How to choose the best health insurance company

Healthcare costs in India are increasing at a distressing rate. Based on some estimates the annual healthcare inflation is the range of 15 – 25%. A hospitalization for a serious illness can cost Rs 5 lakhs or above. In the absence of health insurance, a serious illness in your family can cause financial distress or leave a big hole in your hard earned savings, at a time when you least expect it. Health insurance is essential in ensuring your family’s critical healthcare needs. Buying health insurance is not the easiest of tasks. There are several key considerations involved in buying health insurance (please read our article Protect your family with health insurance). There are more than 25 General Insurance Companies marketing and selling a large number of health insurance or Mediclaim plans. These plans have a wide range of premiums, limits and features. For health insurance buyers, premium is an important consideration. However, it is very important to note that, a cheaper policy is no good, if the health insurance company for some reason or another cannot fulfil the claim. Even if the health insurer fulfils the claim, if it takes a very long time to fulfil the claim, it can put you in a stressful situation.

There are a few important metrics that one needs to analyze, when evaluating health insurance companies. The most important operating metrics that health insurance buyers need to evaluate relate to claims settlement. Unfortunately the disclosure standards of the Indian health insurance companies, especially with regards to operating metrics related to claims settlement, leave much to be desired. Health insurance companies publish this data on a quarterly or annual basis. But the quality of the data is not great and it is not available in an easy to use comparable format. Even the Insurance Regulatory and Development Authority (IRDA) does not report the claims settlement ratio of health insurance companies in its annual report like it does for life insurance companies, which is a little surprising because health insurance is an extremely important requirement in our country. For the benefit of our readers, Advisorkhoj.com has collated the claims settlement data from some leading health insurance companies. However, we should put some disclaimers, regarding the claims settlement data before we proceed further.

Segregation between Group and Individual Mediclaim plans:

Health insurance companies do not segregate the claims between group and individual Mediclaim plans.Closed Claims:

You will see later in the article, a metric called "closed claim". What is a "closed claim"? This is a claim, which has been submitted by the insured, but not paid, because sufficient documentation was not submitted by the insured. After a certain period of time, these cases are closed by the health insurer. They can be reopened, once the insured submits the required documentation. The problem with closed claims is that, there is not total consistency in how health insurers report these numbersQuality of data:

The quality of data in the public disclosures of the health insurance companies is not excellent, and in some cases a few adjustments had to be made, to match the balances carried forward to the next quarter

However, you can use our analysis as a directional indicator of how health insurance companies settled claims. For our analysis, we have looked at two important metrics, Claims Settlement Ratio and Ageing of Outstanding Claims. These two metrics will give you directional guidance on the likelihood and efficiency of the payment of your claims made to the health insurance company.

Claims Settlement Ratio

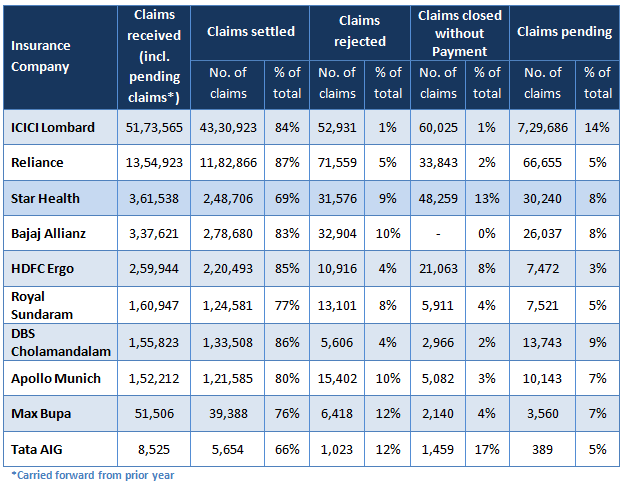

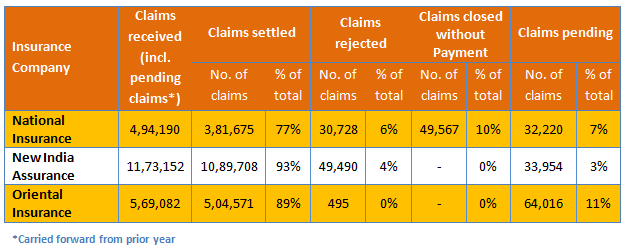

This is the single most important metric to consider when choosing a health insurance company. The metric tells us how many health insurance claims were made to the insurer in a financial year and how many were fulfilled or paid, and gives you a broad sense of the likelihood that your insurance claim will be paid. This metric is critical in determining the reliability of the health insurance company, irrespective of the premium to cover ratio and brand image of the company. We have analyzed this data for 10 leading private sector and 3 public sector general insurance companies. In most cases the data pertains to FY 2013 – 2014. However, in some cases, complete FY 2013 – 2014 data was not available and therefore, we used FY 2012 – 2013 data for such cases. The table below shows the claims settlement ratios for the some of the leading private sector health insurers for the FY 2013 – 2014 (except ICICI Lombard, Royal Sundaram and Tata AIG, where the data is for FY 2012 – 2013).

You should pay particular attention to the metrics, claims rejected and claims closed without payment. These are the cases where the insured did not receive any payment. There can be a number of reasons for claims rejected or closed without payment. The main reason why claims can be rejected is on account of pre-existing medical conditions. However, it suffices to say that a reject or closed without payment percentage of more than 10% warrants further analysis. There may be genuine reasons for rejects or closed without payments to be high. Therefore, one needs to look at this data over a 3 to 4 year period. If rejects are generally low over a 3 to 4 year period, with occasional spikes, one may treat the spike as an outlier. However, if the rejects are consistently high, then it is a cause of concern. Claims settled ratio is also an important metric, but if claims settled is low due to pending cases that are likely to be settled in the next quarter, then it is not so much of a concern (e.g. in the case of ICICI Lombard). We will discuss the ageing of pending claims later in our article. We will now discuss the claims settlement ratio for the public sector health insurance companies.

Ageing of Pending Claims

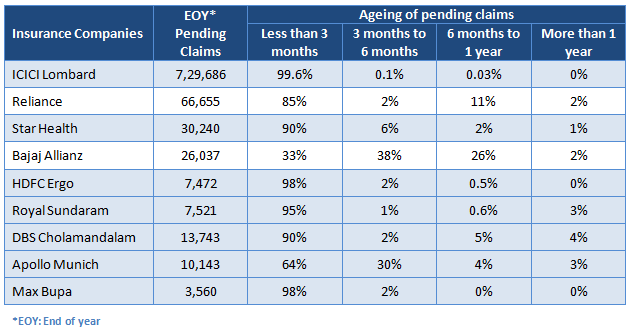

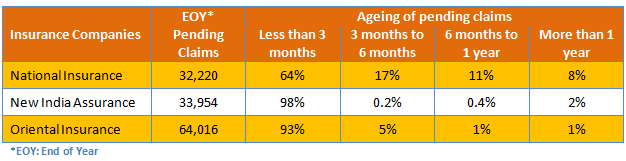

Another important metric for a health insurance provider is how quickly the company is able to settle claims. Ageing of pending claims helps the Mediclaim buyer evaluate the efficiency of the claims settlement process. The table below shows the ageing of pending claims less than 3 months, between 3 months to 6 months, between 6 months and 1 year and more than one year, for the leading private sector health insurance companies.

The table below shows the ageing of pending claims less than 3 months, between 3 months to 6 months, between 6 months and 1 year and more than one year, for the public sector health insurance companies.

Conclusion

Choosing a good health insurer provider is an important step in choosing the right Mediclaim policy for your health insurance needs. As discussed earlier, premium should not be the only consideration in selecting a Mediclaim policy. Health insurance should always been seen as protection for your family’s health and wellness. As such, the considerations above should be very important when you should choose your Mediclaim policy. You should consult an experienced health insurance adviser, to help to you select the best Mediclaim policy.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Jio BlackRock Mutual Fund launches Jio BlackRock Short Duration Fund

Jan 8, 2026 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches Jio BlackRock Low Duration Fund

Jan 8, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Small Cap Fund

Jan 8, 2026 by Advisorkhoj Team

-

Bank of India Mutual Fund launches Bank of India Banking and Financial Services Fund

Jan 8, 2026 by Advisorkhoj Team

-

Sundaram Mutual Fund launches Sundaram Income Plus Arbitrage Active FoF

Jan 5, 2026 by Advisorkhoj Team