ICICI Prudential Value Discovery Fund: Best performing diversified equity fund in the last 10 years

If you had invested र 1 lac ICICI Prudential Value Discovery Fund NFO 11 years ago, the value of your investment on December 4 2015 would be र 11 lacs. This implies the fund has given 11 times returns in the last 11 years. Very few investments, whether in financial assets or physical assets, would be able to match these returns over the same period. In fact, ICICI Prudential Value Discovery Fund is one Mutual Fund scheme which gave the highest returns among all diversified equity flexi-cap or multi-cap funds over the last 10 years. CRISIL has highest ranking for the ICICI Prudential Value Discovery Fund in diversified equity funds category. Morningstar has given this fund a five star rating.

The fund is sector and market-capitalisation agnostic, and its focus is on value investing only. When the fund was able to find more value in mid-cap during 2007 initial years hence it was overweight on midcap companies. Now as the fund has higher exposure in large-cap companies as the fund manager believes that there are better value opportunities in this segment of the market.

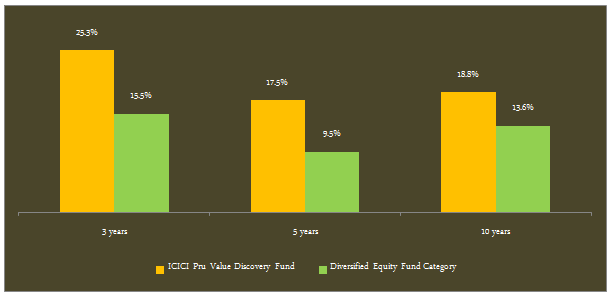

The fund has outperformed the diversified equity funds category in terms of annualized trailing returns over 3, 5 and 10 year time horizons. The chart below shows the trailing 3, 5 and 10 years returns of ICICI Prudential Value Discovery Fund and the diversified equity funds category.

Source: Advisorkhoj Mutual Fund Research

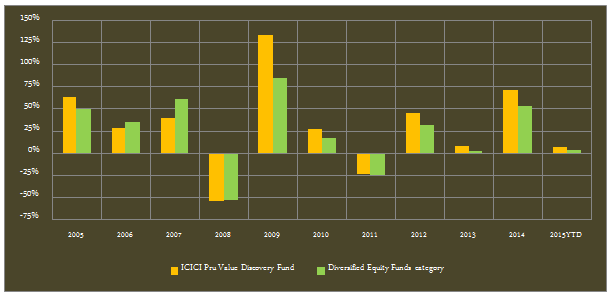

Even in terms of annual returns the ICICI Prudential Value discovery fund has outperformed the diversified equity funds category, every year since 2009. The chart shows the annual returns of ICICI Prudential Value Discovery fund and diversified equity fund category from 2005 to YTD 2015.

Source: Advisorkhoj Mutual Fund Research

One of the best measures of fund performance consistency is rolling returns relative to its benchmark.

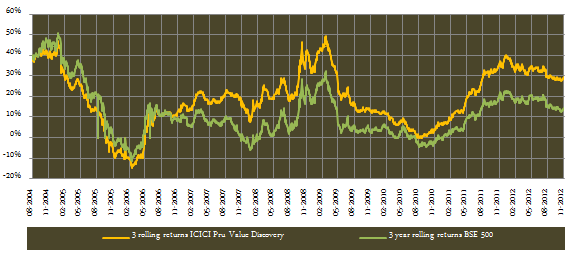

We have chosen 3 years as the rolling returns time period because it is always recommended that long term investors should hold equity oriented funds for at least 3 years. The chart below shows the 3 year rolling returns of the ICICI Prudential Value discovery fund relative to the benchmark S&P BSE 500 Index. We can see that since 2007, the fund has outperformed S&P BSE 500 Index 100% of the time over a three year investment horizon.

Source: Advisorkhoj Rolling Return Calculator

Fund Overview ICICI Prudential Value Discovery Fund

The ICICI Prudential Value Discovery fund was launched in July 2004. The fund has around र 11,000 crores of average assets under management. The expense ratio of the fund is 2.24%. The manager of this fund is Mrinal Singh since 2011. Mrinal has a strong track record as fund manager. The fund is suitable for investors looking for long term investment objectives, like retirement planning, children’s education etc. Morningstar has a five star rating for this fund.

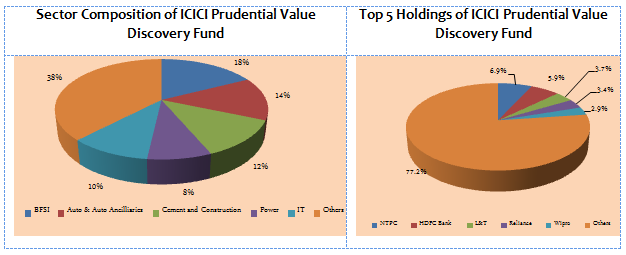

Portfolio Composition

While the fund has large cap bias, it also has significant allocations to small and mid cap companies. The fund manager identifies stocks trading at significant discount to fair value with substantial upside potential. The portfolio is overweight on cyclical sectors, with sectors like Banking and Finance, Automobile & Auto Ancillaries, Cement and Construction, Capital Goods, Oil and Gas, Infrastructure, etc. accounting for nearly 80% of the portfolio value. With cyclical sectors poised to do well with the revival in economic growth and capex cycle, the ICICI Prudential Value Discovery fund is positioned strongly to do well over the medium to long term. In terms of company concentration, the top 5 companies, NTPC, HDFC Bank, L&T, Reliance Industries and Wipro accounts for only 23% of the portfolio value. Even the top 10 companies account for only around 36% of the portfolio holdings.

Source: Advisorkhoj Research

Risk Measures

While the ICICI Prudential Value Discovery fund has consistently outperformed the diversified equity funds category in terms of returns, the fund has also has done well in terms of risk measures. The annualized standard deviation of monthly returns of the ICICI Prudential Value Discovery fund is lower than the annualized standard deviation of monthly returns of the category. On a risk adjusted returns basis, as measured by Sharpe Ratio, the fund has outperformed the diversified equity funds category. Sharpe ratio is defined as the ratio of excess return (i.e. difference of return of the fund and risk free return from Government securities) and annualized standard deviation of returns. Higher the Sharpe ratio better is the risk adjusted performance of the fund. The Sharpe ratio of the ICICI Prudential Value Discovery fund is 1.14, while that of the diversified equity fund category is only 0.66.

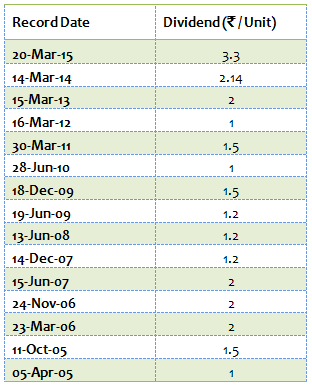

Dividend Payout Track Record of ICICI Prudential Value Discovery Fund

ICICI Prudential Value Discovery fund, dividend option, has a strong dividend payment track record. The fund has paid dividends every year since inception. The table below shows the dividend history of the fund’s dividend option.

Source: Advisorkhoj Historical Dividends Look Up

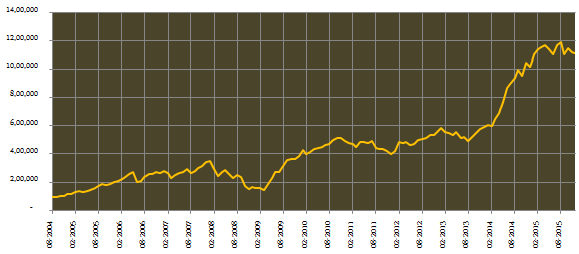

Lump Sum and SIP Returns of ICICI Prudential Value Discovery Fund

The chart below shows the growth of र 1 lac investment in the ICICI Prudential Value Discovery fund (Growth Option).

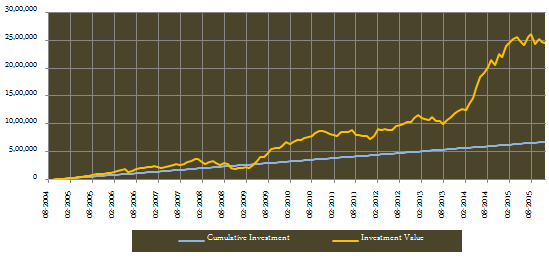

The chart below shows the returns since inception of र 5000 monthly SIP in the ICICI Prudential Value Discovery fund (growth option).

The chart above shows that a monthly SIP of र 5,000 started at inception of the ICICI Prudential Value Discovery fund (Growth Option) would have grown to nearly र 25 lacs by Dec 8 2015, while the investor would have invested in total only र 6.8 lacs. The Systematic Investment Plan return is 21% since inception.

Conclusion

The ICICI Prudential Value Discovery fund has been a favourite with mutual fund investors in India. It has created substantial wealth for its investors. This fund is suitable for investors with a long time horizon. Investors, who are looking for long term capital appreciation, can consider investing in the scheme through the systematic investment plan (SIP) or lump sum route. Investors who prefer dividend payout can also invest in this fund. Investors should consult with their financial advisors if ICICI Prudential Value Discovery fund is suitable for their investment objectives.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team

-

Reciprocal Tariffs: Casting a wider net

Apr 7, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Energy Opportunities Fund

Apr 3, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty 500 Momentum 50 ETF FOF

Apr 3, 2025 by Advisorkhoj Team