Financial Planning for Children Education

Financially our lives can be divided into long terms goals and short term goals. The short term goals could range from taking a foreign holiday or buying the latest LED television in the market. Long term goals are usually far away in the horizon. However, you start investing because of their future value. Fortunately for parents, there are enough investment products to help them fulfil the dreams for their children. Chosen appropriately, these options can help you save enough to send your daughter to the best college in the country, or book a 5-star hotel for your son's wedding. No concession in life insurance premium or special interest rate or return will be offered for the investment meant for your child’s higher education. The choices will largely be dependent on these four factors:

Time period of the investment

The tenure of investment is dependent upon how early or late you start investing for your child’s higher education. If you start early it allows you to take risk and aim for higher returns from equities. The longer period also reduces the overall risk. However, if you are starting late then you will have to go for schemes that will have modest returns preferably with capital protection.

Risk appetite

As an investor if your risk taking appetite borders on the higher side, then take a leap and invest in equity oriented mutual funds. Equities have often been known to generate the best returns over a long period of time. You will also have to bear with fluctuations of the market at the same time and cannot allow slight volatility to affect your nerves. However, if you have low or moderate appetite for risk then you may invest in balanced funds, capital protection fund or even debt funds. The other option is to opt for traditional form of investments like fixed deposits, postal saving, PPF or Sukanya Samriddhi Scheme if you do not want to take any risk at all. This will provide security of assured returns.

The overall returns generated

It is your responsibility to keep a track of your investments. The investment segment focused on your child’s higher education should generate a certain percentage of return annually. The return is crucial to the creation of the corpus. Hence, if any of the funds are under performing then you must consider switching funds or making additional investment to compensate for it. The overall return generated is crucial to the corpus your child will require for the higher education purpose.

Taxability of the income and returns

Let us assume that you have invested in fixed deposits and along with the principal and the interest accumulated you have created a corpus for your child’s higher education. However, when you are about to withdraw, then the gains are taxable or treated as an income and you have to pay an income tax according to your income slab. After the tax deduction you have fallen short of the predetermined amount. Hence, while determining the goals, you must take possible taxations into consideration.

On the other hand, if you invest in equity oriented mutual funds or balanced funds then the long term capital gain is totally tax free

Education in India: The Present and the Future Costs (INR)

In the graph and table above the present and the probable future cost has been portrayed. Now you are beginning to understand the cost you will have to bear in future. This situation presents you with two options: yes and no. Yes, you could save and afford the cost in future. No, you can not afford the cost and that will only make your child’s future darker. The most important question that arises here is that of affordability. Can you afford these educational costs in future? Our answer is, yes! But with the right investment options and perhaps starting little early. As an investor it is crucial to be aware of the future value of your portfolio. Let us explore some options that you may employ to create the corpus for your child’s education.

Mutual Funds: Is it the best Option?

Mutual Funds are one such investment that caters to all kinds of investor with varied financial temperament. While you are looking into ways to create a corpus for your child’s future this option is worth exploring and investing. If the age of your child is less than ten years old, you are in a stage where you can take risk. Hence, investing in Equity funds tend to generate higher returns. While, it is often considered to be risky, the long time period reduces the risk. Equity Link Savings Scheme (ELSS) might be a good option as it is an investing and tax saving option, both. You can also invest through Systematic Investment Plans (SIP) which allows you to invest a stipulated amount weekly, monthly or quarterly while allowing the corpus to grow slowly and steadily. SIPs also helps you in rupee cost averaging as you ride through the market cycle during the investment period.

It is also possible that you started late or have been consistently investing in traditional forms such as fixed deposit or recurring deposit. You may have realized that the required amount will not be available by the time your child is ready for higher education. In such a situation you will require security and returns. Balanced funds are ideal in such a scenario because it provides exposure to equity up to 65-70% and provides security upto some extent by investing the rest 30-35% in bonds. Therefore, this ensures high returns with moderate risk.

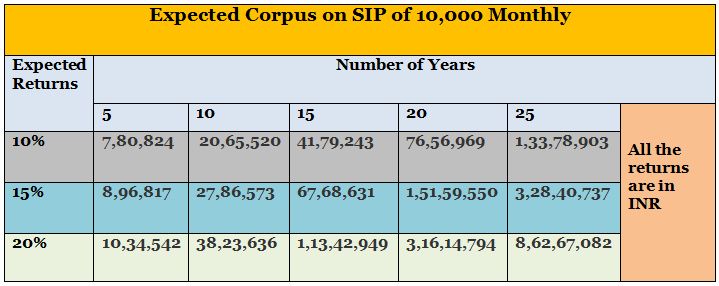

Planning for your child’s future is an important long term plan. Retirement is also one of those long term plans which require a hefty corpus. The corpus of both the plans cannot be compromised with. You child needs to study in the college he/she wants to graduate from and you need to maintain the lifestyle that you have been acquainted to. Hence, compromising one plan to make up for the other goal is not an ideal situation. Given below is a hypothetical scenario where if an investor invests 10,000 INR monthly with certain expected rate returns and what the expected corpus will be like. The table below is an illustration of the power of compounding. It reflects the various possibilities and the future value of 10,000 INR monthly investment.

Source: https://www.advisorkhoj.com/tools-and-calculators/sip-calculator

Debt Instruments

As an investor you have a moderate risk appetite or believe in being risks aversive then you have the option of investment in debt instruments such as Public Provident Fund. PPF launched by the Government of India primarily invests in corporate and government bonds and securities. This ensures moderate returns along with security. The PPF has a lock in period of seven years. Hence, this must be kept in mind while you are saving for your child’s education. The period of lock in should not clash with your time of withdrawal. Lets now look at the returns of PPF from the below chart. For example - If you invest Rs. 150,000 per annum you can generate a corpus of 46.76 Lacs in 15 years.

Source: https://www.advisorkhoj.com/tools-and-calculators/ppf-calculator

Comparison of PPF vs Equity or Balanced Mutual Fund investment through SIPs

As you can see in the above chart, you can accumulate Rs. 46.76 Lacs by investing Rs. 150,000 every year for 15 years. However, if your invest the same amount thru SIP ( Rs. 12,500 per month = Rs. 150,000 per annum) in a balanced fund you can accumulate as much as Rs. 84.61 lacs (at an assumed rate of return 15%). The difference is huge, almost Rs. 37.85 Lacs

Sukanya Samriddhi Scheme (SSS) is another scheme that invests in debt. This scheme can be availed by investors who are parenting girl child. The return on the scheme is declared every year by the Reserve Bank of India. The return for 2015-16 stands at 9.2%. The biggest advantage of this account is it allows the girl child to take control of the account. The account matures when the girl child turns 21 and the corpus can only be transferred in a bank account under her name. This scheme allows moderate risk and moderate returns and is a good choice for risk aversive investor. You can accumulate as much as 75 lakhs INR at the end of 21 years if the investment is done on a monthly basis. If the investment is done on a lump sum basis i.e. paying 1.5 lakhs INR at one go you can accumulate up to 79 lakhs. The future value of the investments may increase or decrease depending upon the change in the interest rate. Interest rates are declared every year by the RBI.

Life Insurance

An untimely death can lead to loss of income and put the child’s future at risk. Parents should buy adequate life insurance through term plans to secure the future of their children. They should ensure that the sum assured covers not only the income needs of the family in the event of an unfortunate death but also the future goals of their children like higher education and marriage.

Conclusion

One always expects the best from their children. As parents you push them to work hard and aim for excellence. However, the same needs to be reciprocated by you. A shortage of funds, when you could have created a corpus, is not an excuse to deny your child the best education. Do not fool yourself by thinking that your child is too young and you will utilize this time to focus on other life goals. Start early to avoid shortages and make the best out of your child’s life.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV and New Age Automotive ETF FOF

Mar 28, 2025 by Advisorkhoj Team

-

UTI Mutual Fund launches UTI Income Plus Arbitrage Active Fund of Fund

Mar 21, 2025 by Advisorkhoj Team

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV & New Age Automotive ETF FOF

Mar 21, 2025 by Advisorkhoj Team

-

Angel One Mutual Fund launches Angel One Nifty 1D Rate Liquid ETF Growth

Mar 20, 2025 by Advisorkhoj Team

-

Zerodha Mutual Fund launches Zerodha Overnight Fund

Mar 19, 2025 by Advisorkhoj Team