Tax planning: Which is the best fixed income investment option PPF VPF NSC or FD

We are already in the third month of this financial year. Unless you have already started your tax planning, now is a good time to start planning for tax saving investments for the year FY 2014 – 2015. Remember, the longer you wait for start your investment, the more you will lose out on returns. In this article, we will evaluate the post tax returns of some of the popular fixed income tax saving investment options. The fixed income investment options that qualify for deduction under Section 80C of Income Tax Act are as follows:-

- Voluntary Provident Fund (VPF)

- Public Provident Fund (PPF)

- National Savings Certificates (NSC)

- 5 year Post Office Time Deposits

- 5 year Tax Saving Bank Fixed Deposit

Please note that Employee Provident Fund (EPF) also qualifies for tax saving under Section 80C. Your employer deducts your contribution to your PF account from your monthly pay cheque (12% of your basic salary). The annual interest earned on your PF savings is 8.5%. Please note that, this will have to be shown as a deduction under Section 80C in your Income Tax Returns. Therefore the balance amount left after deducting your EPF contribution from Rs 1 lakh is what is available for your tax saving investments under Section 80C. Let us now discuss the other investment options available to you.

There are 3 important considerations when evaluating fixed income investment options under Section 80C.

- Interest Rate

- Tax treatment

- Liquidity

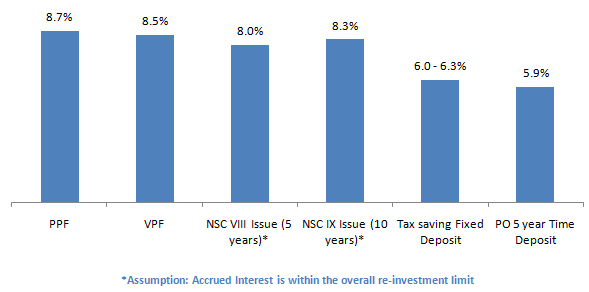

Interest Rates

The interest rates offered by these instruments are fixed from time to time by the Government or the banks. The chart below shows the interest rates of these instruments.

We can see that Bank FDs, 10 year NSC and PPF offer higher interest rates, compared to other instruments. The interest rate of Post Office 5 year time deposit is the lowest at 8.4% (in fact, it was even lower in the prior financial year). At first glance to less discerning investors, the difference in interest rates may seem small. But for investors with a long time horizon, a 20 – 30 bps difference in interest rate on a compounded basis can add up to a not so insignificant amount. However, investors should not make investment decisions based on interest rates alone, because tax treatment makes a big difference to the final returns.

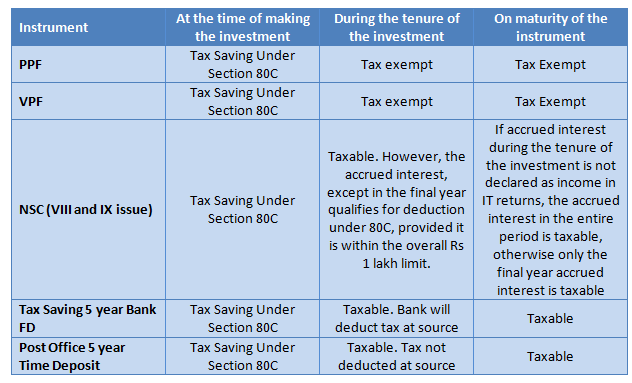

Tax Treatment

To fully evaluate the impact of taxes on these instruments, one must understand the tax treatment at three different stages of investment:-

- At the time of making the investment

- During the tenure of the investment

- On maturity of the instrument

The table below shows the tax treatment at each stage for various investment options

We can see from the table above that, PPF and VPF are the most tax friendly investment options. Bank and Post Office Fixed deposits interests are taxable. Even NSC interest is taxable. However, the accrued interest in NSC is deemed to be reinvested for tax savings under Section 80C of the Income Tax Act, provided it is within the overall limit of Rs 1 lakh allowed under Section 80C, along with other tax saving investments. Therefore the investor can declare the accrued interest as "income from other sources" in the Income Tax Return, and at the same time claim an 80C deduction for the accrued interest. In effect, accrued interest income and reinvestment cancel out each other, making the investment tax exempt throughout the term of investment, except the year of maturity. In the year of maturity, the investor cannot claim an 80C deduction for the accrued interest, because the interest is re-invested but paid to the investor. For details on how you can save taxes in NSC, please refer to our article, Tax Savings: A deeper look at National Savings Certificate.

The chart below shows the annualized post tax return from these various investment options.

We can see from the chart above that PPF is the best post tax investment option for the investor. The returns from Bank and Post Office fixed deposits are lower due to the taxability of interest in these investment options. As long as the accrued interest is within the overall 80C limits, the returns from NSC are above 8%. However, if an investor makes a large NSC deposit every year, then along with other eligible 80C deductions like employee provident fund contribution, life insurance premiums etc there may not be enough room within the available 80C limit for the accrued interest to qualify for 80C deduction. It will then substantially reduce the post tax returns from NSC.

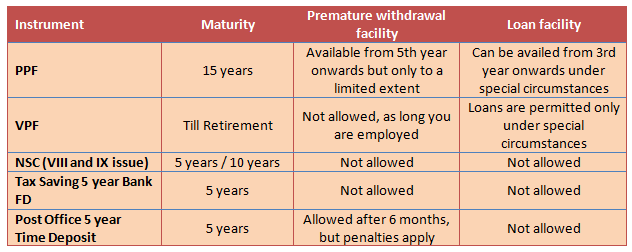

Liquidity

The other important investment consideration is liquidity. There is no general financial planning guidance on liquidity. It depends on the financial situation of the investor like, income, fixed expenditure, savings pattern, existing assets, liquidity of those assets etc. When you make an investment, you should make sure that you are comfortable with the liquidity of the investment that you are making. The table below shows the liquidity related considerations for these best investment options.

The table above shows that the liquidity of PPF and VPF is lower compared to other investment options. However, you can take loans from your PPF account from 3 years onwards, under special circumstances. In the case a Post Office time deposit, you can withdraw after 6 months, but if you withdraw before the expiry of one year from the date of deposit, simple interest will be applicable. For the others, if deposit is withdrawn after one year from the date of deposit, interest will be calculated 1% less than the rate specified for the period.

Conclusion

In this article we have seen that if the investor has a long time horizon and does not need liquidity from the investment before maturity, then PPF is the best investment option. VPF is also a good investment option for a long time horizon, but companies may have timelines beyond which VPF contribution will not be accepted. If you are interested in making a VPF contribution, then you should check with the payroll department of your employer, if you can still make VPF contributions. If you have a shorter time horizon for your investment, then you may find NSC to be a more suitable investment option. However, the post tax returns on NSC will depend on your other 80C deductions, as discussed above. You can consult with an expert financial planner and / or chartered accountant to discuss with best tax saving investment option is suitable for you. Time is of essence in tax saving investments. You should finalize your tax saving plan as soon as possible.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Groww Mutual Fund launches Groww Nifty Smallcap 250 ETF

Oct 13, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Consumption Fund

Oct 6, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Gold Silver Passive FOF

Oct 6, 2025 by Advisorkhoj Team

-

Invesco Mutual Fund launches Invesco India Consumption Fund

Oct 6, 2025 by Advisorkhoj Team

-

ICICI Prudential Mutual Fund launches ICICI Prudential Conglomerate Fund

Oct 6, 2025 by Advisorkhoj Team