Arbitrage Mutual Funds: A good short term investment option in volatile markets

Most of us keep our money lying in savings bank if we plan to use them in short term (less than 12 months) and park it in fixed deposits if we do not plan to use it in the short term (more than 12 months). We have discussed in our blogs that, liquid fund is a much better option than savings bank for parking your surplus funds for short durations ranging from a month to a year. Liquid funds are money market mutual funds and invest in instruments like treasury bills, certificate of deposits and commercial papers and term deposits. The objective of liquid funds is to provide the investors with an opportunity to earn returns, without compromising on the safety and liquidity of the investment (please read our blog, Top Liquid Funds: Better options than savings bank for parking your surplus cash). With decline in yields, liquid funds have given lower returns in the recent months than they were giving a year back. Even with lower yields, liquid funds are still much better instruments for parking your cash compared to your savings bank. In this blog, we will discuss another option of parking your cash for short term which can provide returns comparable to liquid funds and are more tax efficient than liquid funds. In volatile equity market conditions Arbitrage Funds are good alternative investment options to liquid funds.

What are Arbitrage Funds

Arbitrage fund is a type of mutual fund that leverages arbitrage opportunities between the spot (cash) and the derivatives (F&O) markets. What is arbitrage? Arbitrage is the opportunity to make risk free profits. Is there anything such as "risk free profit"? In the ideal world, there should not be risk free profits. However, we do not live in an ideal world. Arbitrage opportunities arise due to market inefficiencies. Smart investors take advantage of these opportunities to make profits with minimal or no risk.

How do arbitrage funds work

Suppose the price of the share of a company today in the spot or cash market is र 100 and the price of the November futures contract of the company in the F&O market is र 110. If you buy 1000 shares of the company in the cash market and sell 1000 futures, you will lock in a gross profit of र 10,000 today itself. On expiry of the November futures contract on 26/11/2015, the spot and futures price will converge. The expiry price is irrelevant. You will still make a net profit before other expenses. Let us understand how. Suppose the expiry price is र 120. You will make a profit of र 20 per share on the shares that you bought or took delivery in the cash market. On the other hand, you will make a loss of र 10 per share in your futures. The net profit for you, before other expenses, will be र 10 per share or र 10,000 on 1,000 shares. What if, the price of the share falls to र 90 on expiry date? You will make a loss of loss of र 10 per share you bought / took delivery. However, you will make a profit of र 20 per share on the futures. Your net profit per share will again be र 10 or र 10,000 on 1,000 shares. Therefore, we have seen that, using this strategy you can lock in profits and there is virtually no risk, as long as you can spot the arbitrage opportunity.

So if you see a 1 paisa difference between the spot price and futures price, should you go ahead and execute an arbitrage strategy and make a risk free profit? It is not so simple. You need to factor in transactions costs. You need to factor in transaction costs. For each trade, both in cash and F&O market, you need to consider brokerage payment, Securities Transaction Tax (STT), Service Tax etc. Further, your broker will require you to maintain a margin for your futures contract. You need to factor in the opportunity cost of keeping that margin. If the price difference between spot market and futures market is large enough to cover all these costs, only then should execute an arbitrage trade. Price difference between spot and futures market is one example of arbitrage opportunity. Price difference of a share between National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) constitutes another arbitrage opportunity, among others. In my experience, only professional traders are able to execute arbitrage opportunities successfully over a period of time, and therefore, if you want to leverage arbitrage opportunities, you should invest in an arbitrage funds.

Benefits of Arbitrage Funds

As discussed earlier, Arbitrage Funds offer the investors to earn short term returns by taking minimal or no risks. In fact, in volatile market conditions arbitrage funds can provide comparable or even higher returns than low risk liquid funds. The other big advantage of Arbitrage Funds compared to liquid or debt funds is related to taxation. Arbitrage funds are equity oriented funds. Short term capital gains in equity oriented funds are taxed at 15%. Short term capital gains in the context of equity oriented funds are applicable for a holding period of less than 12 months. Short term capital gains in debt oriented funds, including liquid funds are taxed as per the investor’s applicable income tax rate. So if you are in the highest tax bracket and your investment holding period is less than 12 months, then your liquid fund returns will be taxed at 30%, while arbitrage fund returns will be taxed at 15% only. If your investment holding period is between 12 to 36 months and you are in the highest tax bracket, then your liquid fund returns will be taxed at 30%, while arbitrage fund returns will be totally tax free.

What if you wanted dividends? Even here, Arbitrage funds score over liquid funds in terms of tax benefits. Irrespective of your investment holding period, Arbitrage fund dividends are totally tax free, whereas liquid fund dividends are paid out to you after withholding a dividend distribution tax of around 28%. In fact, if your investment horizon is less than 12 months, from a tax perspective, it is more efficient to subscribe to the dividend option in arbitrage funds compared to the growth option.

Arbitrage funds have been around for almost a decade, but they have gained much popularity until recently. Arbitrage funds have been popular with a section of HNI investors investing through the Portfolio Management Services (PMS) route for some time, but now even mutual fund arbitrage funds are gaining popularity with HNI and Corporate investors. While retail investor traction is slow in arbitrage funds, there is no doubt that retail investors can also benefit by investing in arbitrage funds in these market conditions.

Be prepared for short term volatility

We should understand the basic nature of arbitrage funds. While the price of securities in the cash and future market will converge on expiry, in the interim period there will be volatility. The NAVs of arbitrage funds are calculated on a marked to market basis, therefore one must be prepared for volatility before expiry. Also, it is quite possible that the fund manager may not find sufficient divergence between cash and futures price in a current series, but may find it subsequent series. Let us understand this further. Suppose the price of a share is ` 100 today. The price of the futures contract in the November series is ` 101, which is not sufficient to generate arbitrage profits after factoring in all the costs. On the other hand, the price of the futures contract in the December series is ` 112. The fund manager will execute an arbitrage trade between cash and December futures. Therefore, if you are an investor, you will have to wait till the end of December to make arbitrage profits. Investment experts recommend a minimum holding period of 90 days for Arbitrage Funds. Most arbitrage funds have exit loads for redemptions within 90 days, which will reduce your returns if you redeem within 90 days.

Returns of Arbitrage Funds

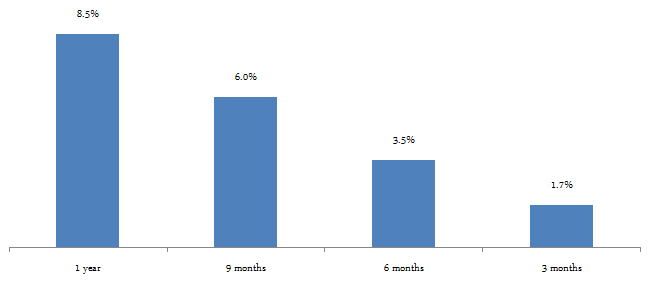

One cannot expect very high returns from Arbitrage funds, given that these funds are basically risk free in nature. The chart below shows the trailing returns of top performing arbitrage funds over the past 12, 9, 6 and 3 months respectively (NAVs as on November 18, 2015).

Arbitrage Fund Returns are linked with Volatility in Markets

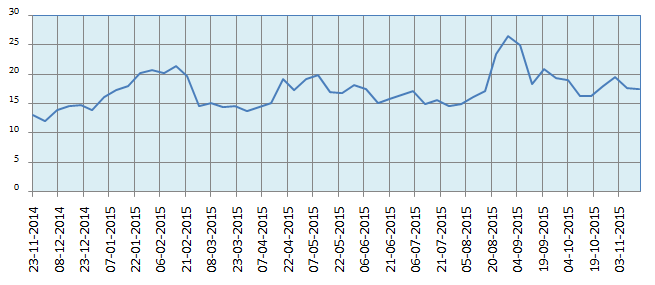

Based on historical data, it has been seen that arbitrage opportunities are higher in volatile market conditions. As such, Arbitrage Fund returns are higher in volatile market conditions. While most retail equity mutual fund investors understandably dislike volatility, if you are an Arbitrage Fund investor, volatility is actually your friend. In volatile market conditions, divergence between spot (cash) and futures price is usually higher. India VIX is the volatility index of our equity market. Higher the India VIX, higher is the volatility. You can get the India VIX data from the National Stock Exchange (NSE) website. The chart below shows the India VIX over the past one year.

Many investors and financial advisors believe that Arbitrage Funds give good returns in bear markets because they expect volatility to be higher in bear markets. That is not always true. If you observe the chart above, you will see that volatility was higher in January and February, when the market was in an uptrend, compared to March and April, when the market was in a downtrend. On the other hand volatility was highest in September, when the market corrected sharply. The point is, we cannot make assume what the volatility is, based on market trend. We should actually see what the India VIX index is telling us. Some investment experts in fact believe that, futures premia is higher in bull markets and therefore one can expect higher Arbitrage Fund returns in bull markets.

Top Arbitrage Funds

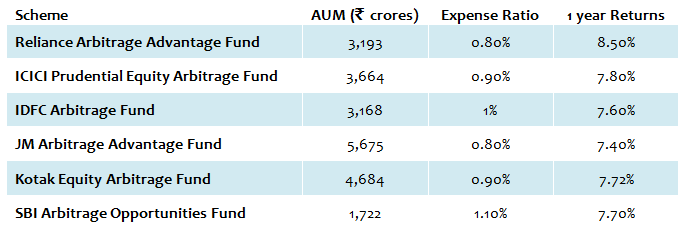

The chart below shows the top Arbitrage funds along with their one year trailing returns. When selecting Arbitrage funds, you should consider the AUM of these funds. Higher the AUM, lower is the risk of redemption pressures affecting the returns of these funds. Expense ratio should be another very important consideration.

Conclusion

In this blog, we have discussed how arbitrage funds can be good short term investment opportunities as alternatives to liquid funds in volatile market conditions. You should consult with your financial advisor, if arbitrage funds are suitable opportunities for your financial needs.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team