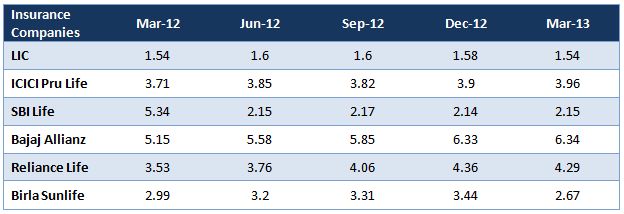

Solvency ratio is another important metric. It measures the ability of the insurance companies to pay the death claims. It is calculated as a ratio of assets of insurance company to its liabilities. An insurer is insolvent, if its assets are not adequate or cannot be disposed of in time, to pay the claims arising. If the solvency ratio is less than 1, then the insurer will not be able to pay all the claims, and therefore be deemed insolvent. The solvency ratio of the insurance company should be more than 1, with some cushion. Higher the solvency ratio, stronger is the financial capacity of the insurance company to honour the claims. The table below shows the quarter end solvency ratio of the biggest life insurers in FY 2012 – 13 (you can find the same for all insurers in the solvency ratio table in the IRDA annual report, available for download on the IRDA website).

The table above shows that LIC has the lowest solvency ratio in the range of 1.5 to 1.6, while the private insurers have higher solvency ratios. Though LIC’s solvency ratio is less than private insurers, it has a sufficient cushion (more than 50%) to fulfil claims obligations. Since the insurance industry is regulated, the IRDA ensures that the Indian insurance companies have adequate solvency. When comparing smaller insurance companies, individuals should look at this ratio, since it will give them a sense of the relative financial capacity of the insurance company to honour their claims (if any).

Duration wise settlement of death claims

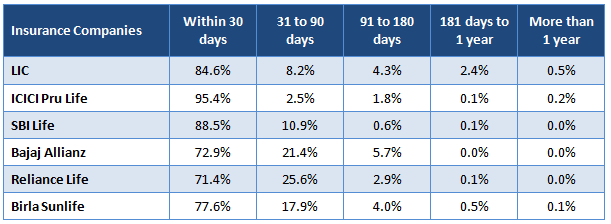

Another very important metric for a life insurance provider is how quickly the company is able to settle claims. Death of a loved one is a traumatic experience for the family. If it takes too long and too much effort, to settle a claim, one can only imagine what the family goes through during such difficult situations. Duration wise settlement of death claims helps insurance buyer evaluate the efficiency of the claims settlement process. The table below shows the percentage of claims settled in less than 30 days, between 31 to 90 days, between 90 days and 180 days, between 181 days and one year, and more than one year by some of the biggest life insurers in FY 2012 – 13 (you can find the same for all insurers in the duration wise settlement of death claims table in the IRDA annual report, available for download on the IRDA website). Obviously, higher the percentage of claims settled in the quickest possible time, the better is the experience for the family of the insured, in the event of an untimely death of the insured.

The table above shows that ICICI Prudential has settled 95% of its claims within 30 days in FY 2012 - 2013. SBI Life and LIC also settled 85%+ claims in the first 30 days.

Conclusion

Choosing a good life insurance provider is an important step in choosing the right policy for your insurance needs. Educating yourself is essential to making the right choice. As discussed earlier, premium to cover (or sum assured) ratio should not be the only consideration. It is important here to reiterate the purpose of life insurance. Life insurance should always been seen as protection for your family, in the event of untimely death. As such, the considerations above should be very important when you should choose your insurance policy. All the metrics above are available in IRDA’s annual report. The very least you can do is ask your insurance agent the pertinent questions, so that you can choose the right insurance policy for you and your family.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025 by HDFC Mutual Fund

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team