Support and Resistance levels: Technical resistance for Nifty at 8000 to 8100

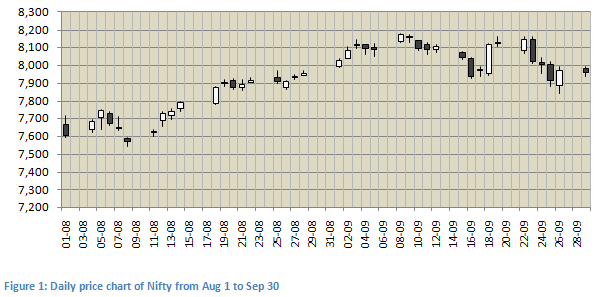

For the last few weeks, the Nifty has largely been trading in the range defined by its support level at 7,800 and resistance level at 8,100. Support and resistance levels are very commonly used terms in share trading. In simple terms, support is the price level below which a scrip or index does not often falls and resistance is the price level which the scrip of or index does not often exceed. The chart below shows the candlestick chart of the Nifty from August 1, 2014 to September 30, 2014. A candlestick chart is so called, because the intraday price movement is depicted by a candle. The body of the candle shows the open and close price (white if close is higher than open and black if close is lower than open) and the wicks at the top and bottom of the body show the intraday high and low prices.

The chart shows a support resistance pattern formation for Nifty after August 20, with support level near 7,900 and thereabouts. The resistance level has formed at 8,100 are thereabouts. For the last month Nifty has been trading largely within this range and has struggled to break out on either side.

While many investors are familiar with the concept of support and resistance, one needs to understand these concepts in greater depth in order to use these levels to trade profitably. Trading based on a superficial understanding of support and resistance is risky as these can lead to losses. In this blog, we will discuss various characteristics of support and resistance levels without going into the intricacies of technical analysis.

How are support and resistance levels formed?

Support and resistance are formed because share prices have memory. These are price points where a significant number of buyers and sellers would have participated in the past. When the share price retraces to those points, significant number of buyers and sellers participate again with similar effect. Let us understand with the help of an example. Let us assume that a scrip is trading at र 100. If the price of the scrip suddenly falls to र 80, some investors will feel that they lost the opportunity to sell the scrip at र 100. So they will wait for the scrip to go back up to र 100 and when the scrip reaches र 100, these investors will short or sell the scrip, preventing the scrip for rising further. Therefore र 100 becomes the resistance level for the scrip. Similarly, investors who could not buy the scrip when it fell to र 80 will feel that they lost the opportunity to buy the scrip at र 80 and make a profit. So when the scrip comes back to र 80, buyers will flock into the market to buy the scrip, preventing the scrip from falling further. Therefore in essence, support and resistance are important psychological levels for demand and supply of a scrip. When the scrip reaches the support level demand increases and when the scrip reaches the resistance level supply increases.

Characteristics of support and resistance levels

Round Numbers:

Round numbers tend to be universal support or resistance levels. The reason is purely psychological. Buyers and sellers enter the market when a scrip or an index approaches a round number, either to buy or book profits depending on the direction of the price movement. Investors who have been following the equity market for the last few days would have observed that 8,000 is now a resistance level for the Nifty. Similarly, 6000 and 7000 were important resistance levels for the Nifty on it’s up.Strength:

New investors should understand that there are multiple support and resistance levels of a stock. These levels by themselves are not as important as the strength of these levels. If an investor takes a positional call based on a weak support or resistance level, he or she can incur big losses since a weak support or resistance level can easily be breached. How can the strength of a support or resistance level be assessed? As per technical analysis, the number of the times a level is tested but not broken implies the strength of the level. If we refer to the daily Nifty chart shown in Figure 1, we will see that Nifty tested the 8,100 level seven times in the last one month but was not able to breach it. Therefore, 8100 is a reasonably strong resistance level for the Nifty. Short term traders or investors should bear this in mind when taking long positions.Breakout:

Support and resistance levels do not hold for ever. They are meant to be broken. When a support or resistance level is breached, the price moves sharply either upwards or downwards depending on whether the support level is breached or the resistance level. This is known as a breakout. There are two kinds of breakouts. Sometimes a support or resistance level breach attracts a large number of buyers and sellers sharpening the price movement. This can be attributed to herd mentality of the traders or investors. However, there are times when a breakout fails to attract a large number of buyers and sellers. The price of the scrip then retraces back to support and resistance pattern. This is known as a false breakout. How can the investor distinguish between a genuine breakout and a false breakout? If the breakout takes place on the back of large volumes, the breakout is often genuine. Going back to the daily Nifty chart (Figure 1), even though the Nifty attempted a few breakouts above 8100, it was not convincing and it retraced below the 8100 level. Therefore these were false breakouts.Role Reversal:

When a support or resistance level is breached, its role is reversed. If a support level is breached, then it becomes a resistance level. Similarly if a resistance level is breached, it becomes a support level. This is because the supply and demand pattern shifts once a breakout happens. For example, if the resistance level of a scrip isर100 and a breakout takes it toर110, investors who sold the scrip atर100 will regret the missed opportunity to sell at a higher price. Such investors will wait for the scrip to come down toर100, so that they can buy the scrip to sell it later at a higher price. Therefore the resistance level becomes the new support level for the scrip. Similarly, if the support level of a scrip isर80 and a breakout on downward side takes it toर70, investors who bought the scrip atर80 will regret the missed opportunity to buy at a lower price. Such investors will wait for the scrip to rise toर80, so that they can sell the scrip to buy it later at a lower price. Therefore, the support level becomes the new resistance level for the scrip. For the Nifty 8,000 – 8,100 is the resistance level. If the Nifty breaks out of this resistance, then 8,000 – 8,100 will be the new support level.

Trading Strategies based on support and resistance levels

Determining support and resistance levels falls requires the expertise of a technical analyst. However, retail investors can get these levels both for individual scrips and the indices (e.g. Sensex, Nifty, Bank Nifty etc.) from various sources. Financial newspapers, journals, business news channels frequently mention these levels for scrips and indices. Brokerages also issue technical guidance on support and resistance levels of various scrips and indices from time to time. Investors can also subscribe to technical analysis services. Knowing support and resistance levels is critical to the success of short term equity investors or traders. Investors should be more alert when the scrip starts trading near their support or resistance levels. Price of scrip usually bounces from support levels and rebounds from the resistance levels. So the strategy is usually to go long (buy) at support levels and go short (sell) at resistance levels. Intraday traders usually adopt this strategy, also known as channel trading. Investors should not place buy or sell order exactly on the support level or the resistance level. This is because the price gets close but usually does not reach the support or resistance level. Many investors wait for a breakout from support and resistance levels, to take long or short positions depending on the direction of the move. This is usually a more sound investing strategy.

Nifty support and resistance level

Despite the Reserve Bank of India (RBI) policy announcement, the Nifty closed today (September 30 2014) at 7,965. The Nifty seems to consolidating for the time being. As discussed earlier 8,100 is the major resistance level for Nifty and 7,800 seems to be a good support level. It will probably take a major development or strong Q2 earnings growth story for the Nifty to breakout from the 8,100 level. The all time high of the Nifty is 8,180. So if the Nifty breaks out of the 8,100 level and manages to cross the all time high, then much higher levels are possible on the Nifty.

Conclusion

In this article, we discussed several aspects of support and resistance levels, two very important concepts in equity investing. Investors should educate themselves about these levels and use them intelligently while making their investment or trading decisions, so that they can maximize their profits.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Motilal Oswal Mutual Fund launches Motilal Oswal Diversified Equity Flexicap Passive Fund of Funds

Jan 2, 2026 by Advisorkhoj Team

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025 by HDFC Mutual Fund

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team