Should you Pre Pay your Home Loan

India has been in the grip of a very high interest rate regime over the past few years. Home owners have seen a larger and larger portion of their equated monthly instalments (EMIs) going into interest payments every month. With the recent increase in inflation, fears of another rate hike by the RBI in June policy review have again resurfaced. In such an environment, many people who have home loans are considering whether they should pre-pay their home loans. In this article, we will discuss various factors involved in home loan pre-payment.

What is pre-payment?

Pre-payment is paying back an additional amount of principal, over and above the regular EMI, ahead of time. Pre-payment reduces the principal outstanding. You can use pre-payment either to reduce your EMIs or reduce the balance tenure of your home loan. After an RBI notification in 2012, banks have stopped levying pre-payment charges. This has made pre-payment an even more attractive option.

How does pre-payment benefit the home owner?

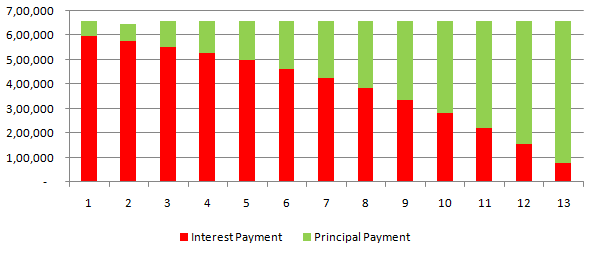

First let us understand how interest is calculated in a home loan. Home loan interest rate is usually calculated on a monthly reducing balance basis. This means that your home loan interest for a month depends upon the outstanding principal balance at the beginning of the month and the applicable interest rate. The EMI is a combination of the interest payment for the month and a part of principal payment, such that the loan is fully paid off at the end of the tenure of the home loan. You can check out our EMI calculator to get a break up of the interest and principal components of your EMI. Let us understand how pre-payment benefits you, with the help of an example. Suppose you have taken a Home loan of Rs 50 lakh for 20 years at an interest rate of 12% floating rate. Your monthly EMI in that case, will be Rs 55,054. The chart below shows the interest and principal payments of your home loan EMI.

The red portion of the chart represents interest payment and the green portion of the chart represents the principal payment. The horizontal axis represents the number of years of the loan tenure. As you can see, in the earlier part of the home loan term most of the EMI goes towards interest payment. In fact, for the first 8 years of the loan over 75% of the EMI goes to interest payment. Over the tenure of the loan you will pay a total interest of over Rs 82 lakhs. The total interest is much more than your total loan amount.

Now let us assume you make a prepayment of Rs 1 lakh, after 1 year. What happens to your loan? If you keep paying the same EMI, the total tenure of the loan will reduce from 20 years to 18 years 7 months. You also have the option of reducing your EMI and keeping the tenure of your loan the same. Your reduced EMI will be Rs 53939, about Rs 1000 per month less than your current EMI.

What if you made a prepayment of Rs 2 lakhs after 1 year? If you keep paying the same EMI, the total tenure of the loan will reduce from 20 years to 17 years 5 months. If you keep the tenure same and reduce your EMI, your reduced EMI will be Rs 52823, more than Rs 2000 per month less than your current EMI.

Let us look at total interest paid by you over the loan tenure in either case. As discussed earlier, the total interest paid by you over the 20 year period, assuming constant interest amount is Rs 82 lakhs. If you make a prepayment of Rs 1 lakh after 1 year, the total interest paid by you over the tenure of the loan reduces to Rs 74 lakhs (if you retain your EMI), a saving of Rs 8 lakhs. If you make a prepayment of Rs 2 lakhs after 1 year, the total interest paid by you over the tenure of the loan reduces to Rs 67.5 lakhs, a saving of nearly Rs 15 lakhs. Clearly pre-payment makes a lot of sense. Pre-payment reduces your interest expense and leaves you with more money for your investments.

After pre-payment should you retain the EMI or reduce the EMI and retain the tenure?

As discussed earlier, when you pre-pay you have the option retaining your EMI and reducing the tenure of your loan, or retaining the tenure and reducing the EMI. Which is a better option? Let us revisit our earlier example. You have 20 year, 12% floating rate loan of Rs 50 lakhs, for which you pay an EMI of Rs 55,054. You make a pre-payment of Rs 1 lakh after 1 year. Before the pre-payment your outstanding loan balance was Rs 49 lakhs 36 thousand. After you make the pre-payment the outstanding loan balance reduces to Rs 48 lakhs 36 thousand. As discussed, you have 2 options:-

- You retain your EMI at Rs 55,054 and reduce the tenure of the loan from 20 years to 18 years 7 months

- You retain the tenure at 20 years and reduce your EMI to Rs 53,939

In order to decide between the 2 options, we need to understand the difference between the EMIs of the two options. In the first option you continue to pay an EMI of Rs 55,054 and in the second option your EMI is 53,939. In both options, the outstanding balance at the beginning of year 2 is Rs 48 lakhs 36 thousand. Remember, interest of the home loan is paid on the loan balance. So the interest expense for the month is same in both the options. So where does the extra Rs 1100 EMI payment in the first option goes? It goes to the principal payment. So your loan balances will be lower in the first option. Since interest is paid on a reducing loan balance basis, your interest expense for subsequent months will be lower in the first option. Let us look at the interest payment over the tenure of the loan in both the options.

- Option 1 (Retaining EMI and reducing the tenure): Total interest payment over the tenure of the loan is Rs 74 lakhs

- Option 2 (Retaining the tenure and reducing the EMI): Total interest payment over the tenure of the loan is Rs 80 lakhs

Therefore, if you can, you should opt for retaining your EMI and reducing your loan tenure. If you were able to pay the higher EMI from your monthly savings, then you should continue to pay the same EMI as part of good financial discipline. You will get the benefit of saving interest expense over the tenure of the loan that you can re-invest for your other long term financial objectives. Also do you not, want to be debt free earlier?

Should you pre-pay on a regular basis or wait till you accumulate a corpus for pre-payment?

Let us examine this question, by revisiting our earlier example. Let us look at 2 options.

- Option 1: You pre-pay Rs 1 lakh every year out of your savings

- Option 2: You accumulate Rs 1 lakh every year for 5 years, and then pre-pay

Intuitively scenario 1 is better, since you will have reduced the outstanding loan balance by the pre-payment amount, as early as the second year of your loan and then every year going forward. Since interest is calculated on a reducing balance basis, this option is better than waiting 5 years to accumulate a substantial corpus to pre-pay. But what is the financial benefit? Let us examine.

- Option 1: Assuming you retain the EMI, by the beginning of year 6, the loan tenure will reduce to 15 years 8 months. Your interest expense over the loan tenure is Rs 58 lakhs.

- Option 2: Assuming you retain the EMI, by the beginning of year 6, the loan tenure will reduce to 16 years 5 months. Your interest expense over the loan tenure is Rs 63 lakhs.

It is clear from the above example that, you should pre-pay on a regular basis, instead of waiting to accumulate a corpus. Some banks stipulate a minimum pre-payment amount. As part of good financial planning discipline, you should set yourself a pre-payment target every year and pre-pay regularly.

Tax benefit for principal pre-payment

You can claim a deduction of up to Rs 1 lakh on home loan principal payment under Section 80C of the Income Tax Act. You can claim the benefit irrespective of whether you occupy the property or not. One should note that for calculation of principal payment, both principal payment under EMIs and principal prepayment should be considered. If you have bought your property from a real estate developer, you should note that you can claim the 80C deduction only once you have received possession of your property. If your builder has not handed over possession to you, you will not be eligible for 80C benefits. Long possession delays have now almost become the norm, not the exception. If you are desirous of getting tax savings on your principal payment, you should take “time to possession” in account while buying your property. Do not believe in what the builder promises. The track record of even reputed builders is not very good. Do your own research. Look at the track record of the builder, look at the state of construction and take feedback from buyers who have bought houses or apartments by the builder.

You should also note that, principal payments would only qualify for the deduction as long as it is within the overall Rs 1 lakh limit in Section 80C. Employee provident fund contributions, insurance premiums, housing loan principal repayments, tuition fees, public provident funds, equity linked savings schemes and NSC deposits are also covered under the same Rs 1 lakh limit. Your bank or housing finance company will give you an income tax certificate, which you can submit as a proof for claiming 80C deduction. However, you should not let the Rs 1 lakh limit under 80C be a ceiling for your home loan pre-payment. If you can pre-pay more than Rs 1 lakh per year, you should go ahead and pre-pay. It will be financially beneficial for you. Let us revisit the example above. If instead of an Rs 1 lakh pre-payment you made an Rs 2 lakh pre-payment, you save an additional Rs 7 lakhs in interest expense over the tenure of the loan. So, even if you do not get 80C benefit for the additional Rs 1 lakh pre-payment, you should still go ahead and pre-pay, because you will save on interest expense, which you can re-invest to create wealth for yourself.

Prioritizing between insurance premium, PPF and principal pre-payment

You should pay your life insurance premium first. That should be non-negotiable for you. Life insurance is about providing safety for your family, in the event of an unfortunate demise. As part of good financial planning discipline, you should also invest in PPF for your retirement planning. Retirement planning is an important goal that you should not compromise on. Ideally, you should be saving enough for your insurance premiums, retirement planning and home loan pre-payment. However, if you need to compromise, then you need to balance your PPF and home loan pre-payment. Remember PPF gives you a return of 8.7%, however on home loan prepayment you can save 11 – 12% interest on the principal pre-paid.

Should you pre-pay if interest rates are coming down?

Some people argue that in a declining interest rate environment, one should not pre-pay. I completely reject that argument, especially if you are in the early stage of your home loan tenure. A pre-payment reduces your loan outstanding on a permanent basis, and therefore you will get the benefit of saving interest expense irrespective of whether interest rates are lower or higher. True, if interest rates are declining the benefit will be lower. But remember your home loan is for 20 years. Interest rates will not decline for 20 years. It may decline for some time, but it will go up again depending on the demand and supply of credit. Further, home loan interest, in all likelihood, will be higher than returns from most debt investments. Therefore, it always makes sense, to pre-pay your home loan, irrespective of the interest rate regime.

Would you be better off pre-paying your home or investing the money?

It would really depend on the return on your investment. Let us examine this, by expanding on our earlier example. To recap, you have 20 year, 12% floating rate home loan of Rs 50 lakhs, for which you pay an EMI of Rs 55,054. Let us assume you prepay Rs 1 lakh every year, while retaining your EMI and reducing the loan tenure every year. If you can prepay Rs 1 lakh every year then your loan will be fully paid by 13 years 4 months only, instead of the initial tenure of 20 years. The chart below shows the interest and principal payments of your home loan EMI, with a prepayment of Rs 1 lakh every year.

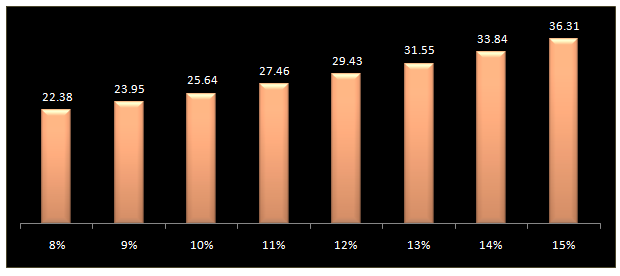

Now let us look at the alternate scenario. If you do not make any pre-payment, your loan balance at the end of 13 years 4 months will be Rs 31 lakhs 22 thousand. Let us assume instead of making pre-payments, you invested Rs 1 lakh every year. Let us look at what the returns will be in 13 years 4 months. Please see the chart below, for the value of the Rs 1 lakh investment per year in 13 years 4 months at various rates of returns (amounts in Rs lakhs).

From the chart above it is clear that, you are better off investing instead of pre-paying your home loan, only if the compounded annual returns are 13% or higher. At a 13% compounded annual return, your Rs 1 lakh annual investment will grow to Rs 31.55 lakhs, which will be sufficient to pay off your home loan. Which investment can give you 13% post tax compounded annual returns over 13 years? Clearly, the only asset class which can give that kind of returns is equities. In fact, top performing equity linked saving schemes from mutual funds, which also are eligible for 80C benefits, have given that kind of returns and even more over the long term. But you should also note that mutual fund investments are subject to market risk, whereas principal pre-payment is not subject to market risk. So should you pre-pay your principal or invest in equity mutual funds? It depends on your risk tolerance and investment horizon. If you have a high risk tolerance and long investment horizon, you are better off investing in equities. In my opinion, you should do both. You should aim to pre-pay your principal on a regular basis to reduce your loan outstanding and you should also invest in good equity mutual funds through systematic investment plans. If you have windfall gains, as a result of a one-time income (e.g. annual bonus, sale of asset etc.) you should pre-pay your home loan.

Conclusion

In this article, we have discussed various factors involved in pre-paying your home loan principal. Pre-paying your home loan is always a good idea. While pre-paying your home loan, you should always adhere to solid financial planning disciplines. For example, you should always ensure that you have adequate life insurance cover and you have adequate funds set aside for financial contingencies. If you have a home loan and you plan to invest instead of pre-paying the principal, you must ensure that the returns on investments are higher than your home loan interest rate and that you are comfortable with the risks associated with the investment. You should consult with a financial planner who will help you plan your investments, in terms of how much you should pre-pay and how much you should invest, and more importantly guide you to invest in the right assets.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team