Canara Robeco Liquid Fund: One of the best liquid funds

This is our first review of a liquid fund in Advisorkhoj.com. We thought that we would start our liquid fund review with one of the best liquid funds, the Canara Robeco Liquid Fund. Retail investor’s interest in liquid fund is still quite low in our country. Many investors think that, liquid funds are for institutional investors. However, liquid funds are very beneficial for retail investors as well as they offer better options for investors to earn much higher returns on their short term funds compared to their savings bank account. Liquid funds are money market mutual funds and invest in instruments like treasury bills, certificate of deposits and commercial papers and term deposits. The objective of liquid funds is to provide the investors with an opportunity to earn returns, without compromising on the safety and liquidity of the investment. Typically liquid funds invest in money market securities that have a residual maturity of less than or equal to 91 days. Liquid funds have no exit load and therefore you can withdraw money either partially or fully at any point of time. Redemptions from liquid funds are processed within 24 hours on business days. Over the one to two years top performing liquid funds have delivered 7 - 8% returns, which is much higher than your savings bank interest rate of 4 - 6%.

The Canara Robeco Liquid fund has given 8.1% return in the last one year, which is around 20 basis points more than average liquid fund returns. A 20 basis points outperformance may apparently seem small, but for a liquid fund it can be pretty significant especially if the investment is large. The fund was launched in July 2008 and has given 8.1% annualized returns since inception. The fund has an AUM base of र 2,200 crores (as of end of February). The expense ratio of the fund (regular plan) at 0.13% is lower than many of its peers. For liquid funds investors should pay attention to AUM and expense ratio. A sufficiently large AUM base can help the fund meet liquidity needs of the investors, while a small expense ratio can ensure better returns. CRISIL rates Canara Robeco Liquid fund as a strong performer. Value Research has a 4 star rating for this fund. Suman Prasad and Girish Hisaria are the fund managers of this liquid fund scheme.

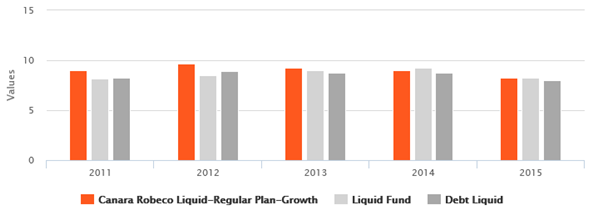

The chart below shows the annual returns of Canara Robeco Liquid Fund over the past 5 years.

Source: Advisorkhoj Research

You can see that the fund has beaten the CRISIL Liquid Fund index as well as the average liquid fund category returns consistently over the last 5 years. You can also observe that the annual returns were more than 8% every year, much higher than your savings bank interest rate.

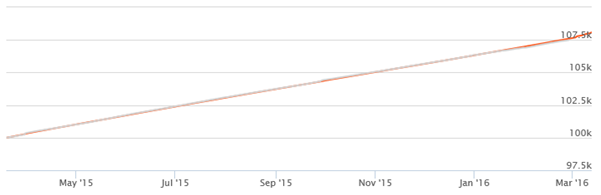

The chart below shows the growth of र 1 lac lump sum investment in Canara Robeco Liquid fund over the last one year.

Source: Advisorkhoj Research

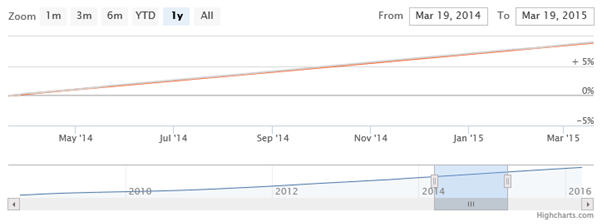

You will observe that fund has given around 8% returns. You will also observe that the orange line is almost linear. You may be asking, why is this important? In liquid funds, stability of returns is very important. To understand why stability of returns is important let us review the objectives of investing in liquid funds. We invest in liquid funds to park our funds for short durations, ranging from a few days to few months, till we deploy those funds to some other use. Therefore, low volatility is very important, because we should have reasonable degree of confidence with respect to how much the investment value will be when we redeem the units of the fund. Very often when we invest in liquid funds we are uncertain about the investment tenure, because we may not know when we will need the funds. Therefore, it is important that the rate of return should not be impacted to certain degree by the length of the tenure of investment. The linear graph of the absolute returns of Canara Robeco Liquid Fund above implies that, the rate of return was the same, whether you invested for a few weeks or few months. Observe the NAV movement of the fund over the last one year in the chart below. Again you will see that the NAV movement is almost linear.

Source: Advisorkhoj Research

The annualized standard deviation of the monthly returns of Canara Robeco Liquid Fund is much lower than the average standard deviations of the liquid fund category. So, while on one hand the fund beat the average returns of liquid fund category, the volatility of this fund is lower than the category. This is the hallmark of a good liquid fund.

It is important to note, however, that Liquid Funds invest in money market securities. The prices of these securities are market linked, and therefore Liquid Funds like other mutual funds cannot assure you guaranteed returns. However, because the duration of these money market securities is very short the interest rate risk over the tenure of the investment is minimal. The average duration of the money market securities in the portfolio of Canara Robeco Liquid Fund is 3 to 4 months. The current yield to maturity (YTM) is 7.7%. Since the current portfolio YTM is lower than what it was one year back, not just for Canara Robeco Liquid Fund, but almost all liquid funds, it may not be able to give last year’s returns in the next one year, unless the yields increase, which is unlikely. However, the portfolio YTM will give you a fairly decent estimate of the fund’s expected returns over the coming months.

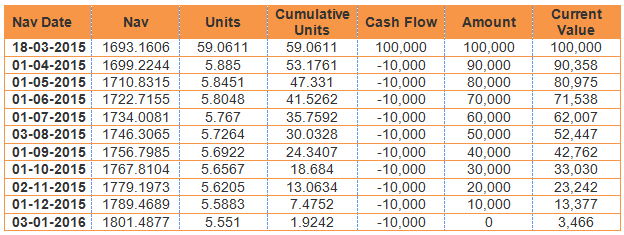

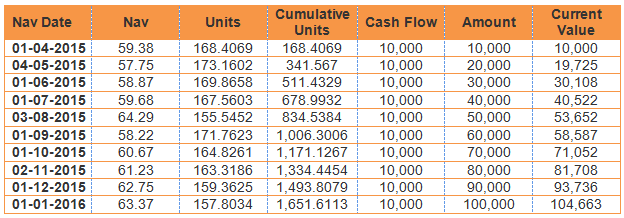

If you have lump sum funds to invest in Canara Robeco equity funds, but are worried about volatility in equity markets, you can invest in Canara Robeco Liquid Fund and transfer funds to the equity fund of your choice through Systematic Transfer Plan (STP) at a suitable frequency (weekly, monthly etc) over a period during which you expect the market to be volatile. Through an STP you can take advantage of market volatility through rupee cost averaging as well as continue to earn liquid fund returns on you diminishing balance investment in the liquid fund. As an example, we have shown below a monthly STP of र 1 lac lump sum investment in Canara Robeco Liquid Fund to Canara Robeco Emerging Equities Fund over the last 1 year, in monthly instalments of र 10,000.

Let us see first see, how the transfer takes place from Canara Robeco Liquid Fund.

Source: Advisorkhoj STP Calculator

Let us see first see, how the transfer takes place to Canara Robeco Emerging Equities Fund.

Source: Advisorkhoj STP Calculator

The current value of your investments would be around र 1.08 lacs. Let us now see, what your investment value would be if you invested र 1 lac lump sum in the equity fund, one year back. See the chart below.

Source: Advisorkhoj Research

The current value of your र 1 lac lump sum in the equity fund, one year back would be around र 92,000. We will discuss more about STP in a different post, but the benefits of STP in a volatile market, are quite evident in the above example.

Conclusion

Canara Robeco Liquid Fund is one of the best liquid funds. Investors can put this fund to variety of uses, as discussed in this post. Investors should consult with their financial advisors if Canara Robeco Liquid Fund is suitable for their financial planning requirements.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Motilal Oswal Mutual Fund launches Motilal Oswal Diversified Equity Flexicap Passive Fund of Funds

Jan 2, 2026 by Advisorkhoj Team

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025 by HDFC Mutual Fund

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team