DSP Black Rock Balanced Fund: Strong outperformance even in difficult market conditions

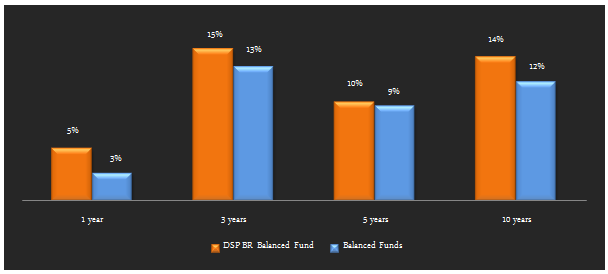

Balanced funds are attractive investment options for first time mutual fund investors and investors with moderate risk tolerance, especially during periods of high volatility. In fact over the last year balanced funds on an average have outperformed large cap funds category. Balanced Funds which are hybrid equity oriented funds with about 65 – 75% allocation to equity and the balance to fixed income, have given positive returns in the last one year, while large cap equity funds on an average have given negative returns. Within the balanced funds category, DSP Black Rock Balanced Fund, which had been underperforming in a relative sense compared to its top performing peers for some time, has made a smart turnaround over the past one year or so. Outperformance in volatile market conditions is often a good performance indicator for balanced funds. Even on a 2015 year to date basis, DSP Black Rock Balanced Fund has outperformed the Balanced Fund category. The chart below shows the trailing annualized returns of the DSP Black Rock Balanced Fund compared to the Balanced Fund category across several timescales (NAVs as on December 23, 2015).

Source: Advisorkhoj Research

Fund Overview of DSP Black Rock Balanced Fund

The DSP Black Rock Balanced fund is suitable for investors looking for long term capital appreciation with moderate levels of risk. As such the fund is suitable for investors in the moderate risk category planning for retirement or other long term financial objectives. The fund was launched in May 1999 and has nearly र 930 crores of assets under management. The expense ratio of the fund is slightly on the higher side at 2.78%. The asset management company, DSP Black Rock, is one of most respected asset management companies in India. The fund managers of this scheme are Vinit Sambre and Dhawal Dalal. Morningstar has a 4 star rating for this fund. The fund enjoys equity taxation.

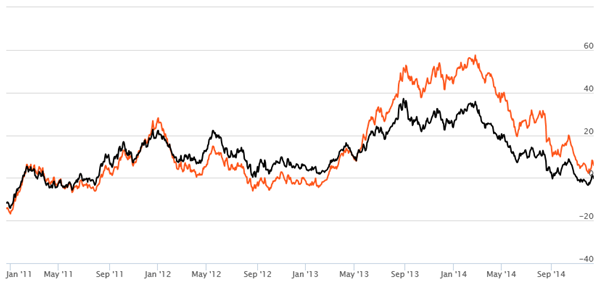

Rolling Returns

The chart below shows the 1 year rolling returns of DSP Black Rock Balanced over the last 5 years. Rolling returns are the total returns of the scheme taken for a specified period on every day/week/month and taken till the last day of the duration. In this chart we are showing returns on every day during the specified period and comparing it with the benchmark. Rolling returns is the best measure of a fund’s performance. Trailing returns have a recency bias and point to point returns are specific to the period in consideration. Rolling returns, on the other hand, measures the fund’s absolute and relative performance the timescale in question, without bias. The orange line shows the 1 year rolling returns of DSP Black Rock Balanced Fund (Growth Option) and the black line shows the 1 year rolling returns of the benchmark, CRISIL Balanced Fund Index.

Source: Advisorkhoj Research

We can see that DSP Black Rock Balanced Fund’s performance was inconsistent till about from September 2010 to May 2013. In fact, for a period of 2 to 3 years, the fund was underperforming versus the benchmark. But the fund’s performance turned around from May 2013 onwards and since then till date, it has consistently outperformed the benchmark.

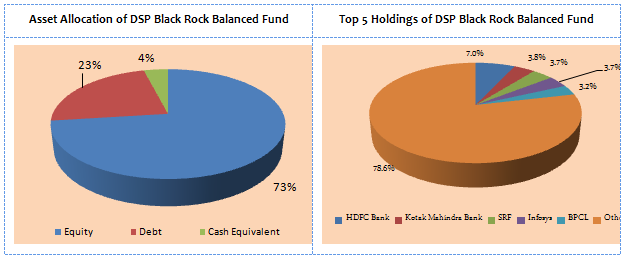

Portfolio Composition of DSP Black Rock Balanced Fund

In terms of portfolio construction equity comprises 73% of the portfolio mix, while debt comprises 23% and cash equivalent comprises 4%. Over the past few months the fund managers have tactically increased the equity allocation taking advantage of correction in share prices. The fund has a predominantly large cap bias with a high growth focus. Large cap stocks account for 70% of the equity portfolio. In terms of sector allocation of the equity portfolio, the fund has a bias for cyclical sectors like banking and finance, automobiles and auto ancillaries, cement and construction, oil and gas etc. With the improvement of the macro-economic condition in India and revival of earnings growth in Indian companies cyclical stocks are likely to give good returns in the next few years. The fund is well diversified, with the top 5 stock holdings accounting for around 21% of the fund’s portfolio. The debt portion of the portfolio has an average maturity of 6 – 7 years. The debt portfolio has moderate sensitivity to interest rate risk and can give good returns on a relative basis in different interest rate scenarios. However, with interest rates expected to come down in the coming quarters, one can expect good returns from the debt portfolio of the fund as well.

Source: Advisorkhoj Research

Risk & Return of DSP Black Rock Balanced Fund

From a risk perspective, the volatility of the fund is lower than balanced funds as a category, making this fund a good investment choice for investors with slightly moderate risk tolerance profiles. The annualized standard deviation of monthly returns of the DSP Black Rock Balanced fund for three is 12%, while that of balanced funds category is 17%. However, on the basis of risk adjusted returns, as measured by Sharpe Ratio, the fund has outperformed the balanced fund category.

The fund has given 15.4% compounded annual returns since inception. र 1 lac investment in the NFO of the fund (growth option) would have grown to nearly र 11 lacs by December 23 2015.

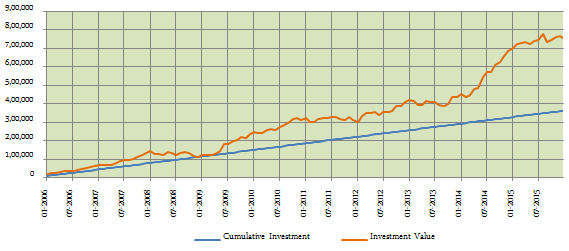

The chart below shows the returns over the last 10 years of र 3,000 monthly SIP in the DSP Black Rock Balanced Fund (growth option).

Source: Advisorkhoj Research

The chart above shows that a monthly Systematic Investment Plan of र 3,000 started 10 years back in the fund would have grown to over र 7.5 lacs by Dec 22 2015, while the investor would have invested in total only र 3.6 lacs.

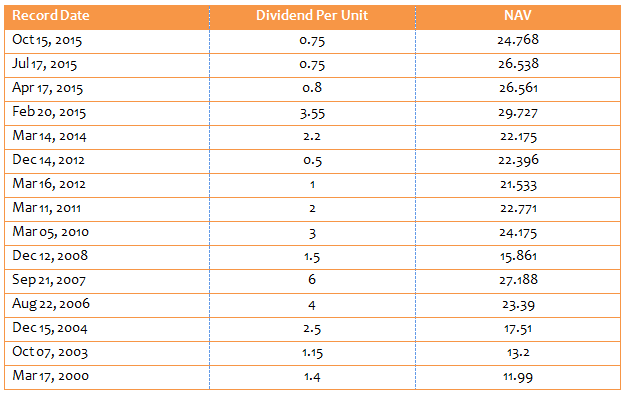

Dividend History of DSP Black Rock Balanced Fund

DSP Black Rock Balanced Fund dividend option has a good dividend payout track record. The scheme also has a quarterly dividend option. The table below shows the dividend history of the fund.

Source: Advisorkhoj Research

Conclusion

DSP Black Rock Balanced Fund has completed over 15 years and staged a smart turnaround in performance over the past year or so. Investors with moderate risk profiles may consider this product for their retirement planning and other long term financial objectives, through systematic investment plans or lump sum route. Given its good dividend pay-out track record, investors who prefer dividends can invest in the dividend option of the DSP Black Rock Balanced Fund. Investors should consult with their financial advisors, if this scheme is suitable for their financial planning objectives.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team