Reliance Growth Fund and Reliance Vision Fund: The great wealth creators over 20 years

Reliance Growth Fund and Reliance Vision Fund recently celebrated their 20th birthdays on October 8th. While it is common knowledge Reliance Growth Fund’s reputation of wealth creation is second to none, Reliance Vision Fund also has a very impressive long term track record of wealth creation. The returns of Reliance Growth and Vision Funds over the last 20 years are testimonies to the age old virtue of investing in equity over a long time horizon. There are still many people who believe that real estate is the best investment. An ex business colleague told me that he bought an apartment in Gurgaon in 2004 for a little less than र 50 lacs and sold it last year for र 3 crores. While the returns seem phenomenal when you hear about it, if you do a little math the picture is slightly different. If you factor in the registration and stamp duty charges, interior work, brokerage and the capital gains tax my colleague had to pay, the compounded annual growth rate of his investment is actually around 15%. If you then factor in, the interest he paid on his home loan, the returns might very well be in single digits. While most people focus on absolute numbers, the single most important metric for evaluating the performance of an investment is compounded annual growth rate or CAGR. The CAGR of Reliance Growth Fund since its inception 20 years back is nearly 25%, while that of Reliance Vision Fund is 20%. By investing in these funds over a very long investment horizon, investors would have created substantial wealth. In this blog we will review these two funds along with some other diversified equity funds which have completed 20 years. All these funds are extremely popular diversified equity flexicap funds.

Returns since Inception

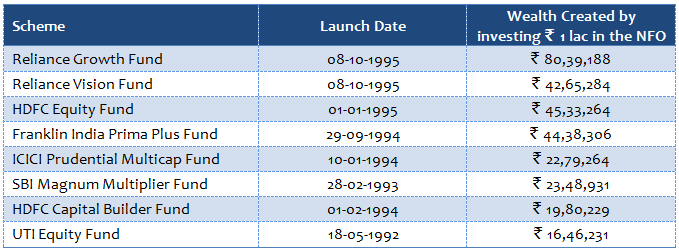

The table below shows the wealth created by investing र 1 lac in the following funds (growth options) on their inception.

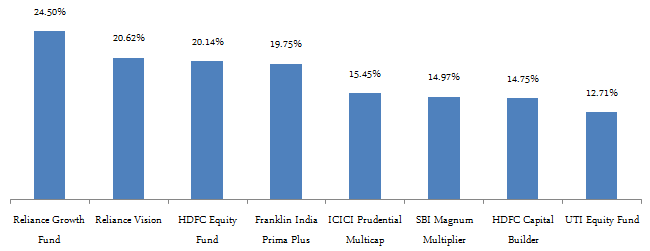

We can see that wealth created by Reliance Growth Fund clearly stands out in this table. By investing र 1 lac in the NFO of Reliance Growth Fund, an investor could have accumulated a corpus of more than र 80 lacs as on October 10, 2015. The wealth created by Reliance Vision Fund is also very impressive. So are also the returns of HDFC Equity Fund and Franklin India Prima Plus. The chart below shows the compounded annual returns of these funds since inception.

The compounded annual return of Reliance Growth Fund is around 4% more than its nearest peer (in terms of performance). However, when this is translated to wealth creation, it is almost double; र 80 lacs for Reliance Growth Fund on a र 1 lac investment compared to र 40 - 45 lacs for its nearest peers. This demonstrates the power of compounding. Similarly the wealth created by Reliance Vision Fund is almost double compared to some of the other funds, though the difference in compounded annual returns is only about 5%.

SIP Returns

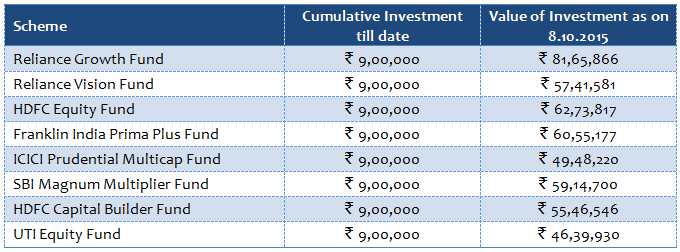

Let us now see, how much wealth an investor would have created by investing र 5,000 through a monthly SIP in the growth options of these funds over the last 15 years.

You can see that by investing र 5,000 through a monthly SIP in any of these funds you could have accumulated a substantial corpus over the last 15 years. However, Reliance Growth Fund is again the standout performer here. By investing र 5,000 through a monthly SIP in Reliance Growth Fund (Growth Option) you could have accumulated a corpus of nearly र 82 lacs. Reliance Vision Fund too is one of the top performers in this list. One interesting thing about the SIP returns from these funds is that the funds are more closely matched compared to the lump sum returns since inception. All funds go through ups and downs, but over a sufficiently long time horizon quality equity funds has the potential to create wealth for their investors, provided one invests systematically across different market cycles and more importantly stay invested.

Reliance Growth and Vision Funds

Reliance Growth Fund and Reliance Vision Funds are flagship schemes of Reliance Mutual Fund, one of the largest asset management companies in India. Reliance Growth Fund is managed by veteran fund manager, Sunil Singhania, who is also the Chief Investment Officer – Equities of Reliance Mutual Funds and is widely recognized as one of the best respected investment managers in India. Reliance Vision Fund is managed by Ashwini Kumar, a veteran fund manager with a great track record of managing top performing funds like Reliance Top 200 and Reliance Tax Saver funds. Both the schemes are diversified equity flexicap funds. These funds invest in companies across sectors and market segments. Reliance Growth Fund has around 54% of its portfolio invested in large cap companies and around 46% in mid and small cap companies. Reliance Vision Fund has around 66% of its portfolio invested in large cap companies and around 34% in mid and small cap companies. Reliance Growth and Vision Funds were lagging behind some of the top performing funds for some time, but if we look at performance over the last 3 years, Reliance Growth and Vision Funds have given compounded annual returns of 20% and 17% respectively.

Conclusion

In this blog we looked at some of the most popular diversified equity funds that have completed 20 years. Over such a long period of time, it is natural that funds have ups and downs. Reliance Growth and Vision Funds too have had their phases of ups and downs. But given their long term performance and the terrific track record of their fund managers, these funds have the potential of continuing their strong long term performance in the future. Advisorkhoj wishes Reliance Growth and Vision Funds a belated very happy birthday and hope to see them continue to create wealth for their investors in the future as well.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team