Mirae Asset India Opportunities Fund: One of the best SIP returns in last 8 years

Have you wondered why many mutual fund houses have multiple products with very similar investment objectives and strategies? When we ask the fund houses, why they have two or more very similar products, they try to explain the differences between the schemes, but these differences in most cases are minor and cosmetic. While fund houses may have their own reasons for launching multiple products with similar investment strategies, we have seen that this causes confusion for the investors. Further, we have also seen that there are differences in the performance of these products. Mirae Asset Mutual Fund has just 6 equity oriented mutual fund schemes in its product portfolio, a diversified equity fund, a midcap fund, two thematic funds, a balanced fund and an equity linked savings scheme (ELSS). There are very well defined product differentiations between these schemes and it makes the job of selecting the appropriate scheme considerably easier for the investor. It also ensures that, adequate management bandwidth is available for each of these products, which translates into superior product performances. Mirae Asset India Opportunities Fund, a diversified equity scheme, has been a top performing fund in the diversified equity category. If you look at the monthly Systematic Investment Plan (SIP) returns of this fund, it has given one of the highest SIP returns in the last 8 years in the diversified equity category. A र 5,000 monthly SIP in Mirae Asset India Opportunities fund started 8 years back at the time of the launch of the fund, would have, grown to around र 9.6 lacs by April 6 2016, with a cumulative investment of just र 4.8 lacs.

Fund Overview

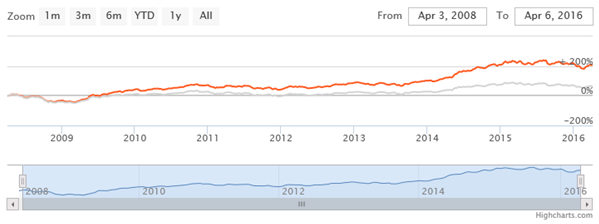

Mirae Asset India Opportunities Fund was launched on April 4, 2008. The fund has about र 1,450 crores of assets under management (AUM). The expense ratio of this fund is 2.4%. Neelesh Surana and Sumit Agarwal are the fund managers of Mirae Asset India Opportunities Fund. This fund is rated highly by the research agencies. CRISIL ranks this fund as a strong consistent performer (Rank 2) among all equity funds. Morningstar has a 5 star rating for this fund. The chart below shows the NAV movement of Mirae Asset India Opportunities Fund since inception.

Source: Advisorkhoj Research

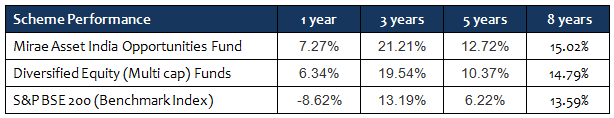

The fund has outperformed the average category trailing returns consistently over different time periods.

Source: Advisorkhoj Research

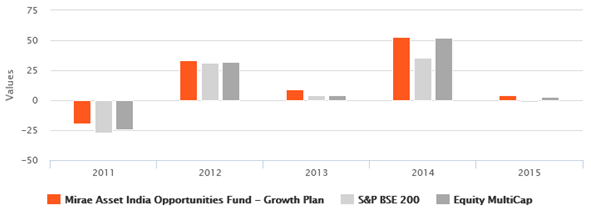

If we look at the annual returns of this fund over the last 5 years, relative to the category and the benchmark, you will observe that the fund has outperformed the category and benchmark even in terms of annual returns.

Source: Advisorkhoj Research

The consistency of superior performance of this fund, in terms of both trailing and annual returns, explains the high rank given to it by CRISIL.

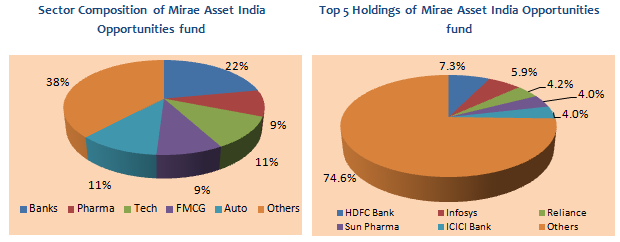

Portfolio Composition

Mirae Asset India Opportunities Fund invests across sectors, market capitalization, themes & investment styles (growth and value). The Portfolio is constructed based on Core and Tactical portions. The core portion is invested in quality businesses from long term perspective, while the tactical portion takes advantage of short to medium opportunities in the market. The fund managers employ bottoms up approach to stock selection. We have seen that a bottoms-up approach to stock selection gives better results in different market conditions compared to a top-down approach of adjusting sector weights relative to the benchmark index. The fund has a large cap bias with a high growth focus. The portfolio has a 22% weight on the financial sector. Among other sectors, the portfolio has substantial exposure also to Technology, Pharmaceuticals, Energy, Automotive and FMCG sectors. The sector composition gives the portfolio a good balance between cyclical and defensive sectors. In terms of company concentration, the portfolio is very well diversified with its top 5 holdings, HDFC Bank, Infosys, Reliance, Sun Pharma and ICICI Bank accounting for only about 25% of the total portfolio value.

Source: Advisorkhoj Research

Risk and Return

From a risk perspective, the volatility of Mirae Asset India Opportunities Fund is lower than the average volatilities of diversified equity funds. We had seen earlier that the fund outperformed the diversified equity fund category in terms of returns. Lower volatility and higher returns make Mirae Asset India Opportunities fund a strong performer in terms of risk adjusted returns. In fact, the Sharpe Ratio, a measure of risk adjusted returns, of this fund is significantly higher than average Sharpe Ratios of the category.

The chart below shows the growth of र 1 lac investment in Mirae India Asset India Opportunities fund (growth option) NFO over the years.

Source: Advisorkhoj Research

You can see that, the र 1 lac investment in Mirae India Asset India Opportunities fund (growth option) NFO would have grown nearly 3 times in the last 8 years. In the last 8 years period, the equity market has gone through three bear market phases, in 2008, in 2011 and in 2015 – 16. Despite the difficult market conditions, the fund has given over 15% annualized returns, while the benchmark index, BSE – 200, gave just 6.8% annualized returns.

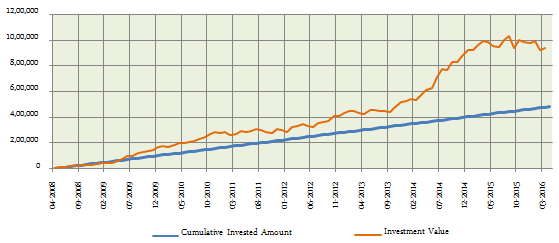

The SIP performance of the Mirae India Asset India Opportunities Fund is even better. The chart below shows the returns of र 5,000 monthly SIP in the growth option of the fund since its inception.

Source: Advisorkhoj SIP Calculator

With a monthly SIP of र 5,000, you would have accumulated a corpus of nearly र 9.7 lacs, while your cumulative investment would have been only half of that amount (र 4.85 lacs). The annualized SIP returns (XIRR) since inception of this fund 17%.

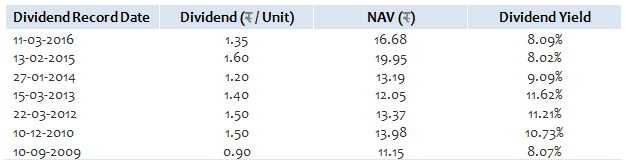

Dividend Pay-out Track Record

Mirae Asset India Opportunities Fund has a good dividend pay-out track record. Since its inception, the dividend plan of the scheme has paid annual dividends every year, except in 2011. The tax free dividend yield of the fund is also quite good, as can be seen in the table below. You should note that, dividends in mutual funds are not guaranteed, either in terms of the quantum of the dividend or the frequency of payment. Dividends in equity mutual funds are entirely tax free.

Source: Advisorkhoj Historical Dividends

Conclusion

Mirae Asset India Opportunities Fund has just completed 8 years. The performance of this fund over this period has been truly outstanding. One needs to have a long investment horizon for Mirae Asset India Opportunities Fund. This fund may be suitable for a variety of long term investment goals like retirement planning, children’s education, children’s marriage etc. Investors can choose either lump sum or SIP as modes of investment depending on their financial planning considerations. The dividend pay-out track record of the fund is also quite good. Investors should consult with their financial advisors, if Mirae Asset India Opportunities Fund is suitable for their investment needs.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Motilal Oswal Mutual Fund launches Motilal Oswal Diversified Equity Flexicap Passive Fund of Funds

Jan 2, 2026 by Advisorkhoj Team

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025 by HDFC Mutual Fund

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team