ICICI Prudential Select Large Cap Fund: Potential to deliver strong returns

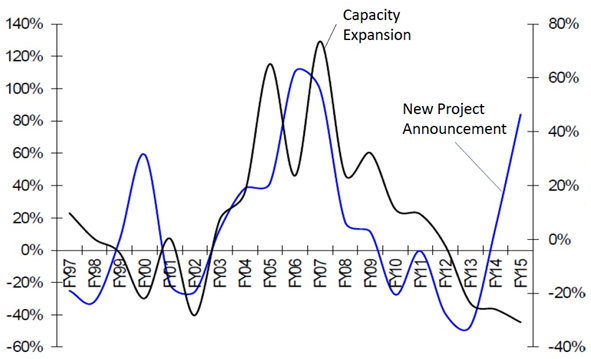

The last one year has been very difficult for equity markets. Though weakness was seen across the breadth of the market, the large cap market segment saw the biggest decline. In the last one year while the S&P CNX 500 index fell by 11%, the Nifty (which comprises the largest market cap stocks) fell by 13%. The decline in the share prices of large cap stocks over the last one year can largely be attributed to the activities of the Foreign Institutional Investors (FII). The chart below shows the Net Purchase / Sales figures of FIIs over the last one year in र crores.

Source: Moneycontrol.com

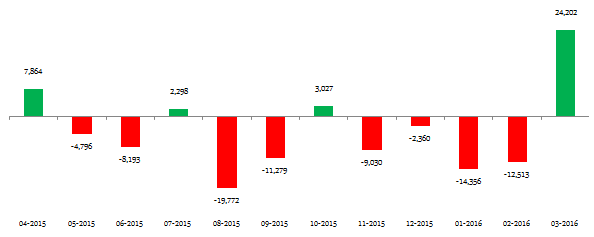

Since the FII activity mostly affects the large cap stocks, the large cap segment has been the hardest hit. As a result large cap stocks are now trading at a discount relative to midcap stocks. The chart below shows 90 days moving average Price Earnings Ratios (PE) of Sensex (green line) versus BSE Midcap Index (violet line).

Source: ICICI Prudential Mutual Fund

You can see in the chart above that, whenever valuations of midcap stocks exceeded large cap stocks, the large cap stocks outperformed midcap stocks in the following years. For a number of months, large cap valuations are cheaper relative to midcap, therefore large cap funds present attractive investment opportunities.

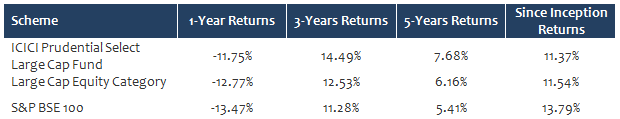

ICICI Prudential Select Large Cap Fund, launched in May 2009, invests in about 20 high conviction large cap stocks in the S&P BSE 100 index. The fund has र 550 crores of assets under management with an expense ratio of around 2.74%. Vinay Sharma and Mrinal Singh are the fund managers of ICICI Prudential Select Large Cap Fund. Though less well known relative to its very popular and successful sibling, ICICI Prudential Focused Bluechip Equity Fund, the Select Large Cap Fund has been a consistent performer since its inception. The table below shows that, the trailing returns of ICICI Prudential Select Large Cap Fund have outperformed the average trailing returns of large cap equity funds category.

Source: Advisorkhoj Research

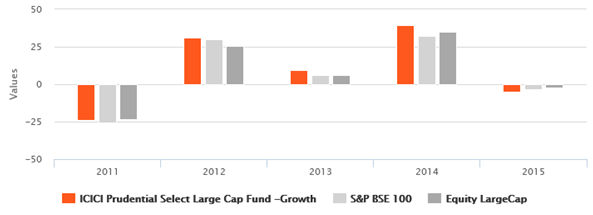

The ICICI Prudential Select Large Cap Fund has also outperformed the large cap equity funds category and the benchmark index in terms of annual returns over the last 5 years, except in 2015.

Source: Advisorkhoj Research

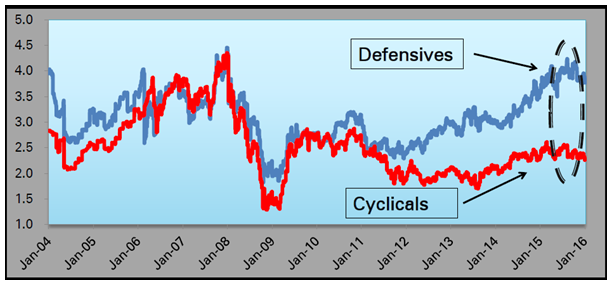

Though the fund underperformed in 2015, we can expect to see outperformance from this fund with the cyclical recovery in the Indian economy and equity markets. The fund is overweight on cyclical sectors, which are hardest hit during a market downturn. However, when market recovers, cyclical themes tend to outperform other themes.

Cyclical Sectors as theme

While there has been reversal of valuation gap between large cap and mid cap market segments in the past one year or so, there has also been polarization of valuations between cyclical and defensive sectors. The valuation gap between cyclical and defensive stocks have widened over the past several years.

Source: ICICI Prudential Mutual Fund

We can see that the valuation gap between cyclical and defensive stocks is now at its widest extent. We can also see in the chart above the valuation gap between cyclical and defensive stocks have converged in the past. Once we see recovery in demand growth and earnings, good companies in cyclical sectors are likely to give great returns. The combined effect of large cap focus (as discussed earlier) and cyclical theme has the potential of delivering outstanding returns for the investors of ICICI Prudential Select Large Cap Fund, with the recovery in the Indian equities market.

Investment Strategy

The stock portfolio of ICICI Prudential Select Large Cap Fund is purely large cap and the stocks in its portfolio are predominantly from the BSE – 100 index. The investment style is a blend of growth and value. The fund, as discussed earlier, is overweight on cyclical sectors. Currently the fund is focused on three cyclical themes.

Banks:

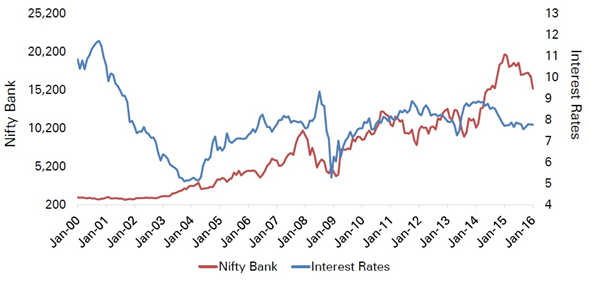

The fund managers are bullish on the private sector banks. The private banks lending to the corporate sector have the highest weight in the portfolio. ICICI Bank, Axis Bank, HDFC Bank, Federal Bank and State Bank of India are the top 5 banking stocks in the portfolio of the ICICI Prudential Select Large Cap Fund. The banking stocks in the portfolio of ICICI Prudential Select Large Cap Fund can benefit from falling interest rates and Government spending in rural and infrastructure growth and cyclical economic growth. The RBI had cut repo rates by 125 basis points last year. In the last monetary policy announcement the RBI reduced interest rates by another 25 basis points. The RBI has also been taking steps, to ensure better transmission of monetary policy actions to actual lending rates. While, as per earnings estimates from some brokerage houses, the banks may continue to face bottom-line stress in quarter ending March 2016, higher credit off-take is expected in the coming quarters due to measure taken by the RBI may result in improved earnings for the private sector banks. In the past, bank stocks benefitted from interest rates (please see the chart below).

![Equity Funds Large Cap - Bank stocks benefitted from interest rates Equity Funds Large Cap - Bank stocks benefitted from interest rates]()

Source: ICICI Prudential Mutual Fund

Lower interest rates will also alleviate the bad loan (NPA) problems the banks are facing. Though public sector banks have faced the brunt of the NPA issues, private sector banks like ICICI Bank and Axis Bank were also affected. However, one needs to keep an eye on asset quality, provisions and the management's guidance on credit costs. The Government has invested a considerable amount in Infrastructure last year and cleared a lot of stalled projects. In this year’s Budget, the Finance Minister increased the allocation to the rural sector by

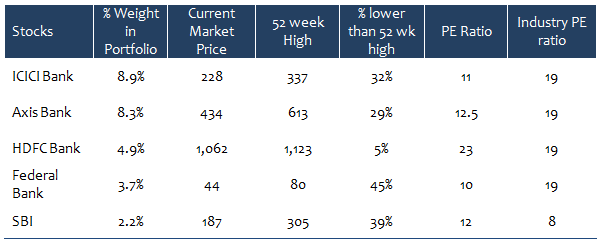

र8,200 crores. The effects of lower interest rates along with the Government expenditure on rural development and infrastructure spending can lead to economic recovery and higher credit off-take, which will result in improved top-lines for the banks, which in turn may translate into higher share prices. The stocks of many large cap banks are trading at very attractive valuations, despite the recovery from their February lows. The chart below shows statistics of the top 5 bank holding of ICICI Prudential Select Large Cap Fund.

![Equity Funds Large Cap - Statistics of the top 5 bank holding of ICICI Prudential Select Large Cap Fund Equity Funds Large Cap - Statistics of the top 5 bank holding of ICICI Prudential Select Large Cap Fund]()

Source: Moneycontrol.com

Cement:

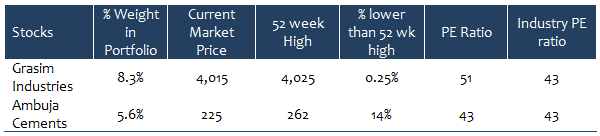

ICICI Prudential Large Cap Select Fund also has substantial positions in the cement sector. The fund managers prefer with low debt equity ratio and strong managements. Grasim Industries and Ambuja Cements are the two top cement stocks in the portfolio of fund, accounting of around 14% of the portfolio value. The fund managers expect demand for cement to improve due to the Government spending on infrastructure and rural development. Higher demand and lower capacity expansion will result in higher capacity utilization. Improved capacity utilization, combined with the effects of lower commodity prices and stable cement prices, can result in higher operating margins for the cement companies. Cement stocks like Grasim Industries and Ambuja Cements have shown very strong growth in share prices in the past 2 months, rising 21% and 16% respectively.

![Equity Funds Large Cap - Cement stocks like Grasim Industries and Ambuja Cements have shown very strong growth Equity Funds Large Cap - Cement stocks like Grasim Industries and Ambuja Cements have shown very strong growth]()

Source: Moneycontrol.com

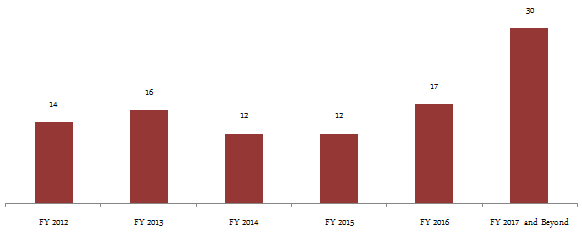

The bullish case for cements stocks is based on growth in cement demand for infrastructure projects as well cyclical recovery in the Indian economy. The chart below shows the number of kilometres of road construction per day before and after the NDA Government came to power and beyond.

![Equity Funds Large Cap - The number of kilometres of road construction per day before and after the NDA Government Equity Funds Large Cap - The number of kilometres of road construction per day before and after the NDA Government]()

Source: ICICI Prudential Mutual Fund

Based on the chart above, we can see that cement consumption for road constructions is expected to nearly double in the medium term. This explains the bullishness of ICICI Prudential Select Large Cap Fund’s managers with respect to cement stocks

Construction:

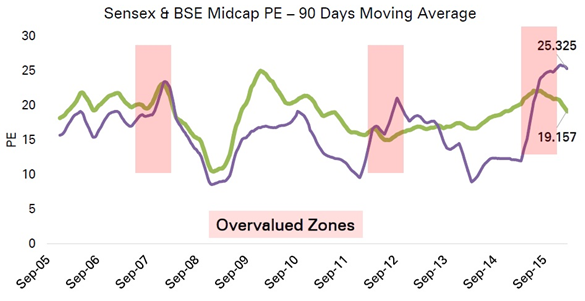

Larsen and Toubro is the other major stock holding of ICICI Prudential Large Cap Select Fund constituting 8% of the fund’s portfolio value. Construction is the third major cyclical themes, which the fund managers are bullish on, in the medium to long term. The construction sector has been one of the hardest hit over the past one year, with the share price of Larsen and Toubro (L&T), the largest construction company in India, falling nearly 33% in the last 12 months. However, it is important to note that, the construction sector is critical to the cyclical recovery of India. After the Budget, L&T has recovered about 13%, but is still 35% lower than its 52 week high. ICICI Prudential Large Cap Select Fund managers have reasons to be bullish on the construction sector, and in particular, on L&T. The announcement of new projects could improve capacity utilization and Earnings per Share (EPS) of construction companies.

![Equity Funds Large Cap - The announcement of new projects could improve capacity utilization and Earnings per Share (EPS) of construction companies Equity Funds Large Cap - The announcement of new projects could improve capacity utilization and Earnings per Share (EPS) of construction companies]()

Source: ICICI Prudential Mutual Fund

The construction sector can also benefit from increased spending on defence projects. Capital expenditure in defence projects have been growing at a CAGR of about 3.5% in the last 5 years; however, ICICI Prudential estimates the defence capex to grow at nearly 6% year on year in FY 2017. The increased capex in defence project spending is likely to help the construction companies.

Apart from the 3 major cyclical themes, ICICI Prudential Select Large Cap fund is also invested in Technology and Pharma stocks, which are bottoms up picks. Infosys and Cipla comprise more than 10% of the portfolio value. Both are very strong companies in their respective sectors. While Infosys is trading at 5% lower compared to its 52 week high, Cipla is trading at more than 32% lower compared to its 52 week. Therefore, there is potential value upside in these defensive stocks as well.

Conclusion

ICICI Prudential Select Large Cap Fund has consistently been a good performer since its inception. In the last one year, the fund has underperformed versus its top performing peers. However, as discussed a number of times in our blog, recent past performance is not indicative of future performance of a fund, because market conditions change over time. The underperformance of ICICI Prudential Select Large Cap Fund can be attributed to the large cap cyclical focus of this fund. Funds with focused portfolios tend to outperform / underperform by a bigger margin depending on market conditions, but over the long term these funds can give excellent returns and create wealth for their investors, if their investment themes play out. We have discussed various factors, related to the investment themes of ICICI Prudential Select Large Cap Fund, which can enable this fund to deliver strong returns in the future, with the recovery in Indian economy and equity market. Investors should consult with their financial advisors if ICICI Prudential Select Large Cap Fund is suitable for their investment portfolios.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Groww Mutual Fund launches Groww Nifty PSE ETF

Jan 22, 2026 by Advisorkhoj Team

-

Samco Mutual Fund launches Samco Mid Cap Fund

Jan 22, 2026 by Advisorkhoj Team

-

WhiteOak Capital Mutual Fund launches WhiteOak Capital Consumption Opportunities Fund

Jan 20, 2026 by Advisorkhoj Team

-

Shriram Mutual Fund launches Shriram Money Market Fund

Jan 19, 2026 by Advisorkhoj Team

-

PPFAS Mutual Fund launches Parag Parikh Large Cap Fund

Jan 19, 2026 by Advisorkhoj Team